FatCamera/E+ via Getty Images

Confidence in Therapy

Home builder sentiment in July dropped back to levels last seen in the early months of the pandemic. However, those numbers run counter to the abiding confidence still beaming from the earnings reports of home builders. For example, Tri Pointe Homes, Inc. (NYSE:TPH) is riding high on a record near $3B backlog. While dropping full-year guidance in its otherwise impressive Q2 2022 earnings report, the company affirmed its belief in strong future results (from the Seeking Alpha transcript):

“By focusing on converting our existing backlog, maintaining a steady flow of new orders, opening new communities and reducing future land [spend], we believe Tri Pointe is in an excellent position to generate positive cash flow from operations while adapting to the changing landscape. In addition, we enter this period of uncertainty with a record backlog and healthy operating margins, given us great confidence in our ability to generate profits and increase book value for the foreseeable future.”

Guiding customers to the finish line is core to the company’s confidence. Demand remains strong but the buy cycle is “elongated.” As a result, management described themselves as transforming “from order takers to financial therapists.” Tri Pointe’s customers want to buy, but the rapid run-up in mortgage rates has left them in shock. Constant talk of a recession layers on more hesitancy. These buyers have become market timers given worries about the volatility in the housing market. TPI as the confident therapist has to reassure and reveal possibilities (similar to the work ahead for realtors working in this tough market).

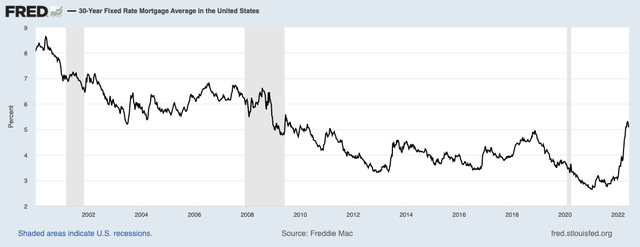

The 30-year mortgage shocked the housing market by rapidly slipping by the previous peak in 2018. (Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis)

Management insists it has the right therapeutics with “all the right tools and mechanisms in place to continue to draw them across the finish line.” Those incentives include “forward rate commitments, rate buy-downs, and rate locks to offset some of the impact of higher mortgage rates.” D.R. Horton (DHI) announced similar incentives in its earnings conference call the same day; I assume most home builders are rolling out similar programs. These programs maintain order flow as well as protect the backlog. Tri Pointe’s backlog includes homes scheduled for completion and delivery in 2023. Accordingly, the backlog is insufficient to hold previous full-year guidance. Management reported that the company needs to sell 600 to 700 homes to land at the midpoint of its previous guidance.

Interestingly, even including price incentives, Tri Pointe is just normalizing incentives back to pre-pandemic levels, “something around the 4% range for financing promotions.” Targeting order pace (or absorption), Tri Pointe is “prepared to pull additional incentive levers to maintain that pace, if necessary.”

Housing Demand and Cancellations

Demand pace for new homes slowed down starting in mid-June. D.R. Horton corroborated this data point. Tri Pointe increased advertising and managed to boost the registered traffic rate from the end of June to July.

Demand is of course not the final story. Cancellations are an on-going threat to the backlog. The demand slowdown that started in June accompanied an increase in cancellation rates. Tri Pointe’s cancellations rose to 15.6% of gross orders. Total cancellations were 6.3% of the backlog at the top of the quarter. The split of cancellations is nearly 50/50 between new orders and the backlog: “48% towards sales that have occurred during that quarter and 52% on sales that had been prior to the second quarter.”

Tri Pointe expects cancellations to trend toward its normal cancellation rate of approximately 20% of gross orders. This rate compares favorably to DHI’s cancellation rate of 24% in its recent quarter versus 17.5% a year ago.

Tri Pointe has no plans to reduce base home prices. Management pointed out such moves are not healthy for the backlog.

Competition

Public builders have reason for optimism than private builders. Well capitalized builders like Tri Pointe view a slowdown as an opportunity to take share. Indeed, over the last 20 years, the largest builders have increased market share and dominance. The Joint Center for Housing Studies of Harvard University estimated that “the 100 largest home builders in the US now account for about half of all new single-family home sales, up from just over a third two decades ago.” More importantly, concentration at the very top has significantly increased. America’s top two builders, D.R. Horton and Lennar (LEN), have grown from a 31.5% share of the top 10 in 2002 to 53.7% in 2020, a startling amount of consolidation.

TPI explicitly proclaimed that “along with the other public home builders [we] have an inherent cost advantage over the smaller industry players and should emerge from this slowdown with increased market share.” The consolidation trend will very likely to continue unabated.

Valuation and the Trade

Like most of the publicly traded home builders, TPH is priced for a recession. TPH trades at a rock bottom valuation of 4.0 P/E (forward and trailing), 0.5 times sales (forward and trailing), and, most importantly, 0.8 times book value. Home builders are considered “cheap” starting at book value.

TPH and most other publicly traded home builders are also benefiting from a religion of discipline earned the hard way after the great financial crisis (GFC). They have generally managed for strong balance sheets and flexibility to respond to changing market environments. Accordingly, strong revenue and earnings performance has generated strong cash flow for TPH. The company currently sits on $270M in cash and equivalents. TPH decided to suspend its share buyback program to further protect cash. The net debt to net capital ratio is a manageable 30.1%. For comparison, D.R. Horton reports an attractive “homebuilding debt to total capital ratio” of 17.0%. Tri Pointe extended maturity dates to June 2027 for its revolving credit facility and its term loan facility. The company also boosted the maximum capacity of its revolving credit facility to $750M from $650M.

Of course, the concern is whether conditions will deteriorate enough to cause a significant mark down in book value. Such concerns are subject to intense debate. Fears of the next housing crash surround the housing market almost every year and are easy to find on social media and YouTube. This year’s fears are at a fever pitch because housing prices soared at an astonishing pace for the last two years and now mortgage rates have soared shockingly fast and furious. Perhaps ironically, the Fed’s belated efforts to normalize monetary policy and fight inflation have made housing even more unaffordable. Relief will not come from supply as builders’ slow starts. For now, single-family housing starts are only back to pre-pandemic highs. Moreover, existing homeowners will be motivated to keep their homes to themselves as long as possible to avoid swapping into mortgages with much higher rates than their existing loans. In other words, a severe price decline is unlikely, at least anytime soon.

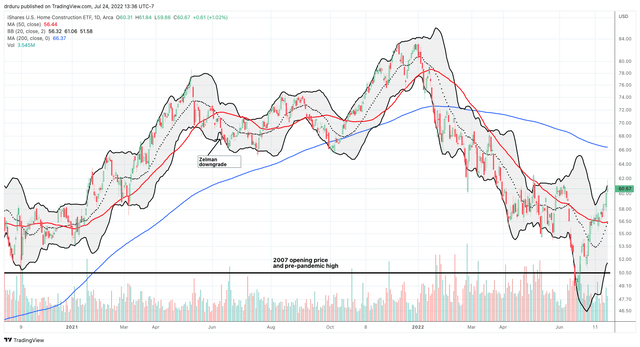

Investors and analysts often cast a wary eye at home builders in search of the tiniest signal that the end of the latest cycle is right around the corner. Accordingly, valuations for home builders tend to be low. Today’s valuations reflect extra doses of skepticism. Yet, with fears riding a fever pitch, home builder stocks are enjoying a counter-trend rally. The iShares U.S. Home Construction ETF (ITB) erased all its pandemic era gains last month but has since rebounded to its June highs. The persistent rally after the breakout above the 50-day moving average (DMA) (the red line below) would deliver a bullish signal if not for the growing signs of recession clouding such a technical assessment.

The iShares U.S. Home Construction ETF (ITB) is enjoying an impressive counter-trend rally. (TradingView.com)

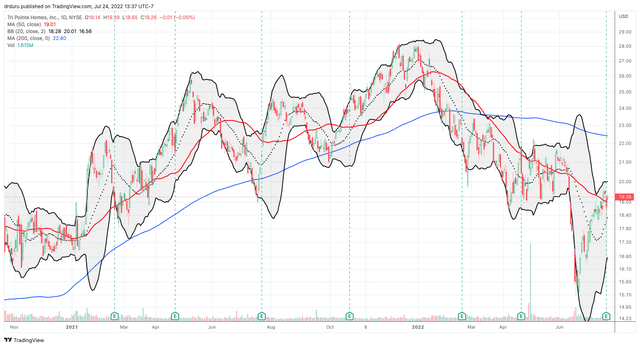

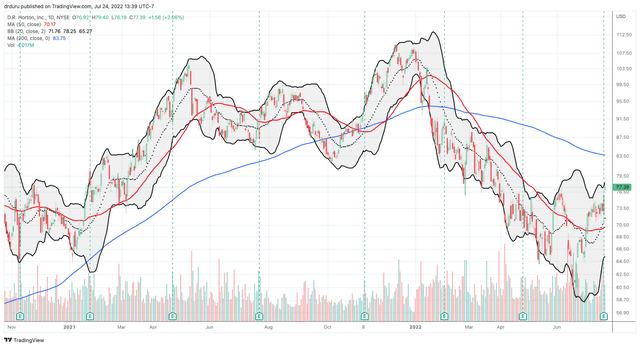

The countertrend rally helped TPH as well. Buyers stepped into the initial post-earnings gap down and closed the stock for a flat performance on the day. DHI did TPH one better with buyers taking the stock from an initial post-earnings gap down to a 3.8% gain on the day. Buyers stayed active the next day despite a general pullback in the stock market.

Tri Pointe Homes, Inc (TPH) is up 25% from its June closing low. (TradingView.com) D.R. Horton (DHI) gained enough post-earnings momentum to surpass its June high. (TradingView.com)

So under technical circumstances, I would be accumulating shares in home builders like TPH. However, I prefer to continue to wait for the period of seasonal strength of home builders. That season is a time when the market tends to have a more positive outlook and looks forward to the potential for the Spring selling season. Coincidentally, financial markets also expect the Fed’s normalization of rates to end next Spring with a rate cut in the summer. When the market starts to price in the possibilities, mortgage rates should also stabilize, perhaps even calm down a bit. The resulting more sustained interest in home builder stocks should further support the seasonal period of strength. As always, time will tell whether all this therapy works out so neatly.

Be careful out there!

Be the first to comment