cemagraphics

The shares of Trinity Industries inc. (NYSE:TRN) are down about 17% since I recommended people avoid the name. You’re welcome. The company just announced a fairly hefty order from rail lessor GATX (GATX), and I thought I’d check on the company again and review how significant this order is to the firm. Additionally, a stock trading at $22.80 is, by definition, less risky an investment than the same stock when it’s trading at $27.50, so I thought I’d review the valuation again to see if it now makes sense to buy.

I like to imagine that my readers are a fun and exciting group of people. I like to imagine that you’re about to explore an ancient tomb that you’ve just discovered, or you’re about to put the finishing touches on your theory about faster than light travel or similar, but you absolutely need to read my self congratulatory screeds first. If you’re curious, I too am busy with hours of soap operas to get through this week. Yes, my life is very well spent. Anyway, because we’re all busy, I think it helpful to offer you a “thesis statement” paragraph at the beginning of my articles so you can get in, understand the “gist” of my thinking, and then get back to lunch with one of your supermodel girlfriends. I’m of the view that Trinity is now a buy. I think the recent deal with GATX is actually quite significant for reasons I go into below. In addition, the shares are now quite inexpensive, especially on a price to sales basis. I think we can thank the general malaise that’s fallen across “the market” recently for this. I would remind readers that you need to “buy low”, and the only way to actually do that is when it feels emotionally painful to do so. Finally, at the current yield, investors are being reasonably well compensated while they wait for the rest of the market to recognise value here.

What We Learned Recently From the Greenbrier Call

Those who are paying attention know that I recently posted an article on Greenbrier where I highlighted a conversation between Greenbrier’s VP of Corporate Finance and Investor Relations and Cowen’s Machinery and Transportation Equipment analyst. I raise that conversation because I think it highlighted some dynamics that are also relevant to Trinity. So, right off the bat I’m going to summarize the relevant points in convenient bullet points for your enjoyment and edification.

- The barriers to entry in this industry are actually fairly significant, as customers will only transact with companies that they can be reasonably assured will be around when the inevitable warranty issues crop up.

- The industry has seen softness over the past few quarters because of the tightness of the rail network, and volatility of the price of inputs. Although people who ship things around North America would prefer rail to truck, as the former is much cheaper on a per mile basis, they’re often not permitted to add freight to the physical network, given how congested it is. The idea was that service will improve, and bottlenecks will be eliminated over the next two quarters.

- Also, input costs have been volatile, and that’s affected margins for obvious reasons. So, if the companies bought steel in early May to build an order that they had received seven months prior, the margin they make on that car will be less than the margin they’ll make on a virtually identical car that they bought steel for in mid-July. Steel prices have moderated over the past three months, which will obviously boost margins.

- These companies have very robust order books at the moment, and these offer excellent visibility into the future of each business. This expresses some confidence in the future of this industry, obviously. Put another way by example, GATX wouldn’t be spending $1.8 billion on 15,000 new tank and freight cars if they didn’t have confidence that these cars would be put to use. Given GATX’s position as a very significant player in the space, I have some faith they know what they’re doing here.

So, in summary, there are high barriers to entry in this industry that is experiencing lower input costs, and is obviously selling products that are in demand. I think the GATX order offers some support to my increasingly bullish take on these businesses.

Speaking of the GATX Order

The specifics of the GATX order are interesting, to me at least. Trinity will deliver a mix of 15,000 newly built tank and freight railcars over a six year period. In addition, GATX has the option to add an additional 500 cars each year. The order for this 15,000 car order is worth $1.9 billion.

Additionally, Trinity will deliver 6,000 tank cars at a rate of 1,200 each year from 2024 through to 2028. The remaining 9,000 cars will move at a rate of 1,500 cars per year between 2023 through to 2028. So, the impact to revenue this fiscal year will be zero, and the marginal impact on revenue in 2023 will be the 1,500 freight cars. So only 10% of the total cars will be delivered next year, and things will ramp up to 18% of the total delivered in each subsequent year through to the end of 2028. Thus, I’m expecting revenue to be boosted by $180 million in 2023 and $324 million in 2024 to 2028 inclusive.

The GATX Order in Context

How significant is this order to Trinity? Is $1.8 billion over a six year period a lot or a little? Is $180 million next year, and $324 million in each of the following years enough to “move the needle” as the young people say? I’m glad you asked that, my rhetorically convenient friend, because that’s the exact question that I’m in the mood to answer.

For the three years before the pandemic, the average annual revenue for this business was $2.553 billion. As I pointed out on my previous work on this name, the company is turning a corner and returning to pre-pandemic levels of production and revenue, but it’s not arrived yet. So, if the back half of 2022 looks like the first six months of this year, we can expect revenue of about $1.78 billion from the company this year. Given a range of between $1.78 billion to $2.55 billion, I think it fair to say that this is a fairly significant order. Holding all constant, it boosts revenue by between 7% and 10% higher than what it would have been in 2023, and by between 12.7% and 18% in each of the next five years. In my view, this deal does in fact move the proverbial needle.

The Stock

I think Trinity’s profit profile is about to improve fairly well over the next few years for a variety of reasons relating to improvements on the rail network, reduced input costs, and, of course, this order. I think the weight of probabilities is such that the company will grow revenues and net income from here. It’s now time to explore the valuation, because, as my regulars know I’m of the view that a great growth business can be a terrible investment if you overpay for it. This is why I need to review the stock as a thing quite distinct from the underlying business.

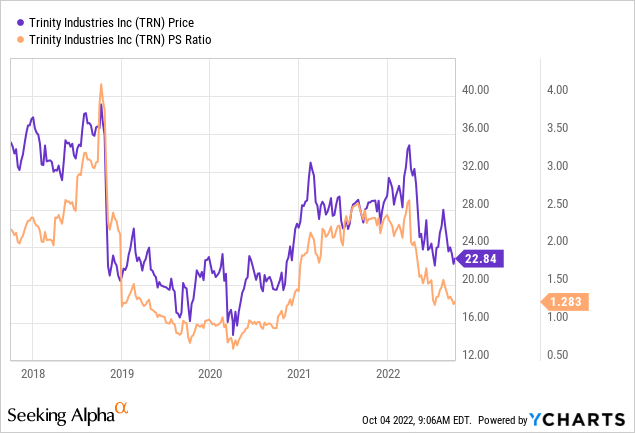

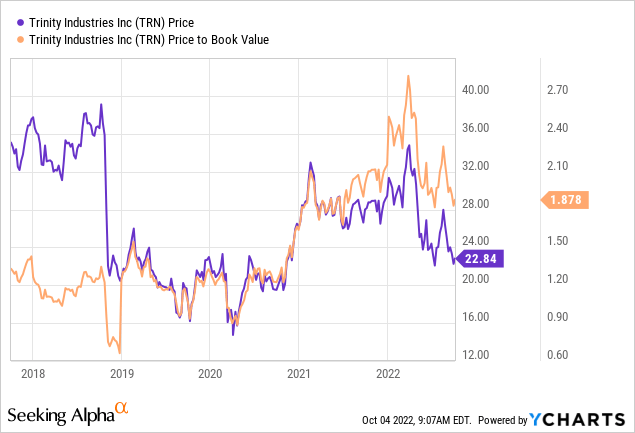

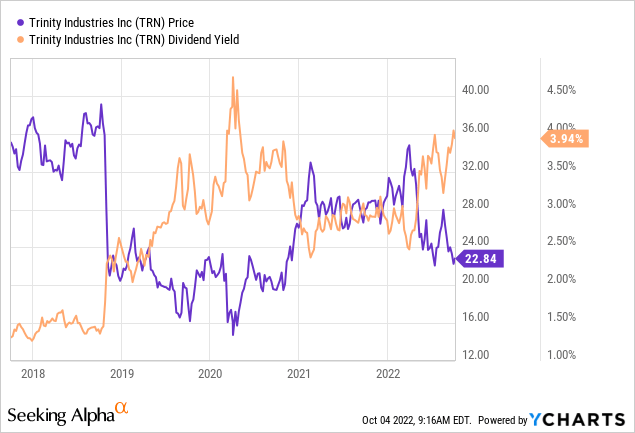

In case you don’t happen to have your “Almanac of Doyle’s Trades” open on your desk, I’ll refresh your memory that when I last reviewed Trinity, the price to sales was about 1.565, the price to book was about 2.29, and the dividend yield sat around a healthy 3.2%. What a difference less than two months makes. Unsurprisingly, the shares are now 18% cheaper on both a price to sales, and price to book basis. This is not the cheapest valuation that we’ve ever seen, but at least the price to sales ratio is near the low end of the recent range. Most interesting of all to my mind is the fact that the dividend yield is sitting just under 4%. This measure, too, is very near the most attractive level we’ve seen in years. At least investors who buy at current levels will be paid to wait for the market to fully recognise the potential here.

In addition to looking at simple ratios, I want to try to understand what the market is currently “thinking” about a given stock. I do this by using the magic of high school algebra to isolate the “g” (growth) variable in a standard finance formula. This is an approach described by Professor Stephen Penman in his tome “Accounting for Value.” It’s also described, in a slightly more accessible manner, in Mauboussin and Rappaport’s recent update to their classic “Expectations Investing.” The approach tries to uncover the current assumptions that go into “making” the current stock price. When I apply this approach to Trinity, it seems that the market is assuming a perpetual growth rate of about 2.7% for this business. That is reasonably pessimistic in my estimation given the tailwinds the company is about to experience. Given the above, I’ll be buying some shares this morning.

Be the first to comment