HATICE GOCMEN/iStock via Getty Images

TransUnion (NYSE:TRU) is one of the “Big Three” credit agencies along with Experian and Equifax. The company has gradually evolved their business model over the past few years to become a “Big Data” analytics provider. The global big data market is forecasted to be worth $103 billion by 2027 and Data has been called the “new oil” due to the immense value it can provide to businesses across all industries from Financial services to Gambling, Insurance and even Marketing. TransUnion has gradually expanded their portfolio of data and software packages through a series of acquisitions and are now poised to benefit from the secular growth in the big data industry.

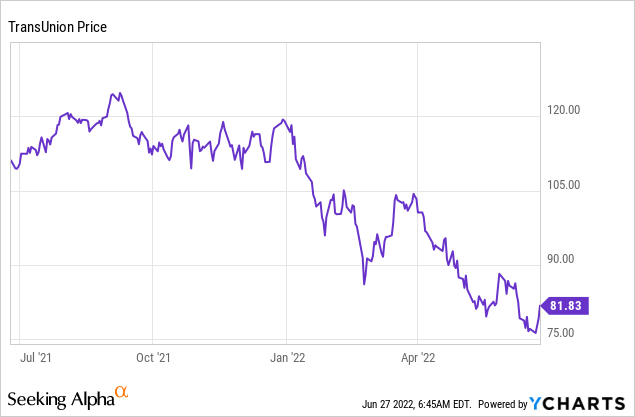

The company was founded in 1968, but didn’t have its IPO until 2015. The stock price doubled from the lows of $54/share during the pandemic crash of 2020, but since September the share price has corrected down by 34%. The decline seems to have been caused by the high inflation and rising interest rate environment, in addition to a decline in the mortgage segment of the business thanks to a shaky housing market. I believe these are all short-term macroeconomic factors and those that will not materially impact the business long term, as Billionaire Investor Howard Marks of Oaktree capital once said “Everything moves in cycles, from the stock market to the economy”. The stock is now undervalued relative to historic multiples, so let’s dive into the Business Model, Financials and Valuation for the juicy details.

Big Data Business Model

TransUnion has its roots as a leading credit reporting agency. They are a US company, but have a treasure trove of data on over one billion consumers and 65,000 businesses across thirty countries. Their consumer services include:

-

Credit Monitoring

-

Credit Protection

-

Score Simulator

Credit score (TransUnion Website)

Credit scores in general are a commodity product, with many alternative providers out there such as larger rivals Equifax and Experian. However, credit scores do act as a “gateway service” to many other financial services from credit cards to home loans, which is one of the key methods these providers make revenue. However, TransUnion is not just a credit data provider they have gradually evolved their business model to become a true “Big Data” provider for businesses. The company has realized its powerful data set on 200 million US consumers can be used for a variety of applications from Marketing to Fraud detection and more. Here is a list of their Business Services;

-

Marketing and Audience Segmentation

-

Customer Acquisition

-

Fraud Detection & Prevention

-

Customer Engagement Solutions

-

Data Breach Services

-

Customer Analytics and more.

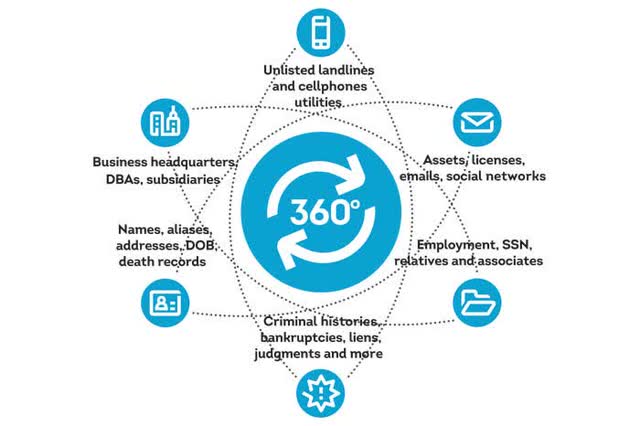

A popular product they provide is called “TLOxP” which doesn’t have the most catchy name, but provides a valuable service. Their software is used for “Skip Tracing” which is the process of locating a debtor who has “skipped town”. The software combines multiple public and private records, from utility records to death records and employment details, in one place to allow rapid verification and location of people. The platform has a 4.6 star out of 5 rating on G2.

Skip Tracing Software (TransUnion Website)

TransUnion has made a series of acquisitions to strengthen their “Big data” business model. This includes the acquisition of Neustar in the fourth quarter of 2021 for a staggering $3.1 Billion, which was their largest acquisition to date. Neustar is an identity resolution company, which offers solutions in Marketing, Fraud and Communications and thus will help strengthen TransUnion’s offering in this space. They also acquired Sontiq for $638 million at the end of 2021 which will bolster their digital identity protection and security portfolio. Most recently TransUnion completed an acquisition of Verisk Financial Services in April 2022, which is set to enable a “full wallet view” of consumer spending, which should increase the value of insights they can offer to business customers. Last year, TransUnion announced the entry into the US sports betting market, which is a $119 billion market opportunity. They are an ideal partner for sports betting providers as they can provide credit details, identity checks, fraud protection and even marketing data on patrons. They already have vast experience offering “affordability checks” on UK sports betting customers for over 10 years.

