Justin Sullivan

Investment Thesis

Monster Beverage Corporation (NASDAQ:MNST), a household name in the energy drink category, gained only 5% in 2021 compared to the S&P 500’s gain of 26%. The long path to nowhere was induced by rising cost of sales, most notably aluminum and fuel. These weighed on margins and investor sentiment and kept shares rangebound for much of 2021. Many of these headwinds have since cleared, allowing Monster to rebound 36% since early March 2022. Even with improving cost of sales and margins, the market seems to have overcorrected to the upside, pricing Monster at a decent premium to its intrinsic value. Keen investors may consider this an opportunity to sell into strength.

Improved Operating Environment

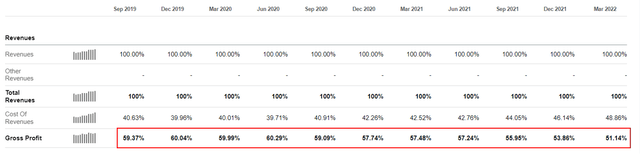

Monster has not been immune to the inflationary environment most companies find themselves in today. They have had to deal with supply chain headaches and rising transportation costs just like everyone else, maybe even more so. Their gross margins have taken a substantial hit as a result, dropping nearly 10% from pre-pandemic levels.

MNST Gross Margins (Chart courtesy of Seeking Alpha)

This is largely due to increased commodity pricing for aluminum and oil. Aluminum pricing impacts Monster’s cost for aluminum cans while oil prices impact the cost of fuel used to transport Monster’s product. These headwinds are the first items mentioned in their Q1 2022 earnings release.

In the first quarter of 2022, the Company experienced significant increases in costs of sales relative to the comparative 2021 first quarter, primarily due to increased freight rates and fuel costs, including costs relating to the importation of aluminum cans as well as aluminum can costs attributable to higher aluminum commodity pricing.

Fortunately, aluminum prices have fallen considerably from early March and are now stabilizing. Fuel prices, while still above historic norms, have also rolled over and are offering a reprieve for consumers, if only for a little while. The market has taken notice and priced Monster accordingly. Indeed, Monster is up 36% from its low in early March.

Aluminum prices stabilizing

The price of aluminum had been rising consistently since the pandemic-induced flash crash of 2020; this squeezed Monster’s margins and weighed on profitability. The chart below shows just how strong the correlation is between aluminum and Monster. Notice how Monster bottomed nearly the same day aluminum peaked?

MNST vs Aluminum Futures (Chart courtesy of Seeking Alpha)

At just over $2,400 per ton, aluminum prices are still elevated compared to their historic average but are not far from where experts expect them to be going forward. Forecasters anticipate aluminum may come down another 15% or so to $2,100 per ton before leveling out and working their way back up. Considering aluminum is already down 36% from its March high and is stabilizing, I believe the good news is already priced into Monster and the aluminum-induced rally may begin to fade.

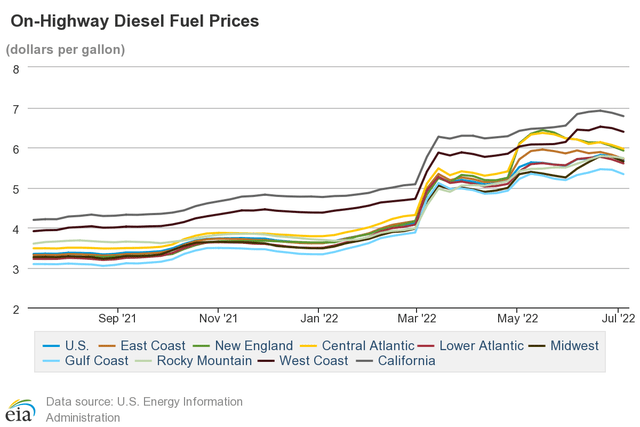

Diesel prices may be rolling over

For those that don’t know, diesel is refined from crude oil and is the primary fuel powering most semi-trucks you see driving down the highway. Exacerbated by the war in Ukraine, crude oil prices have also skyrocketed this year leading to increased prices of gasoline and diesel. We all have felt pain at the pump.

Diesel price per gallon in US (US Energy Information Administration)

Though in recent weeks, not unlike aluminum, oil prices have also begun to decrease. Last week I filled my tank for $4.50 per gallon and felt like I was getting a bargain. Sad, but true. Whether the slide in oil continues is anyone’s guess, but I certainly welcome lower prices at the pump. It leaves a little extra money in my pocket to spend on something else, like Monster.

Crude Oil Futures (Chart courtesy of Seeking Alpha)

Diesel powers the trucks Monster uses to transport its product. And while it is easy to see how decreasing diesel prices will improve Monster’s margins, you may consider how it also leads to increased sales of the beverage itself. This is because the convenience store channel is Monster’s largest channel by revenue.

Aside from the road, where do you typically see a semi-truck? Usually at a rest area, truck stop, or convenience store. Truck drivers spend a lot of time on the road with numerous stops to refuel. And if they are anything like me, they get tired when driving long hours on a boring highway with nothing to do. So, with diesel weighing a little lighter on the wallet, I expect more drivers will splurge on a cool, energizing beverage like Monster.

Actually, I expect this to be the case for all drivers, not just those in a semi-truck. Consumers will be more likely to head into the convenience store to pick-up a candy bar and beverage with a lower price per gallon. I can say this with a good bit of confidence because my father owns three convenience stores in West Virginia where he has seen this exact scenario play out time and again.

During the Q1 2022 earnings call, co-CEO Rodney Sacks had this to say when asked by Morgan Stanley’s Dara Mohsenian about the impact of rising fuel prices on consumers:

…in fact, convenience is our largest channel, which I just think is positive for the future, because we think that will right itself eventually when gas prices sort of normalize and/or people just get used to the gas prices and become whatever the level is, people will get used to it eventually and continue to drive.

I believe we are in this scenario now and this is good news for Monster.

Competitive landscape

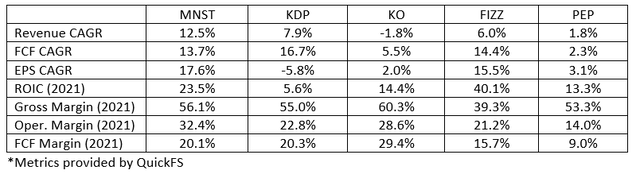

Compared to its competitors, Monster’s operational and financial performance over the past 10 years is quite enviable. Here are a few highlights for the period 2012 through 2021:

Performance Comparison (Author’s personal data)

Monster has a lot of competition in the energy drink category, but few of its competitors are public, pure play energy drink companies. The Coca-Cola’s (KO) and Pepsi’s (PEP) of the world own other food and beverage brands which are stable and, while profitable, weigh on growth. Celsius Holdings (CELH) is probably the nearest in terms of pure play competition, but Celsius is a very young growth story and does not make for a good comparison.

Valuation

I do love Monster’s product and believe the company operates a sound, profitable business model that is friendly to shareholders. However, I cannot recommend investing in Monster at current valuations because I believe it to be trading at a premium to its intrinsic value.

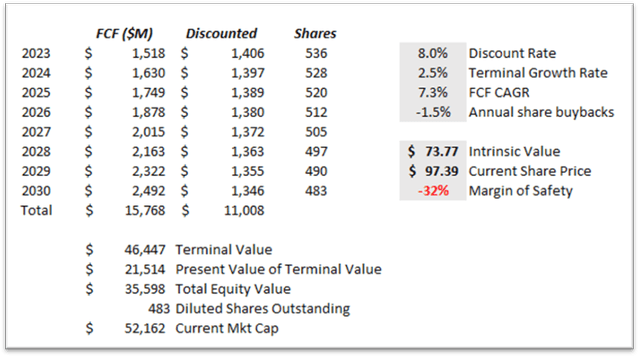

DCF approach

My DCF valuation for Monster is $73.77, which assumes the company will grow FCF per share at 7.3% (10yr average is roughly 13%) and reduce total number of shares outstanding by 1.5% annually via share repurchases. Still, at roughly $98, Monster appears to be 30% overvalued.

MNST DCF Analysis (Author’s personal valuation tool)

Market multiple approach

For growth companies like Monster, I use the historical S&P 500 PEG ratio to find an appropriate market multiple. The S&P 500 PEG ratio typically ranges between 1.2 and 1.6. I split the difference at 1.4 which equates to a S&P 500 PE of 14 using 10% per share earnings growth (14 divided by 10 equals 1.4).

The 22 analysts covering Monster have a 2023 consensus EPS estimate of $3.21, which equates to 19% growth over 2022 assuming Monster delivers near the expected $2.70 EPS.

Put it together and these figures equate to an estimated market multiple (PE) of 26.6 (19 x 1.4) and a fair value of $85.39 ($3.21 x 26.6). With a current value near $98 per share, Monster appears to be 15% overvalued using this approach.

Conclusion

Monster has been riding the tailwinds of easing commodity prices since early March. Shares are up considerably since then and those who bought in at the right time are sitting on a nice profit. But Mr. Market, having gotten overly excited about Monster’s prospects following the decline of aluminum and oil, has gotten a little overzealous with its valuation. With uncertainty in the current macroenvironment and unpredictability of commodity prices, now may be a good time to sell Monster into strength and await a pullback to around $75 or $80 per share before purchasing again.

Be the first to comment