Leestat/iStock via Getty Images

UK economic woes deepened in September as business activity fell at an increased rate, indicating that the economy is likely in recession. Companies report that the rising cost of living, linked to the energy crisis, and growing concern about the outlook is subduing demand and hitting output to an extent not seen since 2009, barring the pandemic lockdowns and initial 2016 Brexit referendum shock.

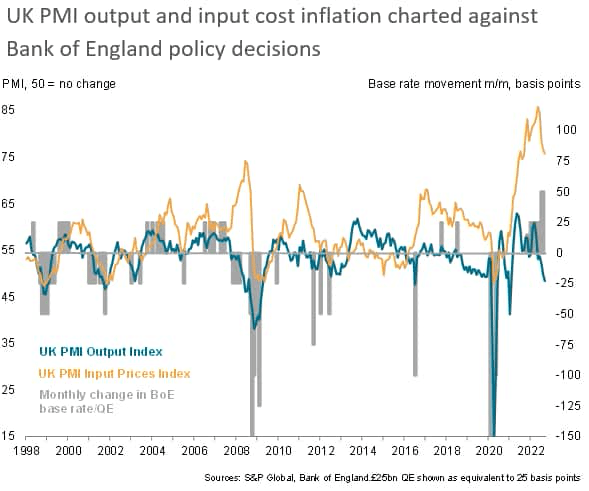

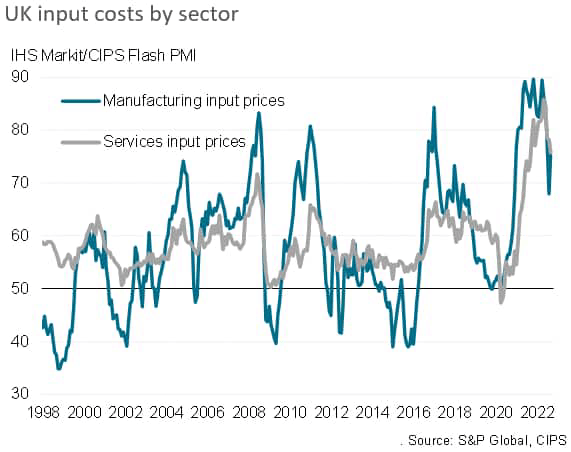

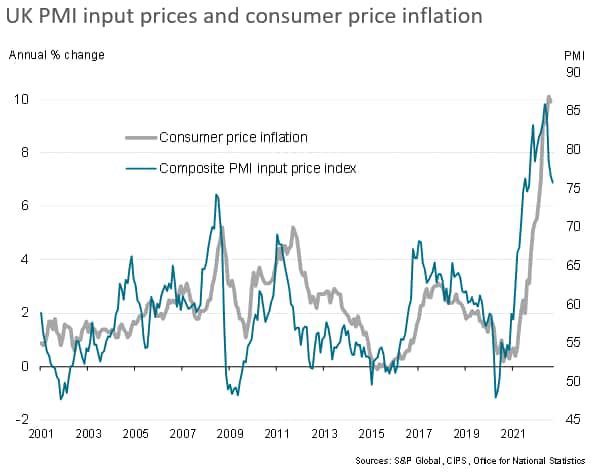

Inflationary pressures meanwhile remain highly elevated, running higher than at any time in over two decades of survey history prior to the pandemic. Renewed supply constraints, soaring energy prices and rising import costs associated with the weakened pound are adding to rising cost pressures. While some relief has come from a cooling of service sector price inflation, the overall rate of increase signalled will remain of great concern to policymakers at the Bank of England.

UK flash PMI falls further into negative territory

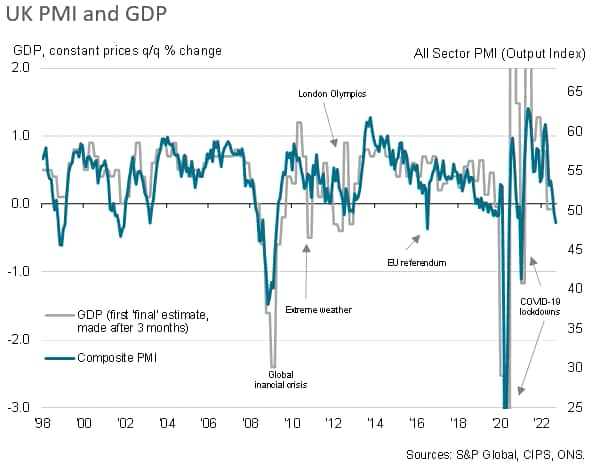

Business activity at UK private sector companies fell for a second successive month in September, the rate of decline gathering pace to the fastest since January 2021. The headline seasonally adjusted S&P Global / CIPS Flash UK Composite Output Index fell from 49.6 in August to 48.4 in September. Excluding pandemic lockdown months, this was the lowest reading since the Brexit referendum shock of July 2016 and, prior to that, April 2009.

Historical comparisons suggest the September PMI reading is broadly consistent with GDP falling at a quarterly rate of 0.25%, and for the third quarter as a whole, the PMI points to a mild GDP contraction of 0.1%. However, while only very modest, coming on the back of a reported 0.1% GDP decline in the second quarter, such a drop in GDP for a second successive quarter would meet a commonly used definition of a technical recession.

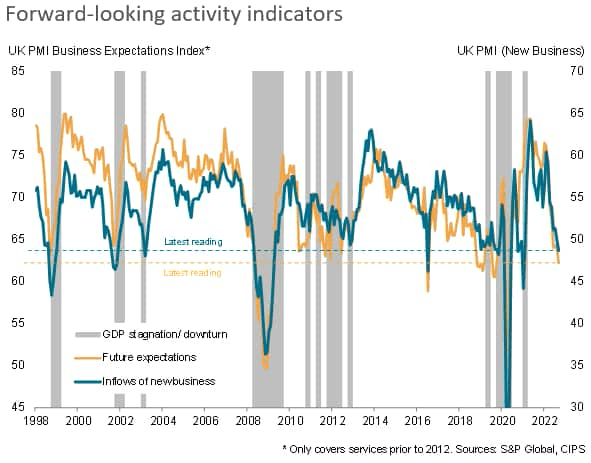

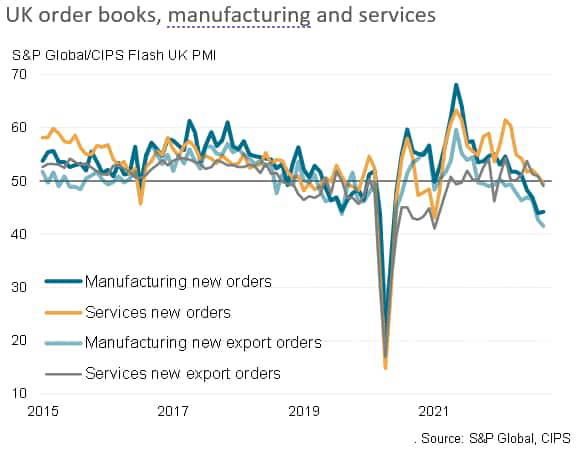

Forward-looking indicators meanwhile deteriorated further in September. Inflows of new business into manufacturing and service companies fell to the greatest extent since January 2021 and companies’ expectations of growth in the year ahead fell to the lowest since May 2020. Both the new orders and future expectations gauges have descended to levels which have rarely been weaker in the past, and are consistent with a deepening downturn as we head into the fourth quarter.

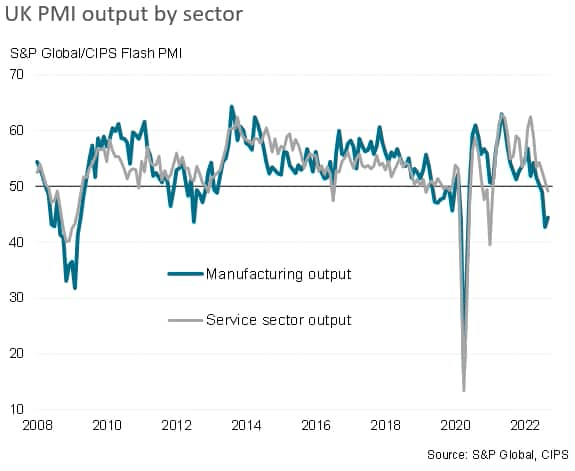

By sector, September saw manufacturing output fall especially sharply again. Although the decline was not quite as severe as that seen in August, it was still the second-steepest since 2009 if the initial pandemic lockdowns are excluded. Service sector activity also declined, falling into contraction for the first time since February 2021.

Hardest hit were hospitality-focused service providers, with hotels and restaurants reporting by far the steepest falls in both business activity and new orders, followed by transport & communications firms. Of the broad service sectors, only computing & IT saw sustained growth of both activity and new orders. While financial services firms also reported higher output levels, inflows of new business fell for the third time in the past four months. Demand for business services meanwhile contracted for a third successive month, dropping at the sharpest rate since the early-2021 lockdowns.

Companies reported that rising prices and the cost of living crisis, often linked to energy prices, had been a key factor behind falling demand for goods and services, both at home and abroad, with exports of goods falling especially sharply. Confidence in the outlook was also reported to have deteriorated among many customers, dampening demand further, while rising supply constraints and surging costs had also curbed business activity, notably in factories.

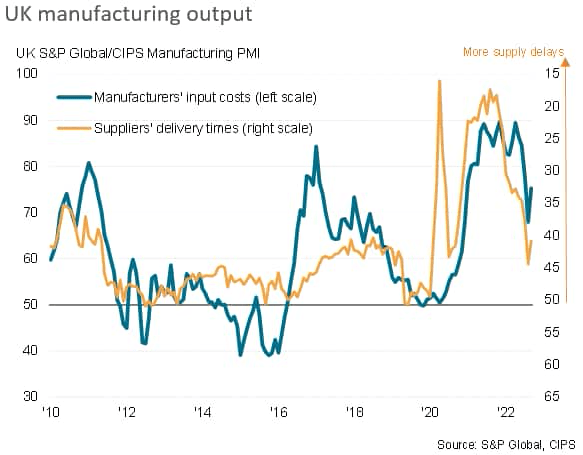

Supply delays worsen, adding to raw material price pressures

While supplier delivery delays remained far less widespread than throughout much of the pandemic, average delivery times lengthened to a greater extent than in August on average, signalling a renewed worsening of the supply situation. China’s lockdowns, port congestion and shipping delays, plus various production issues were blamed for longer lead times, which – alongside rising energy costs – in turn contributed to renewed upward pressure on raw material prices.

There was better news on input cost inflation in the service sector, where the rate of increase moderated for a fourth month running to the lowest since September of last year. When combined, the PMI Input Cost Index for both sectors also fell for a fourth month (the larger service sector outweighing the uplift in the manufacturing sector’s input cost index), down to its lowest for a year.

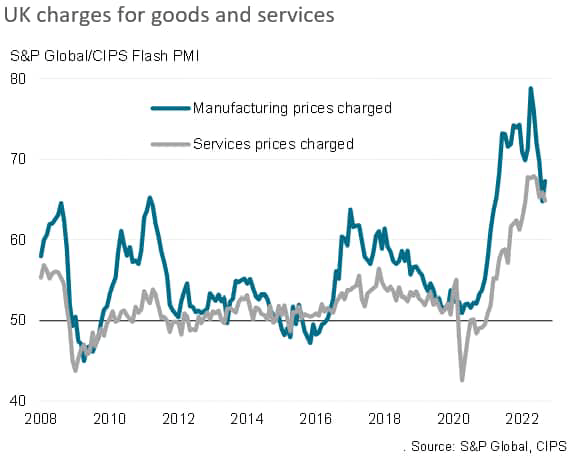

A similar situation was seen for prices charged, with a slight re-acceleration of goods price inflation contrasting with a further cooling in the rate of increase of service sector charges, often associated with discounting to win new business. Inflation rates none the less remained very elevated by historical standards, in both sectors surpassing any prior rates of increase seen before the pandemic.

Persistent elevated inflation

The overall easing in input cost inflation in recent months hints strongly at some moderation of consumer price inflation in the months ahead from the current rate of 9.9%, and the slowing in service sector cost growth is especially welcome (not least as a large element of these costs are wages and salaries). However, it is clear that the overall rate of inflation signalled remains highly elevated, and – at around 7% – far in excess of the Bank of England’s 2% target. Moreover, the renewed rises in the manufacturing sector price gauges add to the potential persistence of elevated inflation pressures in the near future.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment