Lintao Zhang/Getty Images News

Inflation is hitting the average Turkish consumer like never before. With core inflation moving past 48%, rising energy and wheat prices (Turkey is a net importer of both) are making things even worse. Try to imagine what hypothetical consumer Emre will be able to afford by next year: Half his standard supermarket basket of goods.

Yes, wages will eventually rebalance for inflation, but that happens with some delay. And during that rebalancing period, whatever disposable income was lost, will remain as such for good. The higher the inflation, the worse this effect will be. There is suffering.

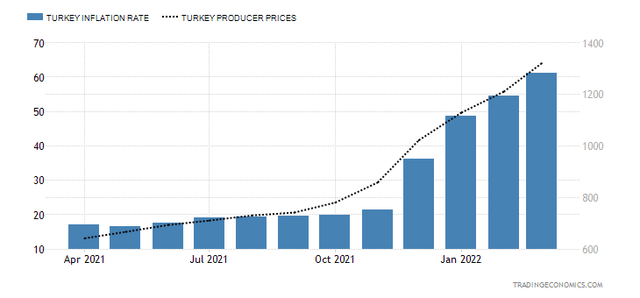

Inflation, Turkey – More pain ahead (TradingEconomics)

The above graph shows producer prices rising sharply. Producer prices inflation rate (MoM) for March 2022 also came in higher compared to February, indicating that inflation will remain elevated mid-term.

The heavily devalued Lira further contributes to that, since imports are becoming more expensive. At the same time, loans denominated in foreign currency are also “inflating”. And while Erdogan tried to contain the collapse of the Lira by promising to “protect deposits denominated in domestic currency from fluctuations”, the positive effect only lasted for so long.

How long before Şahap Kavcıoğlu gives up his seat? (MSN money)

There is of course the positive side effect of a devalued Lira, namely higher growth in exports, but that only truly matters (and works) if production is mostly domestic and raw materials as well.

Turkey’s central bank could deal with the above problems (inflation and Lira devaluation) by raising rates. Simple. And while it would be tempting to just go with the stream and assume that Erdogan is keeping rates low because… he does not understand how money supply works, we should instead do our best and assume there is actually something else going on.

Because you see, the Turkish leader is still showing remarkable foreign policy skills, managing to have it well with all sides, both the West and the new Eastern front. Even Ukraine sees Turkey as a valuable partner. So how can he be so capable in this case and be so “foolish” when it comes to simple economics?

The unobserved trade relationship with China

Turkey is what contemporary pragmatist neutrality looks like: It threats its neighbors once in a while, but nevertheless continues trading heavily with them. The country also trades and maintains political relationships with nations all over the world, even if they are on opposing sides with one another.

Turkey essentially lives in a circle of trade and foreign policy, moving goods 360 degrees around its borders. Its foreign policy skills and geographical position (traffic warden of the Black Sea) have granted it the right to act in such neutrality.

At this point it’s natural to wonder why Erdogan is not dealing head on with inflation and currency pressures. Is he “mad”? The short answer is no, although he is risking greatly with this new scheme of his:

Turkey is importing semi-finished goods from China, “finishes” them domestically and then (re)exports them to the European Union. And it does all that while… completely circumventing the Lira, i.e., it trades entirely in Chinese Yuan and European Euros. So when it imports the semi-finished goods, it pays in Euros and receives Yuan. And when it exports the completed products, it sells in Yuan and receives Euros. The net Euro profits are then gradually boosting its foreign reserves, granting it the capacity to increase the flow of trade over time.

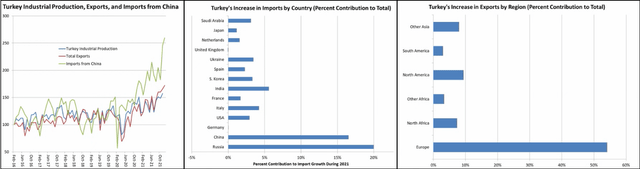

Don’t be fooled, China and Turkey are building something big (TradingEconomics, Statista, edited)

The above combination of graphs constitutes proof of such an arrangement: To the left we can clearly see a major boost in industrial production, total exports and total imports from China. The graph in the middle shows where most imports are coming from (growth rate during 2021 compared to last year) and the final graph to the right reveals the continent these products are directed at.

Now this is where the debate concerning interest rates makes a bit more sense: Erdogan is trying to boost Turkey’s industrial production infrastructure, so that trade can keep growing, granting him an easy win in the upcoming elections (he promotes high growth very much in his speeches). Major investments like these are capital intensive and therefore companies involved rely heavily on debt. Higher interest rates mean a greater financial burden and less investments.

This perspective also proves why Erdogan is stating that “he is planning an interest rate hike after the summer has passed”. He is hoping on strong tourism numbers, now that the pandemic has subsided. The devalued Lira will draw many to Turkey, making vacations very cheap. Tourism will inevitably boost demand for the Lira (people convert their currencies), which will require a more modest interest rate hike. The whole project promises a high growth rate year long.

To sum things up, Turkey has established a new trade deal and China has effectively found a way to keep boosting its exports towards the EU, while avoiding a red flag over its ever increasing trade surplus with the bloc. The perfect Trojan Horse one might say.

Gambling with Russia

Turkey is trying very hard to preserve its neutrality. Aside from depending on China, it is also “hooked on” Russia. It imports huge amounts of oil and gas, and while the Daily Sabah (a major Turkish website) tries to promote a declining dependency, data prove otherwise.

The nation is also importing wheat. Both Russia and Ukraine cover almost all its needs and as thus, the current war has an immediate effect on Turkey.

But exports to Russia are just as important. Based on the current geopolitical state, Russians will have nowhere else to travel, but to Turkey and Asia. So although tourism was already a growing export segment (exporting services to visitors), under the current situation Turkey could turn into the big winner and have people flowing in from both the West and the Eastern front.

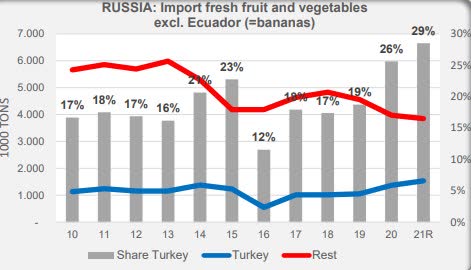

The nation is also exporting machinery, vehicles, iron and fresh fruits and veggies. The latter, although just 3% of exports towards Russia, is valuable from the employment point of view.

Everybody wants to be Turkey’s “friend” – A relationship that is strengthening (freshplaza)

There are also two additional reasons, why Turkey depends on Russia so much:

1. Turkey is building its first nuclear power plant, the Akkuyu, and it is being constructed by Rosatom (via its subsidiary in the region). China has also offered to build additional plants.

2. The nation is a temporary home to more than 2.6 million Syrian refugees, with an additional 3 million waiting near the border. Aside from the financial burden, part of which is being ‘financed’ by the EU, Turkish residents are growing impatient which sparks increasing racist attacks. Now imagine what would happen if Russia started bombing Syria again. More refugees would flow into Turkey, bringing about more distress.

The above dependencies is why I personally think selling more military equipment to Turkey will only cause greater problems in the Aegean in the future (due to the loss in the balance of power between Turkey and Greece). Turkey needs to reduce its dependencies and thus the EastMed project (that would include Turkey into the mix) would be the proper choice here – the presence of the nations involved would then bring stability in the region.

Investor’s Perspective – Takeaway

Strictly from an investor’s point of view now, Turkey only makes sense if Erdogan manages to maintain neutrality. Both the Western (exports, NATO presence) and the Eastern front (dependencies mentioned earlier), have the capacity to ‘break’ the nation’s economic plan. That would in effect push Turkey’s leader into war, in order to maintain domestic social stability – as inflation would rocket in an uncontrollable manner and rate hikes would then only make things worse.

If that was to happen, the stock market would plunge. So it all comes down to neutrality, which is pretty much the story TUR has been telling us. But the longer the war lasts, the more likely it is for Turkey to be forced to pick a side (openly) and markets to warp.

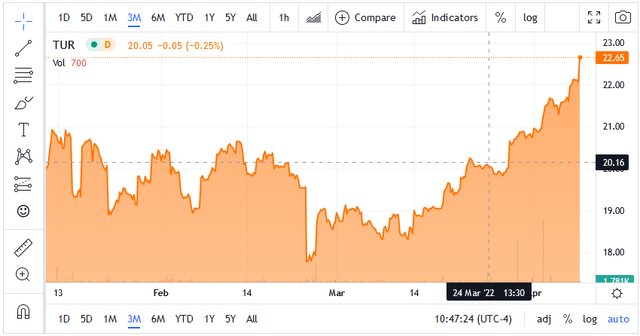

TUR – iShares MSCI Turkey ETF – War has only pushed prices higher (Seeking Alpha, TradingView)

Generally inflation favors all assets, including stocks, as long as broader growth rates remain positive. Erdogan is trying to do just that, pushing Turkey’s citizens into stocks, houses and other real assets. Ultimately then, ceteris paribus for other factors not currently in effect, indexes could move higher, especially if the geopolitical environment was to cool down in part.

It all comes down to Turkey,

(a) being able to maintain neutrality,

(b) war not escalating beyond the current borders and

(c) the US increasing its interest rates in a moderate manner, to avoid a broader market shock (which will most likely be the case, unless there is a military escalation).

Then, once the summer period has concluded, Turkey should be able and increase interest rates a bit to bring down inflation. It’s all very “shaky”, no doubt.

Be the first to comment