Jason Koerner/Getty Images Entertainment

Introducing TriNet

TriNet (NYSE:TNET) is a cloud-based professional employer organization (PEO) focusing on small and medium-sized enterprises.

Shrm.org defines a PEO as:

An organization that enters into a joint-employment relationship with an employer by leasing employees to the employer, thereby allowing the PEO to share and manage many employee-related responsibilities and liabilities. This allows employers to outsource their human resource functions.

TriNet more specifically serves as a client’s outsourced human resources department in some situations by managing payroll and health benefits, offering customers advice on employment law compliance, and lowering risks. TriNet collaborates with businesses with 3 to 2,500 workers.

The company was founded in 1988 and initially provided fundamental employee benefits, dental care, life and disability insurance, and advice on employment law.

TriNet has since increased the range of services it provides by including payroll services, Fortune-500 benefits, 401(k) advice, workers’ compensation, liability insurance, and strategic human resources support and services. The business also offers online resources, including manager and employee self-service portals housed on the web.

Industry Outlook

TriNet is active in the Professional Employer Organization (PEO) industry.

Many entrepreneurs and smaller businesses are becoming more aware that outsourcing their HR and payroll duties to PEO companies can increase their focus on their core business as well as take advantage of cost reductions. Furthermore, as the effectiveness and complexity of the technology used by the PEOs increase over time, increasingly more advanced services can be provided. I expect that these trends will nicely boost the PEO market expansion in the future.

According to a StraitsResearch analysis, the professional employer organization industry had a market size of USD 42 billion in 2017. From 2017 to 2030, it is expected to grow at a CAGR of 11.10 percent.

Competition

TriNet faces competition from:

-

PEOs that compete directly with them

-

HR and IT departments and staff of businesses that manage employee benefits, payroll, and HR for their own businesses,

-

in-house suppliers of some HR services, such as payroll and employee benefits,

-

business process outsourcers with the large transaction and administrative capabilities, and

-

other third-party administrators, and insurance brokers who permit third-party HR systems to integrate with their tech

More specifically, its rivals include big PEOs like Automatic Data Processing’s (ADP) TotalSource division, the PEO division of Paychex (PAYX), and Insperity (NSP), as well as a huge number of smaller and more specialized PEOs and comparable HR service providers with PEO operations. Furthermore, due to the market opportunity of PEOs, in the last 10 years, fast-growing and innovative PEOs have emerged, such as Rippling and Justworks.

|

Company |

Business Description |

Market Cap |

Last Year’s Revenue Growth |

|

TriNet (TNET) |

TriNet is a cloud-based professional employer organization (PEO) focusing on small and medium-sized enterprises. |

4.91B |

12.54% |

|

Automatic Data Processing (ADP) |

ADP is a company that provides payroll and human resource management solutions to businesses of all sizes. ADP was formed in 1949 and today services over 920,000 clients, the majority of whom are based in the United States. |

91.03B |

2.85% |

|

Paychex (PAYX) |

Paychex is a significant provider of payroll, human resource management, and insurance solutions primarily to small and medium businesses in the United States. The firm, founded in 1979, serves approximately 730,000 clients and employs more than one in every twelve private-sector workers in the United States. |

43.63B |

13.68% |

|

Insperity (NSP) |

Insperity, Inc. is primarily a provider of human resources and business solutions that assist firms in improving their performance. The company’s major target customers are small and medium-sized businesses. |

3.95B |

16.00% |

Competitive Position

Overall, I think that the most important competitive factors in the industry are:

-

Benefit plans’ range and breadth,

-

total cost of service,

-

brand recognition and reputation,

-

capacity to innovate and adapt to client needs quickly,

-

ease of use service,

-

advanced features/customizability, and

-

customer service.

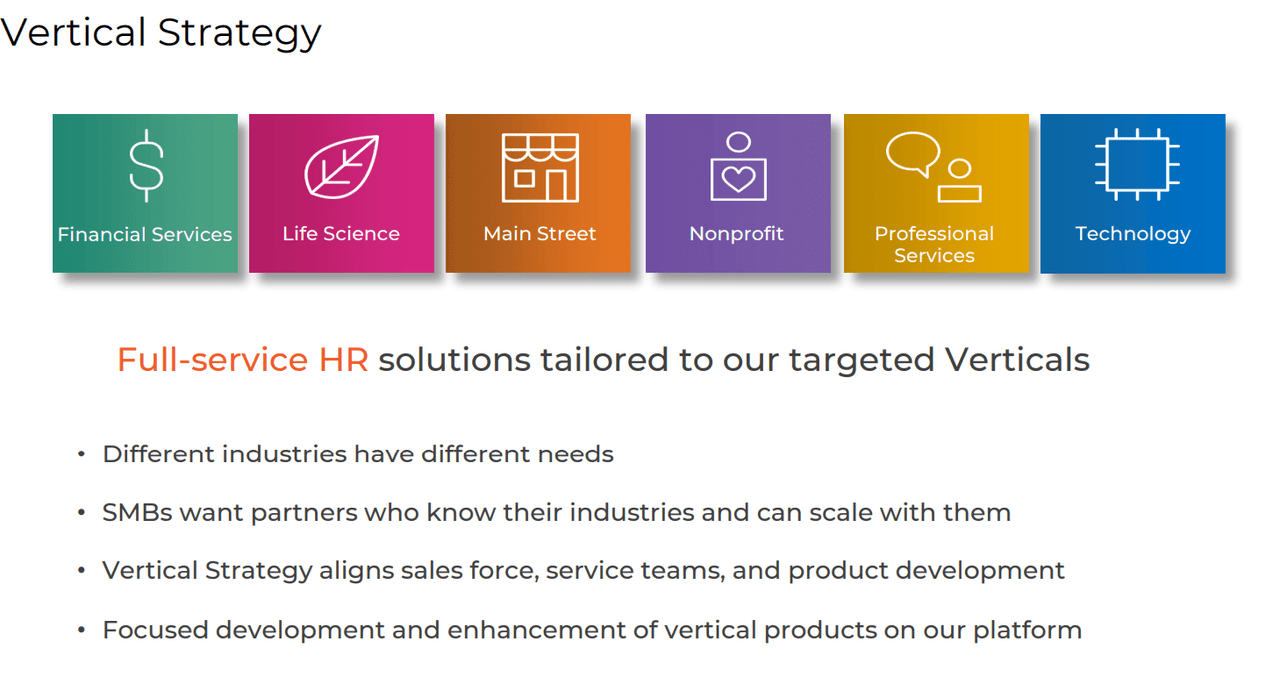

According to its latest annual report, TriNet believes that its vertical approach is a core differentiator for the company. They offer six industry-tailored vertical services:

-

TriNet Financial Services

-

TriNet Life Sciences

-

TriNet Main Street

-

TriNet Nonprofit

-

TriNet Professional Services

-

TriNet Technology.

The advantage of such a strategy is the fact that it could potentially better deliver industry-tailored offerings, maximizing value for its clients.

Vertical Strategy TriNet (Late annual report of TriNet)

Furthermore, they believe that they possess the ability to provide access to a broad range of TriNet-sponsored workers’ compensation, health insurance, and other benefits programs on a cost-effective basis. This is essential as it is claimed that an essential selling point for smaller businesses is that:

They can get health insurance and workers’ compensation insurance coverage at a lower cost than they could on an individual basis. In a period of record-low unemployment, PEOs suggest that companies need to provide the best benefits they can in order to lure candidates.

Combining the above advantages with the fact that the company has been operating for over 30 years has resulted in a trusted brand and large client base of over 16,000 companies (source).

In order to compete well now but also in the future, it’s important that its products are liked by users. In order to analyze the user sentiment, I researched online reviews.

TriNet scores a 7.3 out of 10 on Trustradius, which seems like a decent rating.

Some of the pros mentioned are:

-

Many great benefit plans for employees to choose

-

Effective Payroll Administration

-

Effective Employee Onboarding

-

Ease of use for simpler features

However, recently there have also been some negative things mentioned, such as:

-

Mixed customer service experience

-

Struggles with and limitations on analytics tools and setting up a customized report

-

Platform sometimes has a few limitations related to ease of use and advanced options

While TriNet is used by a lot of companies and seems to do a reasonable job, new players are emerging with an innovative product offering. For instance, Rippling scores an 8.9 out of 10. Users praise its very intuitive, customizable, and advanced platform and services. I believe that this is due to the fact that the company is relatively new (founded in 2016), and since its origination has focused heavily on the technology aspect of the business. Their website claims that:

Rippling is a technology company first, meaning we offer all the services of other PEOs while also providing automation software that seamlessly connects all of your HR and IT systems

Justworks, founded in 2012, also scores a very high 9.3 out of 10.

Perhaps anticipating the emergence of the younger, technology-strong companies, TriNet acquired Zenefits, a SaaS-based human capital management company in February 2022. TriNet’s announcement stated that:

The acquisition expands TriNet’s technology product offering and furthers its position as the leading human resources services provider for SMBs with or without the PEO structure. Through a centralized and highly scalable platform with a modern consumer-like user interface, TriNet Zenefits delivers software-based solutions to help streamline workflows by connecting HR, Benefits, Employee Engagement, Payroll and Time & Attendance.

I do believe that this acquisition could potentially decrease at least some bit of the gap between TriNet’s and the emerging competitors’ technology product offering experience.

However, with Rippling for scoring much higher than Zenefits for instance, there is still a huge challenge awaiting.

Q2 2022 results

On the 26th of July, TriNet reported earnings. According to its most recent earnings call, total revenues grew 9% compared to the quarter last year, which I think is a very robust growth rate. This growth can be mainly attributed to the growth of its installed base, according to the CEO, Goldfield. Furthermore, Goldfield states in their most recent earnings call that:

The TriNet model enables our clients to effectively scale up and down as they navigate rapid changes in the global economy. This model becomes increasingly attractive for SMBs as they look for ways to convert fixed costs into variable costs.

As a result, its new sales grew double-digit compared to the quarter last year, underlining its current attractive offering.

Mainly due to investment expenses related to the integration of Zenefits, its GAAP EPS decreased 1% compared to last year.

Valuation and Financial Performance analysis

Basic statistics comparison:

|

index |

Forward PE |

Gross Margin |

Free Cash Flow Margin |

3Y sales growth |

3Y EPS growth |

Debt / Equity |

|

TriNet |

20.96 |

21.95% |

10.09% |

9% |

24% |

0.73 |

|

Automatic Data Processing |

29.33 |

42.38% |

14.62% |

4% |

12% |

0.79 |

|

Paychex |

29.67 |

70.59% |

29.77% |

7% |

10% |

0.29 |

|

Insperity |

22.57 |

16.23% |

5.54% |

9% |

0% |

12.71 |

Source: Seeking Alpha

It would make more sense to compare TriNet to Insperity first, as they are both pure PEO plays. TriNet is cheaper valued, whilst having higher EPS growth, and free cash flow and gross margins.

TriNet is also much lower priced than its other two competitors, who have lower revenue and EPS growth.

The P/E ratio of the median S&P 500 company is at around 15, meaning that TriNet isn’t much more expensive than the market median.

TriNet has historically grown at a high rate. I believe the estimated PEO market growth is high, resulting in a great market opportunity. Furthermore, I do think that TriNet has a reasonable and robust product and brand to offer to the market, as well as a large client base. The acquisition of Zenefits could further improve and diversify its services. However, some of its competitors are extremely large and respected publicly-traded companies. Next to that, innovative and young companies with an excellent differentiated offering are taking the spotlights. I believe that this competitive pressure increases risks for TriNet, as it might potentially slow future growth.

Overall, I do think that a forward P/E ratio of 21 results in a very reasonable risk/reward ratio based on the factors mentioned above. In other words, I am bullish on TriNet’s stock.

Be the first to comment