aydinmutlu/E+ via Getty Images

We usually think of defense contractors as in military, the battlefield, weaponry, sea superiority, fighter jets, pilots, soldiers, seals. With few exceptions – e.g., drone adaptation – most onlookers do not view these government personnel as drivers of commercial innovation. To the contrary, they often look to business for advancements with artificial intelligence, machine learning, low-cost rocketry, etc. In part, this thinking is because defense contractors are top-heavy with retired servicemembers trapped in their classified legacy paradigms. The National Defense Industrial Association, NDIA, puts it this way:

“Members of the defense industrial base and those that advocate its importance must make a more directed effort at changing the industry’s perception and more clearly communicate its role in developing and deploying new technologies.”

Climate Change

I am optimistic that traction can come from those prompted to think and act big toward helping us meet pressing non-military challenges. I’m channeling specifically on climate where acres of data and observation have established that our planet is rapidly warming resulting in melting glaciers, depleted rivers, rising sea levels, scorched basins, and extreme weather events, storms, floods, and fires. We are under attack.

Those looking for a straight-forward view of what is coming at us can do no better than NOAA’s dashboard (the National Oceanic and Atmospheric Administration). Or, if you prefer, here is what the Environment Protection Agency / EPA has to say on the subject. (Incidentally, the Clean Air Act defines an “air pollutant” as a chemical compound emitted into the “ambient air”; greenhouse gases meet the definition.) For those who reject such analyses, then look to manifestations of global warming that we see or read about every day; four examples:

- Glaciers around the world, including in North American, are receding at alarming rates with all those implications for down-mountain freshwater availability.

- Lakes Powell and Mead are at historic lows, near the point where hydroelectric power will be impaired never mind the H2O that businesses, hoteliers, farmers, and 40 million people need.

- As the result of polar ice melt, sea levels continue to rise threatening coastal properties around the world including on our eastern seaboard.

- The Great Salt Lake is shrinking and could make Salt Lake City (and towns north and south, and the great ski resort areas east?) “unlivable”.

Lockheed Martin

No purpose is served here by reviewing the myriad of approaches for addressing climate change / global warming. Suffice it to say that we must significantly reduce carbon emissions, meaning our dependency on fossil fuels in favor of cleaner renewable energy. But there are challenges including with solar and wind energy when the sun doesn’t shine, and the air goes still. We must find ways to store copious quantities of that energy pending its use before nature again ‘cooperates’. We must also revisit sources of cleaner energy that have fallen into disfavor, meaning nuclear.

Enter defense contractors Lockheed Martin (LMT) with their “flow batteries” and BWX Technologies with their “small modular reactors” or SMR’s. I authored an article two months ago on the former topic that referenced Lockheed. In that piece, I stated that:

“Lead-acid and lithium-ion batteries ‘drain’ such that they need recharging but, even then, require replacement every few years. Still, they are widely available and portable making this technology eminently suitable for electric vehicles and so forth…”

…I went on to say…

“However, grid-level storage of electricity is another matter. In contrast to traditional batteries wherein the electrolytes mix readily with conductors in a single encased cell, in flow batteries the fluid is separated into two tanks and electrons flow through electrochemical cells and a membrane which separates them; the larger the tanks, the more electricity can be generated. This gives flow batteries the distinct advantage of being able to store energy in quantity, before it is needed, as it is created, for example, by wind turbines and solar panels.”

Most companies in the flow battery space are early stage. However, by way of its “GridStar” energy division, Lockheed Martin could become a / the major provider of utility / industrial-strength flow batteries. Yes, really – On June 14th, DOD and Lockheed announced the first long-duration energy storage system for the U.S. Army at Fort Carson, Colorado, under the management of the U.S. Army Engineer Research and Development Center’s (ERDC) Construction Engineering Research Laboratory (CERL). We know little about the technology perhaps because of security issues but their announcement proclaimed:

“Electric grids are undergoing unprecedented change. Energy requirements are shifting as we consider renewable resources coupled with utility-scale, long-duration storage options,” said Dr. Andrew J. Nelson, director, CERL. “Solutions to increase resiliency and self-sufficiency are crucial to economically and sustainably supporting DoD operations.”

We can only hope that, if successful, the Defense Department and Lockheed Martin will think big and ensure that this technology is available to others outside the military. If so, we could accelerate the adoption of wind and solar energy. Will it move the needle for Lockheed and its investors? – that’s for them to decide, time will tell, the demand is there.

