Khanchit Khirisutchalual/iStock via Getty Images

Introduction

Currently, there is a contest on Seeking Alpha with the theme “Top ex-US Stock Pick.” From my point of view, Verde AgriTech (OTCPK:VNPKF) (TSX:NPK:CA) is the ideal candidate for this contest. There will probably be little new in it for regular readers of my previous articles or who follow the company’s press releases. It is a summarizing article that includes the investment thesis and all the arguments for why the stock could explode in the next few years. Unfortunately, due to the contest’s end date, I have to write the article a few days before the publication of the next quarterly report. But there will either be another article, or we will discuss it here in the comments.

I want to structure this article as follows:

- Explain the company’s business model

- How is business going

- Future prospects

- Valuation and why I believe the stock is mispriced

- Risks

- Conclusion

Note: all figures in this article are in Canadian dollars, as all company investor relations documents are in CAD. And I recommend investors to buy in Canada as the trading volume is significantly higher.

1. The business model

We have three baskets for investing: yes, no, and too tough to understand.

Charlie Munger

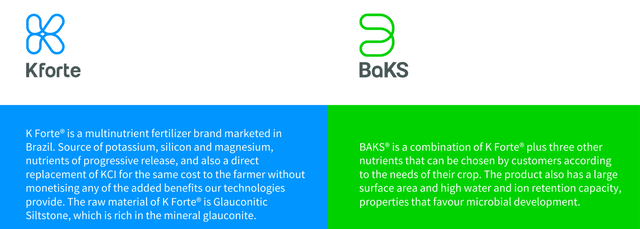

The business model is a simple story. The company produces and sells alternatives to classic KCl (potassium chloride) fertilizers. Verde’s main products are sold in Brazil under the brands KForte and BAKS and internationally as Super Greensand. These are mainly composed of glauconite extracted from the company’s open-pit mines.

Large monocultures need three essential nutrients: nitrogen, phosphorus, and potassium. Without these, yields will collapse by up to 50%. Therefore, an adequate supply is in the interest of farmers and humanity to ensure our food security. Verde´s products are a potassium replacement, not for nitrogen and phosphorus.

Advantages of Verde’s products

Let’s start with the mining. Glauconite is a rock that can be mined very close to the earth’s surface and is only finely crushed and pulverized. No toxic chemicals or the like are necessary. When a particular area is exploited, it can be filled in with soil, and Verde plants new rainforest on top of it (which wasn’t there before because it was an agricultural wasteland, according to Verde’s CEO in this video). So the whole mining process is very environmentally friendly. The glauconite reserves will last for several decades.

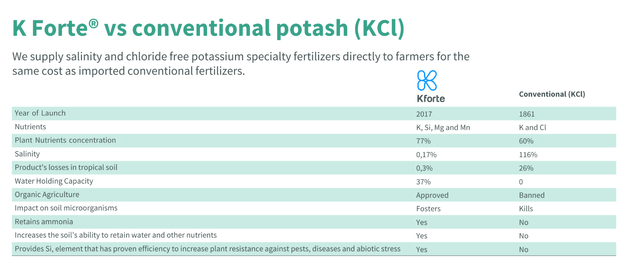

The products contain much fewer salts and chlorides than classic KCl, which destroy microorganisms in the soil and cause it to dry out and die in the long run. At the same time, the product is washed out of the soil slower and increases the soil’s ability to store water. In addition, it is approved for organic agriculture. Here is an overview.

Overall, the product should provide the same and even more benefits but exclude the immense disadvantages of high salt content. In May 2022, they also announced that microorganisms are added to KForte (bacillus aryabhattai ASN10). Here is a description of another strain, AB211. I have not found a scientific paper on Verde’s strain. However, their research is patented and probably kept secret. I assume the effects are similar to those described here.

B. aryabhattai contains many of the signature genes that are functionally linked to the plant growth promotion trait. Besides, genome analysis also confirms its ability to survive the oxidative, heavy metal, and antibiotic stresses imposed within the rhizospheric micro-niche. Our experimental studies have confirmed that strain AB211 can adhere to root surfaces and promote plant growth by synthesizing IAA and other volatiles. Together, the presence of these features makes B. aryabhattai an excellent microorganism for utilization in agriculture.

Frontiers in microbiology study

Even the name Agritech is no coincidence but alludes to the fusion of agriculture and tech. More information can be found in the appendix of the investor presentation.

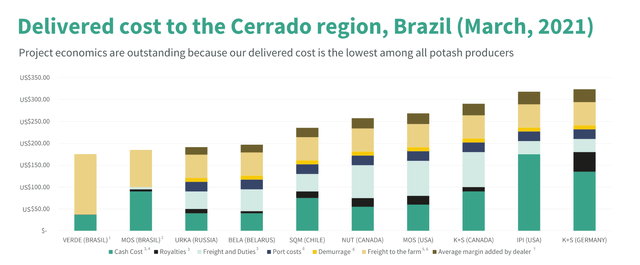

Another huge advantage is the locality and, thus, independence, which has gained importance, especially since the war in Ukraine. The three leading exporters of potassium chloride are Canada, Belarus, and Russia. Conversely, Brazil is the largest importer in the world, accounting for 1.67% of its total imports! According to Verde, Brazil’s entire demand could be met domestically while being cheaper and better for the soil.

2. How is business going?

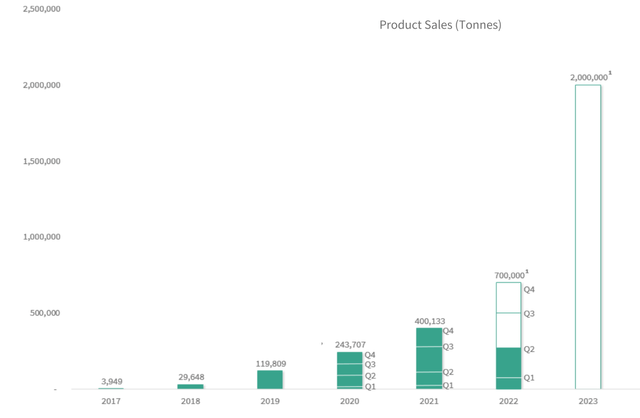

This sounds fantastic, and maybe some readers think it sounds like a typical bubble stock story with big promises, but the company is barely making sales and still making losses for years to come. Fortunately, this is not true but on the contrary. The growth in tons sold has been rapidly increasing for years. This year they are on track to reach 0.7M tons. The target for next year is 2M tons. In the long term, they are thinking much bigger; more about that later.

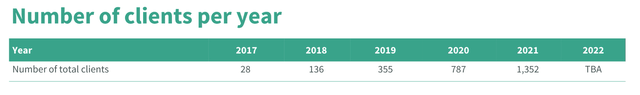

According to Verde, this growth is driven by a steadily increasing number of customers, most of whom are becoming returning customers.

verde agritech investor presentation

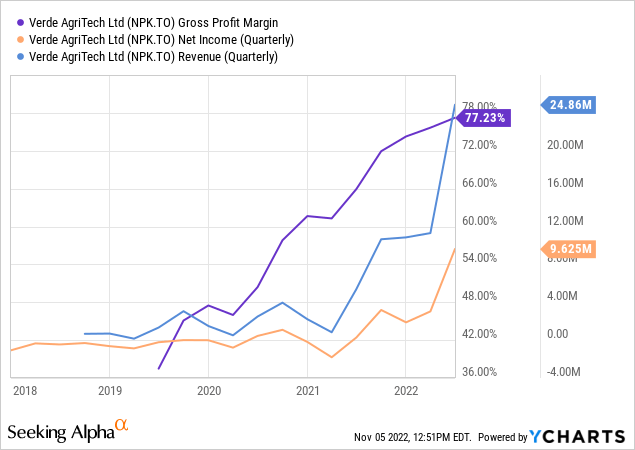

A ton of KForte was sold in the first six months of 2022 for an average of C$115 (vs. C$55 in 2021), with production costs of only C$25 (vs. C$18 in 2021) resulting in a gross margin of 78% (vs. 68%). In the first six months, revenue was C$36M, and net profit was C$12.6M.

The highest cost is freight expenses to deliver the product to the customer. But overall, Verde can offer its product at a lower price than the competition because many other costs, such as freight and duties, are eliminated. Overall, the strategy is to align with global KCl prices but to undercut them for the time being to retain and gain customers. Even though the company wants to undercut its competitors’ prices, the gross margin was still 78% in the first half of the year.

Our product´s price is based exclusively on its potassium content, despite of its other nutrients and benefits. KForte has 10% K2O , whereas KCl has 60% K2O. Therefore, the farmer in Brazil pays six times less per tonne of KForte than he pays per tonne of KCI.

verde agritech investor presentation

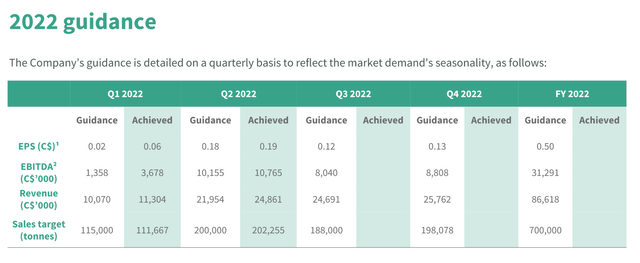

The guidance this year has been up and down. The original guidance EPS was C$0.50; then, it was raised in the spring and recently lowered back to the original C$0.50 due to unforeseen problems with a plant expansion. Overall, the guidance is now 0.7M tons of product sold, C$86M revenue, C$31M EBITDA, and a C$0.50 EPS bottom line. Overall, the company is far from a hype bubble stock but is already making significant revenues and is cash flow positive at an exponential rate of increase.

3. Future prospects

So far, everything the company produces is also sold. This speaks on the one hand for the quality of the product and shows on the other hand that the bottleneck is in its production. This is not surprising, given the rate of growth so far. For their mines, they need permits, production facilities to grind the glauconite, warehouses, infrastructure for delivery, and so on. Everything is expanding steadily, but the biggest bottleneck of all has been the time it takes to get permits and builds for mine and plant expansions.

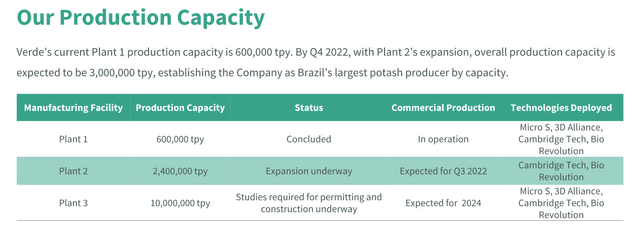

Until recently, one plant was operating and producing 0.6M tons per year. A second production plant has been approved and has been under construction for some time. A few days ago, a press release stated that this plant is now in production and can be ramped up to its maximum of 2.4M tons per year by the end of the year. This will bring the total production capacity to 3M tons per year which is a fivefold increase.

In the meantime, the company is already preparing a third stage, which will deliver another 10M tons per year. This means a total of 13M tons, which would be more than twenty times the previous 0.6M tons.

How big is the market?

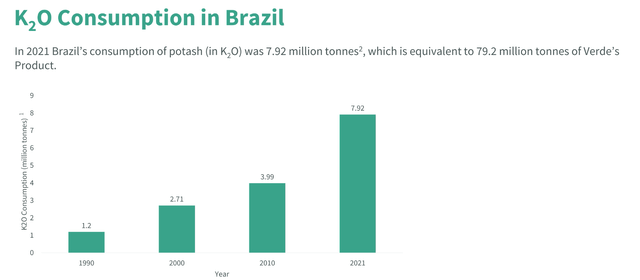

Would there even be enough buyers for such a quantity? Of course, I can’t predict precisely how much Brazilian farmers will buy, and how many will remain loyal to the company, but the potential market is there. Also, the demand is still growing strongly. Currently, there could be demand for up to 79M tonnes. 7.9M tonnes of K2O consumption is equivalent to 10 times the amount of Verde’s product since the K2O concentration is 10%.

Also, this is only the Brazilian market. There is always the possibility for international expansion, and the most promising would be into neighboring countries such as Argentina, which is also a major agricultural player. But of course, at some point, there will be a certain market saturation, and it is impossible to say when that will be, but it seems that we are far from that point. Verde is still a small supplier in a vast market.

Dividend starting?

Another part of the future outlook is the company’s announcement that it will pay dividends. According to the company, free cash flow is already high enough to pay for further expansion in a non-dilutive way while already returning money to shareholders.

By year end 2022, the Company expects to be able to return a minimum of C$10 million to shareholders while maintaining a minimum of C$30 million in cash and receivables. For 2023, Verde expects to continue returning gains to shareholders while maintaining a minimum of C$30M in cash and receivables, in addition to fully self-funding Plant 3, without need for equity or debt financing.

With 52M shares outstanding, C$10M equals C$0.19 per share, a yield of 2.6% at the current price. By the way, CEO Cristiano Veloso is the largest shareholder with 19%.

4. Valuation and why I believe the stock is mispriced

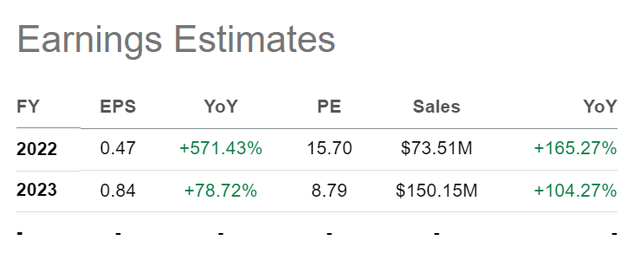

Currently, the stock trades for C$7.24. As I showed earlier, the guidance for 2022 EPS is C$0.50. So far, the company is on track to achieve this even if two quarters are still missing. This would be a P/E of 14.5, but this C$0.50 EPS comes from an annual production of 0.7M tons. The company has not provided EPS guidance for 2023 as it is too early to do so. It would be too inaccurate, given KCI’s price volatility and exchange rates.

However, I believe that given this production increase, analyst estimates are very conservative, and even if only this conservative estimate is realized, the 2023 P/E would already be below 9.

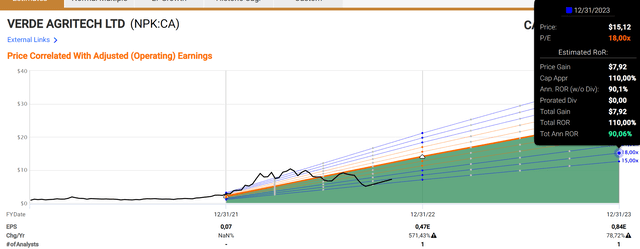

What does fastgraphs say? The stock would double with a P/E of 18 at the end of 2023. And here I would like to point out one thing. There is only one analyst who covers the stock. Does that mean this next year’s EPS estimate is based on that one analyst, and that’s what all EPS estimates on Yahoo, fastgraphs, and Seeking Alpha are now based on? Probably. And that’s our opportunity as investors to dig deep into small stocks that are still undiscovered.

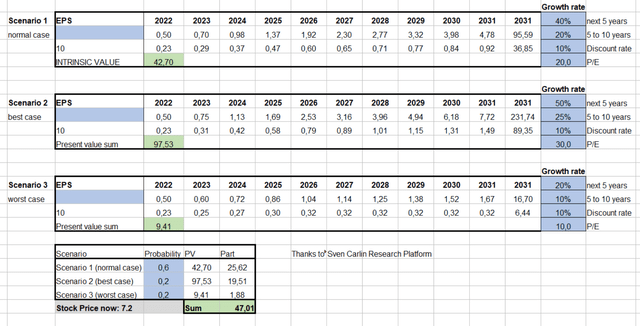

Since the company already has EPS, creating a discount cash flow model is possible. It consists of a normal case, a best case, and a worst case. The normal case is weighted with 60% probability, and the other two with a combined 40%.

I consider even my numbers conservative based on the potential growth rates due to the rapid production expansion. And nonetheless, a fair value of currently C$47 appears. That´s a 550% upside.

5. Risks

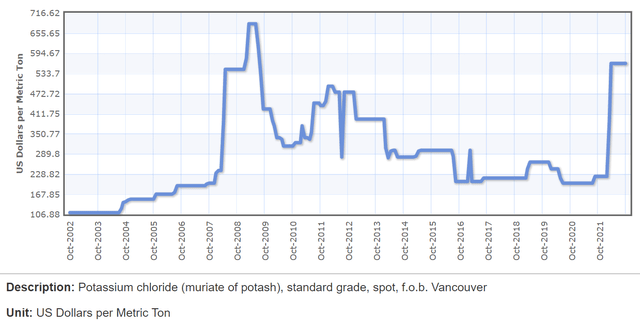

I see three main risks for the company. One of them is margin contraction due to falling KCl prices, on which Verde bases its prices. Here is a 20-year chart showing that we are currently at the upper end of the price range. Of course, this does not indicate what will happen in the future as the situation with Russia and Belarus is quite different than it has been in the last decades. But of course, it could very well be that KCl prices will drop again at some point and, with it, Verde’s margin.

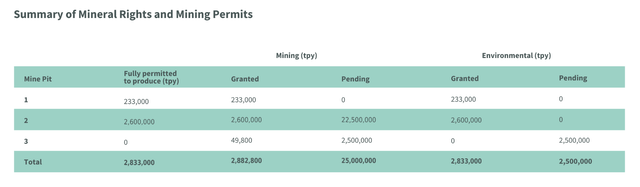

Another risk is that the necessary permits will not be granted. At the moment, the company has three different mines to mine glauconite. The chart below shows that the amount allowed so far is pretty much what they want to produce next year. That means the company depends on further permits that should be granted next year; otherwise, they will reach a bottleneck. I think there is a very high likelihood that the permits will be issued, as there have never been any problems with that. Also, these mines are much more environmentally friendly than many others in Brazil. The company’s efforts to plant rainforest when terminating an area should be an unbeatable argument.

And the third risk is something that applies to many Brazilian companies, namely the currency risk. The company trades in Brazilian Real as it operates mainly within the country and is therefore dependent on exchange rates when reporting in USD or CAD.

6. Conclusion

Ok, that covers the most important things. It is never possible to pack everything into one article, but I think I have provided a good overview of why the stock has a lot of potentials. Of course, there are risks, which I will continue to keep a close eye on. However, the risk/reward ratio is fantastic, as we are already starting at a relatively low valuation. This is a company that has proven it can grow quickly and is already cash flow positive. In addition, the plant expansion has just been completed, and nothing stands in the way of tripling production next year. This potential is not included in the valuation, even though it is pretty certain. And in addition, there is a possible twenty-fold increase in production from 2024. For all these reasons, Verde Agritech is my favorite for the “Top ex-US Stock Pick!” contest.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment