Leonid Sorokin

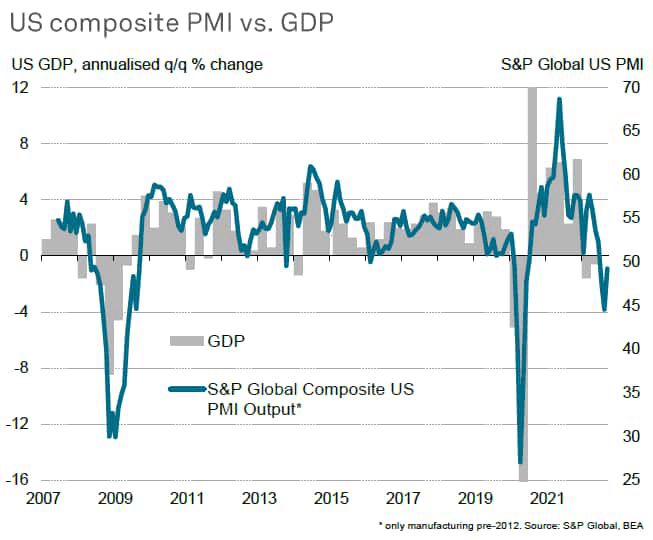

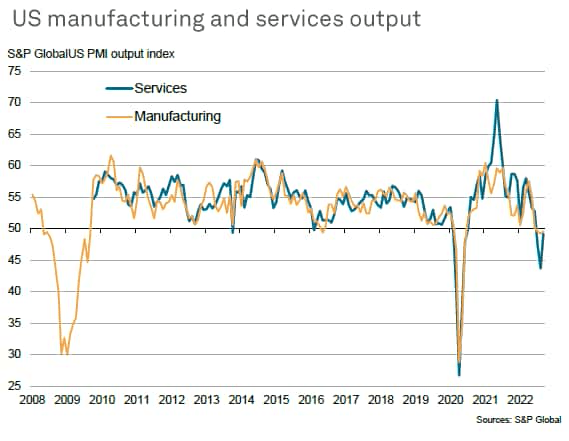

US businesses reported a third consecutive monthly fall in output during September, rounding off the weakest quarter for the economy since the global financial crisis if the pandemic lockdowns of early-2020 are excluded. However, while output declined in both manufacturing and services during September, in both cases, the rate of contraction moderated compared to August, notably in services, with orders books returning to modest growth, allaying some concerns about the depth of the current downturn.

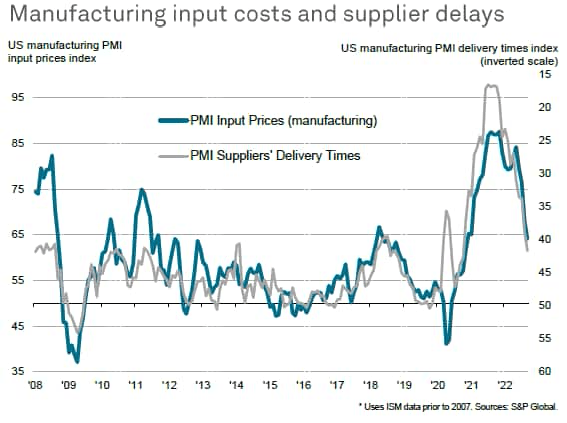

There was also better news on inflation, with supplier shortages easing to the lowest since October 2020. These improved supply chains, accompanied by the marked softening of demand since earlier in the year, helped cool overall the rate of inflation of both firms’ costs and average selling prices for goods and services to the lowest since early-2021.

Inflation pressures nevertheless remain elevated by historical standards and, with business activity in decline, the surveys continue to paint a broad picture of an economy struggling in a stagflationary environment.

Third quarter woes ease a little

S&P Global’s headline Flash US PMI Composite Output Index registered 49.3 in September, up from 44.6 in August, but nonetheless signalling a third successive monthly fall in private sector business activity. The decrease was the smallest in the current three-month sequence of contraction as, although manufacturers continued to register lower production, service providers saw a markedly slower pace of decline in output.

Improved forward-looking indicators

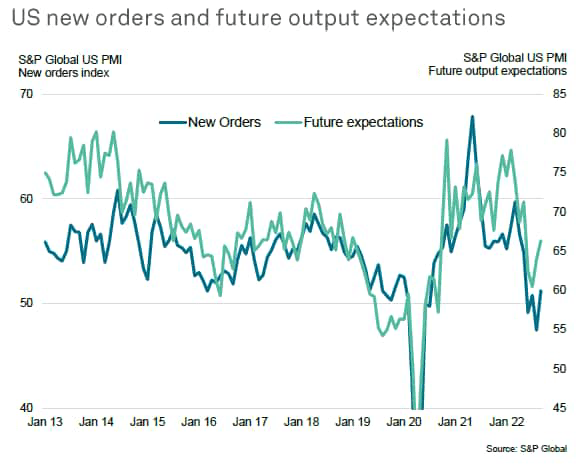

While new orders returned to growth, with gains reported across the manufacturing and service sectors, the upturn in demand was only mild and subdued by historical standards. New export orders remained in contraction, with the rate of decrease the second-fastest since May 2020, linked to weakening economic trends in key markets, notably Europe.

Encouragingly, the upturn in the survey’s new orders gauge was accompanied by a lifting of business expectations for the year ahead, which – like new orders – had sunk over the early summer months to the lowest since the initial pandemic shock. While both gauges remain subdued, the lack of further declines in the face of tightening monetary policy are especially welcome.

