Dejan Marjanovic/E+ via Getty Images

Investment Thesis:

Trulieve (OTCQX:TCNNF) is a very different business to several years ago, with its diversified footprint in the US, we believe it is a great time to invest in the company. Cannabis consumption is growing across many segments for the first time, and with legalization likely within the next few years, the market is expected to explode.

The reason we prefer Trulieve to its competitions is due to the conservative financial position. Unlike most of its competitors, it is free cash flow generating and focused on ensuring a sustainable business model.

If investors are looking to benefit from the impending legalization of Marijuana, Trulieve seems to be the profitable way to go.

Company Description:

Trulieve (OTCPK:TRUL) is the largest retailer of recreational and medical cannabis in the US, with over 150 dispensaries. The business originally operated out of Florida, but has now expanded nationally, via several acquisitions. Trulieve now has 51 dispensaries outside of Florida.

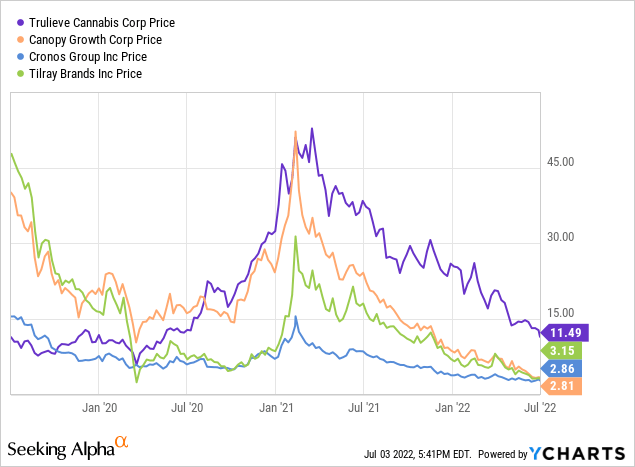

Trulieve, like its peers, saw several periods of large gains as legalization hopes rose and deregulation occurred in the US market. However, we have yet to see legalization at a federal level, with the House of Representatives passing a bill in April which will legalize cannabis throughout the US.

With cannabis stocks at record lows from their ATHs, now seems like a good time to assess the investability of Trulieve.

The Cannabis Market:

The global legal cannabis market is expected to reach over $102BN by 2030, representing a CAGR of 25.5%, according to Grand View Research. Interestingly, the largest segment of this market is oil and tinctures, with 50% market share. This is the area of growth in many people’s view, as medicinal / chronic ailment treatment takes center stage ahead of recreational use. We much prefer this as medicinal consumption is always one of the most inelastic in demand, as consumers usually rely on these products. The benefit here is that demand is less cyclical. Recreational usage is still expected to grow at a strong rate, and so serves as the perfect combination. Further, given that medicinal research is only in its early stages, it is impossible to tell what additional benefits can be discovered with several more years and decades of research.

The North American market represents 80% of the revenue share in 2021, which is not surprising given that Canada and the US are leading the way for legalization.

Trulieve looks set to benefit highly from this. It is the largest operator in Florida, with 25% of the total dispensaries, and has a monster 51% share of the medicinal market. Trulieve also holds medical cannabis licenses in California, Massachusetts, and Connecticut, with California being the clear highlight here. With such a large share in Florida, Trulieve can leverage its brands, expertise and business model to expand into these other markets aggressively. I am sure I would offend many Americans if I suggested they were the same state-to-state, but it is, of course, much easier to market to other American states than it is to expand overseas, for example.

Legalization And SAFE Banking:

When Canada legalized cannabis, many expected the US to quickly follow suit. Although States now have the ability to legalize it at their level, businesses operating in these places still face issues.

One example is banking. As cannabis is illegal under federal law, proceeds from legal operations at a state level can run into major issues, and so many banks have steered clear. The impact of this is greater cost of doing business for companies and a restriction on their ability to grow, for example due to a cash-only model being required. The SAFE Banking Act “seeks to protect banks and financial institutions who choose to service cannabis-related businesses”. The bill has received overwhelming bipartisan support and may finally be passed.

Legalization is equally slow in coming to pass, but again is slowly seeing support in the government growing. Importantly, the people want it and so it is only a matter of time. This will likely begin with legalization for medical use. The reason we believe this is due to the level of scientific studies into its benefits, with many positive findings. Again, this will be highly beneficial for Trulieve and means it can benefit immediately from legalization.

We have no idea when legalization will occur, it could still be a decade away, it could happen tomorrow. What we feel certain of is that when it does occur, and when SAFE Banking does pass, Trulieve will see strong positive price action. This is the ultimate catalyst for this industry. The question is whether Trulieve will give investors a good return until then.

Financials:

Trulieve’s growth has been astronomical since the legislative change, with revenues growing at a CAGR of 162% since 2017. It is easy to assign this to deregulation, but that is lazy, Tilray (TLRY) one of the largest Cannabis stocks, only grew 139.8% (Tilray is valued at 35x NTM EBITDA, whereas Trulieve is trading at only 6x). We believe this is attributable to their strategy. Rather than attempting national domination, Trulieve focused on being the largest player in Florida and focused on building a sustainable model. The outcome was profit-accretive revenue growth, whereas many competitors are still losing money for every $1 of growth.

On a margin basis, Trulieve is also impressive.

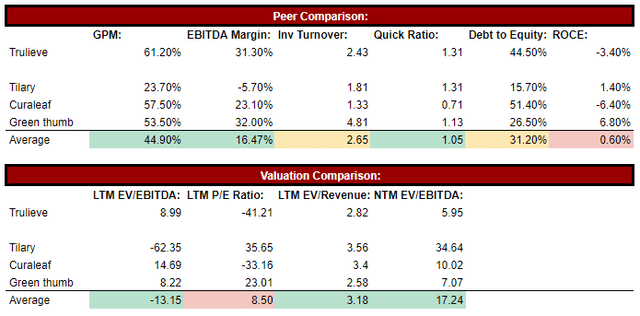

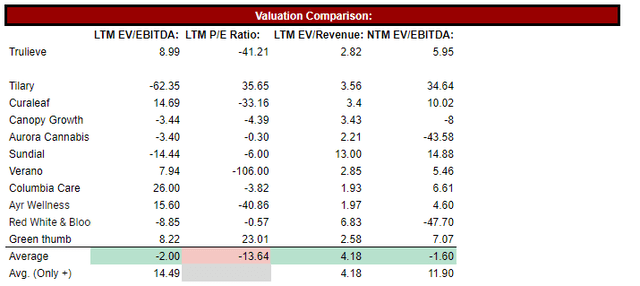

Peer comparison (Tikr Terminal)

We have compared Trulieve to a basket of peers and note that it comfortably outperforms them all on the top and bottom line. Given the relative young age of the industry, it shows Trulieve’s maturity in the market. Conversely, we must also factor growth into these margins.

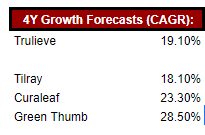

4Y growth forecasts (Tikr Terminal)

Based on analyst’s most recent forecasts, all these businesses are forecast to grow in the region of 20%< with Green Thumb (OTCQX:GTBIF) being the exception. Therefore, if Trulieve can maintain its margins, it will be the most profitable business in its peer group.

Liquidity wise, Trulieve appears to be in a good place. Short-term liquidity is strong and is superior to its peers, and importantly, the business has enough debt capacity currently to continue to invest in growth now and when legalization occurs.

Therefore, on a financial basis, we believe Trulieve to be a great investment. When we consider this in the context of valuation, it suggests Trulieve is undervalued.

The Big Concern:

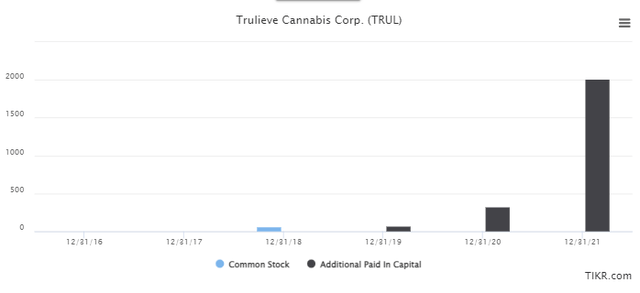

There is one major issue for shareholders, and that is dilution.

Trulieve – Share count (Tikr Terminal)

For the reasons explained above, and the speed at which these cannabis companies have grown, obtaining funding has been extremely difficult. As a result, many have turned to raising money through share issuance (and rewarding the C Suite, of course!).

Trulieve recently filed a registration statement for resale of up to 72.3M shares. The current outstanding shares are 135M and so this is 53% more shares which could be issued. The S-3 filing is good for 3 years.

There are two scenarios here. One, Trulieve is expecting an explosion in the share price and will use the fundraising option only to respond to the catalyst. For example, in response to Legalization or SAFE banking passing, which would inevitably cause large price action and mean dilution doesn’t crater the share price. Secondly, management intends to further raise funds regardless. Unfortunately, we do not have a crystal ball, and so we must make our own judgment as to what we think will happen and what management’s intentions are. As one Seeking Alpha user stated, “you either trust CEO Rivers or you don’t”.

Valuation:

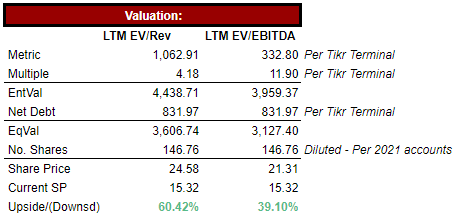

In order to value Trulieve, we have applied the average market multiple of a large set of comparable companies. To be prudent with market conditions as they are, we applied the NTM multiple to LTM EBITDA.

Comp Set (Tikr Terminal) Trulieve Valuation (Author’s own calculation)

This suggests an upside potential of 39%-60%, importantly before any legalization or SAFE banking legislation. As explained above, Trulieve is a strong performer and there is no operational reason for it to be trading at a discount to its peers.

Final Thoughts:

We are honestly torn on Trulieve. It is a fast-growing business and is able to translate that directly into cash flow, thus with scale, has the opportunity to be highly profitable. With legalization and legislation likely in the coming years, their medicinal focus should give them an early boost. If we are honest, the price action caused by these events will impact all businesses in the cannabis market and so to an extent, the fundamentals will take a back seat.

On the other hand, dilution will likely occur at some point, and the general market sentiment is currently negative. This could leave investors suffering until things change.

Overall, we will rate this stock a cautious buy, with the caveat that we expect the short-term to be tough. If management were to sell the shares below the prevailing market rate, we may reconsider this rating. We are swayed by the fact that the stock is trading at a sharp discount and is comfortably EBITDA positive.

Be the first to comment