Jamie McCarthy/Getty Images Entertainment

Article Thesis

Twitter’s (NYSE:TWTR) most recent quarterly results show a lot of problems. The company is unprofitable, dilutes shareholders at a rapid pace, and business growth has turned negative. I do believe that this company isn’t worth $44 billion, which is the amount of money Elon Musk possibly has to pay for Twitter if courts force him to close the acquisition. If that happens, TWTR would have meaningful upside potential from current prices, but I personally am not interested in this somewhat risky bet.

Twitter’s Second Quarter Was Pretty Bad

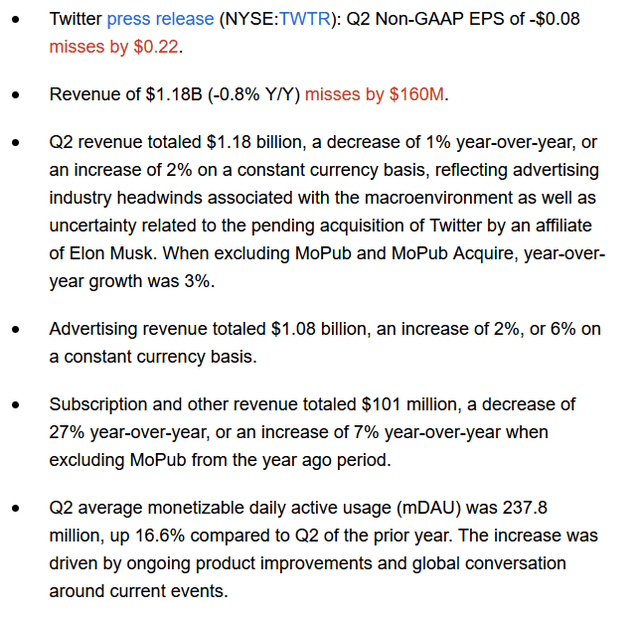

On Friday, Twitter reported its most recent quarterly results. These are the headline numbers:

Not only did the company miss estimates widely, but there were also some rather bad developments on top of that. Revenue for the quarter was actually down year over year, which is pretty disastrous. Not only does this hurt (or potentially even invalidate) the growth story, but it also means that advertisers seemingly don’t put a lot of value on Twitter’s ability to generate traffic and business for them.

Twitter’s daily active users were up 17% year over year, which means that at a constant revenue per user, Twitter should have been able to grow its revenue at a high-teens rate. This does not even account for inflation yet. But Twitter saw its revenue drop 1% year over year, or by around 10% in real terms, despite the fact that its user count was up meaningfully over the last year. Declining revenue per user naturally is bad, as it not only hurts company-wide revenue but since it also leads to declining gross and operating margins.

It should be noted that the weak revenue number was partially explained by the strong US Dollar, as forex changes had a negative impact on reported revenues. But even when we adjust for that, revenue growth was deeply negative in real terms, and revenue per user declined by double-digits. When Twitter isn’t able to grow its revenue during a period when its user count rises, what will its revenue performance look like in a period when its user count is stagnant or declines? Due to the elections in the US later this year, 2022 might be an above-average year for Twitter in terms of user count growth and engagement. If Twitter can’t even perform well this year, it seems doubtful whether the outlook beyond 2022 is better.

The company reported a small net loss of $0.08 per share on an adjusted basis, but that does not tell the whole story. Adjusted earnings per share include a range of add-backs and reported/GAAP results are significantly worse. The company lost $270 million on a net basis during the quarter, or around $1.1 billion annualized. That does already include a benefit from income taxes — operating losses were even higher, at $330 million, or $1.3 billion annualized.

This is a rather bad development, as Twitter wasn’t always this unprofitable. In fact, the weak profitability can be explained by a huge increase in its costs and expenses. Those rose by 31% year over year, which brings up several questions:

– Why are expenses rising by more than 30% during a period where business growth is negative? What is all of this money spent on, and why? It seemingly isn’t generating any growth tailwinds for Twitter. It looks to me like spending is far from rational here, and costs aren’t really aligned with the revenue the business generates.

– Why are expenses rising so much faster than inflation? An EV company that sees its nickel and lithium costs explode naturally faces major cost pressures, and retailers that have to pay a lot for shipping do so, too. But a tech company without large commodity or shipping exposure shouldn’t see its expenses rise at 3x or 4x the rate of inflation, especially when its revenue is actually dropping in real terms.

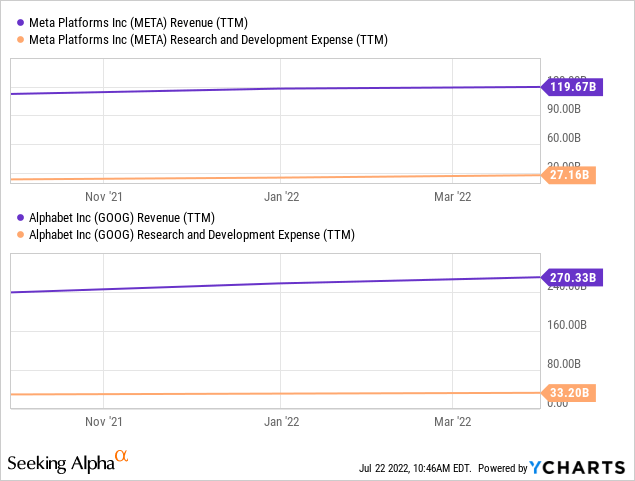

One of the largest spending blocks is R&D. Twitter spent $450 million on that in the most recent quarter, or close to $2 billion annualized. I do not see how this is needed or value-creating, as Twitter has not come out with large and new products in quite some time — otherwise, its revenue performance would be better. R&D spending also looks like it is totally imbalanced versus Twitter’s revenues — the company spent 39% of its revenue on R&D, which is very high relative to other social media and advertising players:

Meta Platforms (META) and Alphabet (GOOG)(GOOGL) are spending 22% and 12% of their revenue on R&D, respectively. One can argue that even Meta is overspending on R&D for now due to its Metaverse ambitions, but Meta at least is very profitable, unlike Twitter. Since both Meta and Alphabet are generating solid revenue growth, their R&D spending also seems to be more fruitful — it actually leads to growth opportunities, which is not the case with Twitter.

Even Twitter’s G&A expenses rose by 54% year over year, and I don’t know any good reason for that. User count is up by 17%, and revenue is down 1%. G&A expense growth anywhere in that range would seem more or less sensible, but a 50%+ increase in general and administrative costs during a negative-growth quarter looks like an incredibly bad result for shareholders — although it could be good for employees, which benefit from huge share-based compensation spending. In fact, Twitter’s SBC expenses rose from $178 million in the year-ago quarter to $282 million in the most recent period, which pencils out to a 58% increase. How anyone can believe that this is justified while these employees do not even manage to keep the top line flat is beyond me.

To me, it looks like Twitter could be a great place to work, as compensation rises rapidly despite Twitter’s underperformance versus peers. But Twitter does not look like a great place to invest one’s money, as I do not have the impression that the company is focused on generating value for shareholders.

Musk Could Get Forced To Buy Twitter At A Too-High Price

Elon Musk, Tesla’s (TSLA) largest investor, could be forced to buy Twitter for $44 billion, as that is the price he originally agreed to in a deal with the company. I do not believe that Twitter is worth $44 billion — that’s a roughly 9x sales multiple, whereas its peers Meta and Alphabet trade for 4x and 5x this year’s revenue, respectively. Not only is Twitter much more expensive, but it is worse in many aspects on top of that. It’s unprofitable, generates less growth (actually shrank in the most recent quarter), has a smaller moat and weaker brand, and issues more shares to employees on a relative basis. A new owner might be able to improve some things, but I do not believe that paying twice the sales multiple of much stronger companies in the hope of improving things is a great idea. Elon Musk seems to agree now, as he wants to back out of this deal. Unfortunately, for him, he could get forced to close the acquisition at the agreed-upon price of $54.20 per share, or around $44 billion. Both parties will be fighting this out in court, but Delaware courts are generally inclined to force the closing of such deals when they go to court, which could give Twitter an advantage. Major investors agree with this sentiment, believing that Musk will get forced to close the deal, even though he doesn’t want to do that any longer.

For Twitter investors apart from Elon Musk, this naturally would be a good thing. If the deal closes, they would receive $54 per share, which is around 38% more than the current share price — a nice return, assuming the deal closes in the next year or so. Twitter could thus be a speculative buy right now, but I do not believe that this is due to its underlying value — which could be even less than the current share price. Instead, Twitter would solely be a buy in order to speculate on a forced deal closing. I personally don’t want to buy based on that, as it seems risky — if Elon Musk were to prevail in courts, Twitter’s stock could fall quite a lot. Snap’s (SNAP) weak results have resulted in a hefty 35% price drop, and without the “Elon put”, Twitter might have suffered a similar fate.

Takeaway

Twitter never was an especially attractive stock to invest in, but things have gotten worse. Growth has turned negative, revenue per user is dropping, and expenses are exploding upwards, without there being an obvious reason for why that would be justified.

On a fundamental basis, I do not believe that Twitter is worth the current share price, as other, stronger social media companies are trading at lower valuations (e.g. Meta). Twitter could still work out as a speculative buy if Elon Musk is forced to close his acquisition, but that is not guaranteed so far. If that were to happen, Elon Musk might be forced to sell some of his Tesla stake in order to increase his liquidity, which is why Tesla’s shareholders will likely also be interested in seeing how this plays.

Due to the potential upside for Twitter in a forced-deal scenario, Twitter could be a speculative buy right here. But I personally prefer to invest based on fundamentals, which is why I’m staying away from this company, which is, I believe, mismanaged — especially since much better peers are available at attractive valuations.

Be the first to comment