1971yes/iStock via Getty Images

Introduction

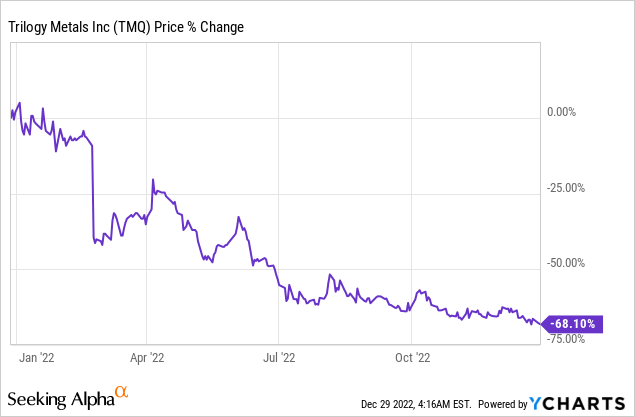

Trilogy Metals (NYSE:TMQ, TSX:TMQ:CA) is a Canadian mining company that aims to develop the copper-zinc Arctic project in northwestern Alaska. Readers may already be familiar with the particulars of its story. The deposit is highly attractive, but it is geographically isolated, so a new road needs to be built. The permitting process has been very slow and has been subject to new uncertainties in recent months. As a result, the share price has corrected significantly. Tax loss harvesting may also be putting further downward pressure on the stock.

Nonetheless, I believe that, at this price, Trilogy represents an attractive speculation. The long-term fundamentals of the copper market are strong. Trilogy management team is world-class. The asset is world-class. The future looks bright for those companies that will manage to bring new copper assets online by the end of the decade. I suspect that Trilogy Metals will be among them, even if after endless tribulations for investors. Thus, it might be time to go bottom fishing in Alaska.

Strong long-term copper fundamentals

The long-term fundamentals for copper look extremely strong. Demand is expected to double by 2035, driven by the electrification of developing countries and the energy transition of developed countries. In addition, supply growth is being constrained by years of underinvestment and the difficulties of bringing online new assets in the current political climate.

I have always found it ironic that Tier-1 jurisdictions are supposed to include developed countries like the United States. A true Tier-1 jurisdiction should have in place a robust and transparent legal system that provides clarity regarding all aspects of the mining process and protects shareholder interests. However, in the United States, this is not the case. In particular, the current administration is pursuing a conflicting strategy: on the one hand, it claims to be aiming at energy transition objectives; on the other, it constrains the domestic supply of “green” metals via arbitrary and capricious decisions. The permitting process is therefore becoming increasingly opaque: it is more and more subject to political whims, rather than being driven by a clear legal framework.

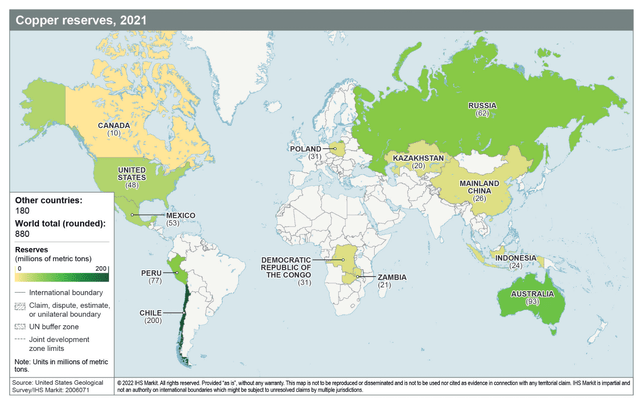

Unfortunately, there are not many alternatives to growing domestic supply, especially considering the geopolitically unstable scenario in which we find ourselves today. If we look at a map of world copper reserves, we discover that, apart from Australia, most reserves are concentrated in “unfriendly” countries: either politically challenged ones (like Peru and Chile), or outright hostile ones (like Russia). While in 2022 the focus has been on the security of energy supplies, the next few years may see a global scramble for strategic metals, including copper.

World copper reserves in 2021 (2022 S&P Global report “The Future of Copper”)

What does all this mean for investors? My base scenario is that by the middle of the decade the reality of the supply/demand imbalance will trigger a substantial appreciation in the price of copper. This repricing could happen very quickly. Moreover, as the world increasingly polarizes into opposing blocks, developed countries will turn to simplifying and even incentivizing the permitting process, as the focus shifts to growing domestic supply. This implies that high-grade deposits, with a long life of mine, currently in the permitting phase are going to be among the greatest beneficiaries. In the meantime, however, investors will remain exposed to substantial volatility, especially from political risk.

An attractive asset

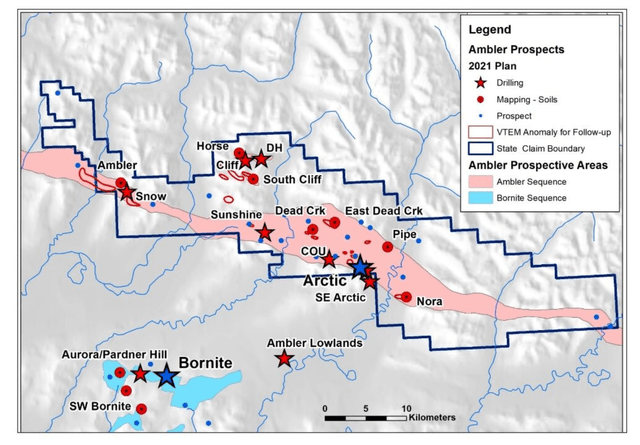

This finally brings us back to Trilogy Metals. Trilogy Metals is a Canadian exploration and development company with interests in the highly prospective Ambler Mining District in Northwestern Alaska. The district hosts world-class volcanogenic massive sulphides (VMS) deposits, containing copper, zinc, lead, silver and gold. It also hosts carbonate replacement deposits, with copper and cobalt mineralizations.

Exploration has been focused on two deposits: a VMS deposit (the “Arctic” project) and a carbonate replacement deposit (the “Bornite” project). Trilogy holds a 50% interest in Ambler Metals LLC, which in turn has a 100% interest in both projects. Ambler Metals LLC is the joint venture with South32 (S32.AX), the $12 billion Australian mining company spun out of BHP in 2015, which holds the remaining 50%. The JV was established in February 2020, with Trilogy providing the exploration rights and South32 seeding it with $145 million.

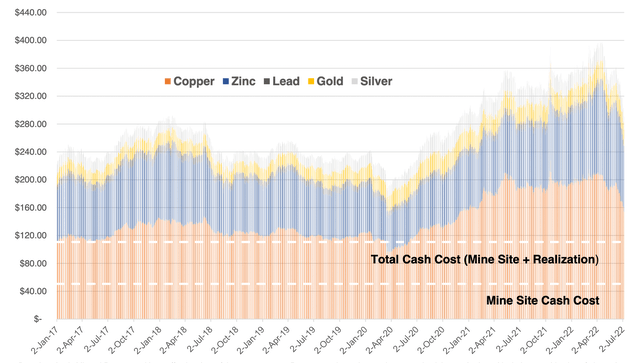

I will not discuss the Bornite project, and focus instead on the Arctic project, for which there is already a feasibility study. The study assumes an open pit mine design, with mill capacity of approximately 10,000 tons per day and 12 years LOM. Arctic is predominantly a copper-zinc deposit. The contribution of lead is insignificant, but recovery of the metal is necessary to clean the copper concentrate, thus capturing the precious metals as by-products. The average annual production and share of revenues by metal are shown in the table below.

| Metal | Price assumption | Copper-equivalent ounces | Share of revenues |

| Copper | 3 $/lb | 155 million | 57% |

| Zinc | 1.1 $/lb | 57.6 million | 26% |

| Lead | 1 $/lb | 9.6 million | 4% |

| Silver | 18 $/lb | 20.4 million | 8% |

| Gold | 1300 $/lb | 12.96 million | 5% |

The price assumptions date back to February 2020, so they are very conservative. Metal prices have increased considerably since then.

Arctic Revenue Per Tonne of Probable Reserves ($/t ore) (Company’s Presentation)

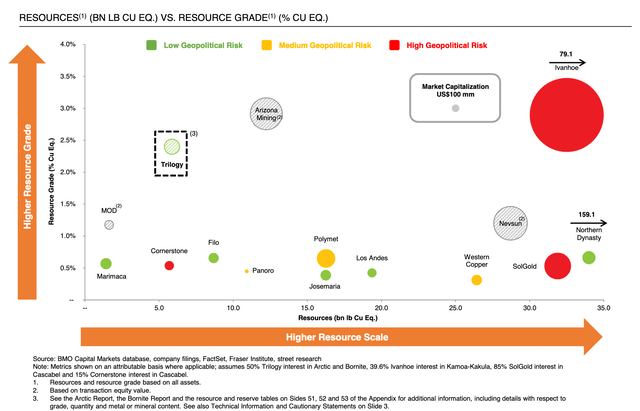

Based on current resources, Arctic is not a huge deposit, but it is very high-grade.

Resource scale vs. resource grade (Company’s Presentation)

Besides, it is geographically close to Bornite, and in a region that is underexplored, but highly prospective, so the exploration potential is considerable.

Upper Kobuk mineral projects area, in the Ambler mining district (Company’s Presentation)

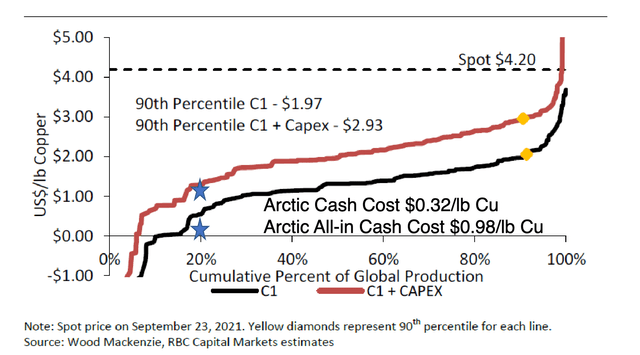

All-in cash costs are estimated at $0.98/lb. The mine would be in the first quartile of the global cost curve.

Global cost curve (Company’s Presentation)

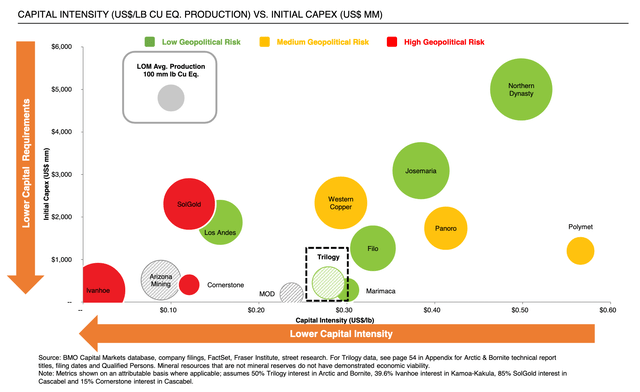

Initial capital costs are estimated at $905 million, with total capital costs of $1225 million. Overall, Arctic compares quite favorably with other copper deposits, especially because of its low initial capital requirements.

Initial capital requirements vs capital intensity (Company’s Presentation)

The economics of the project therefore are robust. Based on the feasibility study, the after-tax NPV with an 8% discount rate would be around $1,135 million (on a 100% basis, half of that is attributable to Trilogy). The company’s current market capitalization is around $70 million.

Permitting uncertainties

Of course, the story is not that straightforward. In fact, at the moment, it is not clear whether the mine will ever be built. First, there is uncertainty regarding the permitting of the “Ambler Access Project”, i.e. the new 211-mile-long road that should provide industrial access to the Ambler Mining District.

To recap a long story, in July 2020, the Bureau of Land Management (BLM) issued a Joint Record of Decision (JROD) and a Final Environmental Impact Statement (FEIS), approving the project. Subsequently, a Section 404 Permit was issued to the Alaska Industrial Development and Export Authority (AIDEA). Everything seemed in place but then, following lawsuits by a coalition of Canadian NGOs, in February 2022 the Department of the Interior (DOI) filed a motion to remand the Final Environmental Impact Statement (FEIS) and suspend the right-of-way permit. In May 2022, the DOI motion for remand was granted without vacatur of the JROD. The remand is meant to allow to supplement alleged deficiencies in the previously issued JROD. In response, the BLM published in September 2022 a Notice of Intent (NOI) that it will prepare a Supplemental Environmental Impact Statement (SEIS) to resolve such deficiencies.

My reading is that the decision was mostly politically motivated. The project maintains strong support among both local communities and Alaskan authorities. AIDEA itself has stated that the development of the FEIS and JROD (which have cost almost $5 million to date) is “comprehensive” and “of high quality”. There was no serious underlying concern that justified imposing further delays at this stage of the process. However, it happened, and it now represents a significant setback in terms of timeline. The BLM has said it anticipates publishing a draft Supplemental Environmental Impact Statement (SEIS) during Q2 2023. It also anticipates publishing the final SEIS within Q4 2023. If everything goes smoothly, a Record of Decision could be expected by mid-2024. With 2 more years for further exploration and permitting, plus 3 years for building the mine, first production could be expected around 2030.

Cash burn

In this dire situation, the good news is that most of the operating expenses related to the Arctic project are well covered. In fact, Ambler Metals still holds a $93.5 million cash position as of Q3 2022, of which 50% are attributable to Trilogy. Thus, there is no short-term need to raise additional funds, which is crucial given the current distressed valuation.

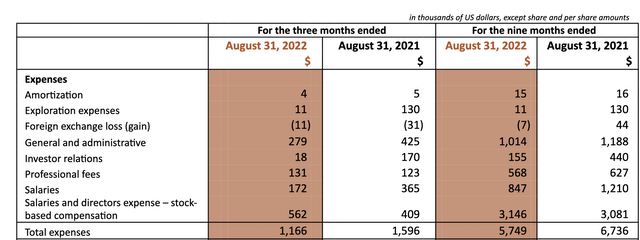

The more urgent issue is how to cover the other company’s expenses (such as G&A expenses, marketing expenses, insurance, and professional fees). It should be noted that Trilogy has a successful history of managing its cash burn under difficult circumstances. In fact, it has already achieved cash savings of $0.9 million during the first 9 months of 2022, compared to the same period last year. The company is also resorting to share compensation to its top management in order to preserve cash.

At the end of August, Trilogy had $3.1 million in cash and cash equivalents and working capital of $2.9 million. Its cash burn rate in Q3 was around $600 thousand, so it seems it has sufficient funds for a couple of years. Trilogy states that it has resources for at least the next 12 months.

Company’s expenses (Company’s 10Q report)

Valuation

I will briefly present my own estimates for the cumulative FCF over the LOM and the NPV of the Arctic project on an attributable basis. Most assumptions related to the production profile, operating costs, taxes, royalties, reclamation charges, and capital expenditures have been taken directly from the feasibility study. See in particular pages 22-1 and following for the economic analysis of the project.

To take into account the fact that spot metal prices have already moved significantly, and are likely to appreciate further by the time Trilogy could enter production, I considered three scenarios. The “base” scenario uses the same pricing assumptions as in the feasibility study; the “spot” scenario uses current spot prices, and the “future” scenario uses long-term conservative metal prices.

| Metal | Base scenario | Spot scenario | Future scenario |

| Copper | 3 $/lb | 2.85 $/lb | 5 $/lb |

| Zinc | 1.1 $/lb | 1.35 $/lb | 1.5 $/lb |

| Lead | 1 $/lb | 1.05 $/lb | 1.5 $/lb |

| Silver | 18 $/oz | 24 $/oz | 30 $/oz |

| Gold | 1300 $/oz | 1825 $/oz | 2000 $/oz |

I also considered different timelines for the permitting process, which has an effect on the computation of the NPV. The NPV is computed with an 8% discount rate and after-tax.

The following table summarizes the results.

| Scenario | First production | LOM FCF ($ million) | NPV ($ million) | Market Cap / NPV |

| base | 2028 | 1419 | 482 | 15.8% |

| base | 2029 | 1419 | 447 | 17% |

| base | 2030 | 1419 | 414 | 18.4% |

| base | 2031 | 1419 | 383 | 19.8% |

| spot | 2028 | 2422 | 911 | 8.3% |

| spot | 2029 | 2422 | 843 | 9% |

| spot | 2030 | 2422 | 781 | 9.7% |

| spot | 2031 | 2422 | 723 | 10.5% |

| future | 2028 | 3610 | 1419 | 5.4% |

| future | 2029 | 3610 | 1314 | 5.8% |

| future | 2030 | 3610 | 1216 | 6.2% |

| future | 2031 | 3610 | 1126 | 6.7% |

If the mine gets built, Trilogy is very likely a multibagger from here. The real question therefore is how to estimate the probability of this happening. An investment in the company can be thought of as a binary option. Our investment is worth zero if the mine does not get built; otherwise, the payoff is the NPV. We can then interpret the last column in the table (the MC / NPV ratio) as a market-implied probability of the mine getting built. The reader is free to choose the scenario she considers most realistic and compare the market-implied probability with her own estimate. Personally, my own estimate is far higher than 10%. Thus, I believe the current valuation is extremely pessimistic.

Conclusion

Summarizing, I believe the mine will be built, eventually. I believe Trilogy is undervalued, as the market-implied probability is far too low compared to my own subjective estimate. I believe that the asset is world-class and the economics robust. So, from a purely value perspective, Trilogy is already a (speculative) buy.

However, I have not pulled the trigger just yet. The reason is that I also believe the permitting process will not be straightforward: the timeline has already been significantly extended and Trilogy will probably need to raise new money along the way. Besides, despite its excellent long-term fundamentals, copper could be vulnerable to another correction in the short-term, which would provide an even better entry point. In short, I count on the fact that there will be opportunities to buy over the next few months. I may be wrong. For the time being, I will keep Trilogy on my radar.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment