Edwin Tan/iStock via Getty Images

Dear readers,

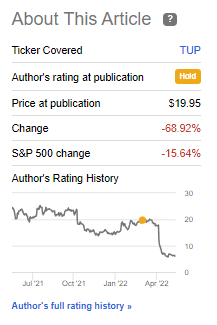

In this article, we’ll take another look at the Tupperware Brands Corporation (NYSE:TUP), a risky business that can be argued to be in the midst of an ongoing turnaround. Of course, from another perspective, it’s a failing business that’s dropped nearly 70% in less than 3 months.

Tupperware Article (Seeking Alpha)

So which one is it? That’s what we’ll try to determine once again in this article, now that the company’s valuation has declined.

Tupperware – Revisiting the company

We reviewed Tupperware’s business model rather extensively in my last piece. The business idea is the research, manufacturing, and sale of plastic storage containers, utensils, and kitchen gadgets. If you’re thinking that such a business must have undergone great fundamental changes since it started, given the state of worldwide commerce today, then – yeah – you’re certainly not the only one to think so.

The company’s initial appeal and product exclusivity was the patented ‘burping seal’ for its containers, something which most products have some variety of today. I think it is important to once again point out that Tupperware no longer has any massively distinguishing characteristics from competitor products. It’s no longer unique or at a significantly higher quality, in a way that would distinguish it fairly from peers.

This is one of the core issues with Tupperware as it stands today. From another perspective, Tupperware is a multi-level marketing [MLM] company. This means that revenues are generated from a non-salaried (typically) workforce that primarily works for sales commissions, with earnings generated from a binary compensation commission system. As I said in my last piece – not a dealbreaker, just a fact that makes it somewhat more challenging long-term than a company with more “standard” forms of operations. The reason is that this sales model has been encountering substantial difficulties for the past 20 years, and is actually in decline as we’re speaking.

To this day, products are still mostly sold through the party plan, with rewards for the hostesses.

The company’s turnaround plan was in full effect in 2021. Some things were looking good, and the company had reached what it considered its “Foundation” of the turnaround, meaning significant CapEx going to digital investment and social tools, divesting non-core assets, segmentation of its non-omnichannel sales, and expanding those channels. By its plan, it should be in the midst of its “Expansion” phase at this time, with competitive loyalty programs, expanding business opportunities, and better service. Share price trends would suggest that this assumption is not the case.

The company has done a few things since I last wrote about it. It’s divesting Nutrimetics, and has terminated its COO as part of restructuring – but more importantly, that ever-important turnaround plan I mentioned with the company expected to be in the “Expansion” phase, was wishful thinking.

The company pulled guidance, and withdrew all guidance causing the company to drop no less than 30% after the market opening. The miss on profit was big – but revenues also came up short. A very unspecific and vague answer was given as to the reason.

“We exited 2021 encouraged that our Turnaround Plan was on track, however with today’s results we acknowledge that this turnaround still requires a lot more work. Results came in below our expectations due to a combination of external and internal factors.”

(Source: Miguel Fernandez, Tupperware CEO)

The actual reasons? Likely to be a combination of COVID lockdowns, Ukraine, inflation and internal issues in the company that’s not yet delivering as expected or promised. For an analyst such as myself, it’s easier to point to some numbers.

Tupperware is, for the time being, fundamentally unable to push price increases for its products due to the competitive space, which forces the company to eat into its own margins in order to keep up sales. In fact, the CEO when talking about this, pretty much mentioned every single factor that could harm a consumer goods company, harming Tupperware. It was a pretty extensive list.

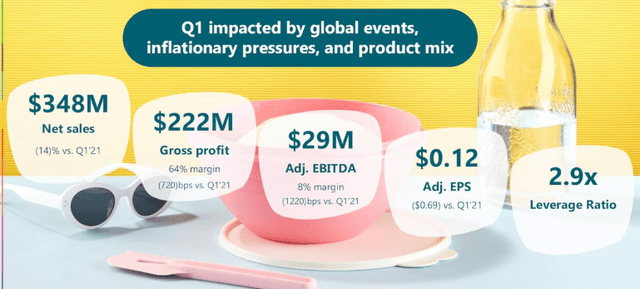

Tupperware presentation (Tupperware IR)

You might consider it unfair to keep harping on this – but on a global level, impacts from Ukraine should have been relatively minor for the company – and they should have done a better job forecasting the issues related to continued inflation, input costs, and the potential of continued lockdown.

No, Tupperware deserves its decline, based on its adjusted EPS of $0.12 alone, despite otherwise positive things like leverage ratios, and a continued 60%+ GM. Of course, the company barely generated any quarterly free cash flow at all compared to YoY.

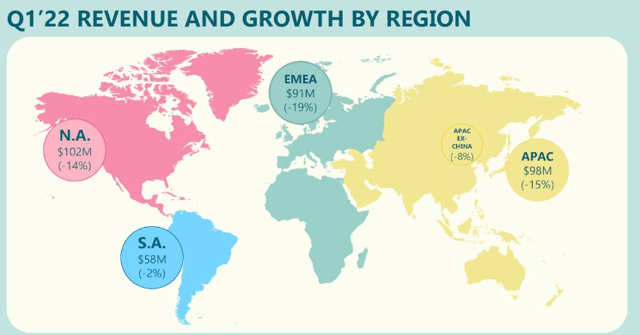

Growth, across the world, was stalled – so it’s not just margins, but mix and volume as well.

Tupperware Presentation (Tupperware IR)

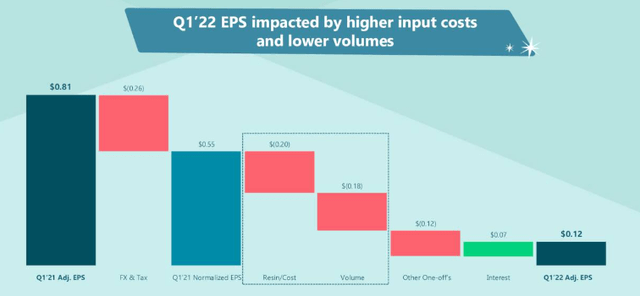

And the EPS bridge, showcasing just how the earnings declined the way they did, is very telling.

Tupperware Presentation (Tupperware IR)

What are the plans? Tupperware is sticking to things and trying to stabilize China’s sales. Also, the company is slowly moving away from MLM through omnichannel and D2C sales, as well as increasing new product innovation for its portfolio. It’s trying to globalize its selling best practices, in order to more or less change its organization and sales to get with the times.

The question becomes, can Tupperware survive if it does this – and/or how much of its actual appeal is based on its MLM model? If this is a high degree, a horizontal move away from this approach would result in massive competitive losses in volume as the products might lose their distinguishing appeal.

I am now arguing that Tupperware products are technically, and fundamentally, some pretty appealing containers and related household products. They are – and over half a decade of sales have shown exactly that. But the differences that we’ve seen arise over the past 20 or so years in terms of the market and how globalism has affected the company’s ability to demand a premium for what is, essentially, no more than a plastic food container, mean to my mind that Tupperware is facing a very challenging near-term.

But there are bright spots.

Tupperware’s valuation

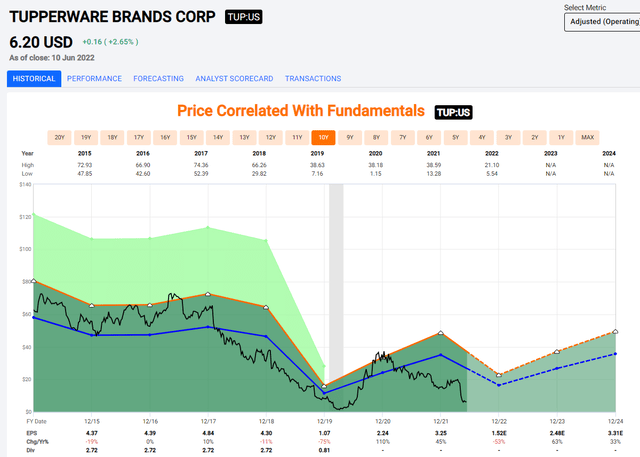

Whenever a company is trading at less than 2.5X P/E, there are grounds for questioning the logic behind such a lateral move in valuation and share price. This is no different for Tupperware.

However, Tupperware has now a market cap of less than $300M and a credit rating of B+. That’s right, single-digit credit with a yield of…yeah, zero.

It’s furthermore now expected to see EPS declines of 53% in 2022, leading to the worst year since pre-pandemic 2019. While forecasts are calling for an upward trajectory beyond this, it’s important to look at exactly how accurate those forecasts have been over the past few years, with miss ratios of over 30% even with a 10% margin of error. It’s hard to believe that not that long ago, this company was a major dividend payor with what some contributors described as a bright future.

Tupperware Valuation (F.A.S.T graphs)

The simple fact for this company is, that I am fundamentally unwilling to put hard-earned capital to work in what I view as elevated-risk turnaround plays. That is exactly what Tupperware is at this time. You can argue around it, but it comes back to the that this company lacks the fundamentals and the prospects, as I see it, to become what it once was. The world is a different place today, and as I see it, the consumer container space has no need for this sort of company as an MLM business.

Will there be a place for Tupperware products on the shelves of retailers as a high-end alternative to your $1.19 containers? Yeah, I believe so. But that is completely different from where the company’s business is today, and how such numbers and such a model would flow from revenues to the bottom line is a completely different exercise.

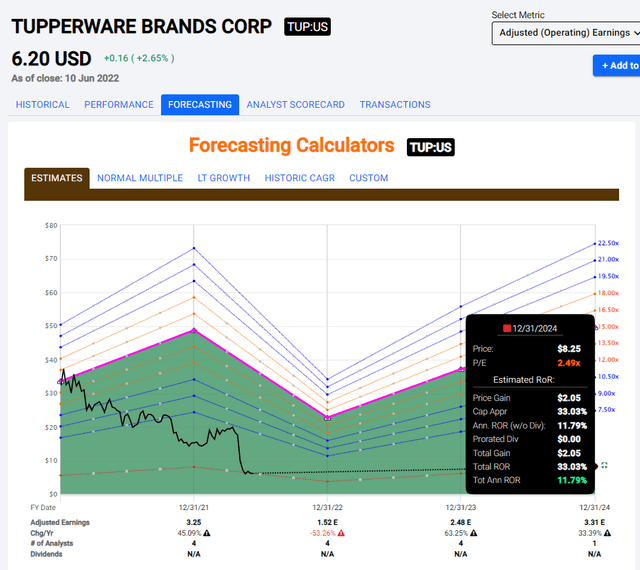

Risk takers can argue that even at the forecasted 2.5X P/E at current expectations, Tupperware will generate 33% RoR until 2024E. And this is a correct statement – at least insofar as these expectations go, and such math would go.

How likely is that math, and how likely is the market to keep punishing TUP?

That’s a different story altogether.

Tupperware Upside (F.A.S.T graphs)

There’s a disturbing lack of upside in this company that makes any sort of assumption or forecast a dicey prospect at best. We can look at analysts calling the company undervalued to a $15.8/share minimum, considering it 156% undervalued here. I would say – good on them if they want to take that risk. With 3 out of 4 analysts at “HOLD” though, and despite a low-range PT of $12.5, it doesn’t seem that most of these analysts are comfortable backing up their targets with “BUY” actions.

For me, the disproportionate risk, the lack of any dividend, the lack of potential returns if the stock keeps troughing, and the aforementioned factors, keep me at a respectful distance from TUP.

I’m at a “HOLD”.

Thesis

While it can be argued that Tupperware is a potential turnaround story in the making or even a potential M&A candidate at the right valuation, the moving parts in the company and its appeal in a DTC world aren’t clear enough to me to even consider them a viable investment at a 5-6X P/E – and it still isn’t clear enough at 2.5X. The company’s turnaround plan has stalled, and we can expect poor returns for 2022, making the company yet again, unattractive.

For now, I am a “HOLD” on Tupperware. If you believe in the turnaround, I’d be curious to hear your thoughts. If you own the company at a profit because you were smart and bought them at dirt-cheap valuations of essentially less than $2/share, then I would argue the time has come to rotate those profits.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Thank you for reading.

Be the first to comment