Better news on supply chains and inflation

The September survey brought some other positive developments, notably in terms of inflation, which likely had a bearing on production and demand growth during the month. Supplier delivery delays, which have contributed to upward pressure on prices during the pandemic, eased further, with September seeing the fewest delays since October 2020. Price pressures for manufacturing inputs cooled sharply further as a result, with input cost inflation in the goods-producing sector now down to its lowest since November 2020, having now fallen for four straight months.

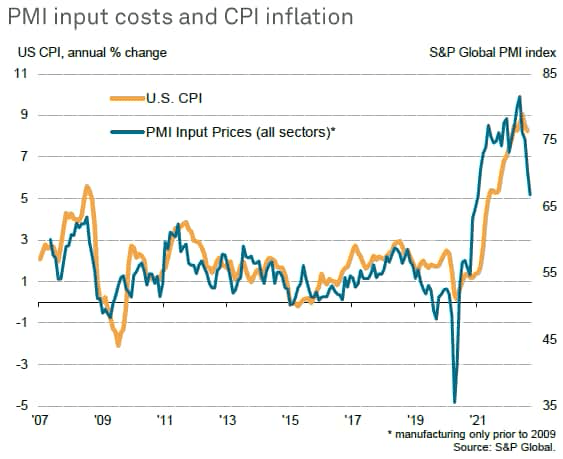

Service sector input cost inflation also moderated sharply in September, likewise down for a fourth month running. Input costs across both sectors consequently rose in September at the slowest rate since January 2021, which in turn suggests that consumer price inflation, currently running at 8.3%, has further to fall from its June peak of 9.1%.

Stagflationary environment persists

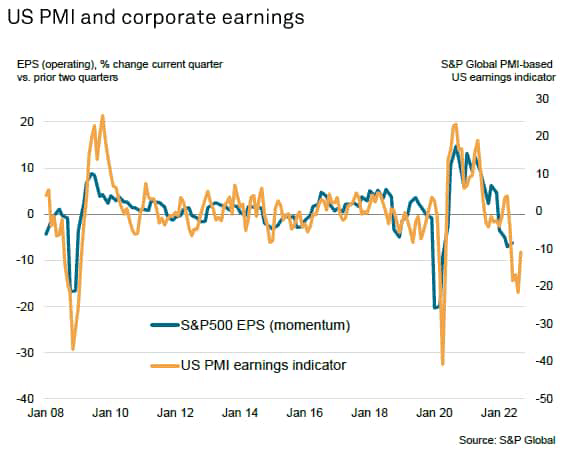

The bottom line from the S&P Global survey data is that the business environment remains one of modestly contracting economic output at a time of still elevated inflationary pressures. Both are clearly adverse to corporate earnings, albeit with the cooling of price pressures and moderating rate of decline of output (and modest return to growth of demand) taking some of the downward pressure off business profits.

Comparisons with other surveys

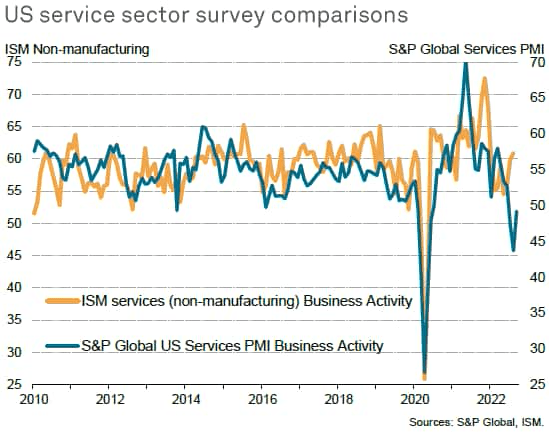

The rise in the S&P Global’s service sector business activity index still leaves a discrepancy against the ISM services (or, more accurately, non-manufacturing) business activity index readings in recent months. Through the summer, the ISM survey has shown booming business conditions despite the soaring cost of living, worsening financial conditions and ever-rising interest rates.

The relative weaker performance of the S&P data likely rests in its greater weight towards financial services and consumer services (which have both fared especially poorly in recent months) as well as its sole focus on private sector services activity. Importantly, note that the ISM non-manufacturing survey includes government services and utilities, which are likely to be showing counter-cyclical trends at the moment.

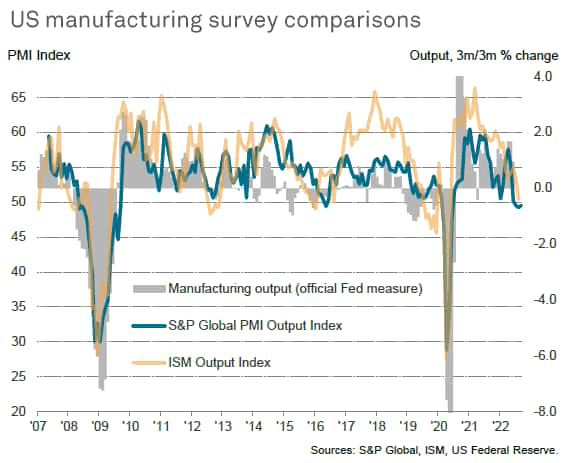

From a manufacturing perspective, the S&P global and ISM surveys are more closely aligned, both in terms of sector coverage and recent data trends. Both are showing a manufacturing sector that has gone from a position of strength earlier in the year, after the fading of the Omicron COVID-19 concerns, to one of falling or, at best, near-stalled manufacturing output.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment