Mlenny

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on November 5th, 2022.

After the latest earnings report, we have been given a better look at where Trinity Capital Inc. (NASDAQ:TRIN) currently stands. This business development company (“BDC”) has been getting slammed lately after downgrades that seem to be related to Core Scientific (CORZ) announcing a potential bankruptcy.

At the same time, there was quite a bit to be encouraged about with the latest report. This negative has also pushed the BDC into a position of opportunity as the discount has widened significantly.

Portfolio Positioning

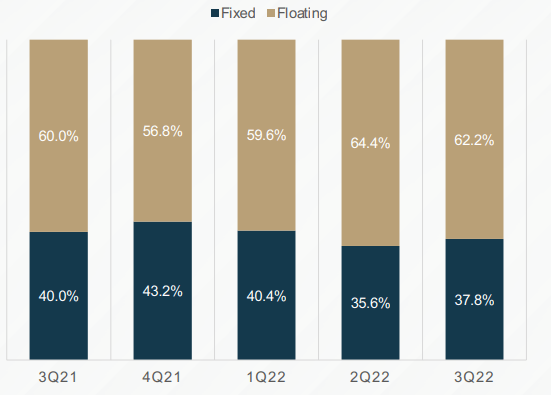

For a quick update on TRIN’s portfolio, more broadly, a large portion of their debt investments are in floating rates. Although there are other BDCs with substantially larger allocations dedicated to floating rate investments. That could highlight another reason why investors are a bit more cautious about jumping into TRIN.

TRIN Fixed Vs. Float Exposure (Trinity Capital)

Loans comprise a significant majority of their portfolio. Equipment financing is a rather minor allocation of their assets.

TRIN Investment Type (Trinity Capital)

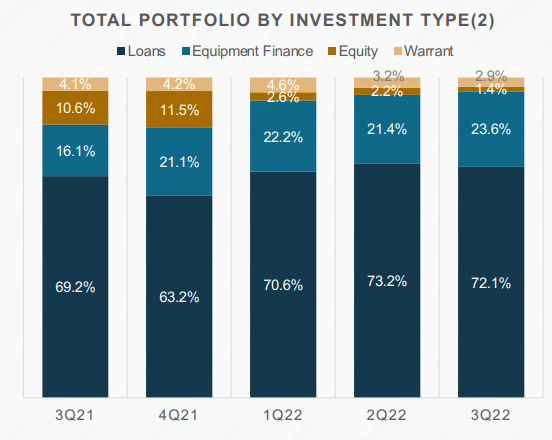

Additionally, most of their debt remains fixed-rate. Though they have access to a credit facility based on SOFR plus 2.85%.

TRIN Leverage (Trinity Capital)

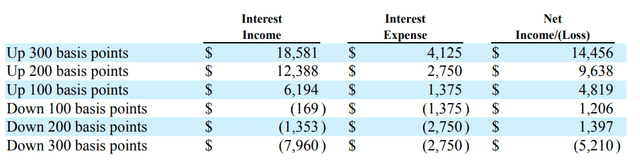

This leaves them in a situation where interest rates rising should benefit them overall. This is laid out in their latest quarterly filing. That’s where we can see that they can even potentially benefit if rates go lower too. Although, at a certain point, lower rates would impact the fund negatively.

Based on our Consolidated Statements of Operations as of September 30, 2022, the following table shows the annualized impact on net income of hypothetical base rate changes in the Prime rate on our debt investments (considering interest rate floors for floating rate instruments) and the hypothetical base rate changes in the SOFR on our KeyBank Credit Facility, assuming that there are no changes in our investment and borrowing structure (in thousands):

TRIN Interest Rate Impact (Trinity Capital)

Crypto Exposure

TRIN had a fairly large equipment financing investment with the CORZ crypto-mining operation. The cost was $24 million, but has been marked down to $19.438 million in the latest quarterly report. CORZ is looking to potentially restructure this financing, which would be better for TRIN than trying to take possession.

