8vFanI

If you’re looking for high yield Venture Capital exposure, it’s easy enough to find – just check out Business Development Companies, BDC’s. This industry lends to privately-held companies in various different industries. Most of these private companies have private equity a hedge fund sponsors, and some of them also have sponsors in the venture capital industry.

That’s a key point – since these sponsors have serious skin in this game, they’re usually willing to offer further support to the private companies when times get tough, such as during the Covid pandemic.

TriplePoint Venture Group (NYSE:TPVG) focuses on companies which are already backed by venture capital firms, with a specific area of concentration on VC-backed firms in the venture growth stage, which haven’t yet gone public:

Profile:

TPVG is an internally managed BDC, founded in 2005. It’s headquartered on Sand Hill Road in Silicon Valley, with regional offices in New York City, San Francisco and Boston. Since inception, TPVG has committed over $10B to 900+ companies throughout the world. It generally does 3-4 year financings, with a loan-to-enterprise value of less than 25%. The portfolio companies are typically preparing for an IPO or M&A in the next 1-3 years.

Holdings:

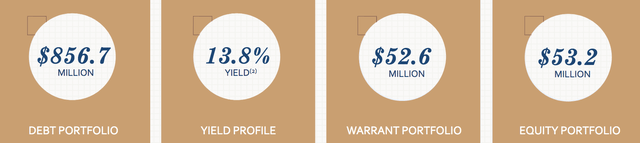

As of 6/30/22, TPVG’s debt portfolio was $856.7M, with an average yield of 13.8%. It also has a $52.6M warrant portfolio, and a $53.2M equity portfolio. Those 2 components have enhanced TPVG’s returns through the years.

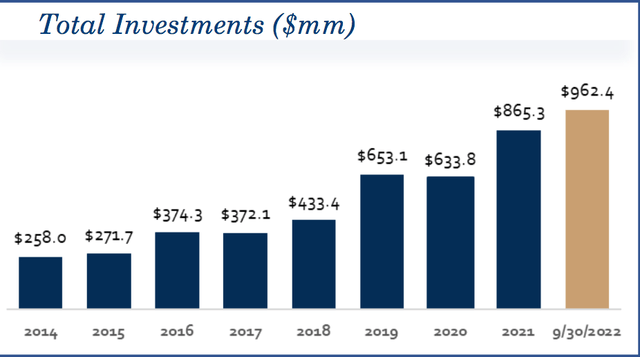

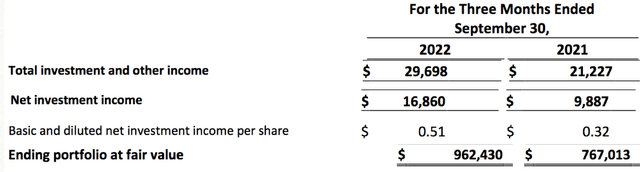

Management has steadily increased the overall portfolio since 2014 – it’s up 11% so far in 2022, to $962M, as of 9/30/22:

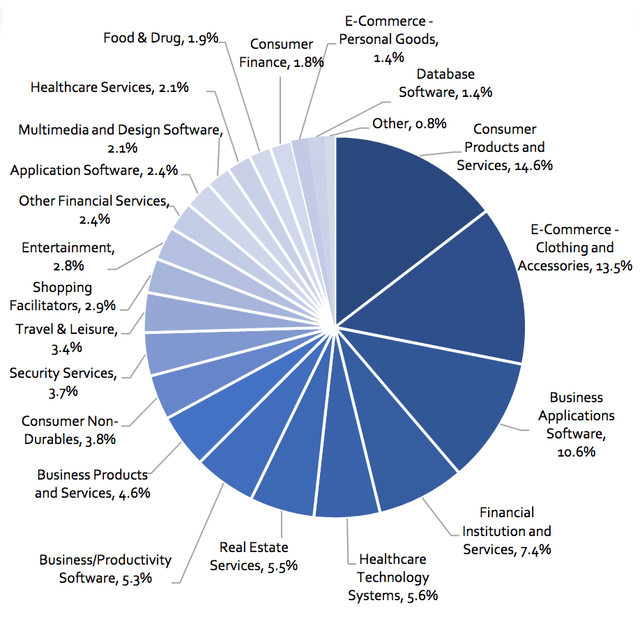

As of 9/30/22, TPVG’s largest 5 industry holdings, which form ~52% of the portfolio, (down from 59% in Q2 ’22), were Consumer Products & Services, at 14.6%, E-Commerce Clothing, at 13.5%, Business Applications Software, at 10.6%, Financial Institution & Services, at 7.4%, and Healthcare Tech, at 5.6%. Financial Institution & Services had the biggest change in Q3 ’22, dropping from 11.6%. Management tends to avoid cyclical industries.

Portfolio Ratings:

A major investor concern during the pandemic lockdowns was how well the BDC industry’s portfolio companies would weather the economic pressures. BDC’s management usually review and rate their holdings each quarter.

Most BDC’s holdings came though that crisis in pretty good shape.

PVG uses a 1-5 tier system, with “clear” or 1 being the highest rating, and “red” or 5, being the lowest.

As of 9/30/22, TPVG’s overall companies’ rating score was down slightly, to 2.04, vs. 2.06 in Q2 ’22. ~90% of its companies were in the top 1-2 tiers, with only 1% in the lowest 4-5 tiers. Management upgraded one company with $14M of principal balance from category 2 to category 1, and one portfolio company with $25M of principal balance from category 3 to category 2 due to improved performance.

They downgraded 1 portfolio company, Medly Health, an online digital pharmacy with a total principal balance of $34.3M in principal balance, from category 2 to category 3, due to reductions in its operating plan, changes in its senior team and the overall liquidity position. There may be another future downgrade of Medly’s outstanding loans in Q4.

Rising Rates Help TPVG’s Bottom Line:

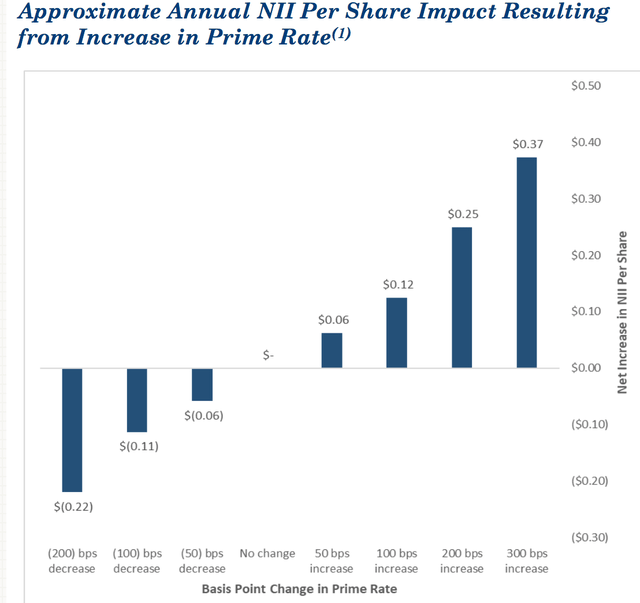

The debt portfolio was 62.3% floating rate as of 9/30/22, up from 58.6% in Q2 ’22. With ~62% in floating rates, management estimates that TPVG would earn $.12/share more in NII for a 100 basis point rise in the prime rate, while a 200 point rise would earn $.25/share, and a 300 point rise would earn $.37 annually. (These estimates have risen since TPVG’s Q2 ’22 earnings report.)

Earnings:

Q3 ’22 earnings were very strong, due to higher interest rates and a much larger portfolio. Total Investment Income was up 40%, while NII surged 70%, with NII/Share rising 59%. The total portfolio value rose ~25%.

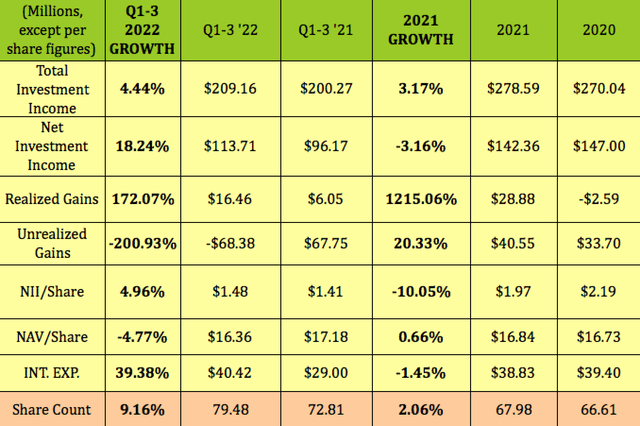

So far in 2022, Total Investment Income is up 4.4%, with NII rebounding from 2021 and rising 18%. Realized Gains, which are lumpy on a quarterly basis, were up 172%, while Unrealized Gains fell -201%, due to non-cash portfolio markdowns. NII/Share rose ~5%, with the share count up by ~9%. NAV/Share was down -4.8%. Interest Expense rose 39%, also due to higher rates and a larger portfolio:

New Business In Q3 2022:

Management signed $269M of term sheets with venture growth stage companies, and closed $103M of debt commitments to 10 companies. 7 of the 10 companies were new portfolio companies and 3 were existing portfolio companies. TPVG also received warrants valued at $1.9M in 16 portfolio companies and made $26 of direct equity investments in six companies.

Dividends:

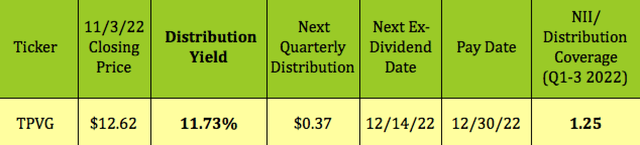

At its 11/3/22 $12.62 closing price, TPVG yields a very attractive 11.73%. Management raised the regular dividend from $0.36 to $0.37, the first dividend increase since Q4 2014. TPVG goes ex-dividend on 12/14/22, with a 12/30/22 pay date:

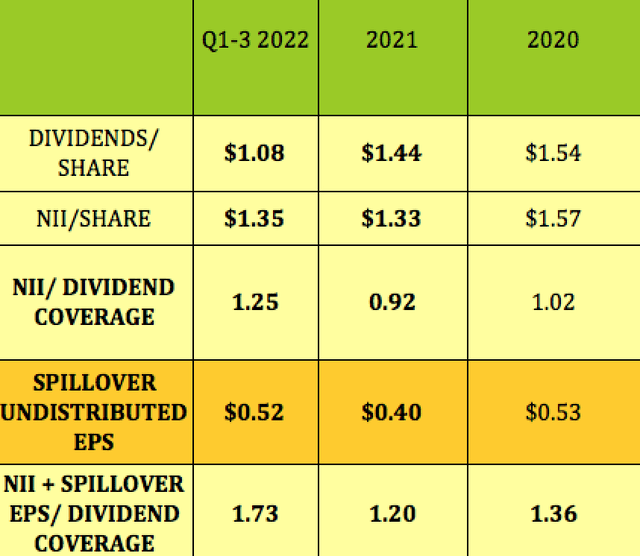

NII/Dividend coverage has been very strong in 2022, rising to 1.25X, vs. .92X in 2021. In addition to NII, TPVG also has a solid cushion of $.52/share in UNII, undistributed NII, which gives it huge coverage factor of 1.73X:

Profitability & Leverage:

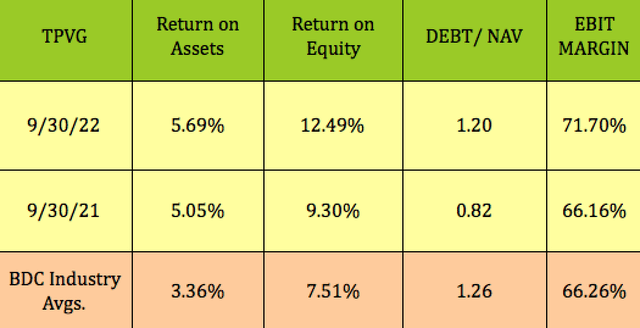

ROE and EBIT Margin both had healthy year-over-year increases so far in 2022, with ROA rising modestly. Management increased debt leverage a great deal, in order to ramp up the portfolio.

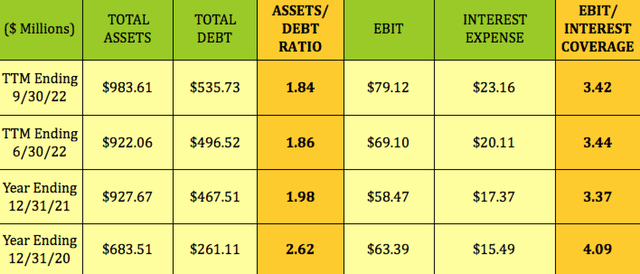

TPVG’s Assets/Debt ratio was steady, at 1.84X in Q3 ’22, as was its EBIT/Interest coverage, at 3.42X:

Debt & Liquidity:

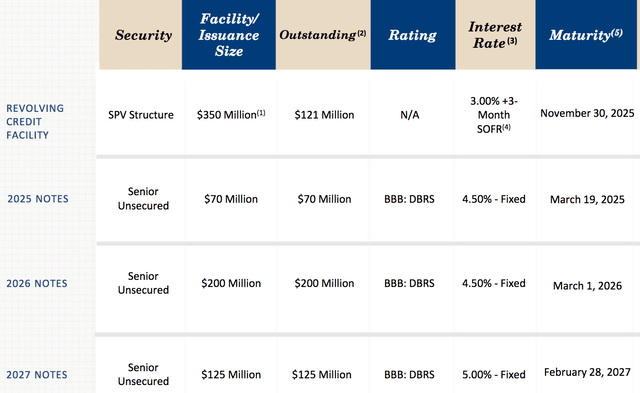

TPVG’s debt looks very well-laddered out into the future – its $350M credit revolver doesn’t come due until November 2025, while its Senior Notes don’t mature until 2025, 2026, and 2027:

Valuations:

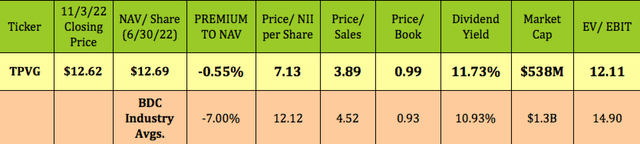

At its 11/3/22 $12.62 closing price, TPVG was selling at a slight 0.55% discount to NAV/Share. They may not sound that cheap, but it’s in stark contrast to 2021, when TPVG was selling at double-digit premiums to NAV of up to 30%-plus.

Just as important is the fact that TPVG’s earnings multiple, Price/NII per Share, is only 7.13X, 40% lower than the 12.12X BDC average valuation. It also looks cheaper on P/Sales and EV/EBIT valuations, in addition to having a more attractive dividend yield.

Performance:

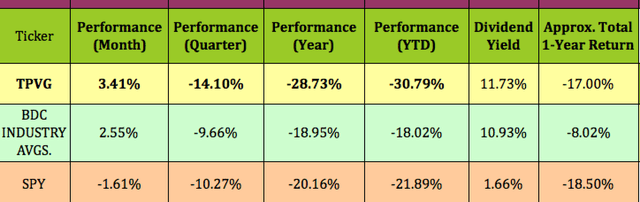

While TPVG has slightly outperformed the S&P on a total return basis over the past year, it has lagged it and the BDC industry over the past quarter, and so far in 2022. It did start to get a bid though in the past month, outperforming the S&P and the BDC industry.

TPVG rose ~38% in 2021.

Parting Thoughts:

We rate TPVG a BUY, based upon its attractive, very well-covered dividend yield, its much lower earnings multiple vs. the BDC industry, its positive rising rate business model, and its much lower-than-normal Price to NAV.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment