imaginima/E+ via Getty Images

Even with rising political pressure in the US and elsewhere in the world to ease the pain at the pump for consumers, we expect crude oil prices to remain high in the second half of 2022. Crude oil supply is highly constrained and there’s little that can be done to resolve this in the short-to-mid-term given the underlying reasons for the supply crunch.

Thanks to shrinking capital expenditures among oil and gas exploration and production companies in the last decade, the world has limited spare oil production capacity. This means additional supply cannot be brought in at a pace and scale that can significantly move global prices lower. Geopolitical developments are also disrupting supply in key markets such as Europe, where the EU has decided to cut 90% of Russian imports by the end of the year due to its invasion of Ukraine.

On the demand side, the prospect of a recovery in China, the world’s second largest economy after the US, is fueling bets that oil prices will rise higher. China is at a pivotal point in turning its economy around. A stream of monetary and fiscal policy measures in recent weeks, timed with the easing of COVID-19 lockdowns across major cities, have provided catalysts for a turnaround.

Go with small cap plays

With crude oil prices likely to remain elevated, the current rally in oil exploration and production stocks is set to continue unabated. For investors looking for outsized gains this far into the megatrend, small cap stocks ($300 million to $2 billion market cap) may offer a better chance relative to mega caps.

One small cap oil stock worth considering is TransGlobe Energy Corporation (NASDAQ:TGA), a Canada-headquartered oil and gas producer with operations in both Canada and Egypt. TGA’s focus is principally on onshore oil fields. It owns 100% working interests in four Production Sharing Concessions in Egypt and high working interest assets in the Harmattan area of Western Canada.

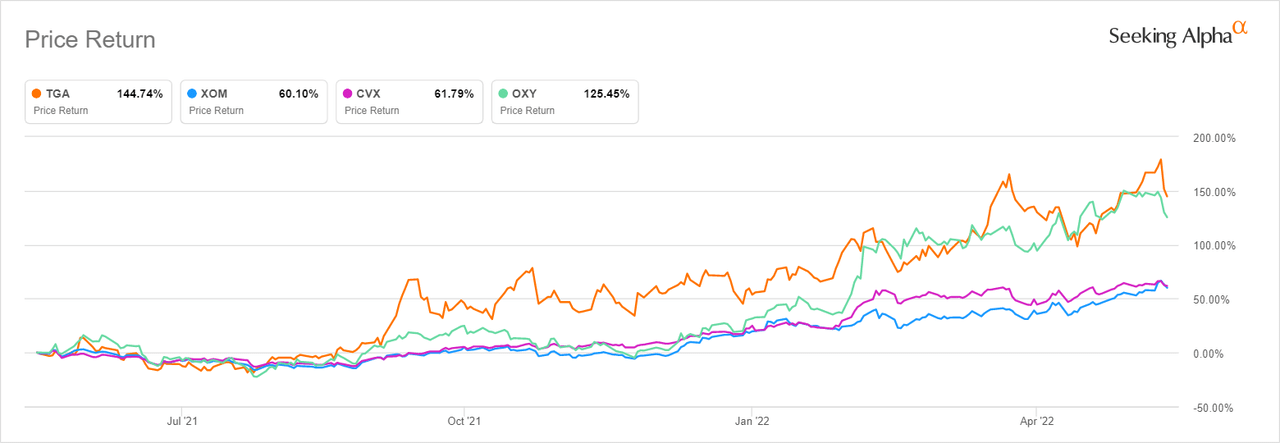

TGA has in the last 1 year outperformed most of the high flying large caps that have dominated headlines – Exxon Mobil Corporation (XOM), Chevron (CVX) and Occidental (OXY).

TGA 1 year performance vs oil majors (Seeking Alpha)

TGA’s strong performance is likely to continue for two reasons. The first and obvious one is the current crude oil price environment which has buoyed oil and gas stocks across the board. The second is the fact that, compared with similarly sized oil producers, TGA is the best performer where it matters most: cash generation, debt reduction and returning cash to shareholders.

TGA is best in its peer set

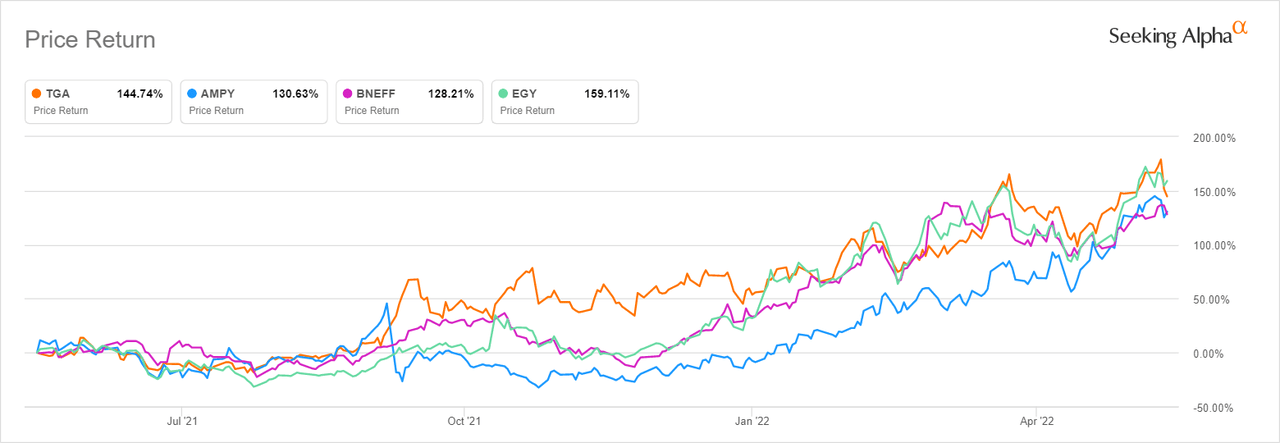

TGA’s peers include Amplify Energy Corp (AMPY), a Texas based producer, Bonterra Energy Corp (OTCPK:BNEFF), a Canada based play, and VAALCO Energy (EGY), also based in Canada. The table below provides some highlights of how these companies compare with each other on key metrics (data from Seeking Alpha)

|

TGA |

AMPY |

BNEEF |

EGY |

|

|

Employees |

55 |

210 |

36 |

117 |

|

Revenue [TTM] |

$203.91 M |

$357.68 M |

$209.78 M |

$227.96 M |

|

Market Cap |

$350 M |

$341 M |

$363 M |

$469 M |

|

Enterprise Value |

$317 M |

$553 M |

$547 M |

$459 M |

|

Total cash (Mrq) |

$37.25 M |

$15.61 M |

$205.57 K |

$18.94 M |

|

Total debt (Mrq) |

$3.87 M |

$228.3 M |

$187.85 M |

$8.64 M |

In cyclical sectors like oil and gas, a crucial test of a management team’s prowess is how effectively it generates cash in times of favorable prices and how wisely it deploys this cash to create shareholder value. If you compare TGA with its peers on this metric, it is the best performer despite having the lowest revenue for the trailing twelve months.

TGA also generates more profits from its assets compared with its peers. TGA’s return on total capital is the highest in its peer set at 39.9%, significantly higher than BNEFF (24.77%), EGY (26.52%) and loss-making AMPY (-31.43%). Return on capital tells you the amount of profit a company is generating per $1 of capital employed.

Importantly, TGA is using the cash it generates to grow shareholder value. One way it has done this is by drastically reducing its debt. It has the lowest debt of its peers, which is highly advantageous as we move into a global economic cycle that will be marked by higher interest rates. Besides paying off its debt, TGA has also significantly ramped up dividends. In March, it declared a dividend of $0.10 per share, a 185% increase from the $0.035/share it paid in 2019.

In light of its improving cash position and strong balance sheet, TGA has adopted a distribution policy to allocate a minimum of 75% of its annual free cash flow to its shareholders through dividends and share buybacks.

TGA 1 year performance vs peer set (Seeking Alpha)

If you look at the stock chart of TGA, AMPY, and EGY, you can see that they have all been moving higher together in the past year in step with rising crude oil prices. While we expect all these stocks to continue benefiting from high crude oil prices, we expect a divergence in performance between TGA and its peers based on the company’s better cash generation, low debt, and shareholder distributions. Moreover, as rate hikes gain momentum in the US and other economies around the world, we expect investors to pay a premium for names with low debt and sell off those with high debt, creating an opportunity for higher returns in TGA relative to its peers, particularly AMPY and BNEFF which are both highly leveraged.

Key risks

TGA is a good pick for investors looking to make high returns in oil and gas exploration and production. The fact that it is a small cap means that it can move faster than its larger peers. It is also fairly valued at 2.37x EV/EBITDA [TTM], which is lower than EGY’s 6.08x. The reason we are comparing it with EGY and not the rest is that EGY is the only similarly sized peer that is tracking in line with TGA in terms of its debt profile, cash generation and profitability. AMPY is unprofitable and BNEFF, while profitable, is heavily indebted.

For all its positives, however, investors also need to be aware of the key risks in TGA. The first is the sustainability of the dividend and share repurchase plans. The company’s dividend, which it intends to pay semi-annually, is correlated to its Egyptian operations cash flow, according to the company’s press releases. In its June 2022 investor presentation, the company notes that it has renewed its key projects in Egypt. This notwithstanding, there is significant concentration risk in terms of TGA’s asset base. Relying heavily on one country can prove disastrous in the event of economic, political, or military developments.

The other risk is a decline in oil prices. Although analysts see the current high prices remaining in place for a while, oil prices will eventually decline. That is just the inherent nature of cyclical sectors. When this happens, small caps such as TGA that have risen much faster than large caps will also decline much faster. Investors who buy into TGA therefore need to be mindful of this volatility and manage their trades and risk accordingly.

Be the first to comment