BWX Technologies

Right up front, BWX Technologies (BWXT) is NOT as clean as Lockheed’s solution because it involves nuclear energy. However, it is cleaner than fossil fuels which is why experts / countries are revisiting it, Three Mile Island, Chernobyl, and Fukushima notwithstanding. The rethink is in the context of “Small Module Reactors or SMR’s. Warren Buffett, Bill Gates, TerraPower (private), NuScale (SMR), and others are pursing these downsized nukes to deliver fission for smaller energy-intensive uses such as powering desalination plants. As their name suggests, among their advantages is scalability.

What makes BWX Technologies unique is that they are quite familiar with the basic technology and services because they have delivered and serviced it for years in the propulsion of naval vessels, aircraft carriers and submarines. As for broader applications, BWX and DOD have just announced “Project Pele” to build and deliver a full-scale, advanced, transportable, quick assembly microreactor, to the Idaho National Laboratory for testing by 2024. Like Lockheed’s flow battery initiative, this initiative could be a gamechanger if those involved have the will to make it so.

A Few Financials

So, there you have it – two defense contractors on the cusp of delivering technologies that could be critically important to our transformation away from fossil fuels to clean(er) renewable energy. Moreover, these companies are already ‘of the national interest’ with good financial profiles as measured by revenue / growth, gross profit, operating income, net income, operating cash flow, liquidity, capital adequacy, PE ratios, dividends / coverage, and human resources. (Numbers compliments of SA.)

|

2021 |

Lockheed Martin |

BWX Technologies |

|

Revenue / Growth |

$67.0B / +2.5% |

$2.1B / 0.0% |

|

Gross Profit / Growth |

$9.1B / +4.8% |

$550M / -4.3% |

|

Op. Income / Growth |

$7.8B / -11.9% |

$402M / +11.1% |

|

Net Income / Growth |

$6.3B / -8.3% |

$306M / +9.8% |

|

Op. Cash Flow / Growth |

$9.2B / +12.7% |

$386M / +96.5% |

|

Liquidity / Current Ratio |

1.4x |

1.7x |

|

Capital / Liabs. to Equity |

3.6x |

2.9x |

|

Price-to-Earnings Ratio |

15.0x |

15.9x |

|

Dividend Yield |

2.8% |

1.8% |

|

Payout Ratio |

47% |

26% |

|

Full Time Employees |

120,000 |

14,000 |

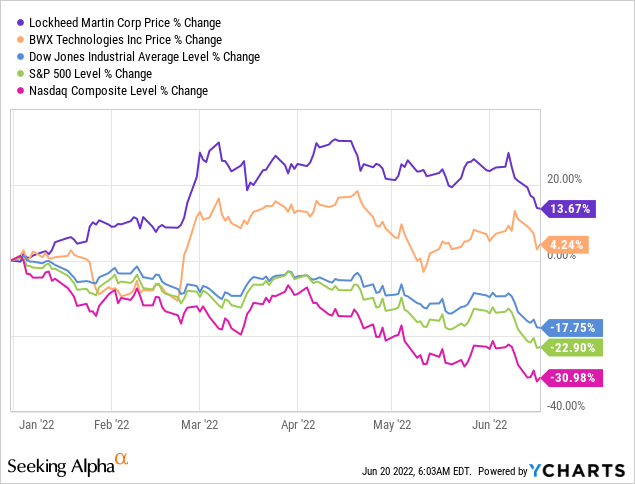

LMT and BWXT are better than resilient stocks insofar as they have risen in these terrible markets. Other defense stocks have also done well YTD owing to Russia’s invasion or Ukraine, China’s posturing in its adjacent seas, and increases in U.S. defense spending.

Overall, the industry is a near perfect place to invest right now. If you accept the hypothesis that LMT and BWXT will benefit from a potential change in their business mix weighted more toward cleaner energy, then they might continue to thrive when geopolitical risks ease. Investment in related metals might do well along with them.

MarketWatch reports that eight out of 21 professional analysts have LMT a “buy” with 13 a “hold” and an average price target of $485.71 representing a 19% premium over Friday’s close of $407.50. Five out of 7 professional analysts have BWXT a “buy” with 1 a “hold” and 1 a “sell” against an average price target of $64.00 representing 27% upside over Friday’s close of $50.29. I’m very bullish.

Be the first to comment