Theerawich Saikosoon/iStock via Getty Images

Peyto Exploration & Development Corp. (OTCPK:PEYUF) may not only be about to enjoy an increase in the price of oil and gas. I don’t believe that most investors have realized the total amount of proven reserves owned by PEYUF. Besides, in my view, if Peyto Exploration & Development continues to reduce its debt, new drills are successful, and the M&A activity continues, FCF will likely trend north. In any case, I believe that the market price misrepresents future expectations of free cash flow.

Peyto

Peyto is a Canadian energy company involved in the development and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin. The company’s production is mostly represented by natural gas, which is close to 89% of the total production.

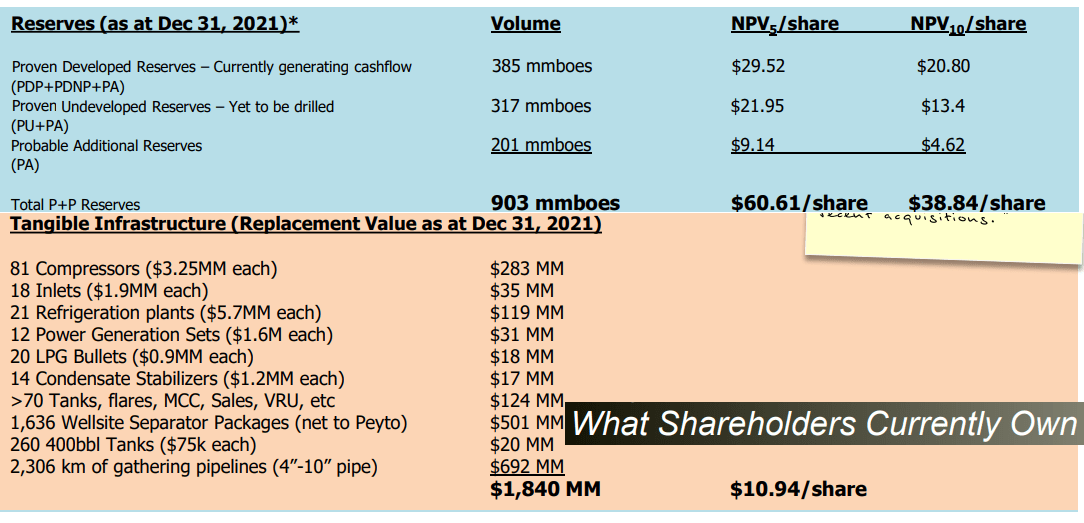

As of December 31, 2021, management reported proven and probable reserves worth 903 million barrels of oil equivalent. I became very interested in Peyto after learning that the company estimates that its reserves would imply a valuation between CAD60 and CAD38 per share. Traders are currently buying shares at less than CAD20.

Corporate Presentation

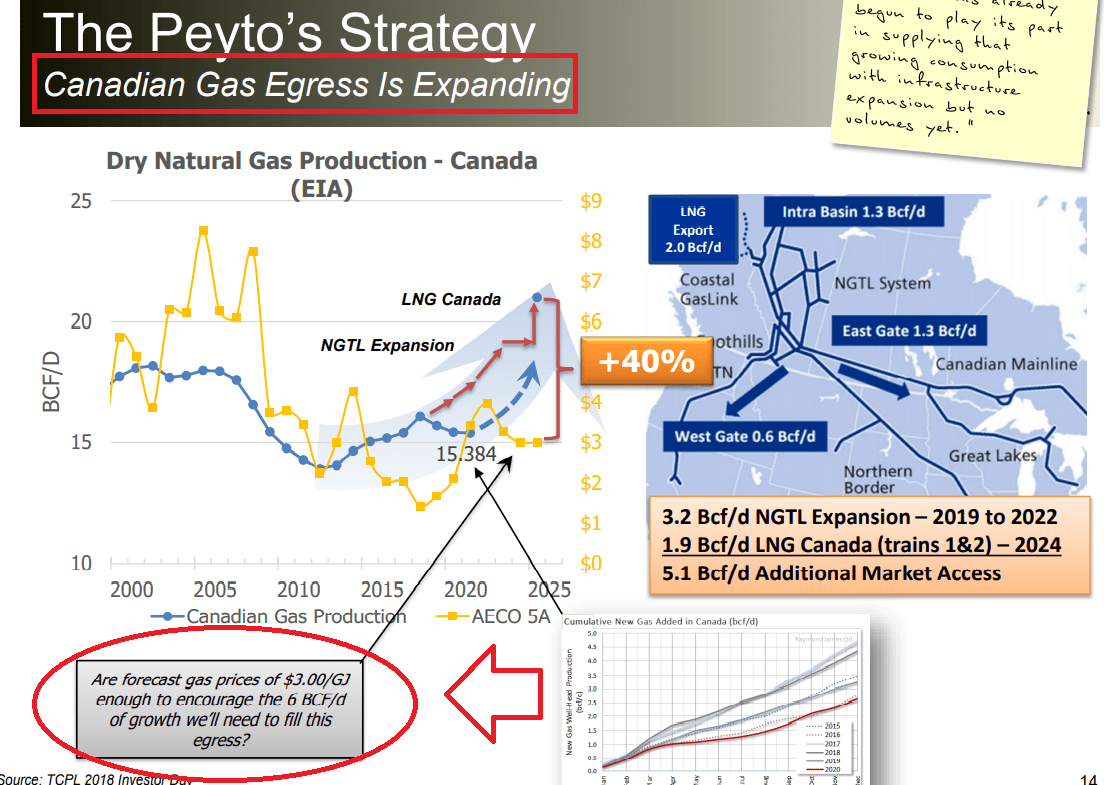

Right now, studying the gas industry in Canada is quite convenient. Keep in mind that from now to 2025, the Canadian gas production and most likely its pricing are expected to increase.

Corporate Presentation

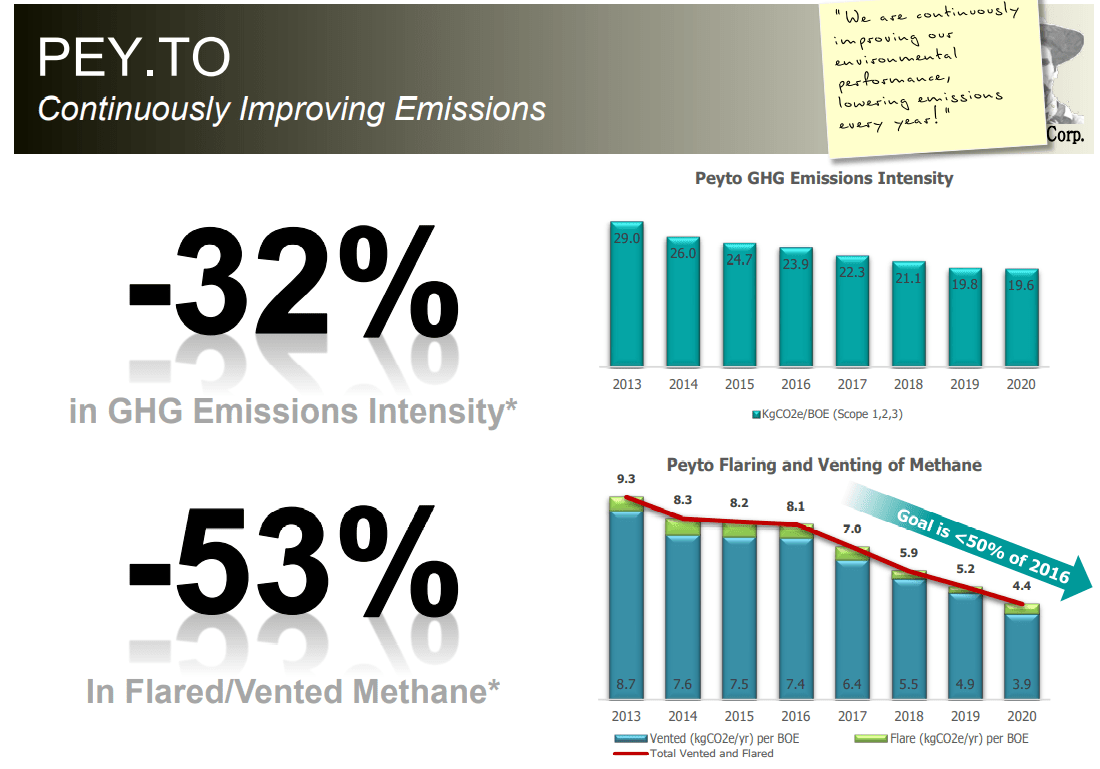

It is also quite remarkable that Peyto Exploration continues to reduce its GHG emissions intensity. In my view, management will be more prepared for dealing with new environmental regulations from authorities. Potential economic fines will be less significant if Peyto continues to decrease its emissions.

Corporate Presentation

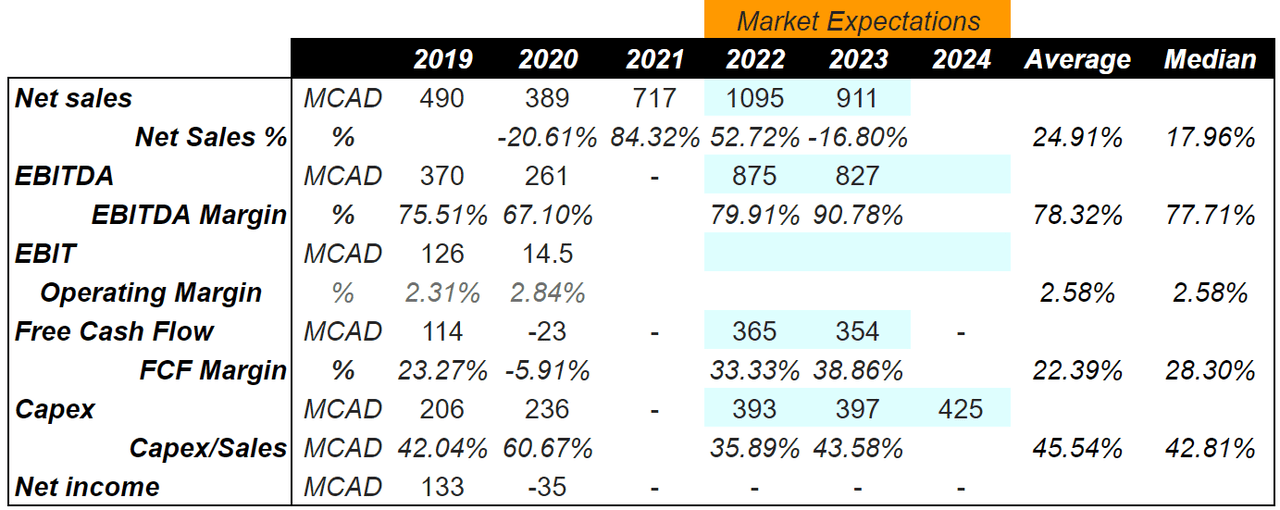

Estimates Are Quite Beneficial

I would have not been talking about this company if I hadn’t seen the estimates delivered by other analysts. They are expecting more than 51% sales growth in 2022. Both the average and the median sales growth from 2019 to 2023 stand at more than 17%. Peyto also reports a massive EBITDA margin. The median EBITDA margin stands at more than 77%. Finally, the FCF margin is expected to be equal to 33% in 2022, and 38% in 2023. While my numbers are not as optimistic as that of other analysts, I needed to point their figures out so that readers notice the current market sentiment.

