cemagraphics

It’s been about five months since I wrote my bullish article on Entravision Communications Corporation (NYSE:EVC), and in that time the shares have returned about 9.2% against a loss of 4.4% for the S&P 500. This past weekend, a friend of mine asked me to “dial back” the bragging, so I’m going to not brag about this massive outperformance in such a short period of time. Additionally, I see no reason to boast about the success of my short put options, the returns from which brought my return on this investment from 9.2% up to about 15.9%. Why would someone brag about such performance? I have no idea. I certainly wouldn’t, and therefore I’m going to refrain from going on for too long about the outperformance.

Anyway, it’s time to get sincere. The company has released financial results since I last reviewed the name, so it makes sense to look at this investment again. Additionally, a stock trading at $5.6 is, by definition, more risky than the same stock trading at $5.2. So, there are a few reasons to revisit this investment. I want to decide whether or not it makes sense to buy more, take my profits, or simply hold my position. I’ll make that determination in the usual way, by looking at the financials and the valuations. Additionally, the put options I wrote previously worked out very well, so I want to write about that also. This is yet another instance of where short put options have enhanced returns while reducing risk. If you’re not yet familiar with these powerful instruments, I would recommend you familiarize yourself, as they have the proven capacity to enhance returns while reducing risk.

I understand that many of my readers are busy, and even larger numbers of them have a limited tolerance for my writing style. For that reason, I offer a “thesis statement” paragraph at the beginning of my articles. I do this because I realize that people may want to read my thoughts while being exposed to as little “Doyle mojo” as possible. I’m of the view that the financial performance has been troubled in many ways. While revenue is up an impressive amount, we owners aren’t compensated with higher sales. We’re compensated with whatever’s left over after employees, suppliers, various governments take their cuts. Net income, which is what should matter to us, is down fairly dramatically over the past year. Additionally, valuations are no longer compelling in my view. For those reasons, I’m selling this morning. Finally, my short puts earned me 7% for six months of, uh, “work”, which validates my fondness for these instruments. The problem is that the premia on offer are too thin at the moment to make it worthwhile to repeat this trade. I’d recommend investors keep an eye out for a drop in price, though. When that happens, premia will spike, and it’ll once again be worth selling short puts.

Financial Update

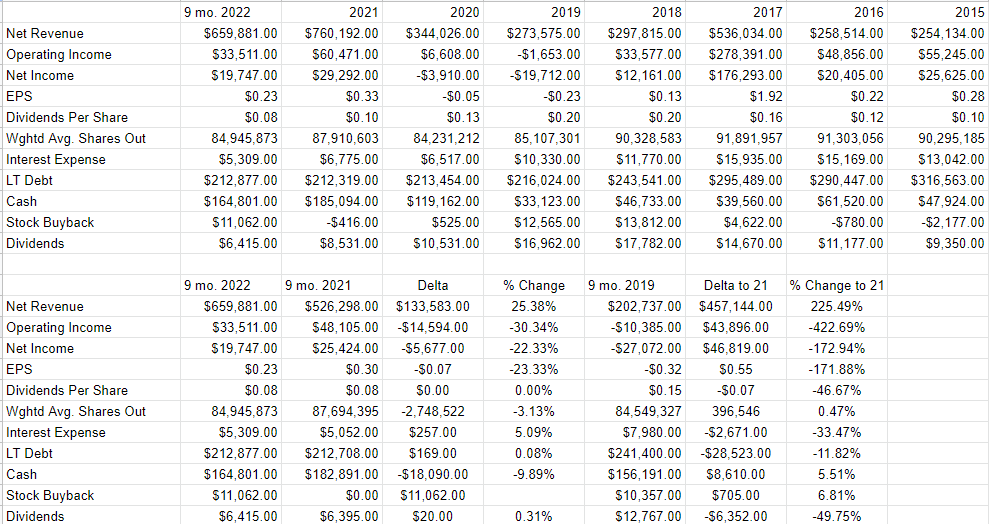

Revenue for the first nine months of the year jumped fully 25.5%, which is quite impressive. The problem for me is that that’s where the good news ends. It’s impressive that revenue rose, but when “cost of revenue-digital media”, and SG&A, and corporate expenses rise by 36%, 28%, and 23% respectively, we have a problem. The fact that costs rose at a much faster rate than revenue explains why net income was 22% lower during the first nine months of 2022 relative to the same period in 2021. At the same time, the capital structure deteriorated slightly, with debt higher by only about $169k, while cash and short term investments were down about 10% to $164 million. So, if I were grading this financial performance, I’d put it somewhere between a B- and a C+. I’d be happy to add to my position only at the right price.

Entravision Financials (Entravision investor relations)

The Stock

My regulars know that I’ve talked myself out of some profitable trades with the words “at the right price.” So, if you’re heading to the comments section to write about how my fastidiousness in this regard is self-harming, save yourself the effort because I’m way ahead of you. In response to this criticism, I’d point out that I’m of the view that it’s better to miss out on some gains than lose capital. My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final product. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for products, the input prices for digital media etc. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. A reasonable sounding, if counterfactual, argument can be made to suggest that the great returns I’ve enjoyed on this name would be even higher if so-called “animal spirits” hadn’t been so tamped down since I last wrote about the business. It’s impossible to prove this point definitively, but it’s worth considering. In any case, the stock is affected by a host of variables that may be only peripherally related to the health of the business, and that can be frustrating.

This stock price volatility driven by all these factors is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

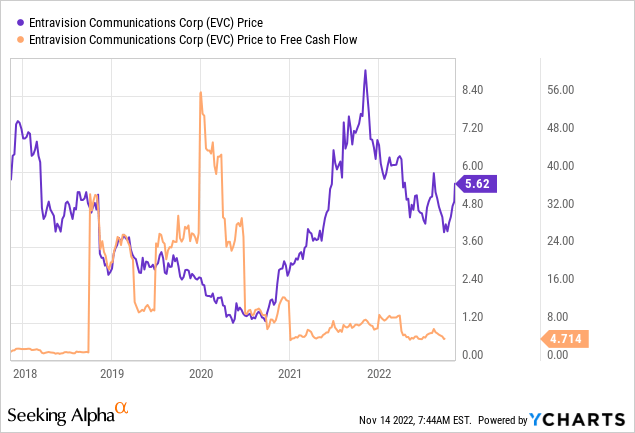

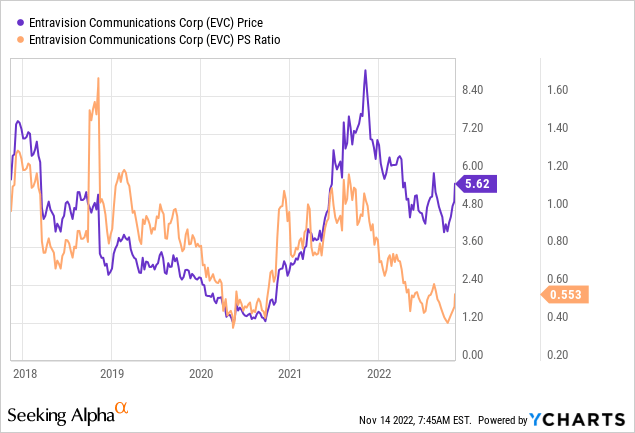

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In case you need to be reminded, when I last reviewed Entravision, the shares were trading near multi year low valuations. Specifically, the market was paying about $.56 for $1 of sales, and the shares were trading at a price to free cash flow of 5.05. Fast forward a few months and this is the current state of the world:

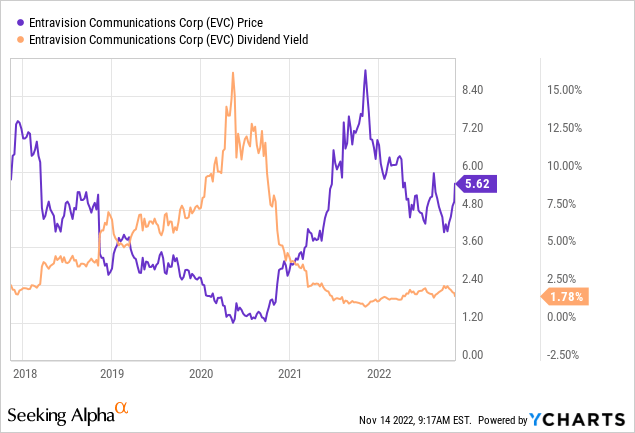

At the same time, though, people who buy now are being compensated with a yield that is on the low side, per the following:

Shares are about 6% cheaper on a price to free cash flow basis, and about the same price as they were previously on a price to sales basis.

None of this suggests to me that the shares are currently a “screaming buy.” Ratios of this sort are relatively unsophisticated, though. In addition to looking at ratios, I want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future.

Applying this approach to Entravision at the moment suggests the market is assuming that this company will grow earnings at a rate of ~9% in perpetuity. I consider that to be a fairly optimistic forecast. Given the above, I can’t recommend buying at current levels. The company is growing sales, but not income. Net income is the most relevant variable for owners of any business. The stock is either “neither cheap nor expensive” or “expensive”, depending upon how you measure it. I think there are greener pastures elsewhere, and for that reason I’m going to be taking my money and running.

Options Update

In my previous missive on this name, I reminded readers yet again of the fact that in February of this year, I sold the August Entravision puts with a strike of $5 for $.35 each. This represented a 7% yield for tying up some capital for 6 months. Even though this option was in the money for a portion of July, unfortunately I wasn’t exercised, so I didn’t have a chance to buy more at a net price of $4.65. That written, I think the trade worked out fairly well. Please take this as a lesson. These instruments are an excellent way to make risk adjusted returns. It’s sometimes the case that when you sell deep out of the money puts, you enter into what I would characterize as a “win-win” trade. Either the shares are put to you at a very attractive price, or you simply pocket the premium, or both.

While I like to try to repeat success when I can, I think there’s little reason to sell puts at the moment. The February 2023 puts with a strike of $5 are only bid at $.05, for example. I think that return is a bit paltry, and so will be taking no action on these today. That said, if the shares fall in price, I’ll certainly revisit the name, and will likely sell puts then.

Be the first to comment