Growing Financials

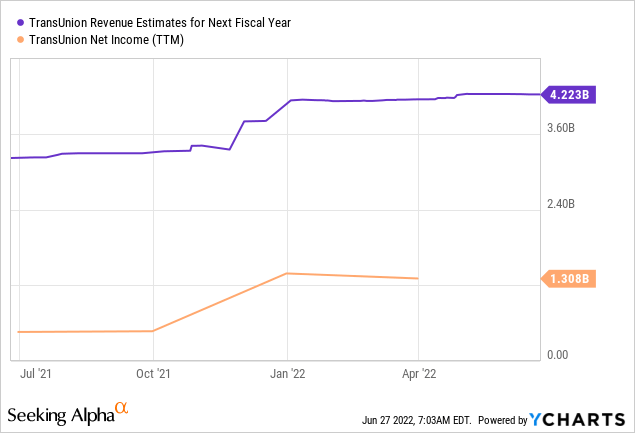

TransUnion had a strong first quarter of 2022, with total revenue of $921 million up a rapid 32% (13% constant currency) compared to the same quarter last year. Management raised their guidance for 2022, with 10% to 12% organic revenue growth expected, which excludes US mortgage impact of the subsiding mortgage market. They are expecting an eye watering 25% decline in U.S. mortgage revenues, which is due to 30% inquiry declines.

The company generated Net income of $48 million in Q122, which was down substantially from the $128 million seen in the first quarter of 2021. While earnings per share (EPS) was also lower at just $0.25 vs $0.66 in Q121. This was driven by a large expense of $30 million from a Legal matter outlined in their earnings report.

TransUnion’s balance sheet has $1.3 billion in cash and cash equivalents, which is great. However, they do have a substantial $5.8 billion in long term debt. Now although high debt levels are more common for a mature company it still is something to be aware of especially given the rising interest rate environment.

Valuation

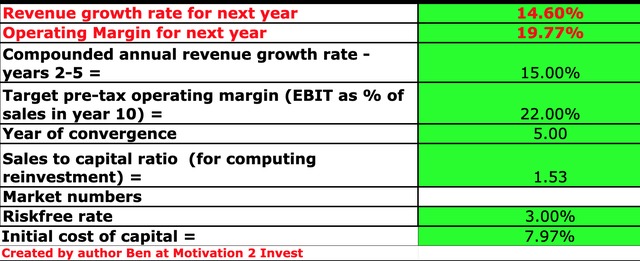

In order to value the company, I have plugged the latest financials into my valuation model, which uses the discounted cash flow method of valuation. I have forecasted 14.6% revenue growth for next year and 15% for the next two to five years. This is at the top end of analyst estimates but lower than the past 5-year average of 25%.

TransUnion stock valuation (created by author Ben at Motivation 2invest)

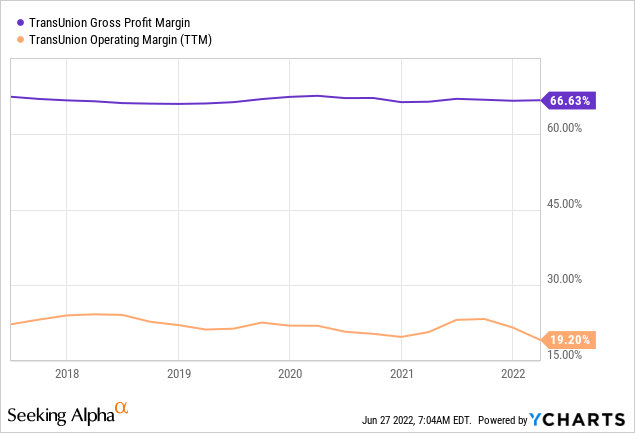

I have forecasted their operating margin to increase slightly to 22% as the company scales and enters new markets.

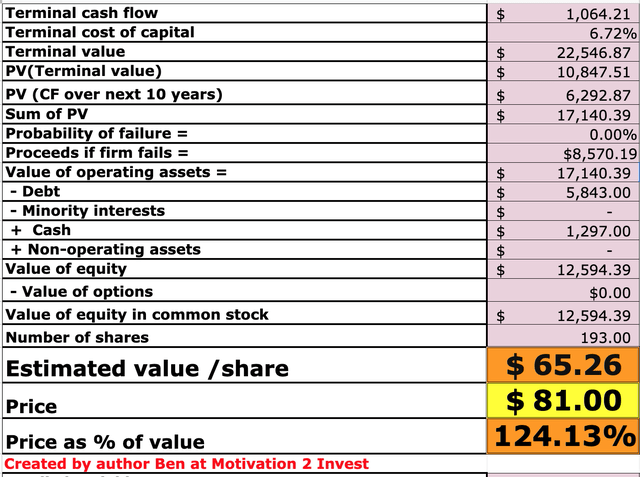

TransUnion stock valuation 2 (created by author Ben at Motivation 2 Invest)

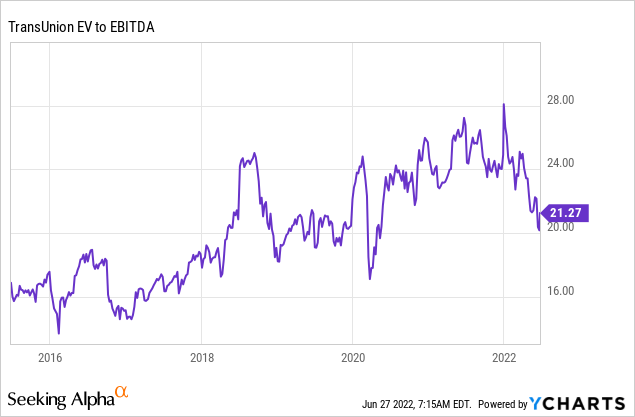

Given these factors I get a fair value of $65 per share, which is 24% lower than the $81 stock price, thus the stock is overvalued intrinsically, despite the large pullback in share price. However, the company has an EV to EBITDA = 21, which is definitely at the cheap end relative to historic levels.

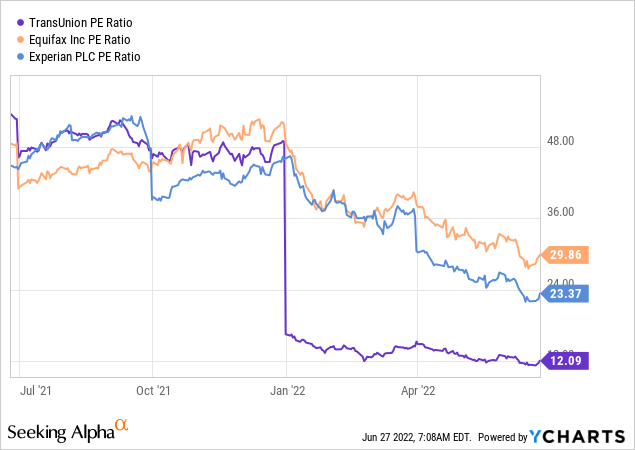

If I compare on a PE Ratio basis, TransUnion has the lowest Price to Earning Ratio of the “big three” credit agencies. They have a PE = 12, vs Equifax (EFX) PE = 29.8 and Experian (LON: EXPN) PE = 23.

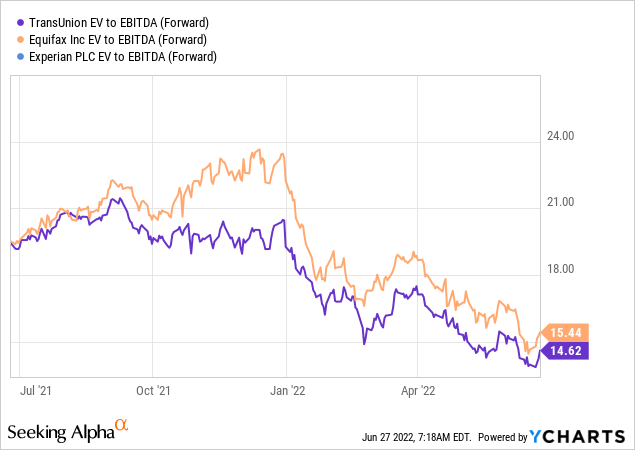

For increased accuracy I prefer to use the EV to EBITDA multiple for comparison as this takes into account debt levels and cash levels, which for this business makes a huge difference due to the high debt ($5.8 billion) mentioned prior. TransUnion again trades lower on a forward EV to EBITDA multiple = 14.6 when compared to Equifax.

Risks

High Valuation

Given the multitude of opportunities in the market right now, TransUnion isn’t exactly cheap intrinsically and their debt levels are very high, which could lower margins as interest rates rise.

Rising Interest Rates

The annual inflation rate in the US accelerated to 8.6% in May 2022 and has consistently been much higher than the Fed’s 2% target since early 2021. Inflation squeezes the consumer with higher food, Gas and electricity costs. The Ukraine-Russian War has only exasperated rising energy costs and higher interest rates will make mortgage payments more expense for households. The company has already seen a reduction in mortgage revenue and is expecting a further decline.

Final Thoughts

TransUnion is a great company which has expanded their business model from being a pure credit provider to major big data analytics player. They have a treasure trove of data on US consumers which is extremely valuable to many business sectors from Financial Services to Marketing and of course Gambling. The stock is undervalued relative to historic multiples, but is overvalued intrinsically especially given the rising interest rate environment. This stock is definitely one for the watch list.

Be the first to comment