Legally: his own worst enemy; financially: his own best friend. Win McNamee

Legal Impact

When I’ve been a plaintiff and a witness in Delaware court, my lawyer tells me,

Tell the truth but don’t volunteer anything.

Elon Musk has proven why that is wise counsel. Like in the Miranda rights,

Anything you say can and will be used against you in a court of law.

And it will be taken out of context and used to maximal effect by very smart and aggressive lawyers working to undermine your case. Here are various ways that Musk’s tweets and other public comments undermine the case that his lawyers are heroically trying to cobble together with bubble gum and shoe strings.

Elon Musk (party in a lawsuit):

Skadden Arps is working hard to present the case that Musk was defrauded by Twitter (NYSE:TWTR). The allegation is that Twitter fraudulently misrepresented the percentage of bots on their site and Musk relied on that fraud when he signed the definitive merger agreement. It is a delicate case to make. If any part of it is disrupted, the claim collapses. There is nothing wrong with being incorrect. The representation must be fraudulent. And the buyer must have relied upon it.

Elon Musk (the guy):

Anyone who uses Twitter is well aware that the comment threads are full of scam, spam, and a lot of fake accounts. It seems beyond reasonable for Twitter to claim that the number of real unique humans is above 95%. That is what they are claiming. Does anyone have that experience?

– Elon Musk

So, far from relying on Twitter’s bot claims, just like anyone who uses Twitter, Musk was well aware of the bot problem.

Elon Musk (party in a lawsuit):

He received Exhibit 4, Twitter’s confidential mDAU auditing guidelines.

Elon Musk (guy who tweets):

If Twitter simply provides their method of sampling 100 accounts and how they’re confirmed to be real, the deal should proceed on original terms.

– Elon Musk

So he tosses out the laundry list of complaints his lawyers made about Twitter and leaves them with a single item (not one that is material, fraudulent, or relied upon, so exceedingly weak in terms of contract law): will Twitter provide their method of sampling? They already did.

Elon Musk (party in a lawsuit):

He signed a document, the definitive merger agreement, which stipulated in section 6.4 that,

… nothing herein shall require the Company or any of its Subsidiaries to disclose any information to Parent or Acquisition Sub if such disclosure would, in the reasonable judgment of the Company, (i) cause significant competitive harm to the Company or its Subsidiaries if the transactions contemplated by this Agreement are not consummated…

Then he brought a precarious case that Twitter did not adequately disclose information to him, even though that case needs to dance around this section allowing them to use their reasonable judgment about the potential for significant competitive harm.

Elon Musk (guy who gets bored and has trouble falling asleep so tweets…):

Does he have thoughts about creating his own social platform if the Twitter deal doesn’t come through? Why yes he does!

X.com

– Elon Musk naming the competitor he would create

So while Skadden needs to say that Twitter can’t limit information that they can limit if their reasonable judgment says that disclosure might cause significant competitive harm, Musk blurts out that he might become a competitor! In short, Musk tweets killed his suit against Twitter.

Financial Impact

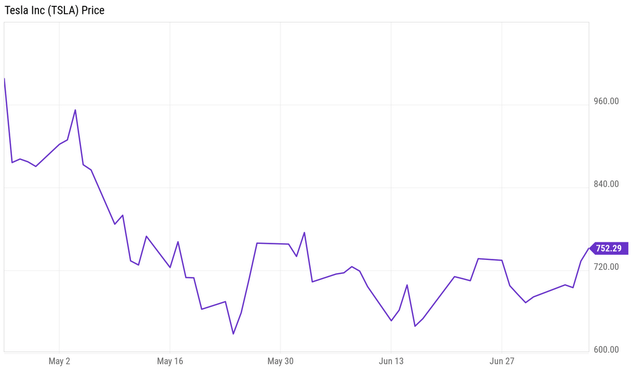

Musk’s efforts to renege on his commitment to Twitter was never about bots. It was always about Tesla (TSLA). When he signed the deal, Tesla cost around $1,000; when he walked, it cost around $750.

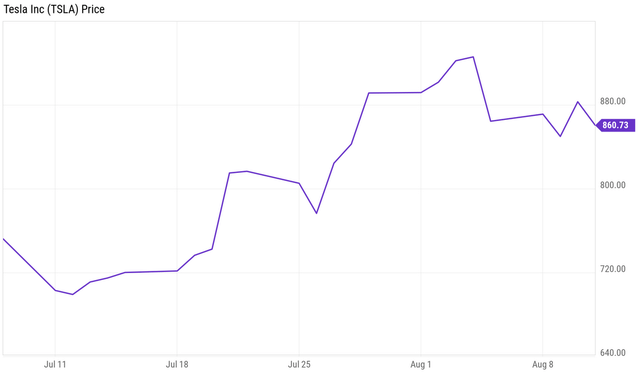

So Musk expected his original $21 billion equity commitment to cost him around 21 million of his TSLA shares. But after they declined, that same equity commitment would cost 28 million TSLA shares or a third more. That is more than he bargained for or wanted to pay, so he walked. But since then, TSLA has substantially recovered.

Now the original equity commitment costs 24 million TSLA shares, leaving Musk with around 155 million. And delaying and obfuscating the TWTR commitment and related need for TSLA sales helped support TSLA’s stock, allowing him to exit higher. The more he cast doubt about TWTR, the better TSLA performed and the more money he was able to raise from his sales. His tweets repeatedly questioned the Twitter deal and committed to not sell more Tesla, allowing him to sell more Tesla in order to pay for Twitter. So even at the original agreed upon $54.20, Musk was able to use the lawsuit to get a price cut, at least denominated in his TSLA shares that were necessary to pay for the deal.

Conclusion

While he is unlikely to win legally, Musk’s public pronouncements have helped him use the legal process to win financially. Much of the pain of buying Twitter’s shares is ameliorated by the pleasure of getting to advantageously sell Tesla shares. The audience for his dubious suit was never Chancellor Kathaleen McCormick, who is about the last person to fall sway to Musk’s antics. The audience was always Tesla fans who believe anything that Musk says or tweets. Whether or not the chancellor would ever believe Musk (spoiler alert: she won’t), Tesla shareholders already bid up the stock over the past month, more than offsetting Musk’s legal bills.

TL; DR

If you’re going to court: don’t volunteer anything.

If you’re the richest guy in the world: do pretty much whatever you feel like.

If you prefer $54.20 to $43.96, then buy TWTR.

Be the first to comment