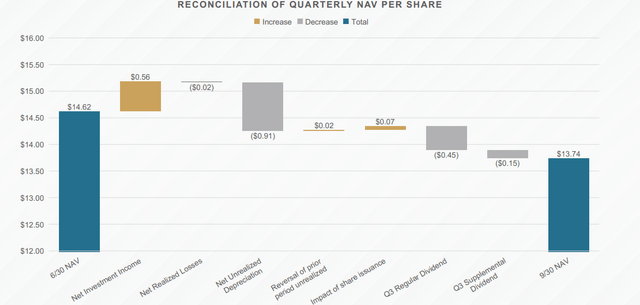

The TRIN management had put CORZ on watch in their latest report. However, since November 1st, 2022, they’ve now put them on non-accrual status. That likely means that the fair value has been reduced once again. Though the hit to the NAV has already been reflected, at least to some degree, in the decline in the fair value. They saw their NAV go from $14.62 at the end of June 30th, 2022, to $13.74 at the end of September.

Besides unrealized depreciation linked to reduced values in their portfolio, the Q3 dividend and supplemental also were a fairly significant portion of the reduction. Helping to offset that reduction was the NII and a small accretion from the share offering.

TRIN NAV Bridge (Trinity Capital)

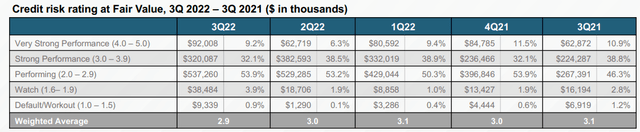

This decline has also pushed their credit risk rating down a notch from Q2; with it now on non-accrual status, this will likely be another hit to their credit risk rating. That certainly is a concerning trend.

On a brighter note, we also see a large jump from Q2 in the “Very Strong Performance” category back to a similar Q1 level. “Performing” has also remained static, meaning things are going as intended with those positions.

TRIN Credit Risk (Trinity Capital)

It isn’t just CORZ where Trinity is holding crypto-related mining exposure. They also have some with Hut 8 (HUT) and CleanSpark (CLSK). HUT equipment financing has a fair value of $23.180 million, and CLSK has $17.412 million. They noted that these positions were in substantially better positions than CORZ.

All said, as of September 30th, 2022, crypto mining exposure was $60.03 million. Against total managed assets, that works out to 5.47% or 12.44% of NAV.

Dividend Remains Well-Covered

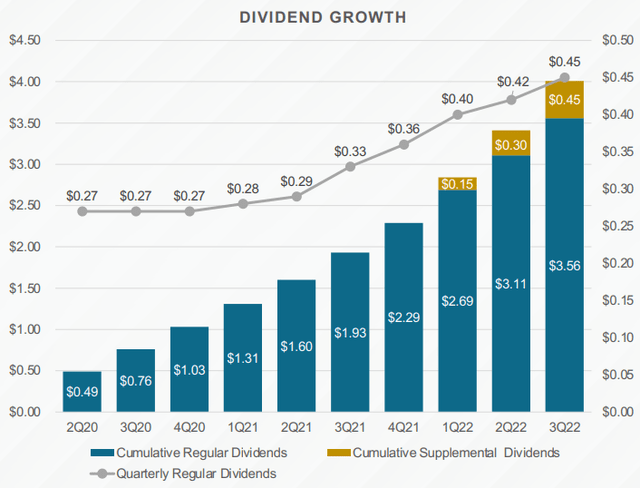

For more encouraging news, the dividend remains well-covered. As was previously announced, the supplemental distribution is also expected to remain in Q4. This was an additional $0.15 supplemental every quarter through 2022 due to spillover from highly successful previous investments.

In addition, we’ve delivered against our promise to provide a supplemental dividend of $0.15 per share for the third consecutive quarter. Year-to-date, we have paid out $0.45 per share in supplemental dividends, and we previously expressed the intent to declare a supplemental cash dividend in the fourth quarter of 2022, subject to our Board approval.

Below we can see the accumulated dividend payments since going public. We also see they’ve been able to grow their regular dividend for seven quarters in a row.

TRIN Dividend Growth (Trinity Capital)

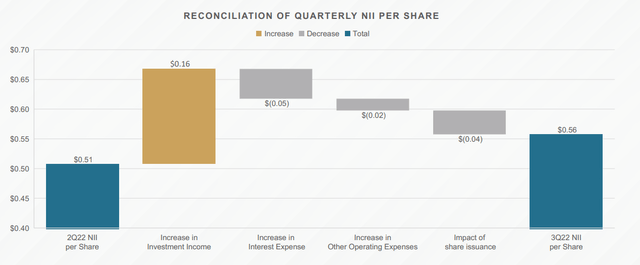

With $0.56 in NII, we still see increasing NII as they put capital to work. This was a 67.6% increase in NII from the year prior and an increase from the previous quarter too.

TRIN NII Bridge (Trinity Capital)

This increase in NII is coming from both higher interest rates pushing up the average coupon rate and putting more capital to work. They’ve been raising equity and debt on several occasions since going public. Which is natural for BDCs as a way to grow. The average coupon rate of the portfolio went from 10.8% in Q3 2021 to 12.1% in this latest quarter, a year later.

Considering that the Fed has raised interest rates once again, this would likely rise again in Q4. Worth noting is that it can be a good and bad thing. The good is obviously higher income due to higher yields.

However, the other side of this is the higher yields to the underlying portfolio companies also pressure these companies. If they are taking a larger and larger portion of their cash to pay the debt, that leaves them less flexible to continue to operate or grow. Hence, we see things like CORZ possibly going under or restructuring.

Considering CORZ’s impact on TRIN, it seems like it won’t derail the coverage from remaining strong. The equipment financing was at a fixed rate of between 10.3 and 10.7%. Let’s consider that the $24.002 million based on cost earned them around $2.5 million annually. They last reported 33.098 million in weighted average shares outstanding.

If we considered the entire CORZ equipment to be a 100% loss, it would be around 7.5 cent hit to NII. That would not be enough to reduce the dividend coverage to below 100%. In fact, they could even raise their quarterly dividend once again if they wanted to be aggressive.

On the conference call, they mentioned that the valuation of the equipment could likely fetch around $9 to $11 million range if a forced liquidation were to occur. That indicates around a 50% recovery from the current fair value, meaning the hit to NII would be even less.

If it comes to a forced liquidation based on the latest market transaction data that we’ve seen, the value of that equipment in an FLV is probably in the $9 million to $11 million range.

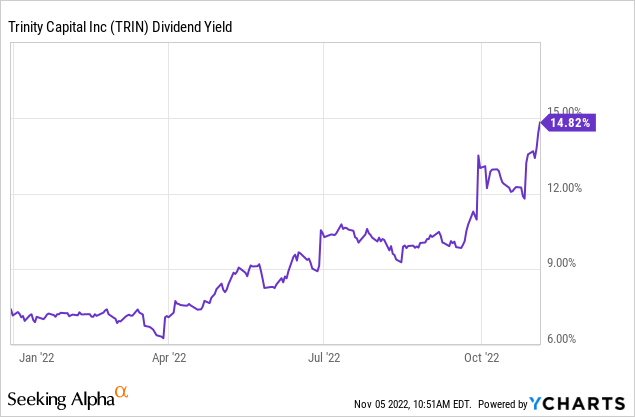

This rapid decline lately has pushed the yield up to considerable levels.

Ycharts

Valuation Is Quite Attractive

While all of this is going on, TRIN has moved to as wide of a discount as it has been since it became publicly traded. It currently stands at a nearly 20% discount to NAV.

At the same time, internally managed BDCs are often given higher valuations. For TRIN, that was generally seemingly going to be the case as well. However, that has been reversing quickly with the more recent moves.

If we considered CORZ in an absolute worst-case scenario of a 100% loss, we would see another almost 0.59 cent hit to NAV. As they suggested in the earnings call, it likely wouldn’t be a complete loss. Even if it was, it would bring us to $13.15 – which would still put the BDC at an attractive discount.

Conclusion

Overall, Trinity Capital is a riskier BDC to invest in. They invest in venture debt and equipment financing for startups. This is why I mentioned last time that it should only be kept to a smaller allocation of one’s portfolio if one wanted to invest anyway, despite the higher risks in this BDC.

Since it began trading publicly in 2020, the first chapter of TRIN showed that they can get lucky and invest in quite lucrative investments. Matterport (MTTR) and Lucid (LCID) are the primary examples. Fortunately, they liquidated these investments quickly since they’ve come crashing down through 2022.

The second chapter showed us that they could also find themselves in less-than-desirable investments as crypto comes crashing down. It seems that the next chapter is now all about how they navigate through this challenging period. Given the current valuation and distribution coverage, I’m willing to take a bet on Trinity Capital Inc. for now.

Be the first to comment