Reg Lancaster/Hulton Archive via Getty Images

Transocean (NYSE:RIG) stock has gained substantially after the publication of my last article about this major offshore driller. But, in my view, the Swiss company is far too cheap, given the fact oil majors are making really immense profits. But let me explain this in some more detail.

Transocean’s earnings release

The company published its earnings report on 2 November. Overall, its results exceeded expectations and were roughly in line with the ones reported for the previous period.

RIG’s results

The data are given in $million.

| 2Q2022 | 3Q2022 | |

| Total contract drilling revenues | 692 | 691 |

| Total adjusted contract drilling revenues | 722 | 730 |

| Operating and maintenance expense | 433 | 411 |

| Net loss | 68 | 28 |

| Adjusted EBITDA | 245 | 268 |

| Contract backlog | 6200 | 7300 |

Source: Prepared by the author based on the company’s data

In some respects, RIG’s 3Q results were better compared to 2Q2022. This is particularly true of the expenses, the net loss, and the EBITDA. The results also turned out to be better than predicted by the analysts. Transocean’s non-GAAP EPS were -$0.06, a beat by $0.12. Adjusted contract drilling revenue, meanwhile, totaled $730M, a beat by $64.91M.

RIG’s CEO Thigpen was also positive about the company’s performance. But I don’t want to go into too much detail about the recent earnings since they were quite predictable. Instead, in my analysis, I would like to focus on the industry’s recovery, the company’s backlog, and RIG’s valuations.

Oil majors’ earnings

A lot has happened since my last article on the Swiss-based offshore driller. The company has published its earnings and its fleet status report. Many oil corporations have also published their quarterly earnings. Overall, my fellow Seeking Alpha contributors are bullish on Transocean’s latest contract additions and I fully agree with them.

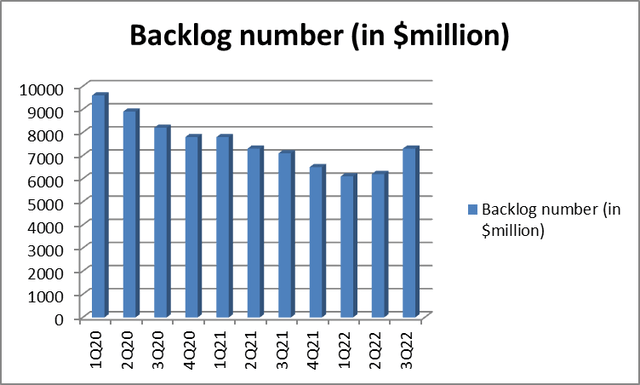

Just a quick recap, the contract backlog reported on 13 October when Transocean’s fleet status report was published, totaled $7.3 billion. On its own, it might not be a very large number. However, if we look at this figure in the context of RIG’s backlog history, we will see that it was quite good.

| Table – Backlog history (in $million) | |

| Reported period | Backlog number (in $million) |

| 1Q20 | 9600 |

| 2Q20 | 8900 |

| 3Q20 | 8200 |

| 4Q20 | 7800 |

| 1Q21 | 7800 |

| 2Q21 | 7300 |

| 3Q21 | 7100 |

| 4Q21 | 6500 |

| 1Q22 | 6100 |

| 2Q22 | 6200 |

| 3Q22 | 7300 |

Source: Prepared by the author based on the company’s data

As can be seen from the table above, the backlog as of 13 October 2022 is at the levels reported for 2Q 2021. It is really good, given the fact RIG’s backlog has been falling for years.

Let me also illustrate this with a diagram.

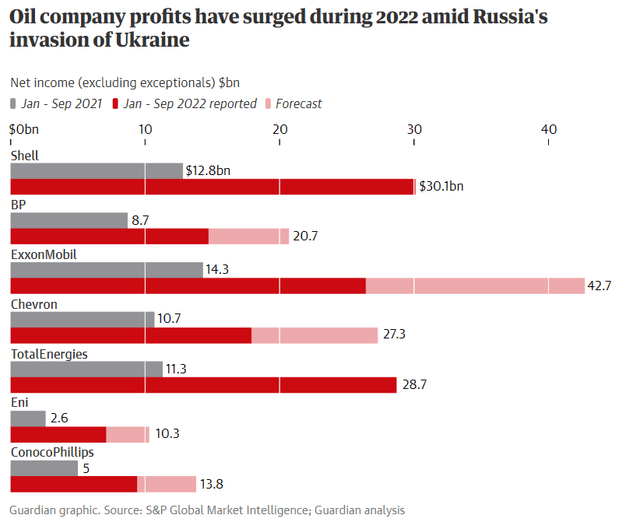

All that sounds good. There was also recently some very important news for RIG in the financial press. Many oil companies have reported their quarterly earnings. Corporations like Chevron (CVX), Exxon Mobil (XOM), Shell (SHEL), BP (BP), many other international oil giants, and the world’s largest businesses in the field, namely Saudi Aramco (ARMCO) have reported record earnings and net cash flows for the last quarter. The last 9 months were brilliant as well. The graph below compares the leading oil majors’ earnings for the 9 months of 2022 to the same period a year ago.

You can see the profits surged twofold and, in some cases, threefold.

But you might say that all this extra cash rather gets directed to the buyback programs and high dividends. Indeed, it does. One of the most obvious examples was BP which announced a $2.5 billion share buyback.

But unlike shale oil companies that direct a lion’s share of their profits to strengthen their balance sheets, large international corporations can afford to invest in exploration, new contracts, and, yes, new production. After all, to take advantage of the reasonably high oil prices that exist nowadays, it is necessary to find new opportunities to increase production. It has been mentioned here many times before that low-cost onshore drilling is the first option for oil majors when the prices for the base commodity go up. However, the world has been facing energy shortages since 2021. So, it is the right time to turn to offshore drillers. Transocean has already proved this with its sound backlog growth.

Drilling activity

Another perfect stimulus for the new contracts I see is the energy crisis that will clearly worsen this winter. In the Northern Hemisphere, especially Europe it is highly likely there will be a tough winter. Many scary forecasts can be found on Oilprice.com. But I will summarize the most probable ones.

Europe’s natural gas reserves are only 90% full. You might think that it is very good news. It could have been, had the EU ensured stable gas supplies. But this is unlikely to happen. The G7 and the EU authorities are trying to cap natural gas prices. If they set the price ceiling for Russian gas, Russia will stop supplying it. Gazprom’s (OTC:GZPMF) Alexei Miller confirmed this. A good alternative to natural gas is oil. Oil products such as diesel are very useful for heating. So, this news is also bullish for oil. But “black gold” is highly likely to be in very short supply as well. That is mostly due to the EU embargo on Russian crude imports by sea. The embargo will enter into force next month. That is why Europe will face very high prices for oil.

The US, meanwhile, is also in a situation of energy deficits. The most notable problem is the diesel shortage. It was recently reported the distillate inventories crashed to multi-year lows. But the US and Europe are not alone when it comes to high energy costs. Many countries all around the world are facing energy shortages, especially the poorer ones.

The reason why I am saying this is because offshore drillers may see even further increases in their contract activity.

Risks

My bullish forecast on RIG is not without its ifs and buts. The most obvious problem with the company itself is its debt load. Transocean’s closest competitors have emerged from bankruptcy, thus getting rid of their high debt loads. Noble (NE) and Valaris (VAL) still cannot compete with RIG in terms of fleet and backlog size but their freedom from debt is a huge advantage.

This is even more true now, given the fact that interest rates all over the world are rising. Many central bankers are getting very hawkish as the inflation readings break multi-decade record highs. This makes it difficult for indebted businesses to pay the interest and raise additional capital.

Moreover, such a hawkish stance has already provoked a massive selloff on Wall Street. But more economic pain could be ahead, which is not bullish for stocks in general. However, given RIG’s volatility, its stock might face additional pressure on the stock market.

At the same time, we could end up in an energy crisis that could last for many years. A recession might not even pressurize oil prices for a long time. A similar situation was observed in the 1970s in the US. At the time, many countries, including the US suffered from energy deficits. Meanwhile, there were several recessions over one decade. Something similar can happen now.

Valuations

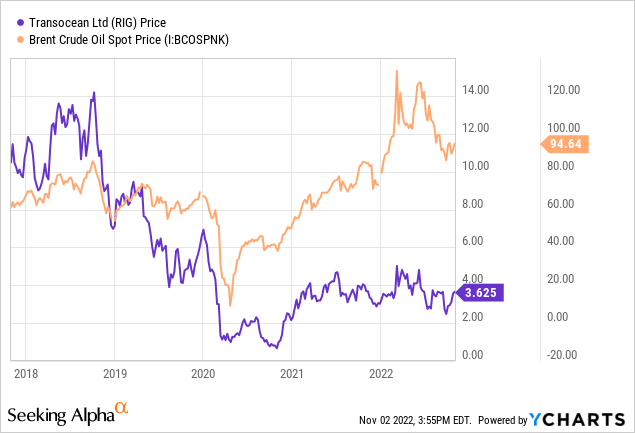

I decided to use the following criteria to value RIG: Transocean’s stock price vs. oil prices, the price-to-sales (P/S) ratio, and the Enterprise Value/EBITDA. RIG’s shares have traditionally moved in a close correlation with the oil prices.

I decided to exclude the price-to-earnings (P/E) ratio since Transocean is loss-making right now. The price-to-book (P/B) ratio is also inappropriate because the real value of Transocean’s fleet is highly likely different from the book value on its balance sheet.

Overall, Transocean’s shares should trade higher, given the current oil prices. In fact, the shares of the major offshore driller have been underperforming the Brent prices since 2020. I appreciate Transocean’s indebtedness and how many worries there have been since the end of 2020 when many analysts predicted RIG’s imminent bankruptcy.

But it seems the stock is still undervalued according to this metric.

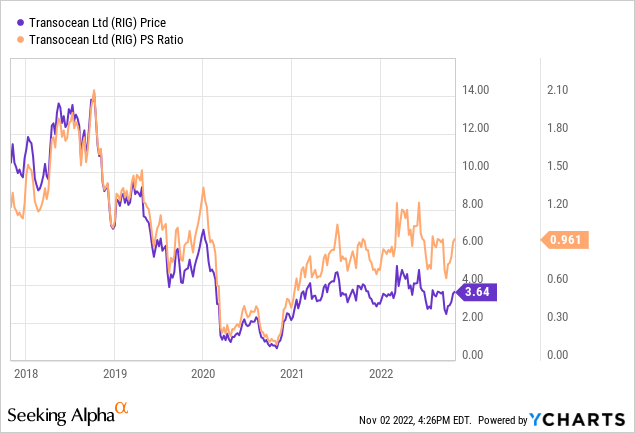

Furthermore, I am considering the P/S ratio, which shows the company’s shares are fairly valued if not undervalued. Its shares are trading at a P/S of less than 1, which is reasonable for a loss-making company.

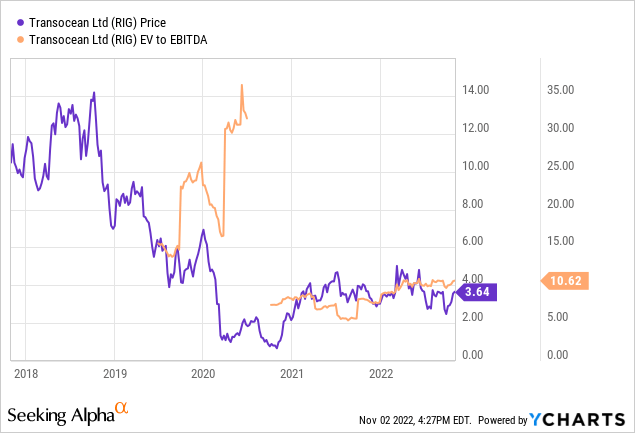

The same is true of RIG’s EV/EBITDA ratio. It is now around 10, which is widely considered to be healthy.

Overall, I would say RIG’s stock is not overvalued.

Conclusion

So far, RIG has shown sound improvements in regard to its earnings and most importantly its backlog. Transocean shares should benefit from a rise in the amount of capital spending by oil majors. It is very reasonable for large oil corporations to further increase their investments in exploration. The very situation of a serious energy deficit should make investing in new oil attractive. The only downside I see is a long and uncontrolled global recession.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment