MarianVejcik

Introduction

Earnings season is back. And isn’t that exciting? A few weeks filled with earnings from the most exciting companies on the market telling us how they are doing and what we can expect from the industries they are operating in. As always, the big banks are the first ones to allow a closer look into their businesses. This includes U.S. Bancorp (NYSE:USB), the regional banking giant headquartered in Minneapolis, Minnesota. In this article, we’re going to take a closer look at the company’s just-released 3Q22 earnings. Not only because it’s interesting to know how U.S. Bancorp is doing, but also because it matters in the bigger context as it’s one of the top three regional banks in the United States. Especially in these times, it’s important to listen to banking comments as financial stability is rapidly deteriorating. The good news is that USB did very well in its third quarter. Debt quality remained high, and overall expectations remain positive. As we’re getting closer to a point where the Fed will be forced to pivot, I believe it’s time to put USB back on one’s watchlist as it’s a great bank with an attractive dividend.

Unfortunately, we’re not out of the woods yet.

So, let’s dive into the details!

Why Banking Earnings Matter

Going into this earnings season, one thing was clear, investors interested in bank earnings would care much more about the outlook than the results of the third quarter – even more than usual.

The current economic environment is tricky as it seems that the Fed needs to decide between protecting financial stability and fighting inflation as I discussed in a recent article.

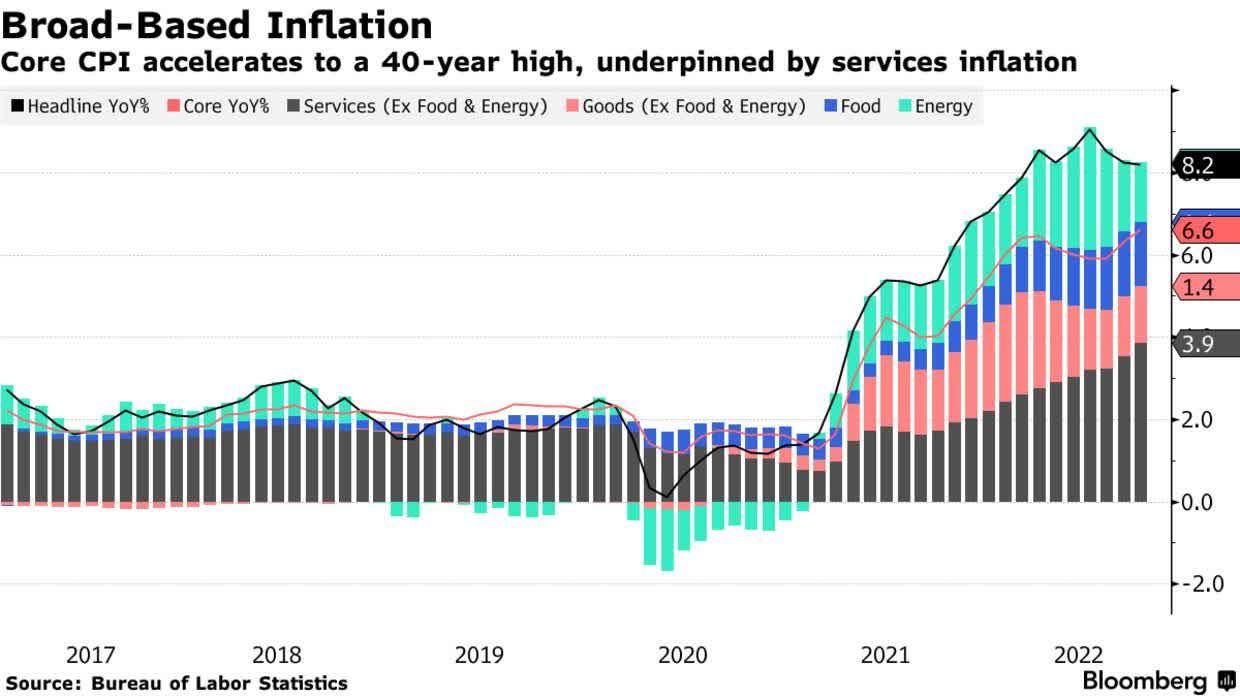

The most recent inflation numbers didn’t help as inflation (including all items) came in at 8.2%. That’s 10 basis points higher than expected. The worst part is that core inflation (all items excluding food and energy) reached a 40-year high despite slowing all-item inflation. As the graph below shows, energy inflation has worked its way through the economy.

Bloomberg

These numbers scare investors because it means the Fed has enough reasons to continue its aggressive hiking cycle.

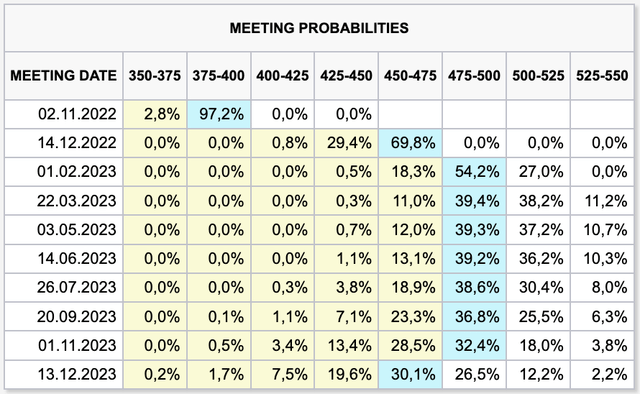

It now looks like the terminal rate (range) is 475 to 500 basis points.

While this is based on market expectations, it’s also what various Fed members are communicating. For example, if it’s up to Mary Daly from the San Francisco Fed, we’ll see that terminal rate for sure, with no cut in the foreseeable future:

“We are not on some sort of course that can’t correct if the economy needs more bridling or needs less bridling,” Daly said. But increasing rates to between 4.5% and 5% “is the most likely outcome,” with the Fed then planning to “hold at that point for some period of time,” she said.

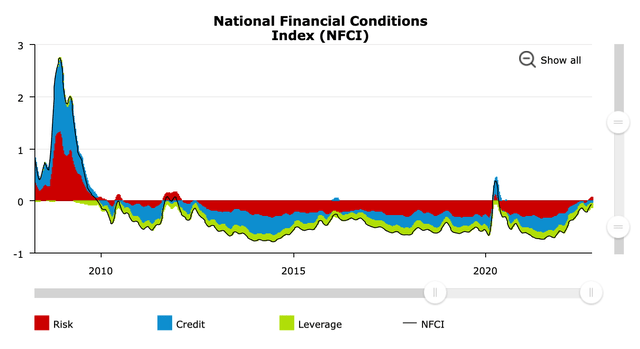

This macro background matters for all stocks. However, banks are once again key as financial instability is rising. The Chicago Fed National Financial Conditions Index shows a steep increase in “risk”. Risk, in this case, incorporates volatility and funding risk.

Again, the worst part is that the market knows that the Fed won’t step in – unlike in 2020 when it didn’t have to deal with high inflation.

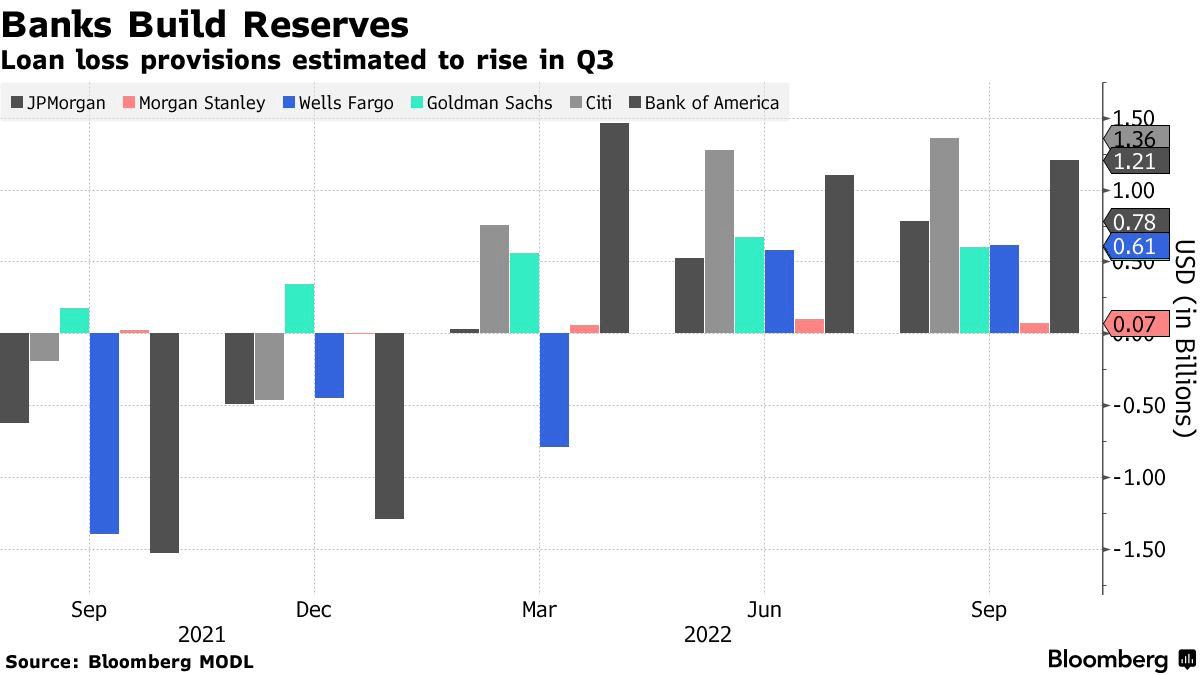

Hence, because we’re now seeing a mix of slowing economic growth, higher rates, and related issues like imploding consumer confidence, and retail sales, banks are preparing for what may come next. Major banks have boosted their reserves as the chart below shows – after reducing reserves in 2021 (after the pandemic).

Bloomberg

Now, before we dig deeper, let’s include the “star” of this article, U.S. Bancorp.

Why USB Earnings Matter

USB is flying a bit under the radar, despite its massive size. People mainly focus on the big guys in the chart above. And that’s fine. They are larger and more influential. However, USB is a regional banking giant, which makes its comments quite important.

With a market cap of $63.5 billion, USB is a top two regional bank in the United States. The bank has more than 70,000 employees, more than $570 billion in assets, and a well-diversified business model. Roughly 40% of its revenue comes from traditional consumer and business banking. 28% comes from payment services like credit and debit cards, and related services. 18% comes from corporate and commercial banking, which includes asset-based financing, leasing, capital markets, and trade services. 15% comes from wealth management services like wealth planning, investments, trust services, private banking, and related.

That said, the company beat 3Q22 revenue estimates by $130 million as it reported a 7.5% increase in revenues to $6.3 billion. Non-GAAP EPS came in at $1.18, $0.02 higher than expected.

These Non-GAAP numbers are adjusted for the acquisition of MUFG Union Bank. This deal was approved on Friday, September 13, as reported by Seeking Alpha.

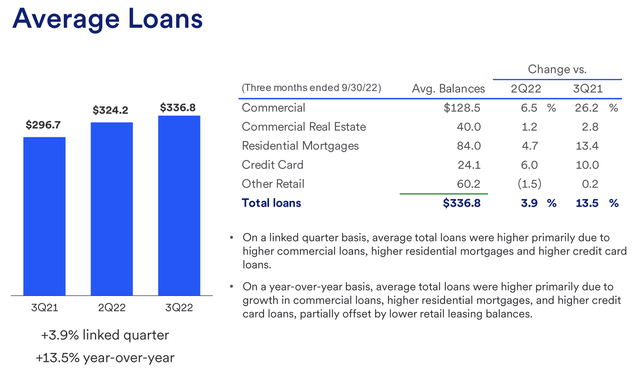

As the revenue growth rate may suggest, USB did quite well in its third quarter. The company’s average loans increased by 13.5% compared to 3Q21. The company did not see slower loan growth in any of its segments as total loans made it to $337 billion.

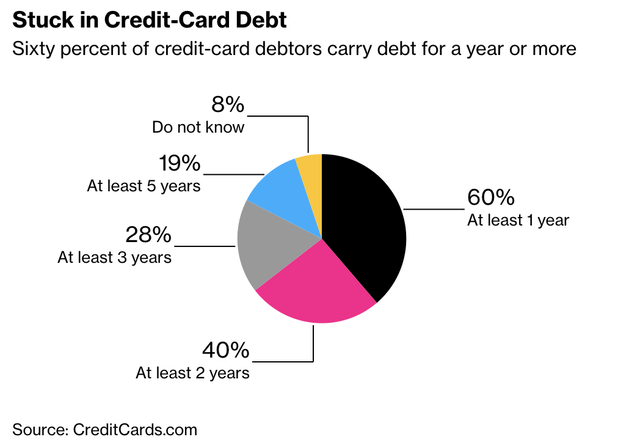

The company mentioned healthy underlying demand and high spending activity from retail clients, resulting in strong loan growth in that area as well. However, my opinion is that this may be a sign of weakness. With prices skyrocketing, more people are using their credit cards to make ends meet.

A chart from September 2022 showed that 60% of consumers carry credit card debt for at least 1 year. That is up from 50% one year ago. 40% carry it for at least two years. That’s up from 32%.

Average deposits increased by 13.3%. Again, with growth in all areas: money market savings, interest checking, savings accounts, and time deposits.

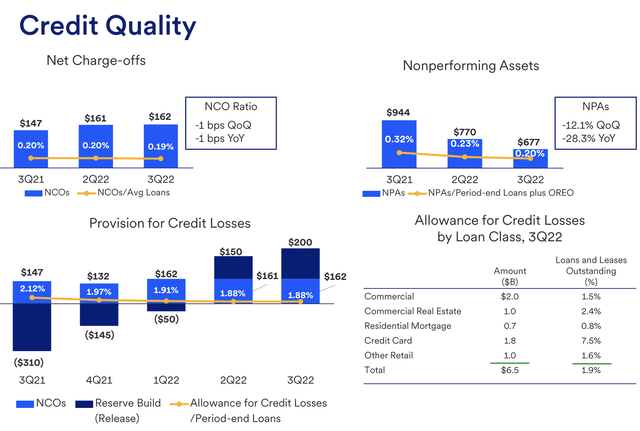

With that said, and in light of the credit card comments I just made, let’s look at credit quality. Credit quality was good – surprisingly good. Nonperforming assets fell to 0.20%. Net charge-offs fell from 0.20% to 0.19%, consecutively. Allowances for credit losses totaled $6.5 billion, or 1.88% at the end of the quarter. That is a $200 million increase and an unchanged ratio. According to USB, this increase was the result of loan growth, and to a lesser extent uncertainties in the economic outlook.

When looking under the hood, we see that credit quality is deteriorating, but not at all at a pace that some may have expected. In commercial real estate, 90+ day delinquencies rose from 0.01% to 0.05% – consecutively. Yet, it’s unchanged compared to 2021. net charge-offs also dropped. Only 0.41% of loans were nonperforming. That’s a new low.

The same is happening in residential mortgages. 90+ day delinquencies fell to 0.10%, from 0.15% in 3Q22. High credit quality is protecting the company against deteriorating debt quality. Only 0.24% of loans were nonperforming.

Credit card 90+ day delinquencies rose from 0.66% in 3Q21 to 0.74%. However, the net charge-off ratio dropped to 1.96. That’s down from 2.01%.

Unfortunately, the company did not comment a lot on expected future risks. The main takeaway is that its customers have high credit scores. Moreover, the company has a major footprint in commercial real estate. Here, the bank witnesses that builders are pulling back from certain projects, which I expect will hurt loan growth. However, no comments on the expected deterioration in credit quality.

That does make sense as the bank wouldn’t benefit from commenting on that. Let’s say the bank says something like “we could see a steep decline in credit quality due to macro factors”. That would be guessing based on economic indicators. It’s all I do on Seeking Alpha, but a bank isn’t going to risk plunging its stock price based on that.

Hence, I do not expect any comments on that until at least 4Q22 when the mix of slower economic growth and higher rates will be more visible.

For now, the bank continues to fire on all cylinders. Net interest income reached an all-time high at $3.9 billion, this implies a net interest margin of 2.83%. This increase was provided by rising interest rates and partially offset by deposit pricing and short-term borrowing costs.

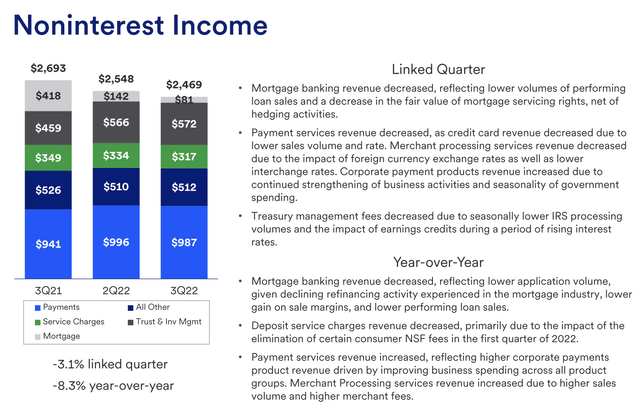

Non-interest income fell by 8.3% versus 3Q21 as a result of lower mortgage applications, lower deposit service charges, and lower payment services. That’s the first place where the economic slowdown becomes visible.

Non-interest expenses increased by 4.8% during this period as a result of higher compensation expenses and marketing/business development items.

When it comes to the bank’s outlook, it sees positive and strong revenue growth in 2022 and a higher-than-expected net interest income. So far, no major macro headwinds except for headwinds that come with higher rates. The good thing is that operating leverage is expected to expand by at least 200 basis points as the bank continues to handle cost increases quite efficiently.

According to Vice Chairman and CFO Terry Dolan:

Let me start with full year 2022 guidance which is consistent with our previous expectations. We continue to expect total net revenue to increase 5.5% to 6% in 2022 compared to 2021. We expect mid-teen growth in taxable equivalent net interest income, which is slightly improved from our previous outlook of low to mid-teens growth.

We continue to expect a decline in fee revenue for the full year, primarily due to the impact of higher interest rates on mortgage revenue due to lower refinancings in the market. Lower deposit service charges due to pricing changes and a decline in other noninterest income. We continue to expect positive operating leverage of at least 200 basis points in 2022, excluding the impact of merger and integration related costs associated with the Union Bank acquisition.

Valuation

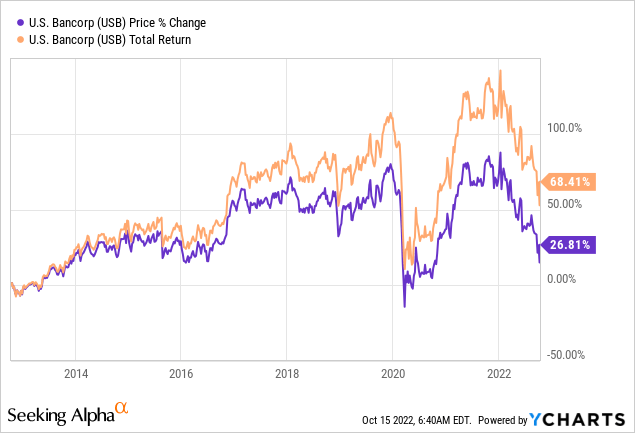

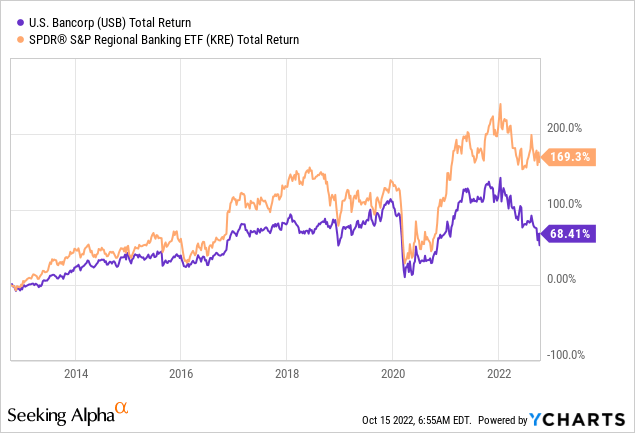

U.S. Bancorp is currently down 24% year-to-date. That’s roughly in line with the S&P 500, which is down 25%. Over the past 10 years, USB shares have returned 68%. The return is 27% excluding dividends.

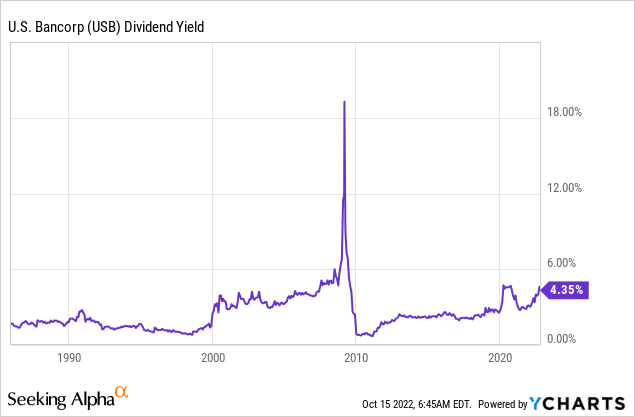

On September 13, 2022, the company hiked its dividend by 4.3% to $0.48 per share per quarter. This implies a 4.5% yield. Over the past 10 years, the average annual dividend hike was 10.1%.

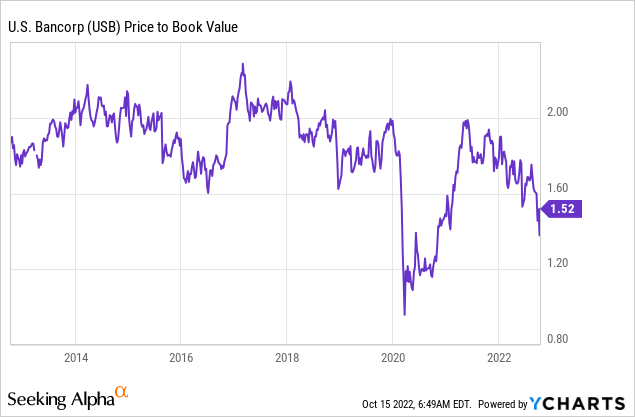

This yield is one of the highest yields since the Great Financial Crisis as the chart below shows. Please note that YCharts has not yet incorporated the recent hike.

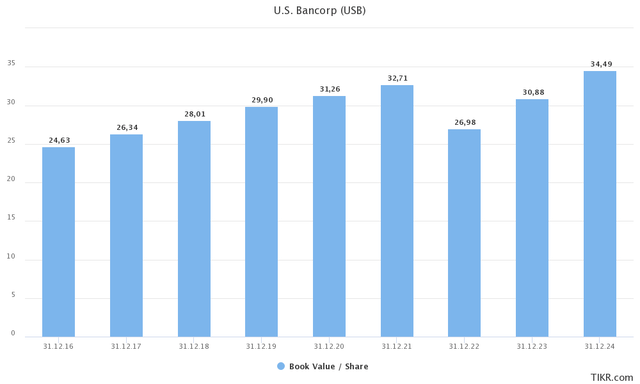

With that said, analysts have adjusted their outlooks. For example, the average EPS estimate for 2024 has been adjusted from roughly $5.90 earlier this year to $5.40. The same goes for the book value (per share). The company is not expected to break its 2021 record until at least 2024.

The good news is that a lot has been priced in. The company is trading at 1.3x 2023E book/share. That’s rather cheap as USB usually trades between 1.60x and 2.00x

There is obviously a reason why USB shares are trading at a discount given elevated economic risks.

However, if I were in the market for some “juicy” banking dividends, I may start buying some USB shares here. However, USB shares have failed to outperform the industry ETF as the graph below shows. While I believe that USB will have some catching up to do, I cannot make the case that USB shares are a must-have.

Takeaway

I have been trading for more than 10 years. That’s not a lot and it excludes the Great Financial Crisis. However, so far, this is the most challenging macro environment – by a long shot. It’s even worse than in 2020 as we’re now stuck. Economic growth is slowing, inflation remains too high, and the Fed is eager to maintain its aggressive hiking cycle.

It’s hurting the market as we had just 3 positive trading days since September 20 and a return of minus 25% since the start of the year.

The “worst” part is that the Fed isn’t seeing reasons to refrain from hiking. While I believe that the Fed will soon have to prioritize protecting financial stability over fighting inflation, we’re not yet at that point.

Despite an increase in financial instability, banks remain in a good spot. Unlike in 2007, customers are doing better. Credit scores are high, default rates remain very low, and high net interest margins protect the bottom line against rising costs.

Moreover, banks are not yet commenting on what could be future risks as none want to be wrong.

In this article, we looked at U.S. Bancorp. The bank beat both revenue and EPS estimates as it sees strong debt quality, debt growth, and strong interest margins – offsetting growth in operating expenses.

Thanks to the weakness in USB shares, the stock appears to be cheap – despite analyst revisions and weak expected growth in the bank’s book value.

Unfortunately, I cannot make the case that this bank is a must-own. While its yield has come up a lot, I am unsure that USB will outperform its benchmark. I also wouldn’t bet against lower share prices in the months ahead until the Fed is forced to pivot. I’m afraid that won’t be the case until banks like USB report a significant decline in credit quality.

In other words, if you do like the valuation and the yield, start buying by adding just a few shares to your portfolio. Then, continue to add on stock price weakness. If the stock continues to fall, investors can average down. If the stock suddenly rallies, investors have a foot in the door.

(Dis)agree? Let me know in the comments!

Be the first to comment