Freder

Macroeconomic Overview

2022 has been anything but run-of-the mill. Market risk has swiftly moved to the downside, with the Federal Reserve wrestling skyrocketing inflation driven by a war in Ukraine.

The SARS-Cov2 legacy now appears clear – this exogenous shock, paired with the subsequent economic lockdown, was met staunchly with stimulative measures by central banks. Cheap money found its way into financial assets, creating a near term equities boom. Inflation quickly followed thereafter.

The bullwhip effect created by an abrupt halting of the world economy has since wreaked havoc. Economic indicators have been all over the place, and reads on future economic expectations have been hard to decipher. Risk has not gone away either. The after-effects of US Midterms, and geopolitical volatility are yet to abate.

So, how can one play the short side of the trade while remaining long? Queue Direxion Daily Small Cap Bear 3x Shares (NYSEARCA:TZA).

Product Overview

Direxion daily, the leveraged fund specialist, markets a range of thematic levered ETFs geared at satisfying specific trader needs. Note that I used the word trader here. The fund’s different ETF wrappers are geared for sophisticated asset allocators looking for punctual risk-on or risk-off exposure.

Therefore, Direxion products are pitched at money managers with a solid understanding of the risks associated with leverage and fully grasping the consequences of resorting to daily leveraged position. These are not appropriate for long-term holdings as internal reset features, compounding, and their synthetic nature all bolster risk.

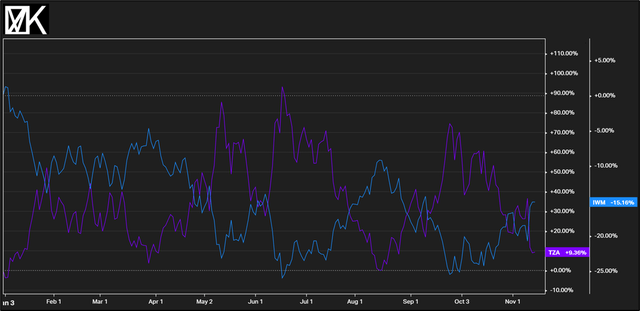

A comparison of IWM returns against TZA shows how well it relatively counters returns in the Russell 2000 index. Note that daily compounding means that gains are not symmetrically 3x the opposite of the index.

That is no different for Direxion Daily Small Cap 3x Bear. This all-in bearish bet on small cap price action inspired by the Russell 2000 aims to deliver returns as markets go under.

The fund’s synthetic leverage ensures a magnifying of returns, while also allowing certain long-only money managers the opportunity to hedge out risk during bouts of market volatility.

My outlook on the product is neutral given its tactical trade-specific pedigree rather than longer duration holdings. Leveraged and inverse leveraged ETFs are riskier than non-levered peers thanks to their synthetic make-up and, in some instances, counterparty risk linked to the use of OTC derivatives.

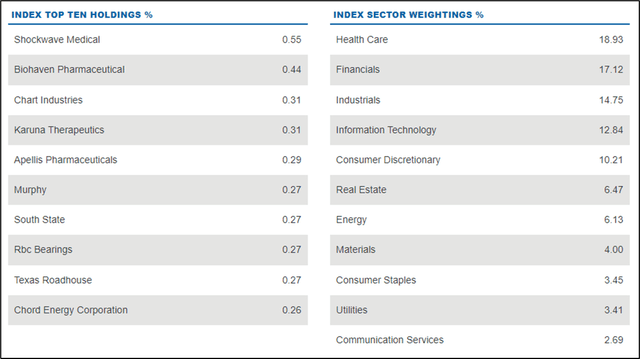

The target index is comprised of the Russell 2000 – TZA aims to emulate 3x inverse exposure to this index.

TZA’s target index is the Russell 2000 which measures the performance of roughly 2000 small cap companies based on market capitalization. The proposal is interesting insofar as small caps generally tend to outperform in times of market buoyancy, but also underperform as market risk escalated.

Being able to figuratively front run these trends by taking on negatively correlated exposure to US small caps is also a compelling way to hedge out near-term risk with very punctual positioning.

Index sector weightings are diverse. Healthcare is the biggest proponent (+18.93%) with financials (+17.12%), industrials (14.75%), information technology (+12.84%), consumer discretionary (+10.21%) all figuring prominently.

The smallest exposure levels go to communication services (+2.69%), utilities (3.41%) and materials (4.00%). The fund charges 105 basis points for the privilege of accessing this leveraged product, placing it in the ballpark of more exotic trading products.

BlackRock Fund Advisors managers this inverse leveraged pureplay comprised of total assets in the region of $530M. Options markets also exist, providing flexibility for traders to tailor risk to specific requirements.

Due to the synthetic nature of the product, its holdings are comprised of a mix of treasury instruments, cash management funds and mutual funds. Implicitly this implies counterparty risk given the over-the-counter nature of this product.

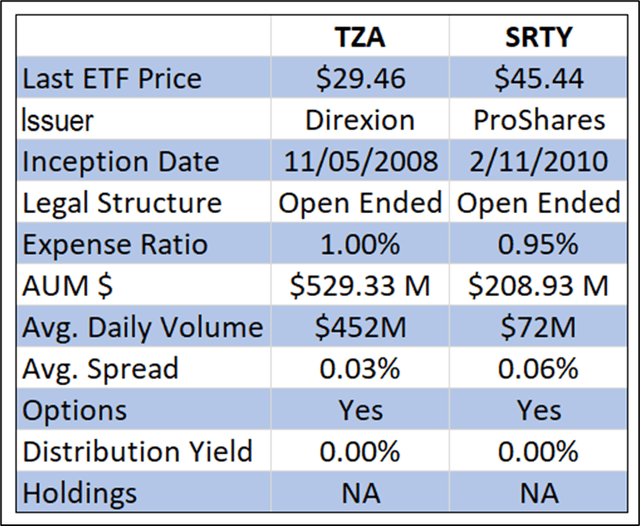

Spreadsheet developed by author with data from ETF.com

TZA dominates the inverse leveraged ETF space with very few competing products targeting the same niche.

Direxion has been the pioneer in this field, with TZA having market presence over the past 14 years. Assets under management are low, while average daily turnover is high, indicative of the short-term nature of a position. The development of derivative markets also makes it possible to generate additional income through option specific strategies.

The inverse leveraged ETF is ideal for money managers bound by long only investment policy statements. For example, in times of market downside, a long position in the Russell 2000 facing losses can be offset by gains generated in a bearish ETF such as TZA.

It’s somewhat a substitute for traditional protection such as put options and, while not being perfect, offers an alternative to recourse to derivative markets for home-made risk dimensioning.

Key Takeaways

Direxion Daily Small Cap Bear 3X Shares offers retail portfolio managers risk-off exposure in times of heightened market volatility.

It makes for an interesting alternative to traditional options markets for risk management and allows some degree of portfolio hedging, even if expected returns are not perfect given the underlying characteristics of inverse leveraged products (daily compounding, path dependency, daily resets etc.) This remains a product to keep at the back of the tool box and use sparingly when markets roll-over.

Be the first to comment