PonyWang

By The Valuentum Team

Taiwan Semiconductor Manufacturing Company (NYSE:NYSE:TSM) is a great way to play secular tailwinds driving up demand for semiconductor components, or “chips,” given the firm’s ample capital appreciation and dividend growth upside potential. As derived by our enterprise cash flow analysis process, which we will cover in great detail in this article, we assign shares of TSM a fair value estimate of $125, well above where Taiwan Semiconductor is trading at as of this writing. Furthermore, due to the company’s stellar outlook and strong financials, we view its dividend growth potential quite favorably with shares of TSM yielding a nice ~3.0% as of this writing.

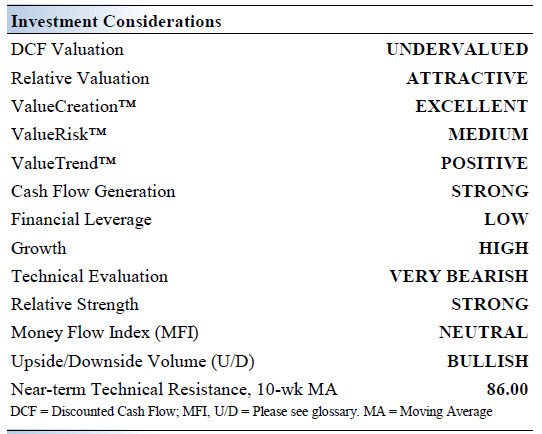

Taiwan Semiconductor’s Key Investment Considerations

Image Source: Valuentum

Taiwan Semiconductor is a foundry that makes semiconductors using manufacturing processes for its customers based on their own or third parties’ proprietary integrated circuit designs. The company is heavily dependent on the highly cyclical semiconductor and microelectronics industries. It was founded in 1987 and is headquartered in Taiwan.

We appreciate that Taiwan Semiconductor is laser focused on innovation and is the leader in the semiconductor fabrication space. It is focused on optimizing its 5nm production processes while rolling out 3nm and 2nm chip fabrication facilities over the coming years. Taiwan Semiconductor is years ahead of its competitors when it comes to its ability to produce the most cutting edge chips, with only Samsung Electronics Co (OTCPK:SSNLF) being a close peer.

As the credit rating agencies rate Taiwan Semiconductor’s debt as investment grade (Aa3/AA-) with stable outlooks, the firm should be able to tap capital markets at attractive rates as needed going forward. Furthermore, Taiwan Semiconductor has a healthy balance sheet with a nice net cash position on hand at the end of June 2022 (we’ll cover that later on in this article). Its free cash flow (defined as net operating cash flow less capital expenditures) generating abilities are stellar, though we caution that the firm operates in an incredibly competitive environment (while Taiwan Semiconductor is a leader in its field, the firm needs to invest heavily in its R&D efforts and its capital expenditures to stay ahead).

Taiwan Semiconductor has embarked on a major manufacturing capacity expansion program with plans to build new plants in Taiwan, Japan, the US, Europe, and elsewhere over the coming years (construction has already started at some of these projects). Its capital expenditure expectations have grown sharply in recent years due to its growth ambitions. In 2021, Taiwan Semiconductor estimated it would spend ~$100 billion over the next three years funding these capacity additions.

Financial Considerations

Please be aware that Taiwan Semiconductor reports its financials in New Taiwan dollars terms, though it also provides some financial items in US dollar terms at a specified exchange rate for the convenience of US-based readers. Additionally, the firm reports its financials in accordance with Republic of China (‘ROC’) generally accepted accounting practices (‘GAAP’), which differs somewhat from US GAAP rules. Taiwan Semiconductor pays out a quarterly dividend in New Taiwan dollars, and each American Depository Receipt (‘ADR’) represents five common shares of Taiwan Semiconductor.

Over the past few years, Taiwan Semiconductor’s business has boomed. Demand for consumer electronics and PCs surged during the initial phases of the COVID-19 pandemic while demand for data centers and smartphones remained robust, driving up demand for semiconductor components. Additionally, automobiles are requiring substantial increases in computing power and the Internet of Things [‘IoT’] trend is adding computing power to products that previously had little to none (such as appliances), creating another source of demand growth for chips.

