CasarsaGuru/E+ via Getty Images

About Turtle Beach

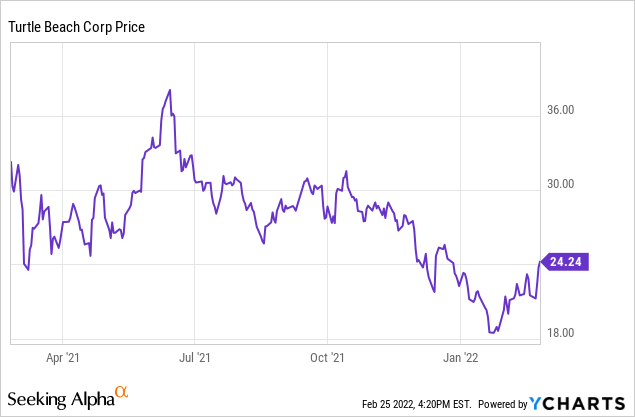

Turtle Beach (HEAR) is a gaming accessory manufacturer based out of San Diego, California. The company operates as an audio technology company as it specializes in gaming headsets. HEAR offers other gaming peripherals as well which makes it easier to compare to companies like Logitech (NASDAQ:LOGI) and Corsair (NASDAQ:CRSR). The entire gaming market saw a surge in growth during the pandemic. While this led to the company reaching its recent all-time high, it has left many investors skeptical about the company’s growth rate and margins as we transition out of the pandemic. The company is currently trading well below its all-time high due to supply chain bottlenecks as well as this post-pandemic uncertainty in the gaming market.

Before the Analysis

“The analysis for this investment idea is going to be split between comparable company analysis and alternative EPS valuation models. I believe the bread and butter of small/mid-cap company analysis comes from more unique valuation strategies. This is because the mainstream valuation models are far too assumption-based to forecast obscure financial statements. Similarly, comparable company analysis can only be considered reliable if the companies are nearly carbon copies, which is rarely the case with smaller companies”.

Comparable Companies

Normally, this stage of analysis is only used to supplement the earnings analysis; however, with HEAR, ratio analysis provides some much-needed context. This is because the earnings models give a very optimistic price prediction for the company.

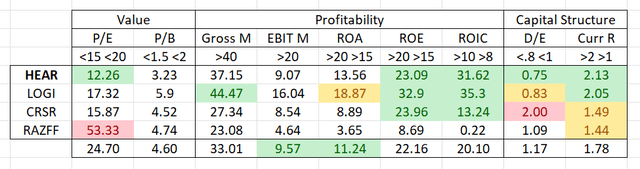

For this analysis, I selected: Logitech which manufactures gaming keyboards/mice, Corsair which specializes in gaming peripherals, and Razer (OTCPK:RAZFF) which focuses on PC gaming hardware.

In terms of value, HEAR is positioned much better than its competitors. However, the backbone of this analysis: profitability, is only marginally above average.

Here’s why: the above companies can hardly be considered competitors. HEAR specializes in the manufacture of gaming headphones whereas the other companies used in this analysis specialize in different gaming-oriented products. In effect, the companies are not fighting for the same market share.

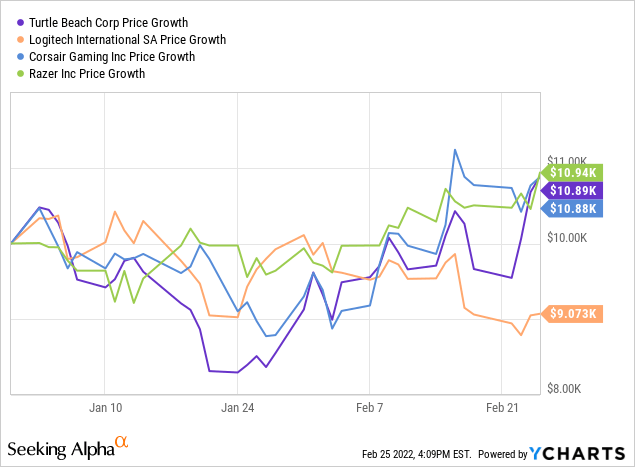

As seen in the ‘Price Growth’ graph (above), all of these companies are excelling in the post-pandemic environment. It’s no surprise that COVID-19 boosted gaming-related sales; the shock is that these companies have been able to maintain their margins. Thus, when looking at HEAR’s profitability, marginally above average becomes much more impressive.

It’s clear that the gaming boom is here to stay, even as the pandemic dies down. HEAR is not only the most specialized company in this market, but it also has a better capital structure and is trading at a better value than its peers.

EPS Multiplier Model

EPS Multiplier Model (link to an in-depth explanation on this model)

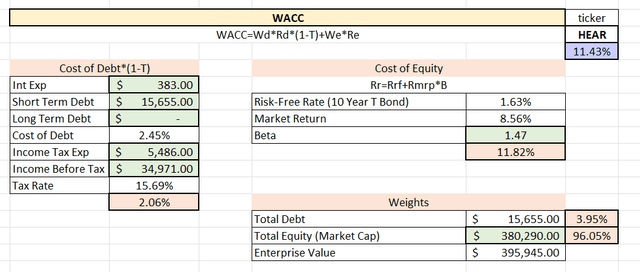

‘The steps are as follows: Calculate the weighted average cost of capital or WACC’.

(Note: Long Term Debt = 0)

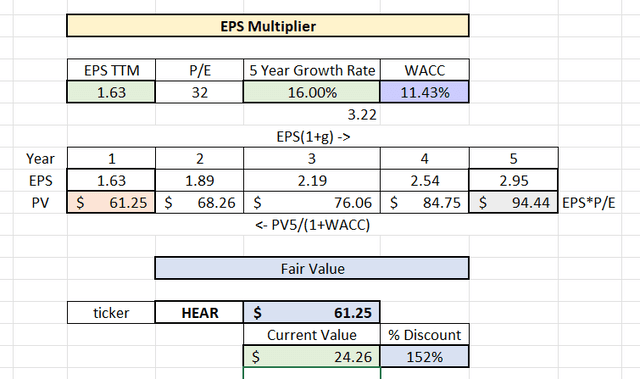

‘Pull the current year EPS and the past 5-year growth rate. Move the current year EPS forward using the growth rate. Multiply the year 5 EPS and the hypothetical P/E to get the year 5 price estimate. Discount this back at the WACC’.

When looking at this model we see that the fair value of HEAR is $61, exceeding the company’s all-time high of $38.

Benjamin Graham Model

Benjamin Graham Model (link to an in-depth explanation on this model)

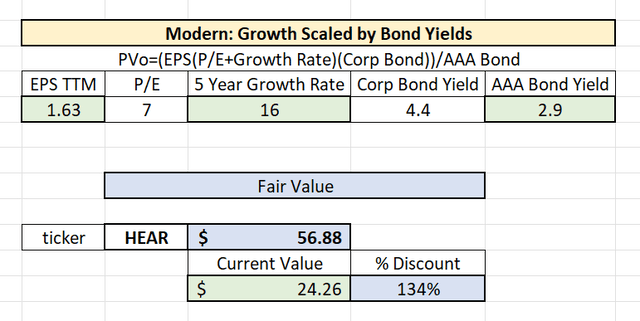

‘When looking at high-growth companies, I find it beneficial to project growth through their earnings. The drawback of this is that the P/E ratios for growth companies are usually either unsustainable or inaccurate. To remedy this, the model creates a hypothetical P/E ratio, which helps remove a lot of the volatility from earnings-based analysis’.

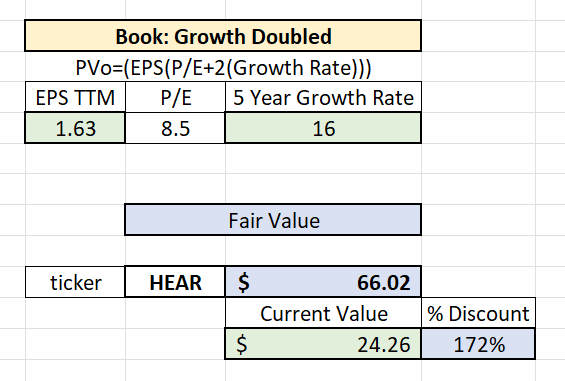

‘To be safe we can even modify the model to have fewer inputs and thus fewer assumptions. Instead of multiplying bond yields, we can use a fixed scaler for the growth rate, and just let the growth rate and EPS tell the story’.

Data from Yahoo Finance

When looking at these models we see that the fair value of HEAR is on average $61, mirroring the result of the previous model.

Investment Projection

Three earnings-based models place the fair value of HEAR at $61; this is more than a hop, skip, and a jump from the company’s all-time high. However, as mentioned in the comparable companies section, there are justifications for this optimistic price target.

One source of optimism regarding HEAR is the fact that the company has no long-term debt. At first, I thought this was an error as I was calculating the WACC (far above). It was not, HEAR has no significant debt, which is the reason its capital structure is so much better than its peers. In terms of growth, having no leverage is the best possible situation as its shows that the company can generate strong cash flows without significant external financing.

The pandemic-induced gaming boom is here to stay. Many are skeptical thinking that as we go back to work that people will have less discretionary time. This is not the right outlook; COVID-19 initiated a new influx of people into the gaming community, as reflected by the growth of console sales. Yes, the pandemic gave gamers more time to enjoy the hobby, but this does not facilitate the majority of gaming-related spending. It is the new gamer, no doubt a product of pandemic-related free time, who becomes the customer of these companies. This is a big reason that investors have overestimated the pullback of these companies and it explains why the earnings projections place HEAR at a new all-time high.

The pandemic brought the gaming scene to an all-time high in popularity; transitioning back into the office is not going to change that. It would not be hard to argue for any of the companies mentioned above but it is especially easy to do so for HEAR. No long-term debt, strong profitability margins, trading at a value when benchmarked against the industry, earnings projections well above the company’s all-time high: it’s hard to ignore the growth potential of HEAR. You don’t have to take these earnings models at face value, in fact, you shouldn’t. I would not invest in HEAR because it is trading at a 172% discount, this is likely overestimated. However, the models do tell us that HEAR should be able to maintain pandemic level growth and that the recent pullback is unjustified.

Be the first to comment