febriyanta/iStock via Getty Images

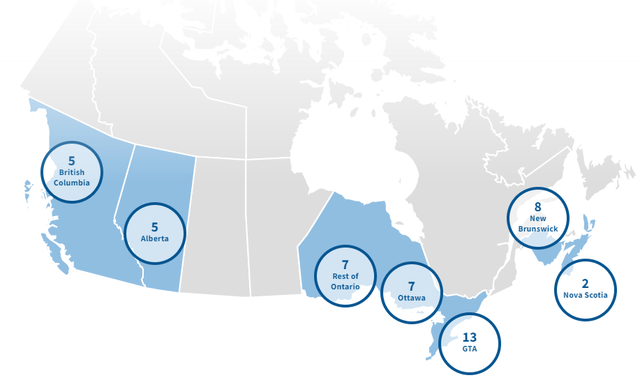

True North Commercial REIT (TSX:TNT.UN:CA) owns office properties in urban locations across Canada.

While it has a presence in both the east and the west, majority of its properties are in Ontario.

This one is externally managed by Starlight Group Property Holdings, Inc., which is considered a related party to True North. The CEO of Starlight is the chairman of the REIT board, along with being a significant unitholder. Starlight has a payout with a base annual management fee that takes into account the purchase price of all properties plus CAPEX undertaken by the REIT. They also enjoy an annual incentive tied to the 2013 FFO and CPI. There is more in terms of compensation related to acquisitions and CAPEX related construction costs, which can be read in further detail in the most recent MD&A. While investors are generally not too thrilled with external managers, we do think that this bunch has done a very good job so far in challenging conditions.

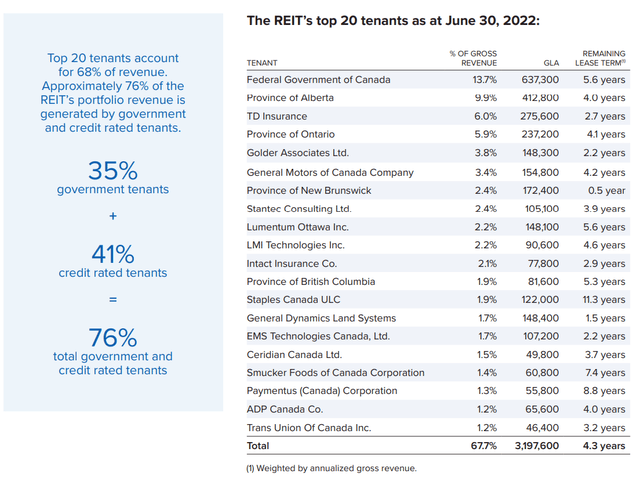

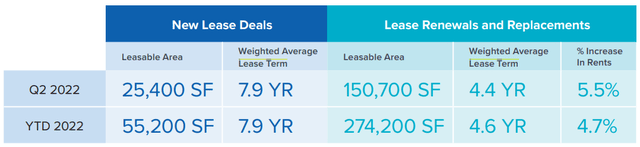

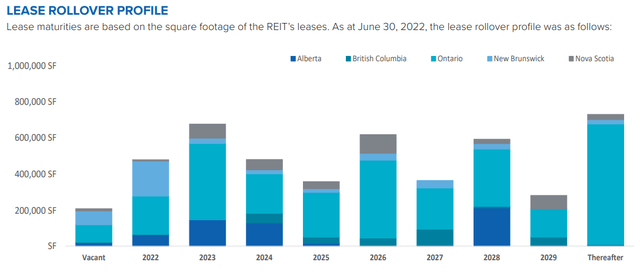

While its tenant base, along with occupancy levels (96%) is impressive, the weighted average lease term not so much at 4.3 years.

The REIT is making an effort on that front which is reflected in their 2022 leasing activity. While their renewals were still in the same 4-year ballpark, they did achieve a significantly higher term for their new lease deals.

They still have a few leases up for renewal for this year. It will be interesting to see how they bring it home.