Due to semiconductor demand vastly outstripping supply, a situation that is slowly resolving itself but continues to this day, Taiwan Semiconductor has been able to push through sizable pricing increases to offset inflationary pressures, supply chain hurdles, and other headwinds. In May 2022, Taiwan Semi reportedly told its customers to expect another round of pricing increases to kick in next year. This comes on the heels of its major pricing increase announcement in August 2021, and so far, demand has held up quite well due to the essential nature of its offerings and lack of serious alternatives.

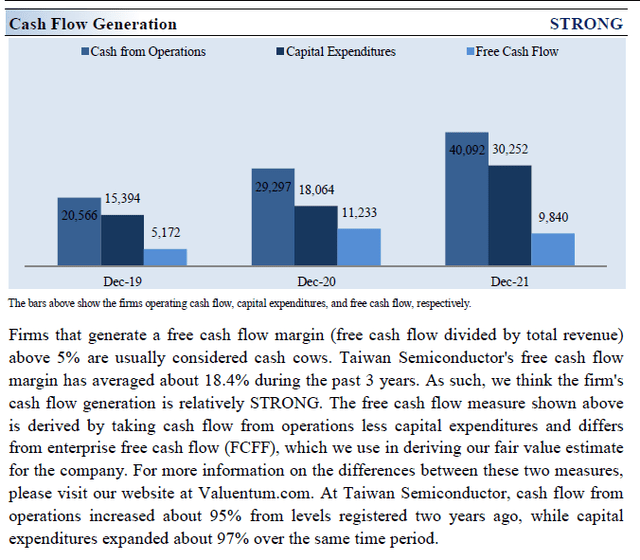

From 2019-2021, Taiwan Semiconductor’s revenues rose 48% in New Taiwan dollar terms and its gross margin expanded by ~560 basis points to reach 51.6%. Revenue growth and gross margin expansion created a powerful combination for its operating income and net income, which grew by 74% and 67%, respectively, during this period. In US dollar terms, Taiwan Semiconductor’s revenues stood at US$57.2 billion, its operating income stood at US$23.4 billion, and its net income stood at US$21.4 billion in 2021.

The company is a cash-flow generating powerhouse, though its capital expenditures increased substantially in 2021 over 2019-2020 levels as it seeks to scale up its global manufacturing capabilities as we noted previously. Last year, Taiwan Semiconductor generated US$40.1 billion in net operating cash flow and spent US$30.3 billion on capital expenditures, allowing for US$9.8 billion in free cash flow which fully covered US$9.6 billion in dividend obligations during this period. It did not spend a significant amount repurchasing its stock last year.

Investors should note that Taiwan Semiconductor’s dividend is exposed to currency exchange rate fluctuations. With that in mind, we expect the company will push through substantial payout increases over the coming years, aided by its stellar free cash flow generating abilities, strong expected demand growth, ample pricing power, and its healthy balance sheet. At the end of June 2022, Taiwan Semiconductor had roughly USD$18.1 billion in net cash on hand (inclusive of current ‘investments in marketable financial instruments’ and short-term debt). We are huge fans of Taiwan Semiconductor’s balance sheet strength.

Earnings Update

When the firm published its second quarter 2022 earnings update in July 2022, it beat both consensus top- and bottom-line estimates and issued out favorable guidance for the third quarter. Its net revenue in New Taiwan dollar terms rose by 44% year-over-year while its operating income rose by 80% year-over-year last quarter, aided by robust demand for chips and recent pricing increases.

In US dollar terms, Taiwan Semiconductor generated USD$8.1 billion in free cash flow during the first half of 2022, which fully covered USD$5.0 billion in dividend obligations and a negligible amount of share repurchases during this period. Looking ahead, Taiwan Semiconductor aims to generate USD$19.8-$20.6 billion in net revenue (up 36% year-over-year at the midpoint) this quarter with an operating margin of 47%-49% (up ~680 basis points year-over-year at the midpoint).

The firm is doing great and its free cash flow generating abilities are holding up quite well, even as its capital expenditure expectations are on the rise. Furthermore, Taiwan Semiconductor stands to be a major beneficiary of the CHIPS Act that recently was signed into law in the US which provides ample subsidies for semiconductor manufacturing activities.

Some of Taiwan Semiconductor’s growth ambitions involve building a chip manufacturing hub in Arizona, which should benefit economically from the CHIPS Act. Additionally, the firm is building another manufacturing hub in Japan, and scaling up production capacity at its enormous chip manufacturing complexes in Taiwan to meet robust demand for its offerings.

Downside Geopolitical Risks

We caution that the single biggest risk to our thesis on Taiwan Semiconductor is the small but non-zero chance that a war breaks out over Taiwan (likely involving China, Taiwan, and the US among other nations). Should that occur, Taiwan Semiconductor’s main manufacturing hub could get destroyed or at the very least, production activities would likely stop until peace prevails. While this is an incredibly unlikely scenario, tensions over Taiwan’s independence status (with Taiwan and the West on one side and China on the other) are building and readers should be cognizant of the substantial geopolitical risks when it comes to Taiwan Semiconductor.

Additionally, Taiwan Semiconductor’s vast production expansion initiatives are quite expensive, and operational execution will be key to ensuring cost overruns don’t ruin the firm’s ability to generate shareholder value. Taiwan Semiconductor is pouring billions into capital expenditures and R&D expenses to ensure it stays ahead of its peers. For reference, its R&D expenses in New Taiwan dollar terms grew by 28% year-over-year in the second quarter and its capital expenditures in New Taiwan dollar terms were up 30% year-over-year during the first half of 2022.

On a final note here, supply chain hurdles and unfavorable foreign currency movements represent additional downside risk considerations that readers should keep in mind when evaluating Taiwan Semiconductor.

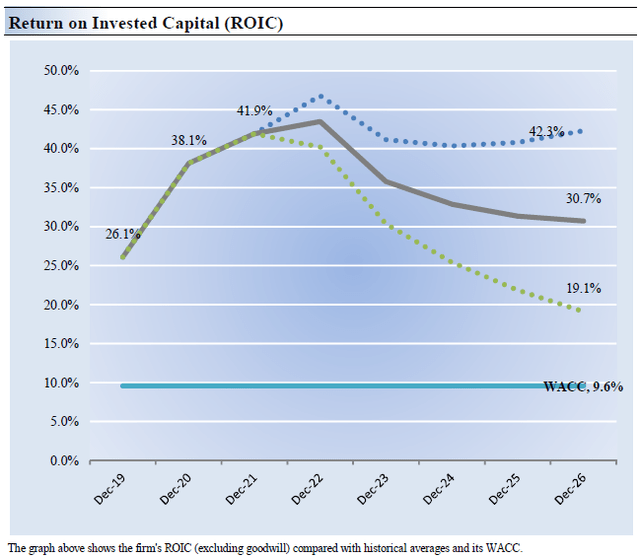

Taiwan Semiconductor’s Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Taiwan Semiconductor’s 3-year historical return on invested capital (without goodwill) is 35.4%, which is above the estimate of its cost of capital of 9.6%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Taiwan Semiconductor has historically been a solid generator of shareholder value and we expect that will keep being the case going forward, keeping its major manufacturing capacity expansion plans in mind.

Taiwan Semiconductor’s Cash Flow Valuation Analysis

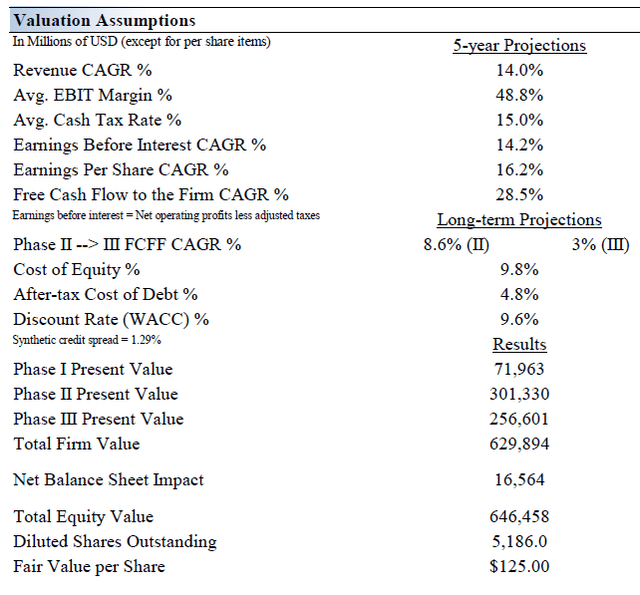

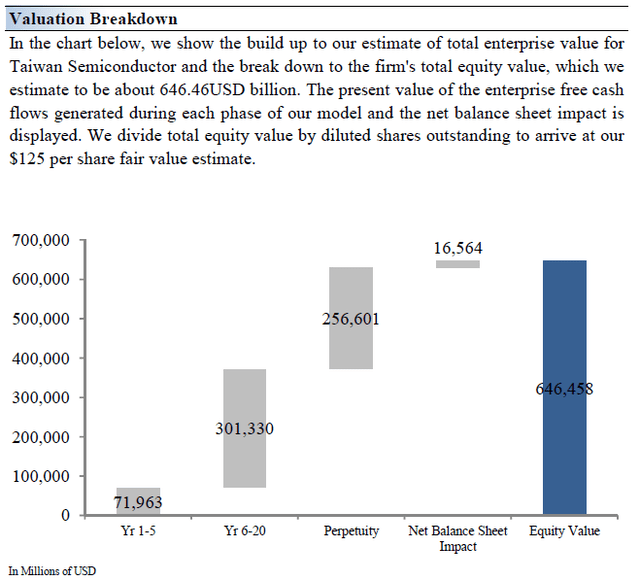

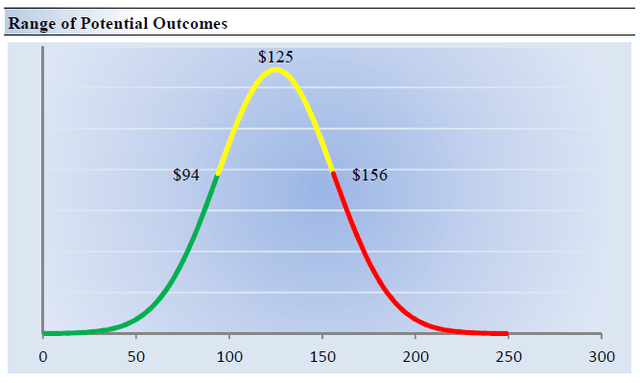

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of balance sheet considerations. We think Taiwan Semiconductor is worth $125 per share with a fair value range of $94-$156. Shares of TSM are trading below the low end of our fair value estimate range as of this writing, likely due to geopolitical concerns arising from US-China trade tensions and China’s claim that Taiwan is a Chinese territory (and not its own separate nation).

The near term operating forecasts used in our enterprise cash flow models, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 14% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 19.3%.

Our valuation model reflects a 5-year projected average operating margin of 48.8%, which is above Taiwan Semiconductor’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 8.6% for the next 15 years and 3% in perpetuity. For Taiwan Semiconductor, we use a 9.6% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum Image Source: Valuentum

Taiwan Semiconductor’s Margin of Safety Analysis

Although we estimate Taiwan Semiconductor’s fair value at about $125 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for Taiwan Semiconductor. We think the firm is attractive below $94 per share (the green line), but quite expensive above $156 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Smartphones, automobiles, cloud computing, and the Internet of Things trend will continue to be key drivers of Taiwan Semiconductor’s growth. In a ‘normalized’ operating environment, its business model is conducive to growing its top-line despite any weakness in global PC and tablet shipments. We love its net cash position, as it provides significant financial flexibility to pursue growth initiatives while laying a foundation for future dividend expansion. Looking ahead, we’re anticipating ongoing, material dividend increases over the coming years.

The company is heavily dependent on the highly cyclical semiconductor and microelectronics industry. However, its healthy balance sheet mitigates the risk of such cyclicality to a degree as it provides a meaningful cushion for the company to fall back on. Investors must also be aware of the potential impact unforeseeable social and political events in China and rising US-China tensions can have on the firm’s operations. Keeping those risks in mind, we view Taiwan Semiconductor’s capital appreciation upside quite favorably as shares of TSM are trading well below their fair value estimate as of this writing.

Be the first to comment