marketscreener.com

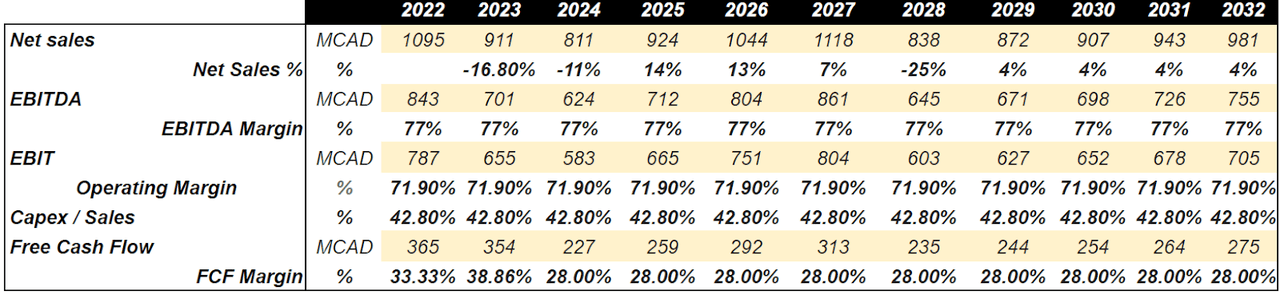

Base-Case Scenario, Assuming Debt Reduction, And Conservative Sales Growth

In the base-case scenario, I assumed sales growth close to 14%-7% from 2025 to 2027, and 4% sales growth from 2029 to 2032. It means that shareholders should envision revenue of CAD981 million in 2032, which is not far from the expected sales in 2022. My numbers are close to the demand and production of gas expected by market experts:

The impact of the 2020 crisis is, however, expected to have repercussions on the medium-term growth potential, resulting in about 75 bcm of lost growth over the forecast period, 2019 to 2025. This forecast expects an average growth rate of 1.5% per year during this period. Source: 2021-2025: Rebound and beyond – Gas 2020 – Analysis – IEA

Canada continues to increase production at a projected rate of 3% annually, mostly from the Montney shale to reach the levels needed to service the 19 bcm/y LNG Canada project. Source: 2021-2025: Rebound and beyond – Gas 2020 – Analysis – IEA

I also assumed the median EBITDA margin of 77% that I saw in the past, operating margin of 71%, and FCF margin of 28%. The results include FCF of CAD365 million in 2022, and 2032 FCF of CAD275 million. In my view, my numbers are very conservative.

YC

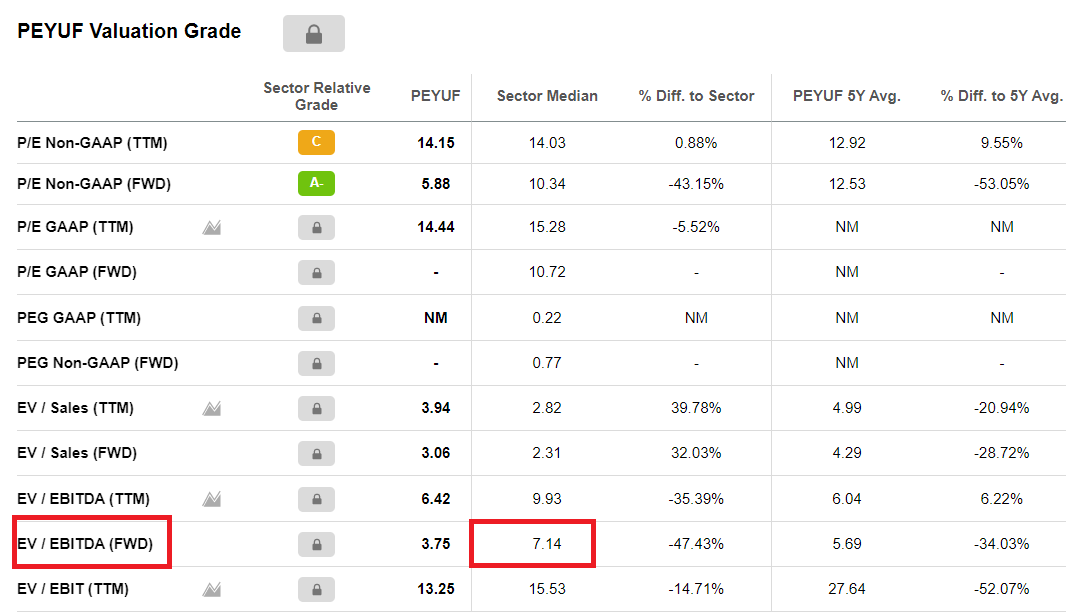

According to stats obtained from Seeking Alpha, the EV/EBITDA sector median stands at 7.14x. The company trades right now way below its peers. However, I assumed that management will reduce its debt, and the company’s EV/EBITDA will likely grow. With this in mind, my exit multiple is around 7x.

SA

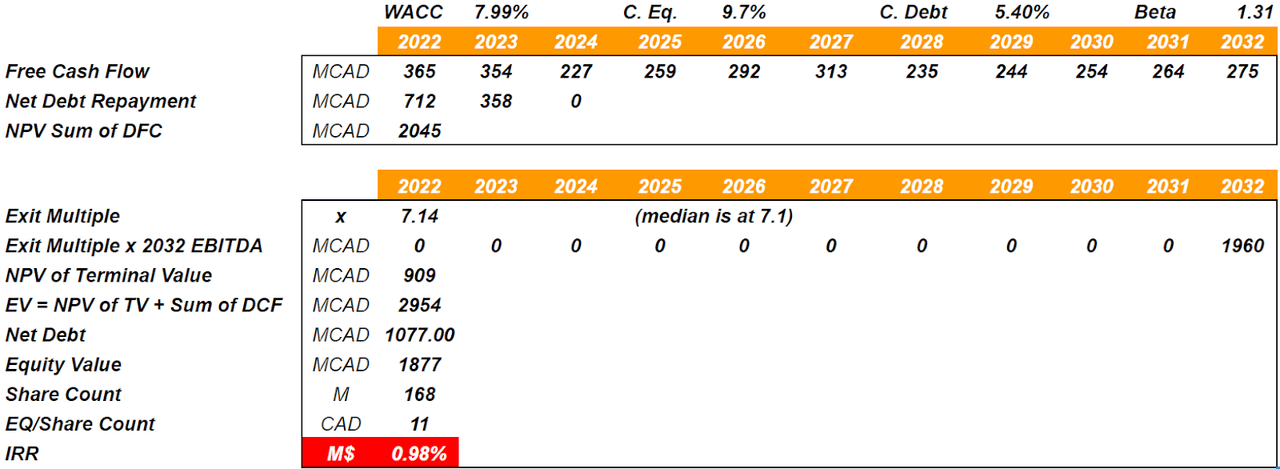

With a WACC of 7.99%, the sum of future free cash flow should stand at close to CAD2 billion. Notice that I also assumed a cost of debt close to 5.4%, cost of equity of 9.7%, and a beta of 1.31. With an exit multiple of 7.14x, the result includes an equity valuation of CAD1.8 billion, and an implied share price of CAD11.

YC

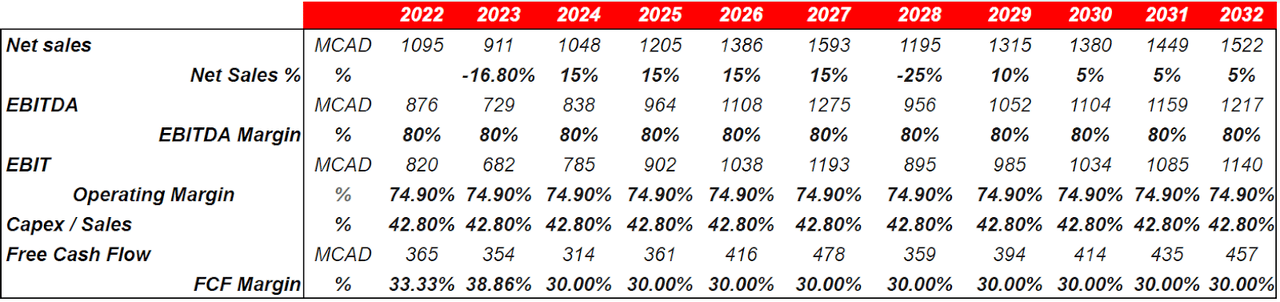

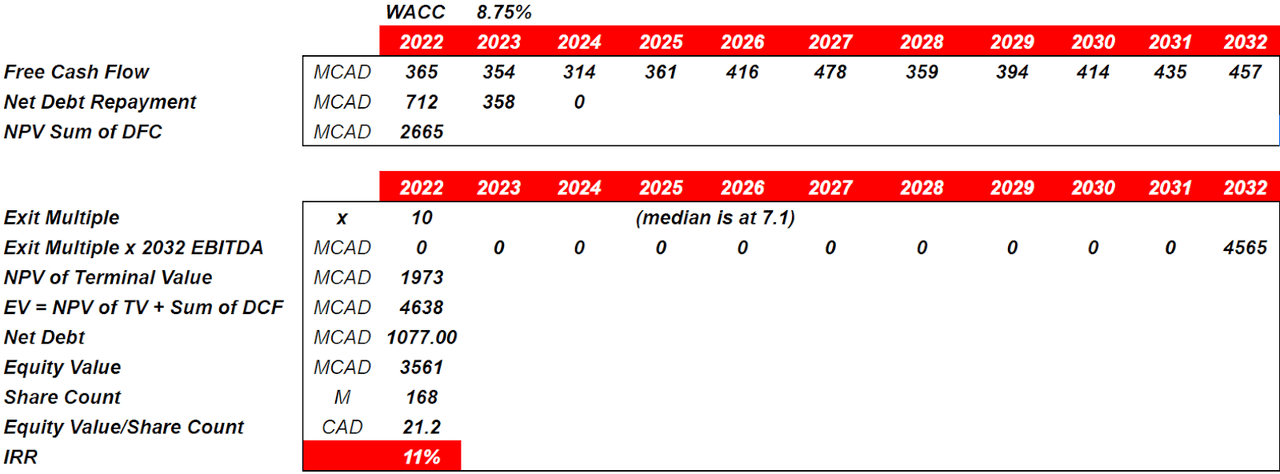

Best-Case Scenario Would Include More Acquisitions And More Successful Drilling Projects

Under the best-case scenario, I assumed that management will continue to hire experienced engineers to deploy internally generated drilling projects. The company has the support of financial institutions, which will likely offer cash in hand to do so. I also assumed that many of them will likely be successful, so the production will increase. As a result, I will be expecting double digit sales growth.

I would also expect an acceleration of the acquisitions because of the recent increase in the price of oil and gas. Let’s also note that the company is currently quite active in the M&A markets. If acquisitions accelerate, we will likely see more revenue growth and free cash flow in the coming years:

On February 1, 2021, the Company acquired assets in the Deep Basin for cash consideration of $35.0 million. The acquisition resulted in an increase in PP&E of approximately $48.0 million including $13 million in decommissioning liabilities. Source: 2021 Annual Report

Under this case scenario, I assumed 15% sales growth from 2024 to 2027, and 5% sales growth from 2030 to 2032. Also, with an EBITDA margin of 80% and FCF/Sales of approximately 30%, 2032 free cash flow stands at CAD457 million.

YC

Under the previous assumptions, a WACC of 8.75% would make a lot of sense because more traders will buy shares, and the cost of equity could decline substantially. Under these conditions, if the company decides to use all its free cash flow in 2022 and 2023 to repay its debts, by 2024, the company would have paid all its debts.

With an exit multiple of 10x, I obtained a net present value of the terminal value of CAD1.97 billion, and an equity valuation of CAD3.5 billion. The implied stock price would be CAD21.2.

YC

Risks: A Decline In The Price Of Gas, Or Failed Assessment Of Acquired Assets

Peyto Exploration acquires rights over oil and natural gas assets. If management fails to determine the value of the new assets, future free cash flow could be lower than expected. Despite doing substantial levels of due diligence and examinations of facilities, the valuation could be wrong. The company noted these risks in the last annual report:

Although Peyto’s focus is on internally generated drilling programs, any acquisition of oil and natural gas assets depends on an assessment of value at the time of acquisition. Incorrect assessments of value can adversely affect dividends to shareholders and the value of the shares. Peyto employs experienced staff and performs appropriate levels of due diligence on the analysis of acquisition targets, including a detailed examination of reserve reports; if appropriate, re-engineering of reserves for a large portion of the properties to ensure the results are consistent; site examinations of facilities for environmental liabilities; detailed examination of balance sheet accounts; review of contracts; review of prior year tax returns and modeling of the acquisition to attempt to ensure accretive results to the shareholders. Source: 2021 Annual Report

If the company produces less or gas prices decrease, future revenue and free cash flow would likely decline. As a result, Peyto’s fair valuation will likely decrease. If the media notes the reduction in future FCF expectations, the stock price could decline:

Expected returns depend largely on the volume of petroleum and natural gas production and the price received for such production, along with the associated costs. Source: 2021 Annual Report

Shareholders could also suffer significantly if geologists have to reduce the number of Peyto’s proven reserves. As a result, the book value per share will likely decline. Expectations of production would diminish, and the company’s fair valuation could decrease:

The value of Peyto’s common shares is based on, among other things, the underlying value of the oil and natural gas reserves. Geological and operational risks can affect the quantity and quality of reserves and the cost of ultimately recovering those reserves. Lower oil and gas prices increase the risk of write-downs on oil and gas property investments. Source: 2021 Annual Report

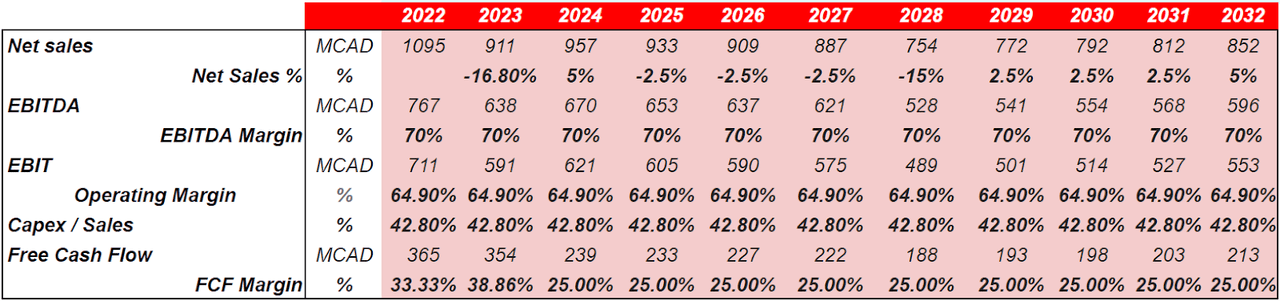

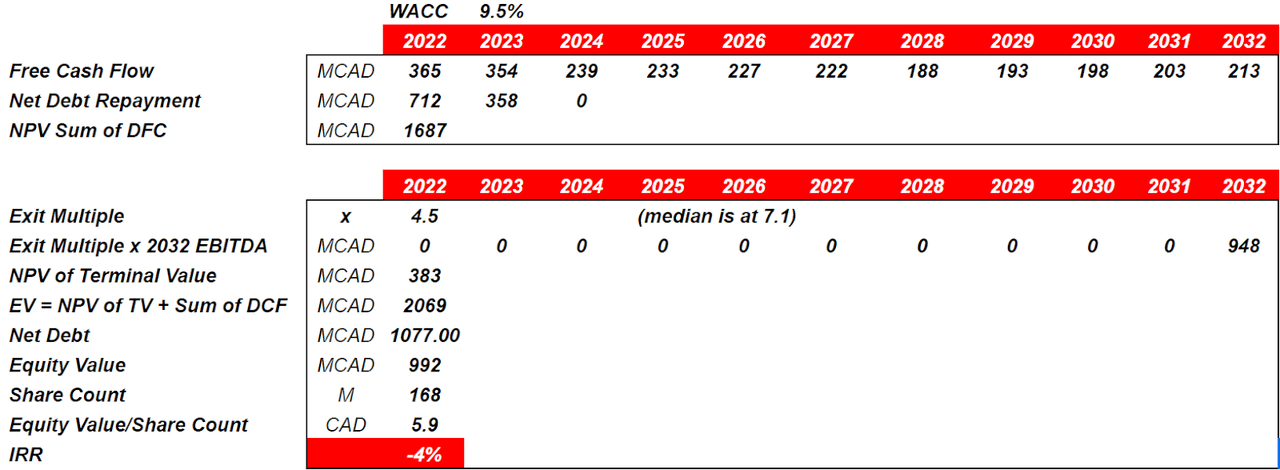

Under these assumptions, I assumed a decline in sales from CAD1 billion in 2022 to around CAD855 million in 2032. Also, with an EBITDA margin of 70% and operating margin close to 65%, the free cash flow would decline from CAD365 million in 2022 to less than CAD213 million in 2032. Also, note that the FCF margin would stand at 25%, which is significantly lower than that in the previous case scenarios:

YC

I also included a WACC of 9.5%, which implied a total sum of free cash flow of close to CAD1.65 billion. If we also include an exit multiple of 4.5x, the equity value should be close to CAD1 billion, and the equity value per share would be CAD5. In the light of these results and my previous case scenarios, I believe that there is more upside potential than downside risks.

YC

The Amount Of Debt Is Substantial, But With The Assumed Future Free Cash Flow, Peyto Will Be Able To Pay Its Debts

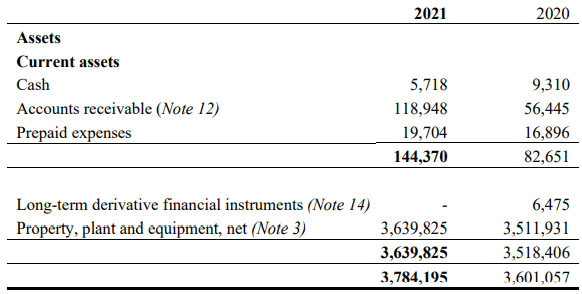

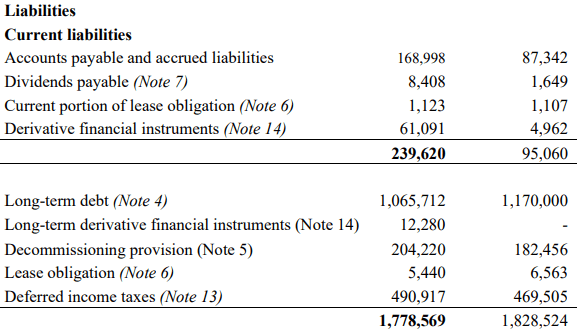

For the year ended December 2021, the company reported CAD5.7 million cash and an asset/liability ratio around 2x. The company’s most relevant assets are the reserves proven and other gas resources, which are depicted as property, plant and equipment, net in the balance sheet.

10-k

I do appreciate quite a bit that management reduced its debt from CAD1.17 billion reported in 2020 to CAD1.06 billion in 2021. With a forward 2022 FCF of CAD365 million, the debt level is below 3x FCF. In my view, most financial advisors will likely not be afraid of the total amount of debt. The company’s current undervaluation should not be justified by the total amount of debt.

10-k

Conclusion

Peyto will likely benefit from the recent increase in gas prices. If the company continues to reduce its debt level, and investors do note the total amount of proved reserves owned, the demand for the stock will likely increase. I would also expect significant free cash flow generation if management continues to acquire assets from competitors, and the assets are assessed correctly. In any case, I believe that the stock price fails to represent the proven reserves per share and the future FCF.

Be the first to comment