atakan/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate

Introduction

Occasionally an investor knows they need a cash infusion near a certain date, like making a RMD payment. Using CDs, a US Treasury issue or a baby bond can be used for such a purpose. By adding some controlled risk, maybe the investor can meet that goal and generate a higher return.

For a 2023 year-end need, both these funds are possible options, but as readers will see, they come with risks that need to be evaluated against the risk-free rates of 4.6% currently available. The two funds covered are:

- Invesco High Income 2023 Target Term Fund (NYSE:IHIT)

- Invesco BulletShares 2023 Corporate Bond ETF (NASDAQ:BSCN)

Based on the differences in each portfolio held, I would rate the IHIT CEF as having higher risk to investors than the BSCN ETF does. Let’s see why.

Invesco High Income 2023 Target Term Fund review

Seeking Alpha describes this CEF as:

The Fund’s investment objectives are to provide a high level of current income and to return Original NAV to Common Shareholders on or about the Termination Date. The Fund seeks to achieve its investment objectives by primarily investing in securities collateralized by loans secured by real properties. Benchmark: Bloomberg U.S. CMBS Investment Grade USD. IHIT started in 2016.

Source: seekingalpha.com IHIT

While IHIT can invest independently of its benchmark, having a description helps to understand how IHIT might invest. Bloomberg provides this:

The Bloomberg US CMBS Investment Grade Index measures the market of US Agency and US Non-Agency conduit and fusion CMBS deals with a minimum current deal size of $300mn. The index is divided into two subcomponents: the US Aggregate-eligible component, which contains bonds that are ERISA eligible under the underwriter’s exemption, and the non-US Aggregate-eligible component, which consists of bonds that are not ERISA eligible. The US CMBS Investment Grade Index was launched on January 1, 1997.

Source: assets.bbhub.io Index

IHIT has $204m in assets and provides investors with a 5.2% yield. The CEF comes with 155bps in fees.

IHIT holdings review

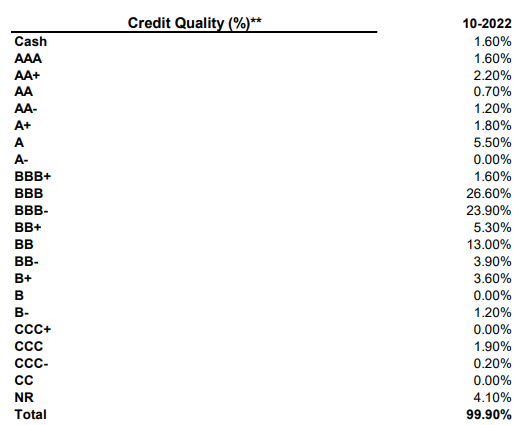

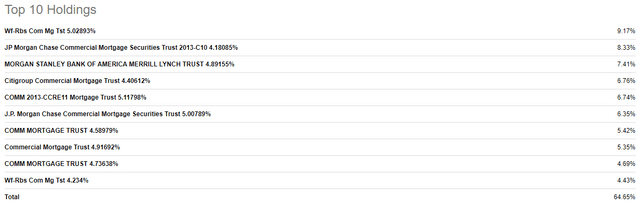

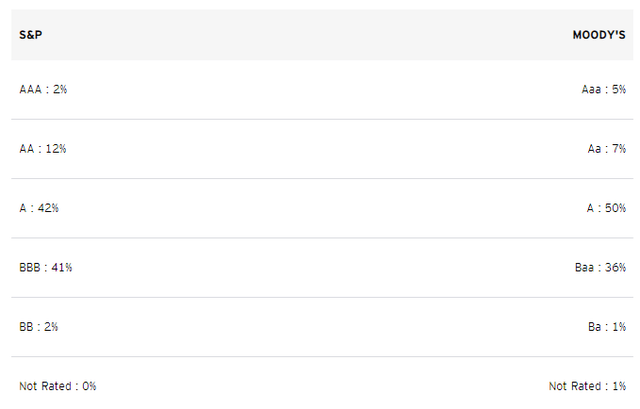

As of the end of November, the latest date for the holdings data, the fund held just 60 issues. IHIT employed a 28% leverage ratio and the portfolio had an Effective Duration of .94 years, though the WAM is 2.56 years. The WAC is 4.87%. While some data is lacking on the Invesco site, they have very detailed ratings data.

invesco.com ratings

I calculated the portfolio to be just below BBB; Morningstar says BB+. Almost 67% is rated investment-grade, with most of the rest between BB- and BB+. The portfolio is 94% CMBS, 4% REITs, 2% other. The CMBS are allocated to the following sectors.

invesco.com sectors

The largest allocations are dependent on a strong economy and one not crippled by COVID restrictions: Retail, Lodging, and Offices. The top holdings are:

The latest full holdings data is from August, contained in the Semiannual report. A quick review shows 11 bonds maturing in 2024, accounting for 42% of the portfolio weight. Another two holdings (4% weight) mature in 2026. That is why I rate IHIT as having a higher level of interest-rate risk than BSCN which has no bonds maturing after 2023.

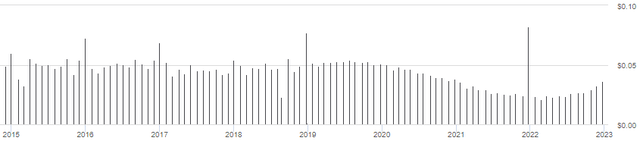

IHIT distribution review

As is common with funds with a termination date, the payout drops as the date approaches for one of two main reasons. First, bonds are sold, and the cash position increases, possibly as a lower coupon. Second, some funds hold back cash to minimize those cuts but also to increase the odds of making the payout goal. Invesco did not show any 19-a forms, indicating to me that no ROC was used recently to make the payouts.

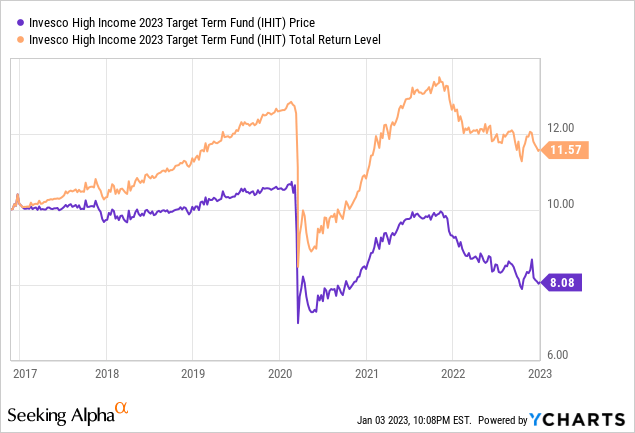

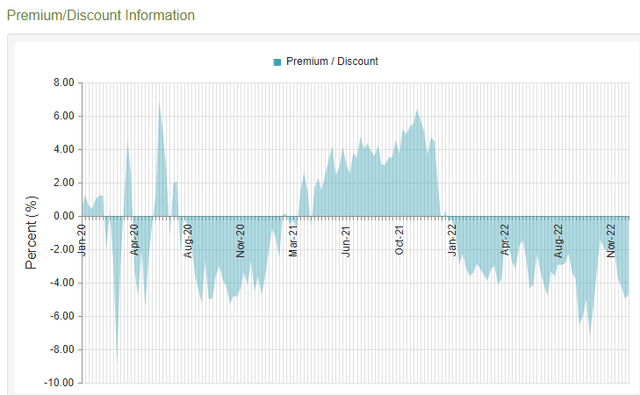

IHIT premium/discount review

With a current 4.6% discount of the price to the value of the underlying assets, IHIT comes with a feature the ETF doesn’t offer its investors, both good and bad. On the good side is the possibility that this gap narrows by the termination date, adding to the ROI investors earn in 2023. A 2% bonus from this seems reasonable based on the above chart. That said, with 40%+ of the assets still trading post-termination, there is no guarantee it will shrink and could increase if recessions fears grow, especially with a below investment-grade portfolio rating.

Invesco BulletShares 2023 Corporate Bond ETF review

Seeking Alpha describes this ETF as:

The fund invests in U.S. dollar-denominated corporate bonds with effective maturities in the year 2023. It invests in investment-grade securities rated BBB- and above by S&P and Fitch or Baa3 and above by Moody’s. The fund seeks to track the performance of the Nasdaq BulletShares USD Corporate Bond 2023 Index. BSCN started in 2014.

Source: seekingalpha.com BSCN

BSCN has $2.75b in assets and the ETF yields 1.5%. The managers charge 10bps in fees. Unlike the CEF, this ETF invests based on an index specifically designed for this fund, which comes with this information:

Description: The Nasdaq BulletShares® USD Corporate Bond 2023 Index provides exposure to a diversified basket of US dollar-denominated, investment grade bonds, all with a maturity of 2023. The Index combines the precise maturity exposure of an individual bond with the diversification benefits of a broad basket of securities, and is expected to have a return profile similar to a held-to-maturity bond.

Methodology highlights: The Index consists of US dollar denominated securities of globally domiciled corporate issuers that pay fixed amounts of taxable interest. Bonds must have a credit rating of at least BBB- (or equivalent) and a minimum outstanding par amount of $500 million to be included.

Source: invescoindexing.com Index

BSCN holdings review

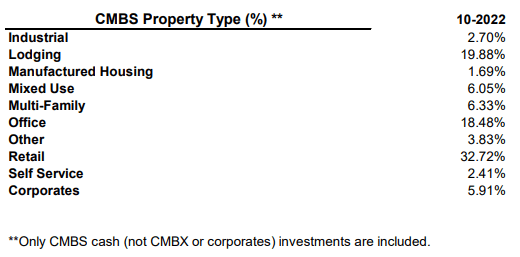

BSCN holds over 300 securities with the WAC being 2.7%, Effective Duration .41 years, and an average bond price of $99.03. The Yield-To-Maturity is 4.89%, which is what investors should earn if every bond is held until it matures. Unlike IHIT, all mature before the ETF terminates.

The credit ratings for the ETF are:

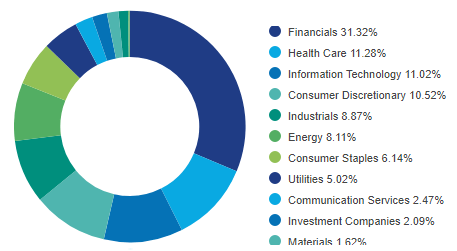

Both my calculation and Morningstar agree on this portfolio: A-; putting this portfolio 3-4 rating levels stronger than IHIT’s rating. The sector allocations between the funds are very different, with Financials the top allocation here: which are not even listed for IHIT.

invesco.com sectors

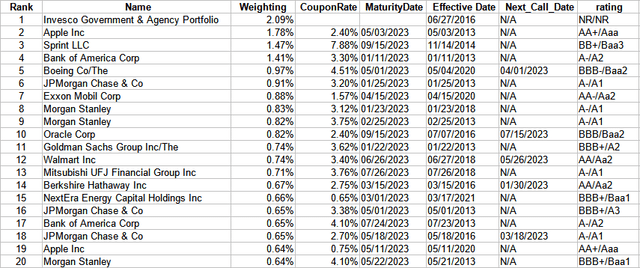

Top holdings

invesco.com; compiled by Author

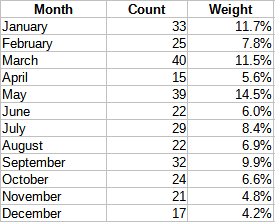

Not counting the cash, the assets 2-20 are 16.7% of the portfolio. Next is the monthly maturity counts and weights for BSCN.

invesco.com; compiled by Author

I delved into the ETF’s Prospectus to see what their policy is related to bonds maturing before the month on December. Here is what it says:

The Fund will terminate on or about December 15, 2023 without requiring additional approval by the Board of Trustees (the “Board”) of Invesco Exchange-Traded Self-Indexed Fund Trust (the “Trust”) or Fund shareholders, although the Board may change the termination date. In connection with the termination of the Fund, the Fund will make a cash distribution of its net assets to then-current shareholders after making appropriate provisions for any liabilities of the Fund. The Fund does not seek to distribute any predetermined amount of cash at maturity. During the maturing year of the Underlying Index (i.e., 2023), no new constituents are added and the Underlying Index rebalances only through June. In the last six months of operation, when the 2023 Bonds held by the Fund mature, the Fund’s portfolio will transition to cash and cash equivalents, including without limitation U.S. Treasury Bills and investment grade commercial paper. The Fund should not be confused with a target date fund, which has assets that are managed according to a particular glidepath that illustrates how its investment strategy becomes increasingly conservative over time.

Source: connect.rightprospectus.com/Invesco BSCN

There are several key points:

- The Board has the right to change the termination date. While it is very unlikely it will be extended, I assume that gives them the right to close the ETF early.

- Before July, money is reallocated to existing bonds as maturity occur. After that, maturing bond proceeds are reinvested in cash, US T-bills, or similar cash-like investments.

About 16% of the portfolio is from Issuers outside the US, some of which could be denominated in foreign currencies, thus exposing the ETF to another kind of risk, especially if the USD stays strong versus those currencies.

BSCN distribution review

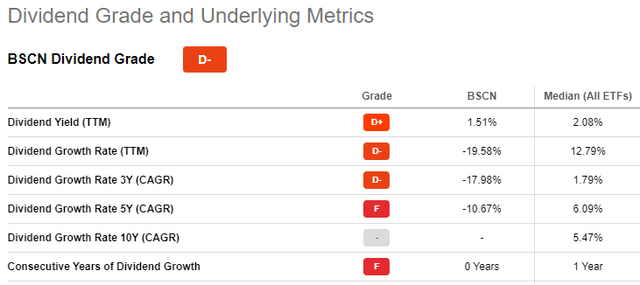

Unlike IHIT, BSCN is showing an increase in payments. Also, being an ETF, Seeking Alpha rates their payout history, here giving BSCN a “D-” grade.

seekingalpha.com BSCN scorecard

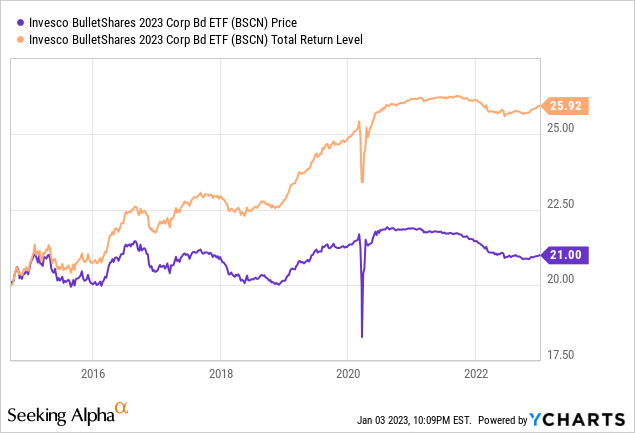

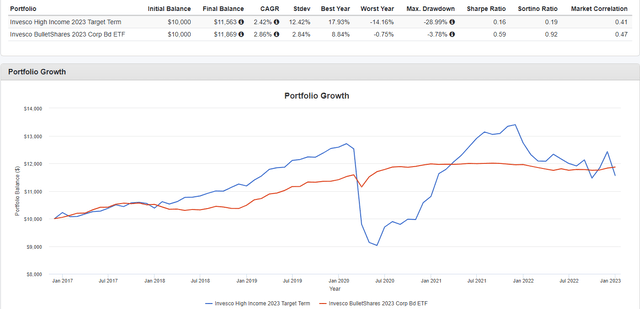

Comparing the CEFs

BSCN has surely provided investors with a smoother ride than IHIT, but that is history. Which fund is best for the rest of 2023 is the question that matters. Here are the data points I think matter at this point in time.

| Factor | IHIT | BSCN |

| Fees | 155bps | 10bps |

| Effective Duration | .94 years | .41 years |

| Weighted Average Maturity | 2.56 years | .51 years |

| Yield | 5.2% | 1.5% |

| Yield-to-Maturity | 8.3% | 4.9% |

| Weighted Average Coupon | 4.87% | 2.7% |

| Portfolio credit rating | BB- | A- |

| Average bond price | $90 | $99 |

| Leverage | 28% | 0% |

| # of issues | 60 | 319 |

| Portfolio weight post 2023 maturities | 42% | 0% |

| Asset mix | 94% CMBS | 90+% Corps |

| Price/NAV discount | 4.6% | 0% |

The YTM for IHIT was not to be found but I did find an YTM calculator to get an estimate based on known inputs. Since the WAM is beyond 2023, all of that would not be achieved this year.

Portfolio strategy

It appears investors are presented with two alternatives with potentially very different risk and return possibilities between now and termination, starting with the possibility that IHIT will delay or even remove the termination feature. Here is what I see as pros/cons of each fund.

IHIT analysis

IHIT offers the possibility of a larger ROI as it has a better yield and currently sells at a discount that could close. There are features that could negatively affect that positive outcome, such as its longer WAM and duration. The elephant-in-the-room is where interest rates will be then with 42% of the portfolio needing to be sold as it matures post-2023. Those are the trade-off IHIT’s investors need to consider.

BSCN analysis

As it has shown in the recent past, I expect BSCN to peacefully glide into its liquidation this December. With an investment-grade rated portfolio, even if a recession hits, the odds of any default materially effecting the final distribution is very small. With 100% maturing, interest-rate risk is eliminated. All that “risk free” support translates into a possible ROI below 3%.

Final thoughts

The BSCN ETF decision seems easy: Sell and buy a 4.6% sub-1-year CD if you need the cash this December. The call on IHIT requires knowing the level of risk an investor wants to take. IHIT’s yield can almost be replaced with the same CD BSCN potential investors can buy. On the other side, IHIT offers an upside maybe as high as twice that depending on whether the discount shrinks and the effect of rising interest rates on the post-2023 bond prices.

Be the first to comment