metamorworks/iStock via Getty Images

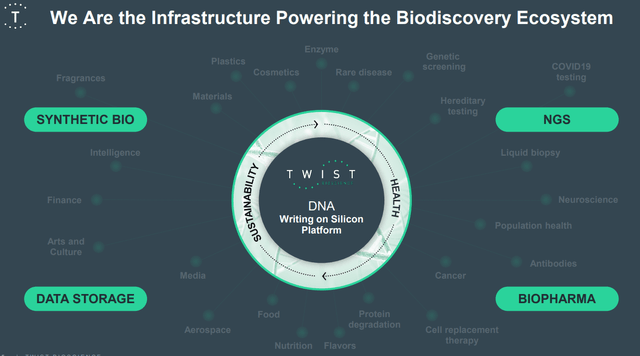

Twist Bioscience Corp. (NASDAQ:TWST) commercializes a DNA synthesis platform that automates synthetic DNA production on a silicon chip. Through software, the process is capable of driving thousands of chemical reactions to write strands of DNA significantly more effectively than alternative methods. The applications here for this type of “engineered biology” cover everything from the diagnosis and treatment of disease in healthcare, genetically modified agriculture, high-tech materials production, and even working as a form of large data set storage.

We last covered TWST with an article back in 2020, highlighting what was then a “breakout year” for the company in terms of showcasing its market potential. While shares held onto a solid gain for much of 2021, the story since Q4 has been significant volatility amid the extreme market selloff, particularly in this segment of the high-growth, yet unprofitable tech companies. Indeed, the stock is off more than 50% from its 2021 high despite what has been overall strong operating momentum. This article recaps recent developments including the latest quarterly report while we reaffirm our long-term bullish view for the stock.

source: company IR

TWST Q3Earnings Recap

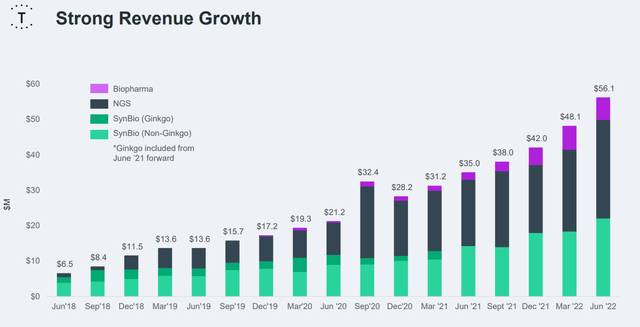

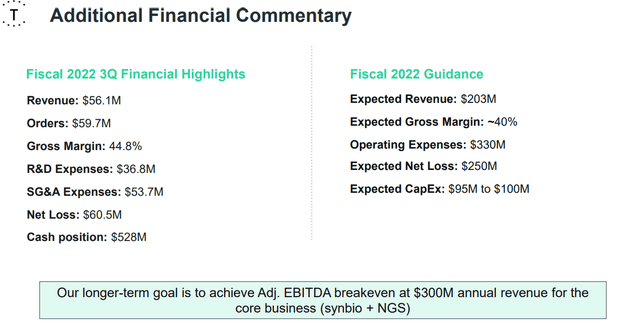

Twist reported its fiscal Q3 results on August 5th with a net loss of $60.5 million or -$1.08 per share, compared to a loss of $40 million loss in the period last year. While higher spending and investments in support of growth explain the larger loss, the real story here is the strong operational momentum. Revenue reached $56.1 million, up 60% year-over-year. The pace also accelerated during the quarter with sales up 17% over Q2.

source: company IR

The company shipped products to approximately 1,900 customers in Q3, versus 1,800 in the period last year, implying an expanding revenue per customer which provides some visibility to the forward outlook. A key operating metric is the number of genes shipped, referring to the manufactured synthetic DNA, each ordered through a customizable online process. One example would be a biotech customer ordering synthetic genes for testing in an attempt to find an optimal sequence in drug development. Other products include Next-Generation Sequencing (NGS) tools that allow customers to work with diseases and viruses for research and in the development of new diagnostic tools.

Notably, Twist in collaboration with privately held “Biotia” received an expanded Emergency Use Authorization from the FDA of its SARS-CoV-2 Next-Generation Sequencing Assay that can identify new variations of Covid. Twist also launched two monkeypox synthetic DNA controls, which is intended for customers to use in the development of next-generation vaccines and field testing. This update likely added to momentum in the stock over the last few weeks, although the actual financial impact is likely limited over the near term. The point here is that the entire product portfolio is leveraged into the same DNA synthesis platform which has significant potential.

In terms of financials, expenses are up ahead of the launch of the company’s new “Factory of the Future” which is billed as a green-energy powered facility expected to more than double capacity once completed. Favorably, the gross margin at 45% in Q3 was up from 40% in the period last year. This trend is expected to accelerate over the next few years as the company scales.

Management is guiding for full year revenue at $203 million, which represents an increase of 54% over 2021. This was revised higher from the Q2 midpoint revenue guidance closer to $195 million. The expectation for a loss of -$250 million, slightly lower than the Q2 estimate, compares to -$152 million in 2021, again based on the larger capex expense. Keep in mind that Twist ended the quarter with $528 million in cash, equivalents, and short-term investments against zero long-term debt. The balance sheet position is a strong point in the company’s investment profile.

source: company IR

What’s Next For Twist

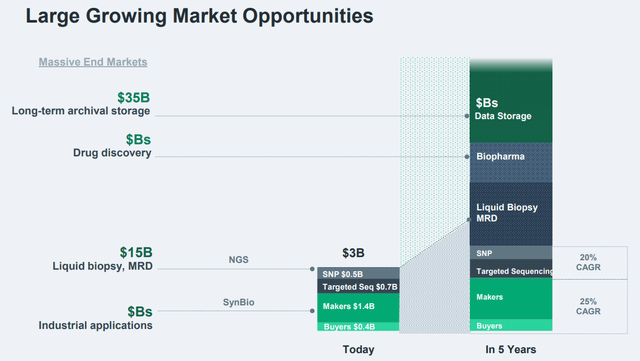

There’s a lot to like about Twist with a recognition that much of its growth opportunities are still in the early stages. From an estimated $3 billion market across its current portfolio of synthetic biology and NGS, Twist is estimating the market growth for core products like markers and targeted sequencing to average 20% and 25% annually over the next five years.

Other areas are set to be even strong with the company very optimistic regarding increasing market adoption of “liquid biopsy”, capable of detecting multiple types of cancer from a single blood sample, as well as minimal residual testing (MRD) capable of personalized testing. The idea here is that the future of medicine and biopharma is that all treatments will be tailored for individual patients, as a tailwind for Twist’s DNA solutions.

We mentioned the concept of DNA-based data storage. This is a market that has been in development for years and is seen as revolutionizing technology, with DNA thousands of times more efficient than traditional data memory drives. Demand from cloud computing and 5G technologies could support a $35 billion market for archival storage utilizing DNA over the next decade. Twist expects the launch of its first commercial solution to represent a game-changer as a major growth driver down the line.

source: company IR

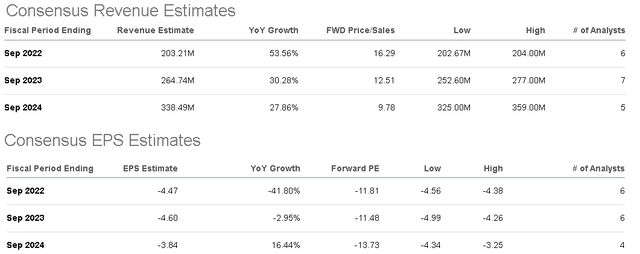

Overall, the positive long-term growth outlook is reflected in Twist’s valuation premium trading at 16x management’s fiscal 2022 revenue guidance. According to consensus, the market sees revenue growth averaging near 30% per year over the next two years. The sales ratio narrows towards 10x by 2024. Note that from the balance sheet cash position represents nearly a fifth of Twist’s current $2.5 billion market value resulting in a lower ex-cash sales multiple.

On the other hand, muted forecast for an improvement in earnings will likely keep shares volatile for the foreseeable future, period. Management has cited a target of reaching breakeven adjusted EBITDA at $300 million in annual revenue, which could be on the plate by fiscal 2024 as a run rate.

The bullish case for TWST rests on the potential that the company may end up outperforming growth expectations and a trend of firming margins into top-line momentum pulls forward the roadmap for reaching underlying profitability.

Seeking Alpha

TWST Stock Price Forecast

The silver lining of the sharp share price correction from the highs of 2021 is that valuation has been reset, providing both a larger room for error in terms of execution over the next few years, while also offering more upside if things go right. That being said, shares have rallied sharply in recent weeks, and currently trading at a 4-month high above $55.00 per share. To the upside, the next big test will be to cross the $60.00 area of technical resistance while the 2022 high at $80.00 would be the next target level. Our call here is that as long as shares remain above the lows of the year, the momentum remains positive which supports more upside.

Seeking Alpha

Final Thoughts

We are bullish on TWST and expect continued momentum alongside what has been a rally in biotech and high-growth names as part of an improving market environment for risk sentiment. The headlines related to its Monkeypox virus DNA controls and COVID sequencing test are the types of developments that keep shares interesting.

It goes without saying that these types of biotech/life sciences companies are among the most speculative in the market. Twist Bioscience remains high risk but the attraction here is its leadership position in several high-growth next-gen technologies supporting a positive long-term outlook.

The company is exposed to high-level macro themes with a sharp deterioration, the macro environment from the current baseline likely pressuring demand for its core products. Monitoring points over the next few quarters include cash flow trends, the gross margin level, and updates regarding its new manufacturing facility under construction.

Be the first to comment