Mara Fribus/iStock via Getty Images

Trilogy Metals (NYSE:TMQ) suffered a significant blow with the Biden administration’s decision to review the Ambler Access Project. The US Department of the Interior [DOI] has filed a motion to remand the Final Environmental Impact Statement for the Ambler Access Project and is also attempting to suspend the associated right-of-way permits. Completion of the Ambler Road is necessary to provide access to Trilogy’s Upper Kobuk Mineral Projects.

Ambler Metals (the joint venture owned by Trilogy and South32) is taking the position that it doesn’t oppose the remand as long as the right-of-way permits aren’t terminated and the remand is completed within nine months (as well as a couple other conditions).

While progress on the Ambler Access Project seems uncertain under the Biden administration, it does have the support of the Alaskan Members of the US Congress, and a change in federal administration would likely go a long way towards helping the project advance again.

Right-Of-Way Permits

The decision to review and attempt to suspend the federal right-of-way permits for the Ambler Road did not go as far as some opponents of the road wanted (which was to revoke the permit). Thus the door apparently hasn’t closed on the development of the road progressing under the Biden administration, although that should probably be classified more as a hope than an expectation.

If there is a change in government with the 2024 elections, there would be a strong possibility that the right-of-way permit gets reissued (or unsuspended). Those elections are still a long way off, but the prediction markets currently have the Republicans as a slight favorite in the Presidential elections.

Although the Ambler Road project faces significant uncertainty now, I still view it as having a reasonable chance of being approved at some point in the future. The Ambler Road project has encountered complications under a Democratic administration, but was progressing well under a Republican administration. As well, the Alaskan members of the US Congress have all voiced support for the Ambler Road. This suggests that a change in administration (with the 2024 elections) could revive its prospects if the project remains stalled under the current administration.

If the project had run into complications under a Republican administration, then I would be considerably more skeptical about its long-term prospects.

Effect On Timelines

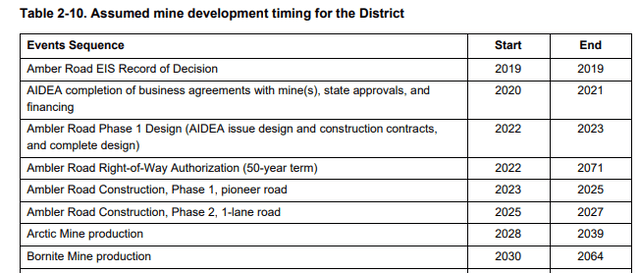

The Arctic Mine was previously expected to start producing in 2028, based on the Ambler Road right-of-way authorization being granted in 2022.

Prior Timeline For Development (Ambler Access Project)

If the right-of-way authorization ends up being definitively granted in 2025 instead, that would appear to push expectations for the first production from the Arctic Mine to around 2031.

There is also the risk that the right-of-way authorization gets tied up in court for a while again by lawsuits.

Notes On Share Count

Trilogy reported that it had 145.5 million shares outstanding as of April 6, 2022. It also mentioned that it had $4.8 million in cash and cash equivalents at the end of February 2022, while it had budgeted $5.5 million for operating requirements during 2022.

The challenge for Trilogy is that its share price has fallen considerably, so that increases the amount of shares per year that it may need to issue to fund its operations. Trilogy’s outstanding share count would increase to around 160 million if it ends up raising funds for three more years of operations (giving it enough cash to last until late 2025) at its current share price.

Notes On Valuation

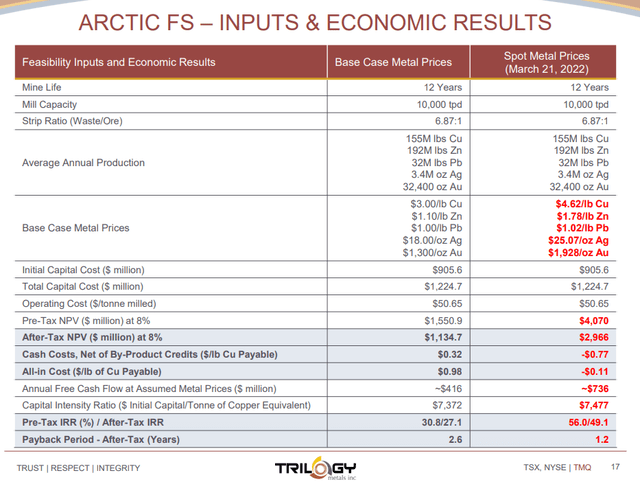

The estimated value of the Arctic Project (if it gets completed) continues to go up based on spot. With base case metals prices, the after-tax NPV8% was around $1.135 billion (on a 100% basis). At March 2022 spot prices, the estimated after-tax NPV8% increased to an estimated $2.966 billion (also on a 100% basis).

Trilogy owns a 50% stake in that project, while the NANA Regional Corporation also has the right to receive a 15% Net Proceeds Royalty or to purchase a 16% to 25% direct interest in the project.

Arctic FS At Strip Prices (Trilogy Metals)

I estimate that Trilogy’s share of Arctic (after adjusting for NANA) would have an after-tax NPV8 of approximately $1.2 billion at spot metal prices.

Trilogy’s current market cap is approximately $167 million, so there is quite a bit of potential upside if the Ambler Access Project eventually gets approved and the prices for the relevant metals remain high.

Of course, there is also a high amount of risk due to the uncertainty around the status of the Ambler Access Project and a potentially lengthy wait before seeing further progress with the road.

Conclusion

The Biden administration’s decision to review (and attempt to suspend the right-of-way permits for) the Ambler Road is a significant setback for Trilogy. However, there is still some possibility that it resumes progress under the current administration, and a high chance that it can progress if there is a change in administration.

With metal prices increasing significantly, there is a lot of potential upside for Trilogy if the Arctic Mine does eventually make it into production. Trilogy’s stake in that project has an estimated after-tax NPV8 (at spot prices) of over $8 per share. There is also a high amount of risk that progress on the access road and mine gets delayed though, so I’d consider Trilogy a high-risk, high-reward stock at the moment.

Be the first to comment