Drew Angerer/Getty Images News

Introduction

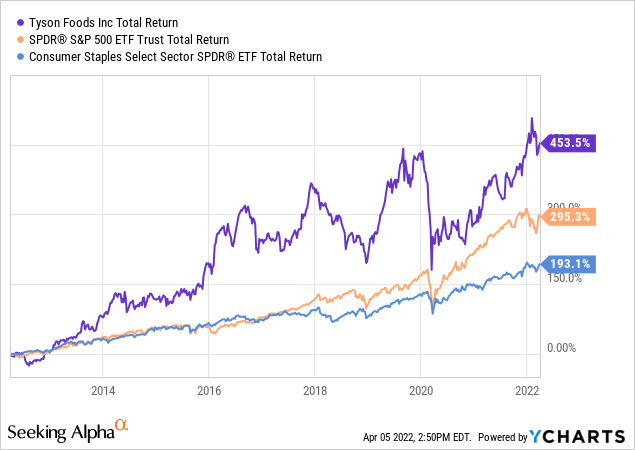

What do dividend growth investors look for in a stock? Reasons vary, but I’m sure that most reasons are tied to safety, consistent and reliable dividend growth as well as inflation protection. One of my favorite dividend growth stocks is Tyson Foods, Inc. (NYSE:TSN). My most recent article on this company was written in June of 2021. Since then, investors have enjoyed a total return of almost 25%. Needless to say, this beats the sky-high inflation rate by a wide margin. Year-to-date, Tyson beats the S&P 500 by roughly 7 points as investors bought “quality” instead of “growth.”

In this article, I will update my bull case and dive into the inflation protection that comes with Tyson as well as the potential to continue high long-term dividend growth.

So, bear with me!

Inflation Is Back

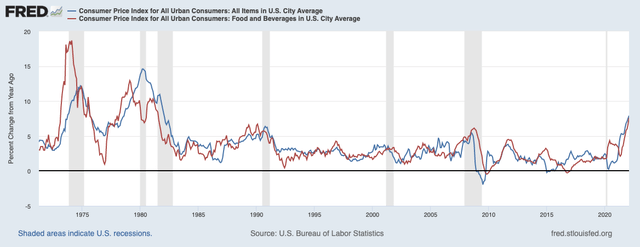

The “inflation is back” segment is almost just a formality, as everyone knows that inflation is back. Everyone who buys groceries knows that prices have gone up – a lot.

In this case, we’re dealing with consumer price growth and food (and beverage) price growth close to 8%. This exceeds anything we’ve seen since the 1980s. It exceeds the pre-Great Financial Crisis surge, and it beats the surge we saw in 2010-2011 when inflation came back after the recession.

These numbers are hurting consumers, and they are resulting in some secular shifts that we haven’t witnessed in a long time. The Wall Street Journal, for example, reports that shoppers are cutting back on consumer staples.

This is a quote from the article:

Now consumers, hit by soaring costs for everything from gasoline to child care, are drawing a line, analysts and retailers say. Shoppers are buying staples in smaller quantities, switching to cheaper, store-name brands and more rigorously hunting for deals. The shift is especially pronounced among lower-income consumers who splurged on household products amid the heights of the pandemic, they say.

What this means is that we need to buy stocks that go further up the supply chain. Tyson Foods, for example, is one of the biggest processors of meats in the United States. This comes with a benefit, as it does have a major footprint in the industry and it is well-diversified. Tyson has a lot of products and services and a big customer base. Walmart, for example, accounts for roughly 18% of total sales.

This is a big benefit, as this means that the biggest headwind is if customers start to cut back on meat consumption. That could happen, but it would mean that the economy is in deep trouble.

One of the problems for meat processors is that inflation is coming from every imaginable angle. This includes labor shortages and wage growth, transportation bottlenecks, rising input prices (animals and related), and more expensive capital expenditure. After all, meat processing is capital and labor-intensive.

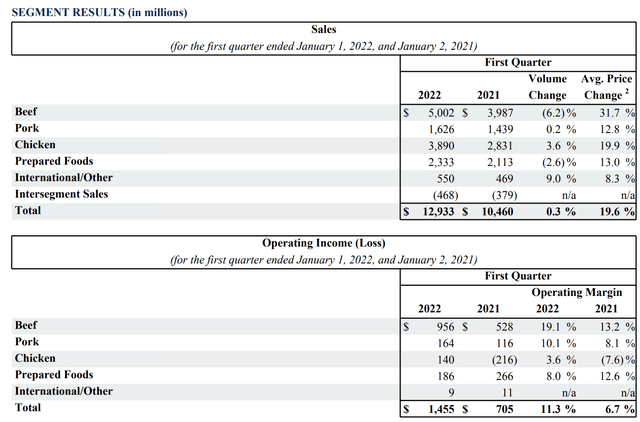

The company’s most recent 1Q22 quarter saw significant COGS inflation of 18%:

We’re also making sure that our pricing incorporates inflationary cost pressures on our business. In the quarter, our cost of goods sold was up 18% relative to the same period last year. We are seeing higher costs across our supply chain, including higher input costs, such as feed and ingredients. We’re also managing higher cost of labor, transportation due to strong demand and limited availability. With these higher costs, we work closely with our customers to achieve a fair value for our products.

As a result, our average sales price for the quarter increased 19.6% relative to the same period last year. This helped us capture some of the unrecovered costs due to the timing lag between inflation and price.

The tables below show what these price hikes look like. Essentially, beef prices were hiked by a stunning 31.7%. I had to read that number twice to make sure I got it right… Chicken prices were raised by 19.9%. Pork rose by 12.8%. As a result of these hikes, operating margins rose across the board with chicken becoming profitable again.

It’s remarkable to see these numbers and it’s good that the company is in a good spot to hike its prices.

Now, with that said, my bull case isn’t built on inflation only for one big reason: I don’t advise people to invest in dividend growth stocks for a limited amount of time only. I only advise stocks that do well throughout cycles. So, if you own TSN now, I advise you to not sell even when prices fall in the future.

Why? Because there’s so much value in TSN.

Value & Valuation

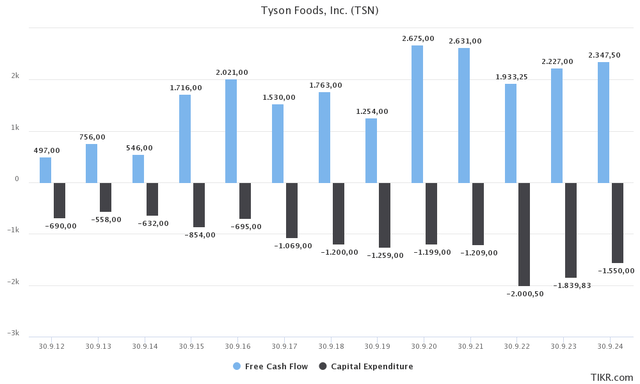

One of the things I cannot stop talking about is free cash flow (or FCF). Free cash flow is net income adjusted for non-cash operating items and capital expenditures. It’s money a company can spend on dividends, buybacks, or debt reduction.

In the meat processing industry, capital expenditures are high as the slaughter process is equipment intensive. It comes with a lot of regulations and sometimes complex buildings and a lot of upkeep. In the case of TSN, the company is expected to spend roughly $1.8 billion annually on CapEx in the 2022/23/24 fiscal years.

Yet, what matters is that it comes with a high(er) operating income. As a result, TSN is in a good position to continue generating close to $2.2 billion in annual free cash flow. In some years it’s higher, in some it’s lower. In this case, I’m going with $2.2 billion as I will show you something using this number.

Tyson has a market cap of roughly $32.6 billion and a 2.0% dividend yield. This means that the free cash flow yield needs to be at least 2.0% in order to satisfy the cash demand needed for its dividends. Yet, the free cash flow is much higher. It’s $2.2/$32.6*100 = 6.7%.

It’s higher using the estimates for the next two business years.

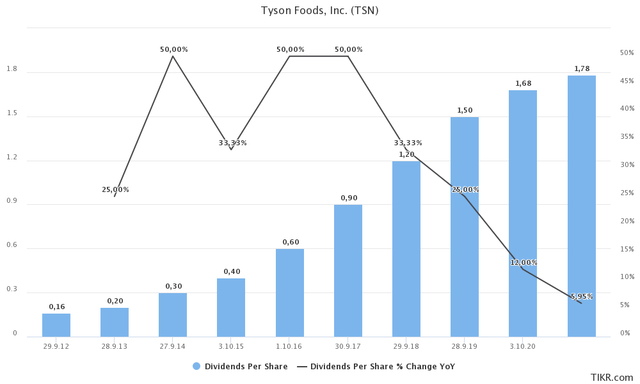

As a result, the company has a dividend history that looks like this:

Between FY2012 and FY2021, the dividend has been raised by 27% per year, on average. Since the start of the pandemic, the growth rate has been lowered.

Needless to say, I do not expect dividend growth to remain close to 27% per year, but double-digit long-term dividend growth is a possibility. After all, free cash flow is high, and the company has no history of net buybacks.

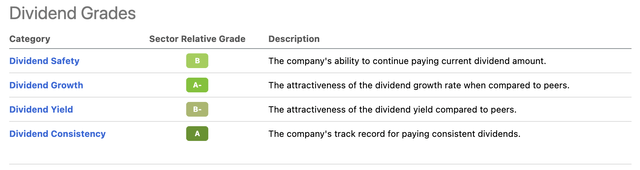

As a result, the company has a dividend scorecard that beats a lot of its peers.

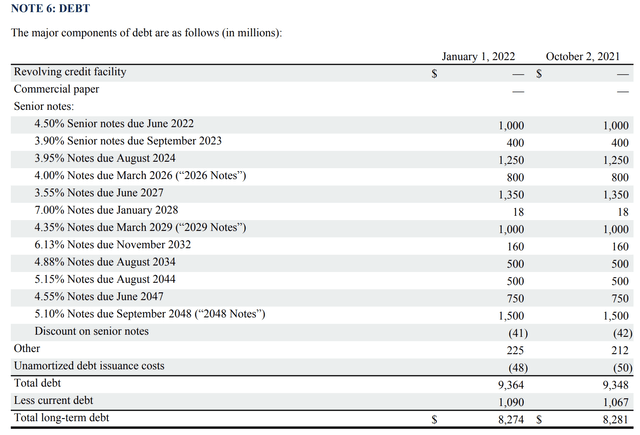

This scorecard is only possible because high free cash flow and strong margins come with a stellar balance sheet. As of January 1, 2022, the company has $9.4 billion in total debt.

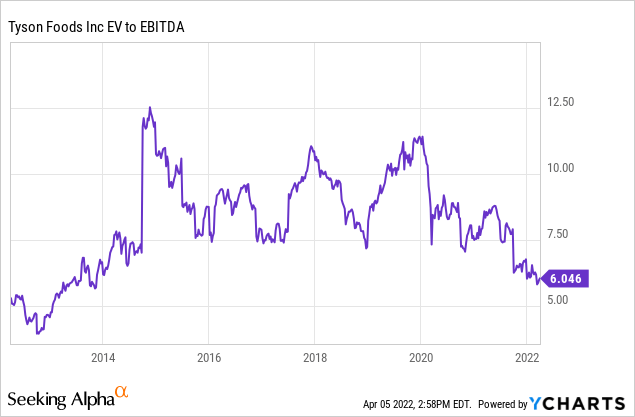

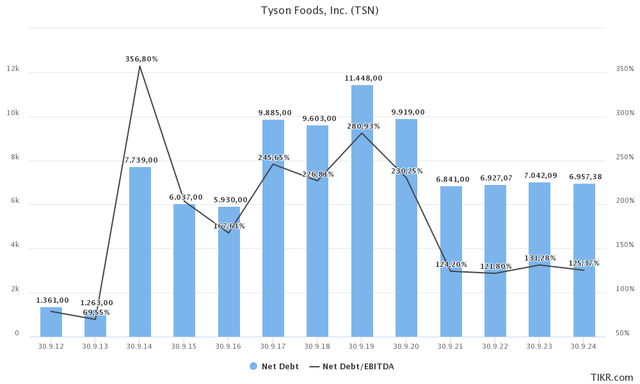

$1.1 billion of this is current debt. When adding $3.0 billion in cash, we get a net debt position of roughly $6.4 billion. That’s roughly 1.2x what the company is expected to do in annual EBITDA (see the graph below).

So far, we have concluded that TSN has:

- An anti-cyclical business model

- The ability to offset high input inflation

- High free cash flow

- A healthy balance sheet

- Strong dividend growth

This more often than not comes with outperformance. In the case of TSN, it most certainly does. Over the past 10 years, the total return (including dividends) has been 454%. The S&P 500 returned 295%. Consumer staples (XLP) returned 193%.

That’s nice, but do new investors need to overpay to get access to this kind of quality in a stock?

Let’s find out using the $32.6 billion market cap and $6.4 billion in net debt. These two numbers give us an enterprise value of $39.0 billion. This is 7.4x expected EBITDA ($7.4 billion).

Given the company’s historic valuation range, 7.4x is a good valuation. I think a fair value would be closer to 8-8.5 to account for high free cash flow (meaning stock price upside), but this price is great for people who have no exposure yet and the ones who want to add to an existing position.

So, let’s summarize.

Takeaway

Tyson Foods is one of the stocks that let you sleep well at night. The company has a solid, anti-cyclical business model. It has the ability to offset high inflation, it has very high free cash flow used to boost its dividend as well as a very healthy balance sheet.

I expect that the stock will continue to outperform the market on a long-term basis and I advise investors who want exposure to use the current price to start a position. The valuation is fair and if the stock dips in the future, one can use dividends and new capital to expand an existing position.

The words “no-brainer” are used a lot, but I think in this case we’re dealing with one. It reminds me a lot of my investments in the consumer staple industry or utilities. I own them, I enjoy their dividends and dividend growth, but I almost never check on them.

It’s what I like to call a “low maintenance stock.”

So, long story short, if you’re looking for quality dividend growth, look no further.

(Dis)agree? Let me know in the comments!

Be the first to comment