xenotar

Introduction

This article has two purposes. First, we’ll discuss why the TransDigm Group (NYSE:TDG) is one of the best ways to buy aerospace exposure. The company has a unique business model, which makes the company a private equity giant focused on buying niche aerospace tools to get pricing power and exposure in all major aerospace programs – both commercial and defense. Second, we are going to discuss timing. The company’s stock price has dropped close to 16% year-to-date, which is opening up new opportunities for investors who want to add aggressive growth to their portfolios.

So, let’s get to it!

A Superior Business Model

TransDigm is a Cleveland, Ohio, based aerospace company with a market cap of $28.3 billion.

The company is one of the few stocks on the market with a business model that comes very close to what I would file in the “genius” category.

Founded in 1993, the company is a leading global designer, producer, and supplier of highly engineered aircraft components for use on nearly all commercial and military aircraft programs that are in service today.

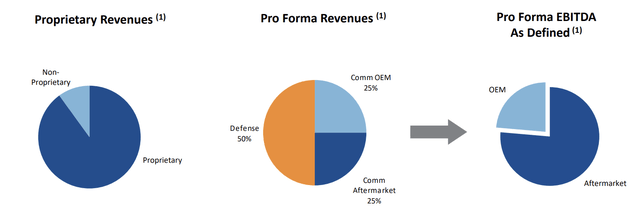

Even better is that the company isn’t just selling “random” parts. 90% of its products are proprietary products. But that’s not everything. The company estimates that 80% of its net sales come from products for which TransDigm is the sole source provider.

In other words, the company acquires smaller companies in the industry, which allow the company to become the sole provider of certain products. This helps to establish more pricing power. Especially because a lot of the company’s products are smaller items. For example, aggressively hiking the price of a small plastic part is much easier than hiking the price of a new engine – in the case of other suppliers. And then again, TDG is the sole provider of 80% of its products. It always helps when your customer doesn’t have a different source.

The company’s products are also highly diversified. The company produces mechanical actuators and controls, ignition systems, engine technologies, pumps and valves, electric motors, radio and antenna systems, winches, handling systems, safety products, and thousands of other products.

We’re still not finished. Another benefit is that most of its products generate significant aftermarket value. TransDigm estimates that the average life of an aircraft program it sells to is 25 to 30 years. That would indicate that it can sell products to a single aircraft for up to 50 years.

The company’s top 10 customers account for roughly 42% of total sales. No customer accounts for more than 10% of its net sales.

With that said, TransDigm is basically a private equity company. It owns more than 48 independent companies that all operate under their own names. In the US alone, the company has 60 manufacturing locations, employing more than 7,000 people.

According to the company:

Our long-standing goal is to give our shareholders private equity-like returns with the liquidity of a public market. To do this, we stay focused on both the details of value creation as well as careful allocation of our capital.

A Return To Growth And Outperformance

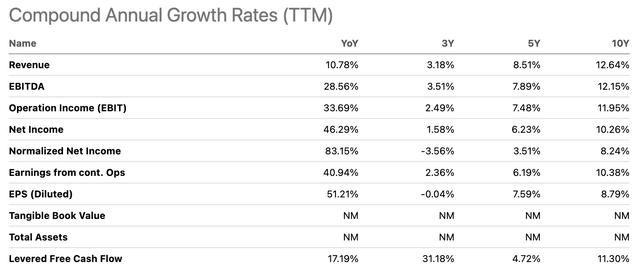

Using the Seeking Alpha overview of TDG’s compounding annual growth rates, we see that over the past 10 years, revenue growth was 12.6% per year. During this period, the company grew annual revenues from roughly $1.7 billion to almost $5.0 billion.

The sales performance of the past 3 and 5 years has come down, which is a result of the pandemic. Yet, it did not contract – at least not using a multi-year average.

Because of the sudden pandemic that resulted in lockdowns, empty airports, and the biggest wave of uncertainty in recent history, aerospace manufacturers slowed down their purchasing plans. After all, nobody knew when demand would come back. Companies preferred to work with existing inventory, which meant TDG and its peers were dealing with pressure on sales for roughly two years.

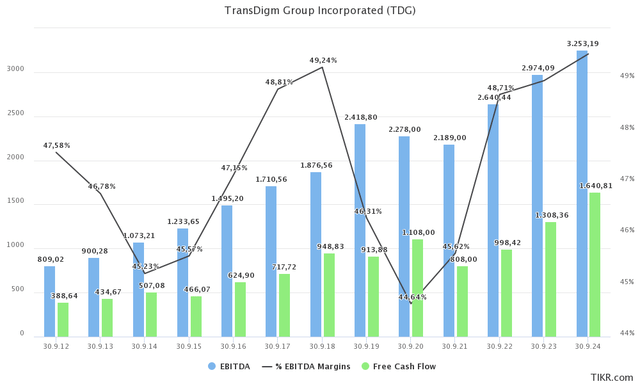

As the chart below shows, the company’s EBITDA peaked in FY2019 at $2.4 billion. It declined until FY2021. The 2022 fiscal year, which just ended is expected to be the first year with a record in EBITDA. It’s also expected to show a steep increase in EBITDA margins, which are a key driver behind this uptrend. Moreover, free cash flow is expected to gradually move towards $1.0 billion again, which would imply a 3.5% free cash flow yield, using the company’s $28.3 billion market cap.

In FY3Q22, the company witnessed 23% pro forma revenue growth in commercial OEM, 44% growth in commercial aftermarket, and flat growth in defense as a result of a delay in shipments and government spending. Also, supply chain issues with customers didn’t help.

This is what the company commented in August of this year:

With softened or fully lifted travel restrictions in majority of countries and the summer travel season upon us, passenger travel demand has been strong. China domestic air traffic remains low but is making progress from its most recent sharp drop-off due to strict Zero-COVID policies limiting travel. International traffic in China is finally starting to improve off of COVID lows.

These comments are still valid despite slowing economic growth. Short-haul travel has recovered in the United States. Long-haul is still an issue and a major driver of demand growth going forward. China is hard to predict. So far, the Chinese continue to stick to zero-COVID, which will delay the long-haul recovery until 2024-2025, I believe.

Given these developments, the company is positioned to return to strong, double-digit annual EBITDA growth. This also helps the company’s debt load.

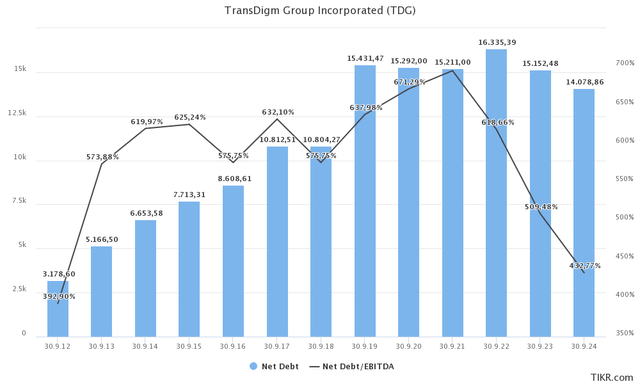

Acquiring growth comes with higher debt. In FY2012, the company had $3.2 billion in net debt (gross debt minus cash). Back then, it was close to 4.0x EBITDA. That number accelerated to more than $15 billion, as a result of aggressive acquisitions. The leverage ratio hovered above 6.0x EBITDA, quite consistently.

That’s a problem in light of the ongoing surge in interest rates – and weakening economic growth. Roughly half of the company’s debt is variable rate debt.

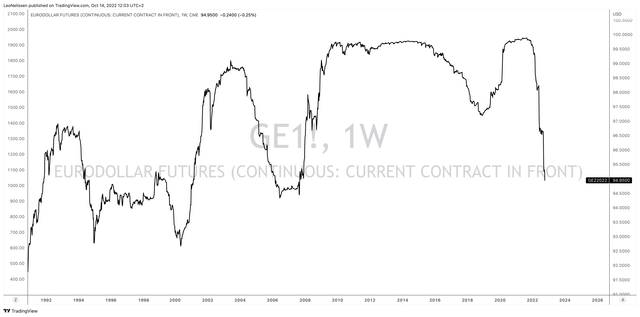

CME eurodollar futures are trading below $95, indicating a LIBOR rate close to 5.0%. That’s the highest rate since pre-Great Financial Crisis levels and well above anything the company had to deal with when central banks in developed nations were applying zero-interest rate policies.

TradingView (Eurodollar futures)

With that said, TDG is in a rather good position – despite the high (variable) debt load. As of July 2, 2022, the company has $19.9 billion in total debt. Net debt is $16.1 billion, incorporating $3.8 billion in cash.

The FY22 weighted average interest rate is 5.45%.

It is important to mention that TDG has hedged its variable interest rates. 85% of its interest rates are fixed through the calendar year 2025. This buys the company a lot of time. This allowed the company to maintain a steady average interest rate. At LIBOR 2.8%, the average interest rate is 5.9%. A LIBOR surge to 5.0%, only results in a 30 basis points increase in that rate to 6.2%.

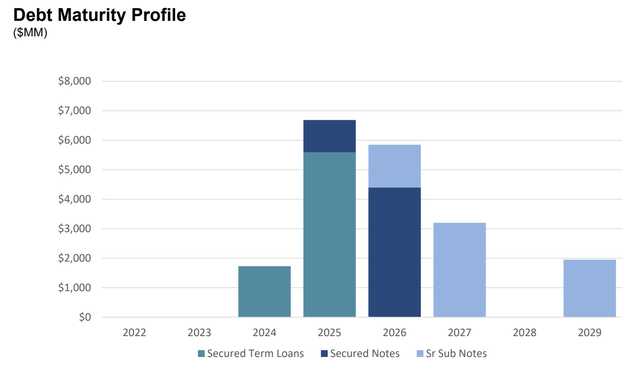

Moreover, the company has no major maturities until 2025. Its credit rating is B+, which is in the “junk” category.

Hence, the company did not change its capital spending priorities.

The priorities are unchanged: first, reinvesting in our own businesses; second, acquisitions; third, returning capital to shareholders via dividends or share repurchases; and finally, paying down debt, which seems unlikely at this time but remains an option. From an overall cash liquidity and balance sheet standpoint, we believe we remain in a strong and good position going forward.

Investments in its own business are straightforward. In FY2014, the company had capital requirements of roughly $35 million. This number has gradually grown to more than $100 million in FY2021. FY2022 is expected to see CapEx at $136 million. This steady increase is the result of acquisitions, inflation, and minor changes in the company’s planning.

Acquisitions are harder (impossible) to predict. The most recent deal was the acquisition of DART Aerospace in a $360 million deal. As reported by Seeking Alpha:

The company expects DART, whose products “have a strong presence across major commercial rotary-wing platforms as well as select applications for defense and safety services,” will generate $100M in pro forma revenues for calendar year 2022.

Moreover, dividends are also irregular as TDG does not pay a regular quarterly dividend. It pays special dividends. The most recent was declared on August 9, when management announced an $18.50 per share dividend. That’s roughly 3.5% of the current stock price.

Prior to that, TDG announced a $32.50 special dividend after it sold Souriau-Sunbank to Eaton (ETN).

Thanks to its many qualities, TDG has been a steady outperformer. Albeit with a high standard deviation, which is partially caused by its high debt load (higher financial risk).

Going back to January of 2007, TDG has returned 27.5% per year, beating the S&P 500 by almost 20 points. This performance has come down a bit in recent years. However, even over the past five years, including two pandemic years, TDG shares have returned 18.8% per year.

So, what about the valuation?

Valuation

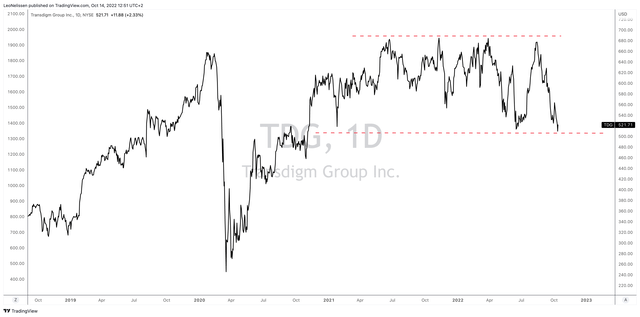

TransDigm is down 16% year to date, which means it’s outperforming the market by roughly 700 basis points. I believe this is mainly due to its defense exposure, rebounding growth in long-haul demand, and the fact that its balance sheet is in better shape than one might think looking at some of the numbers.

Right now, the stock price is once again at the lower bound of a volatile long-term range.

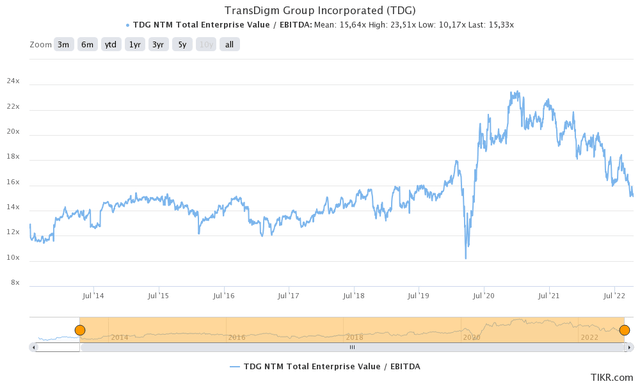

The company is currently trading at 14.5x FY2023E EBITDA of $3.0 billion, which is based on its $28.3 billion market cap and $15.2 billion in expected FY2023 net debt.

This implied valuation is the lowest number since the start of the pandemic and the median of the valuation prior to 2020.

This doesn’t make this a guaranteed bottom, especially not given ongoing economic risks and an aggressive Fed – I summarized all of this in this article. However, If I were looking for aerospace growth stocks, I would start buying at these levels.

Takeaway

TransDigm is one of my favorite aerospace stocks that I currently do not own. The only reason why I do not own TDG is the fact that I have close to 25% of my entire net worth invested in aerospace and defense stocks. All of them are reliable dividend growth stocks. Hence, I’m diversifying before I buy more stocks in the industry.

What makes TDG so special is its dominant position in the aerospace supply chain. The company supplies critical parts for every major commercial and defense program. Most of its products have no competition, and aftermarket sales provide the company with up to 50 years’ worth of sales in each program.

This comes with pricing power, which helps the company to grow through organic growth and M&A. Free cash flow is rising, EBITDA margins are improving, and hedged debt help the company to be back on track after two challenging COVID years.

Thanks to ongoing economic challenges, the company is now trading at an attractive price.

On a long-term basis, I have little doubt that TDG will continue to outperform the market by a wide margin.

(Dis)agree? Let me know in the comments!

Be the first to comment