peshkov

Introduction to Energy:

A little over a year ago, I wrote my first macro piece on US Energy. In it, I argued that energy shares broadly were not reacting to energy commodity prices that were beginning to percolate, that energy companies were showing capital discipline that not only were transforming their balance sheets but would likely lead to even higher energy commodity prices, and consequently that one could almost throw a dart in the energy sector and come out with a winner. It turned out I wasn’t even remotely bullish enough.

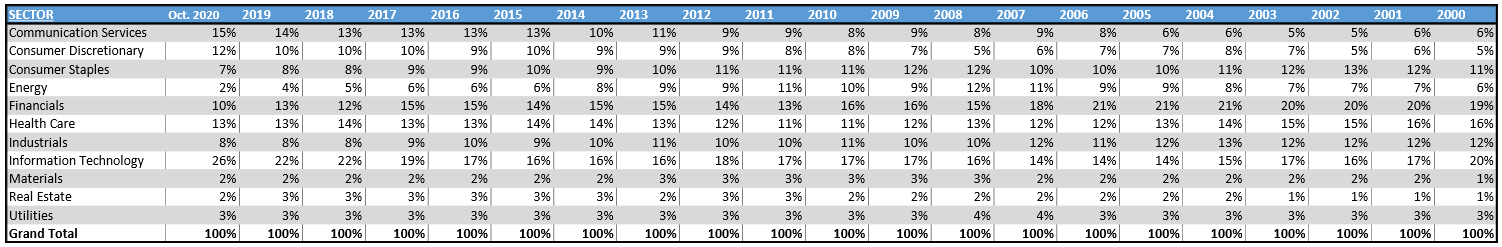

Part of my argument in last year’s piece was that energy’s terrible performance of the preceding few years was caused by a mass exodus from the industry by many investors. Some of it was due to ESG restrictions against owning fossil fuel companies and some was due to the horrendous fundamental performance of many energy companies thanks to bad commodity pricing, terrible balance sheets and (in many cases) worse management teams. A combination of cause and effect of money leaving the sector and moving to others led energy to its lowest weight in the S&P in 20 years which I showed with the below table.

S&P 500 Sector Weightings 2000-2020 (Einvest)

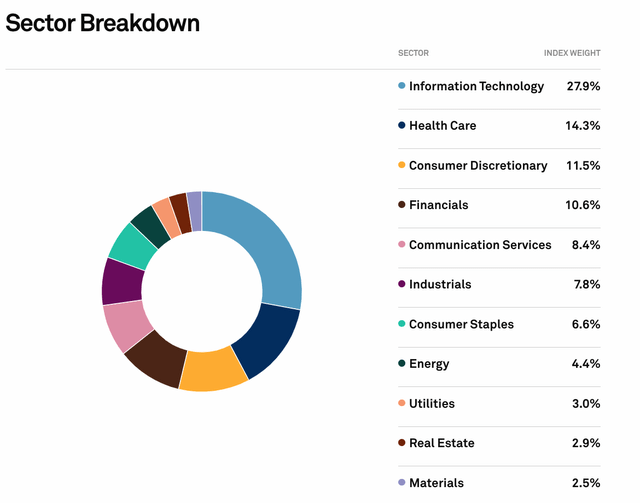

One year later and the weightings have improved but remain extremely low by historical standards.

S&P 500 Sector Weightings (S&P Global)

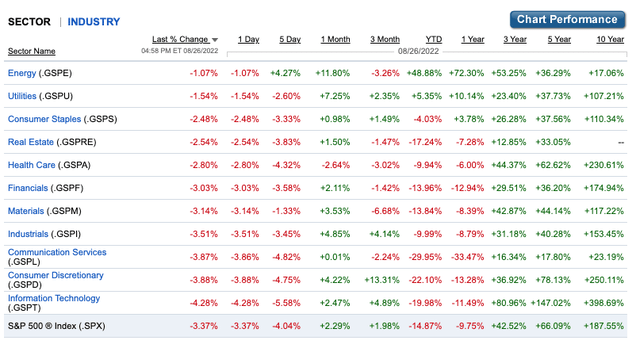

The weighting increase is even more underwhelming when one factors in the underlying performance of the energy sector over the past year.

S&P Sector Performance (Fidelity)

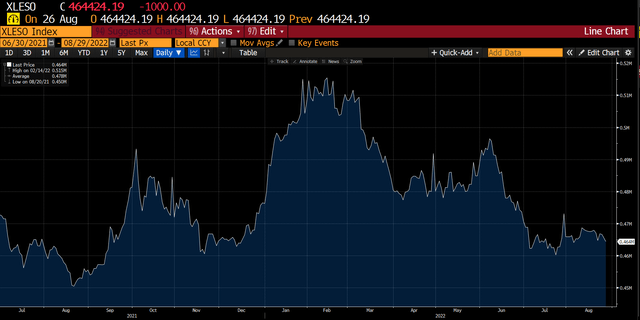

Capital flows represented by ETF shares outstanding indicate that money is not flooding into the sector.

XLE Shares Outstanding (Bloomberg)

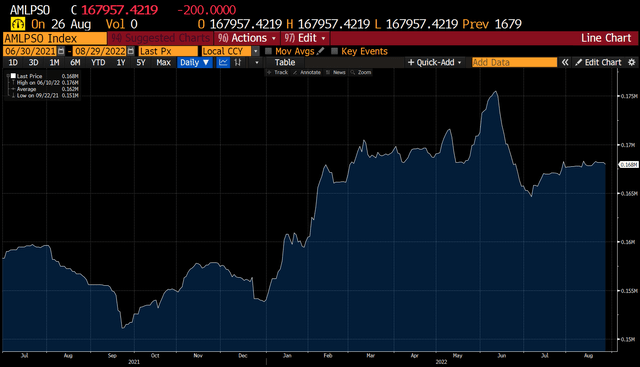

AMLP Shares Outstanding (Bloomberg)

Shares outstanding of XLE are actually DOWN from June 30 last year and shares outstanding of AMLP are up only about 5%.

For a market that seems to chase winners, it is odd to me that a sector that has left all others in the dust year to date and over the past twelve months is not seeing a flood of new capital.

The Opportunity:

In last year’s piece I shared a few charts of underlying commodity performance that gave me confidence that the balance of supply and demand set up well for many energy producers and service companies. Years of underinvestment and newfound capital and operational discipline by management teams simply meant less production while demand was recovering from Covid. Prices shown by last year’s charts are laughable versus today.

12-Month WTI Strip Oil prices are still almost 25% higher despite the US releasing over 1 million barrels per day from the SPR on the market.

WTI Strip Prices from June 2016 to Present (Bloomberg)

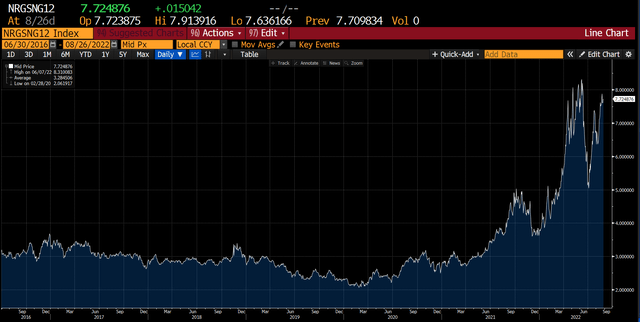

Natural gas, which the government can’t manipulate with any national inventory, has seen much more dramatic price spikes despite Freeport LNG (about 10% of US demand being offline).

Natural Gas 12-Month Strip Prices 2016 to Now (Bloomberg)

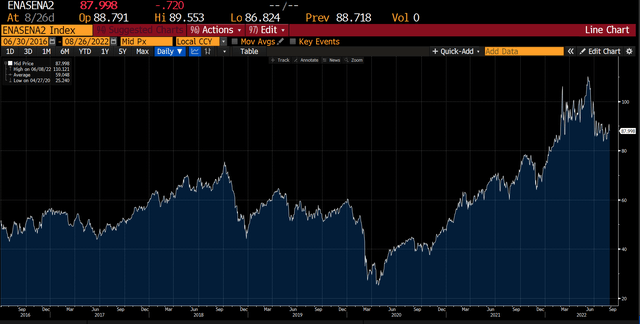

As strong as these prices are, natural gas prices in Europe, which I have covered extensively in articles on Equinor (EQNR) and Vermilion (VET), are parabolic spurred by Russia’s invasion of Ukraine and subsequent reductions/halts of gas transmitted through the Nord Stream One pipeline. In my opinion, Europe will have to pivot from Russia as its top supplier of natural gas and other forms of energy permanently. That move should place a floor under natural gas produced by Equinor in the North Sea and Vermilion at the Corrib Field off the Irish Coast for the foreseeable future.

European Natural Gas Prices in $/mmbtu (Bloomberg)

Obviously, the underlying financial performance of energy producers has been stupendous. Even with hedges in place, energy companies are generating record amounts of cash which most have used to bring leverage down to extremely conservative levels. With deleveraging largely complete, many are now starting to return majority of excess cash flows to shareholders via regular dividends, special dividends, and share buybacks. What most are not doing is increasing production by leaps and bounds.

There are several reasons for this lack of production increase despite extremely profitable commodity pricing. First, management teams are just finishing the transformation that capital markets/investors have demanded of them over the past few years; namely, deleverage the balance sheet, live within midcycle cash flows for production, and return cash to shareholders. If you ask me, the markets remain unconvinced that energy management teams will stick to this discipline and that is a reason why multiples have not expanded.

Costs are another major reason for lack of production growth. Labor, materials, and transportation costs all rose 15-30% this Spring versus the previous according to most Q2 conference calls I heard. Higher costs simply mean higher breakeven prices which will scare off even the most aggressive managements.

A final reason for lack of production, particularly for natural gas, is missing infrastructure. There are simply not enough pipes to move more product from many of the biggest energy basins, especially the gas-rich Marcellus. Joe Manchin successfully negotiated a change in permitting procedures, but that change has not yet led to final permitting for Equitrans’ (ETRN) Mountain Valley Pipeline. I think it will be unlikely that it will coerce any interstate pipeline operators to build new projects until they (or their boards) are convinced that projects can be built at a reasonable cost and on a reasonable timeframe. Bottom line, if there is limited new offtake, companies like EQT, one of my better picks from last year, simply cannot produce more natural gas.

How to Play It:

Last year, I said you could throw a dart in the energy space and probably come up with a decent performer. The four companies I specifically mentioned in last year’s article, Chesapeake (CHK), Crestwood (CEQP), Enterprise Products (EPD), and EQT (EQT) have all seen positive total return including dividends/distributions, with EQT and CHK generating over 100%. I followed up last year’s initial piece with write-ups on California Resources (CRC), Equinor (EQNR), and Vermilion, which have all been nice winners and which I continue to like despite gains. Small companies like SM Energy (SM) are also interesting on their own right and as potential takeout candidates.

I continue to like this barbell approach of commodity exposure via E&P companies and regular steady cash flow with pipelines like CEQP and EPD or even Energy Transfer (ET), which has finally walked the walk of deleveraging. If anything, I think pipelines remain insanely undervalued and are perfect investments for those seeking income and inflation protection as these companies continue to grow their cash flows and their distributions. The MLP structure continues to have investor limitations because of the K-1s that are issued. I like the tax efficiency of the structure but for those who can’t or won’t be bothered, ONEOK (OKE) which I also mentioned last year is interesting.

Risks:

In my mind, a sudden peace deal in the Ukraine is the biggest short-term risk to the energy industry. The market has not priced in all of the supply disruption from Russia but would probably discount the full supply return in a peace deal. A fall-off in demand thanks to elasticity is also a risk. That is primarily tied to oil in my mind. Natural gas demand is far more inelastic than oil. You simply need baseload power, heat, and hot water in a modern society. That said, the market prices many energy stocks off of the price of oil. So, if oil falls for whatever reason, these stocks can fall in the short term. The good news is that cash flows and balance sheets are so robust, companies can take advantage of share declines with repurchases.

Conclusion:

I have been a fan of energy for well over a year. I continue to like it despite pockets of spectacular gains in otherwise moribund market. While I think you need to be a little more careful than simply throwing a dart, specific opportunities are even more compelling now than last year thanks to structural, geopolitical and idiosyncratic changes.

Be the first to comment