The Attraction

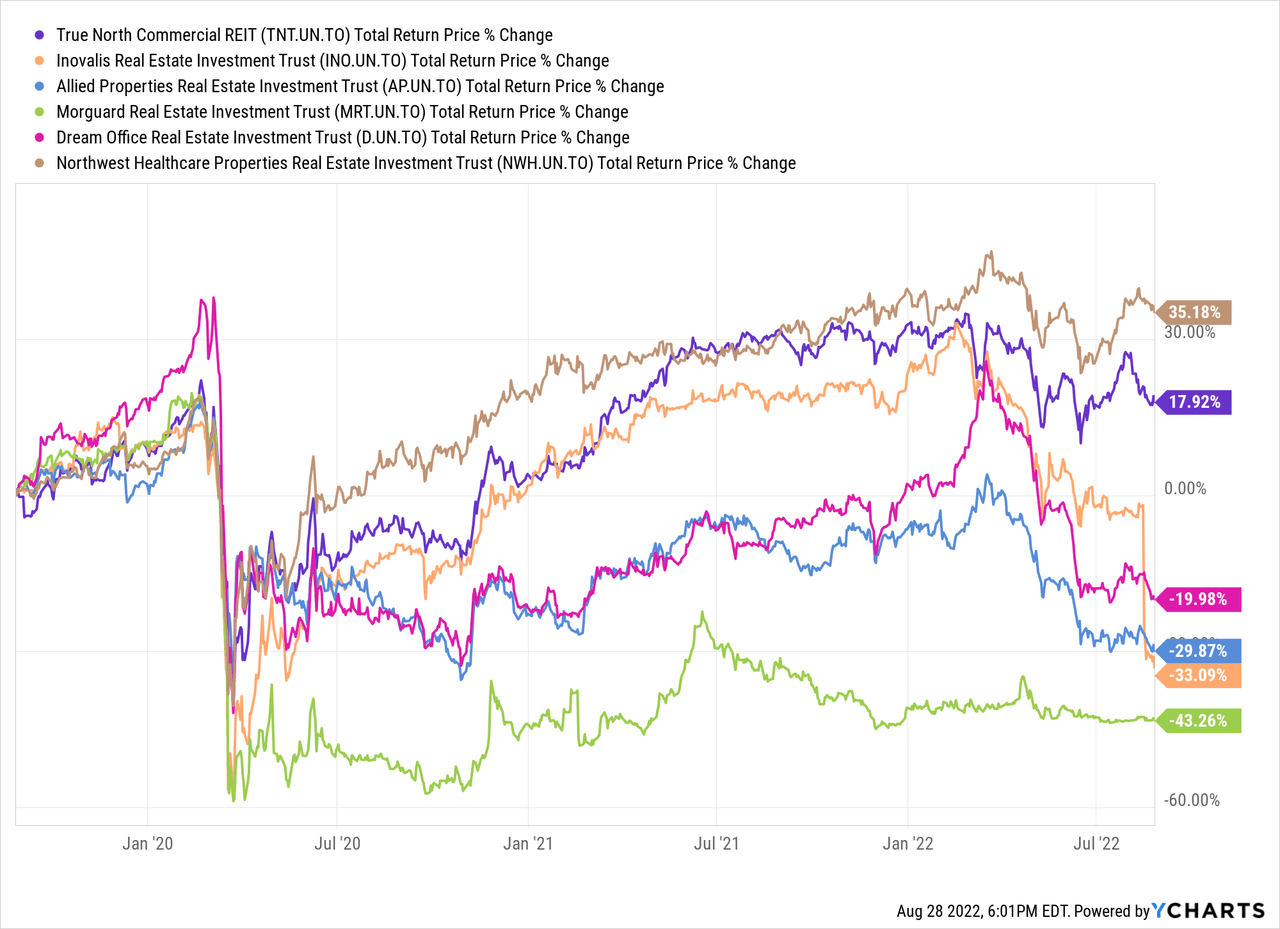

While investors have generally given a cold shoulder to most office REITs today, True North has held up quite well. In Canada, its returns in the last 3 years versus its office REIT peers have been quite outstanding. Comparing to Inovalis Real Estate Investment Trust (OTC:IVREF) (INO.UN:CA), Allied Properties REIT (APYRF) (AP.UN:CA), Morguard Real Estate Investment Trust (MRT.UN:CA), Dream Office Real Estate Investment Trust (OTC:DRETF) (D.UN:CA) and NorthWest Healthcare Properties Real Estate Investment Trust (OTC:NWHUF) (NWH.UN:CA) paints this REIT in a rather favorable light.

Only NWHUF has beaten it in terms of total returns and medical office properties are definitely a notch above the standard office properties. NWHUF also has hospitals and is not impacted to the same extent by the work from home trend.

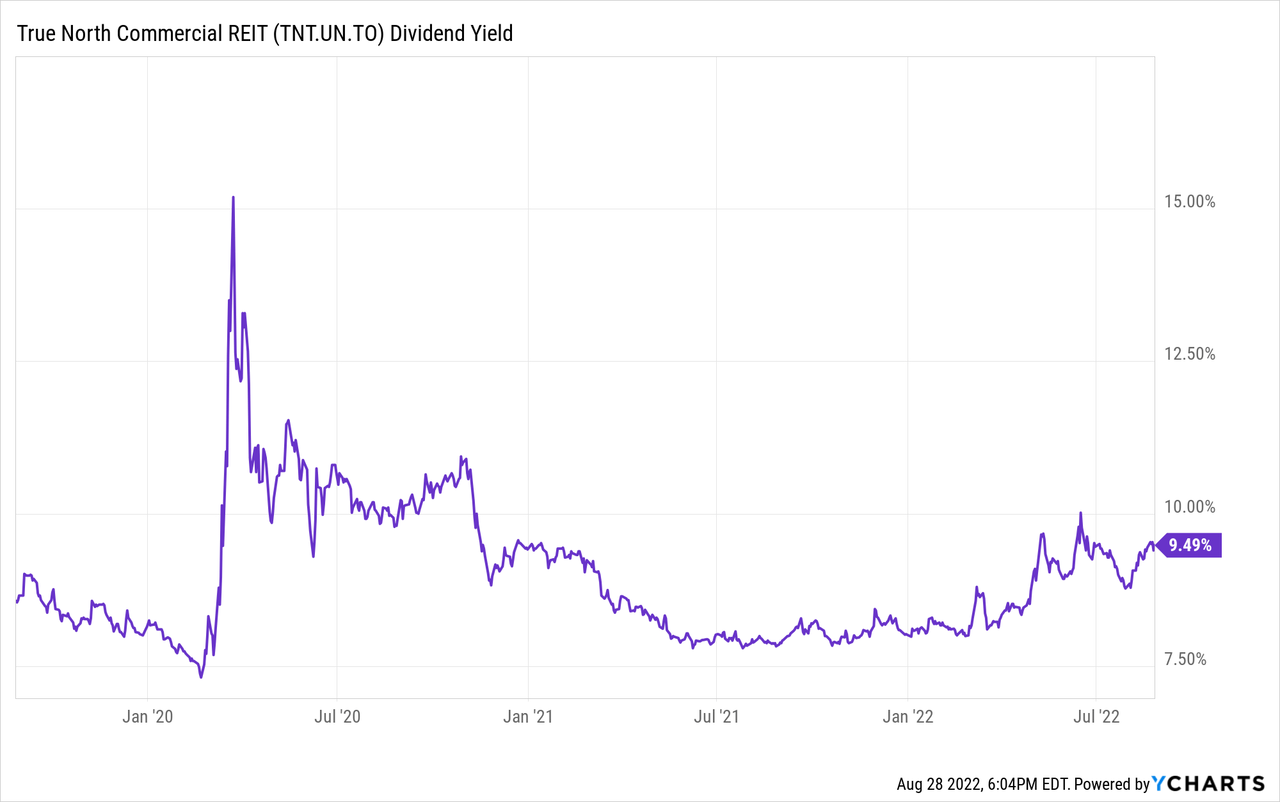

While total returns have been good, price has moved lower over the last three years. It has been True North’s gigantic yield, which stands above the rest of that office group, has kept things going.

Investors today see this has a safe bastion where a 9% plus yield meets some growth potential. After all, they did not cut in the pandemic, so why would they now?

Dividend Safety

While not cutting during the pandemic deserves credit, we don’t think that necessarily forecasts what happens in the next 24 months. There are two huge headwinds that the company faces and it will be challenging to overcome even one of them independently.

The first is the extremely short lease terms and the headwinds it presents. This is across the board and as the REIT gets leases up for renewal, it will begin to feel the impact. Currently its occupancy rates are way higher than the averages for each province and city. For example, its Calgary properties have less than 5% area vacant, but the city itself has a 30% vacancy rate. Greater Toronto Area vacancy rates are near 10%, but True North has less than 5% vacancy in its GTA portfolio. While these sound positive, it actually works in the reverse as tenants are wooed by multiple suitors and tend to get an arm and a leg to stay. So far the drift down in occupancy has been slow, but we believe it will get far more challenging in the quarters ahead.

The picture above might make you think though that the AFFO is doing pretty well and moving up. It does look like that and you have to add these two sentences for context.

Ontario Same Property NOI increased by 11.4% mostly due to termination fees related to a tenant in the REIT’s GTA portfolio that is downsizing a portion of their space effective December 2022.

Excluding termination fees, Q2-2022 FFO and AFFO basic and diluted per Unit would be $0.13 and YTD-2022 FFO and AFFO basic and diluted per Unit would be $0.27. Q2-2022 AFFO basic and diluted payout ratio would be 112% and YTD-2022 AFFO basic and diluted payout ratio would be 111%.

Source: Q2-2022 MD&A

By itself we think this would result in a dividend cut within two years. But the REIT also faces another challenge from rising interest rates.

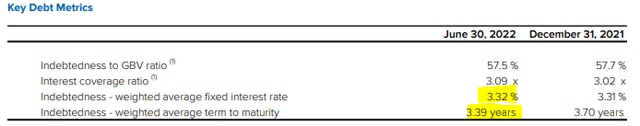

Note below how the rates have jumped in the recent refinancings from first quarter to after the second quarter.

During the first quarter, the REIT refinanced a total of $31,570 of mortgages with a weighted average fixed interest rate of 3.32% for three to seven year terms, providing the REIT with additional liquidity of approximately $5,700. Subsequent to quarter end, the REIT refinanced an additional $47,000 of mortgages with a weighted average fixed interest rate of 4.61% for one to five year terms, providing additional liquidity of $10,800.

Source: Q2-2022 MD&A

Verdict

True North has done an exceptional job so far and maintained an almost occupied portfolio. Unfortunately excluding termination fees, AFFO payout ratios are already past 110%. If we refinance the entire debt profile just 1% higher and exclude the termination fees, AFFO payout ratio would be past 125%. That is even without expecting further occupancy declines.

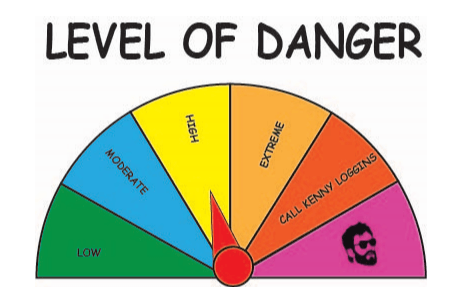

Based on all the information we have looked at, True North has a “High” level of danger of a dividend cut on our proprietary Kenny Loggins Scale.

Trapping Value

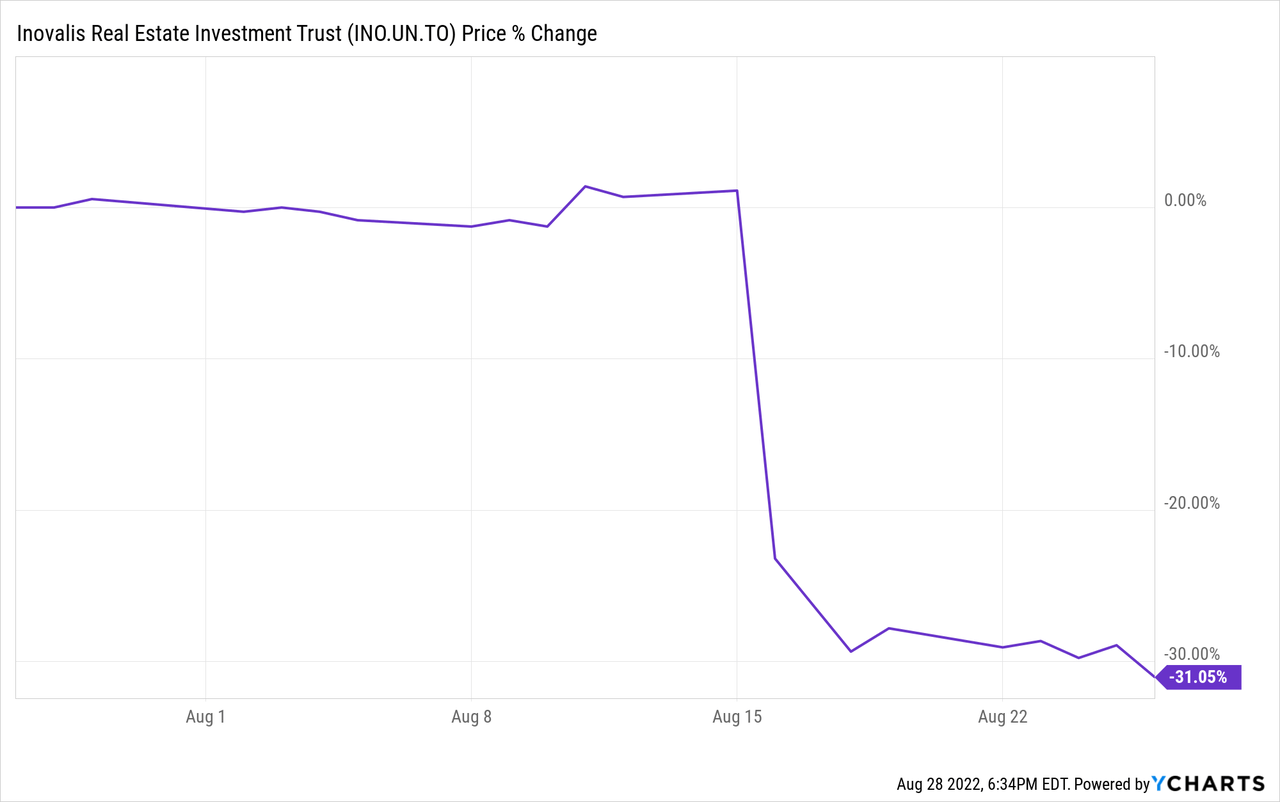

This rating signifies a 33-50% probability of a dividend cut in the next 12 months. We think this probability will increase over time unless we see a rather abrupt change in office market fundamentals. Keep in mind that managers can defer and delay this decision, sometimes more than they should. Look at how bad things got for Inovalis in Q4-2021 (198% payout ratio???) and they cut after Q2-2022.

In Q4 2021, the REIT reported FFO and AFFO of CAD$0.10 and CAD$0.07 per Unit respectively, versus CAD$0.17 and CAD$0.15 for the same period last year The AFFO payout ratio, a non-GAAP measure of the sustainability of the REIT’s distribution payout, is 198.1% for the year ended 2021.

Source: Inovalis Q4-2021

But then there is hell to pay.

Getting back to our protagonist today, we think True North will likely take appropriate steps before things get too bad and help preserve value in the REIT. We are giving this a “hold” rating despite the challenges, as the management has earned some latitude for its good performance.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment