Ethan Miller/Getty Images News

Trane Technologies (NYSE:TT) is one of the largest manufacturers of heating, ventilation, air conditioning, refrigeration systems, and other industrial systems is a buy for the total return growth investor. Trane Technologies has good cash flow, and the company uses some of the cash to expand its product line. The remainder of the cash is used to increase dividends each year and buy back shares raising the stock price. Trane Technologies is 6.4% of The Good Business Portfolio, being my IRA portfolio of good business companies that are balanced among all styles of investing. This full growing position will be watched and trimmed when it reaches 8% of the portfolio.

As I have said before in previous articles.

I use a set of guidelines that I codified over the last few years to review the companies in The Good Business Portfolio (my portfolio) and other companies that I am reviewing. For a complete set of guidelines, please see my article “The Good Business Portfolio: Update to Guide-lines, March 2020“. These guidelines provide me with a balanced portfolio of income, defensive, total return, and growing companies that hopefully keep me ahead of the Dow average.

Trane Technologies is a great investment for the industrial growth investor when the United States economy is growing, and the recent earnings show it is growing well, but we have rising interest rates and high inflation as a negative. I will hold my 6.4% position in the portfolio until after the mid-term elections.

Fundamentals

A quote from the 2nd quarter earning call by the CEO David Regnery sums up the recent business productivity as the impact of the COVID pandemic is controlled, helping the company get back to normal.

I want to frame up the bigger picture, the strategy that enables Trane Technologies to deliver differentiated financial performance and shareholder returns. First and foremost, we are driven by purpose. We love what we do because we are forging new ground for a better, healthier world. Our people take pride in knowing their work makes a real difference for our customers, our communities, and for the world. Our purpose-driven strategy is aligned to mega-trends that are only getting stronger. We see the impact of climate change every day, including more frequent and intense weather events, like the heat waves we’re experiencing in many parts of the world. These climate events have serious and far-reaching impacts on the economy, the environment, and human health. We must act now to mitigate those impacts and ensure the health of our planet for the next generation. Trane Technologies is proud to be leading our industry with bold sustainability commitments and action to back them up. Our innovation is accelerating the decarbonization of commercial buildings, homes, and transport. Our purpose-driven strategy, relentless innovation, and strong customer focus enable us to deliver a superior growth profile through cycles. This, in turn, helps us drive strong margin and powerful free cash flow to deploy through our balanced capital allocation strategy. The end result is strong value creation across the board for our team, our customers, our shareholders, and the planet. In the second quarter, organic bookings were up 7%, reaching the highest level in the company’s history at $4.6 billion. As a result, the backlog also eclipsed prior records, rising to $6.5 billion, up 43% year-over-year, and more than twice historical norms.

This shows the feelings of the CEO and the continued growth of the Trane Technologies business and shareholder return via increased earnings and revenues. Trane Technologies has good growth and will continue as the focus of the pandemic gets controlled by the vaccines distributed worldwide. Morgan Stanley just raised its Trane Technologies’ one-year price target is $166.00 with a buy rating giving you a possible gain of 0% in a year and making Trane Technologies a fair buy at this time considering the estimated yearly growth. The projected one-year PE is average at 18, which shows Trane Technologies’ prospect of growth. Trane Technologies is a large-cap company with a capitalization of $30.6 billion, well above my guideline target of at least $10 billion. Trane Technologies’ 2022 projected increase of 10% in operating revenue is good for a solid growing income for this industrial company.

One method I use to compare companies is to look at the total return. If a company cannot beat the market, why do you want to invest in it? The good Trane Technologies’ total return of 115.92% compared to the Dow base of 70.54% makes Trane Technologies a good investment for the total return investor. Looking back five years, $10,000 invested five years ago would now be worth over $20,700 today. This gain makes Trane Technologies a good investment for the total return investor looking back, which has future growth as the United States and the worldwide economy continues to grow with the increasing need for more HVAC equipment to fight COVID.

Trane Technologies does meet my dividend guideline of having dividends increase for 8 of the last ten years and having a minimum of 1% yield. Trane Technologies has an average dividend yield of 2.0% and has had increases for eight years of the last ten years, making Trane Technologies a good choice for the dividend growth investor. The 3-year dividend growth rate is 6%, and TT should return to its 5-year dividend growth rate of 10.64 as the COVID virus is controlled in late 2022. The five-year average payout ratio is moderate, at 34%. After paying the dividend, this leaves cash remaining for increasing the business of the company by expanding its product line, increasing foreign sales, and increasing the dividend, all of which raise the earnings and value to the shareholder. The graphic below shows the balanced approach of the company to increase the business and reward the shareholder.

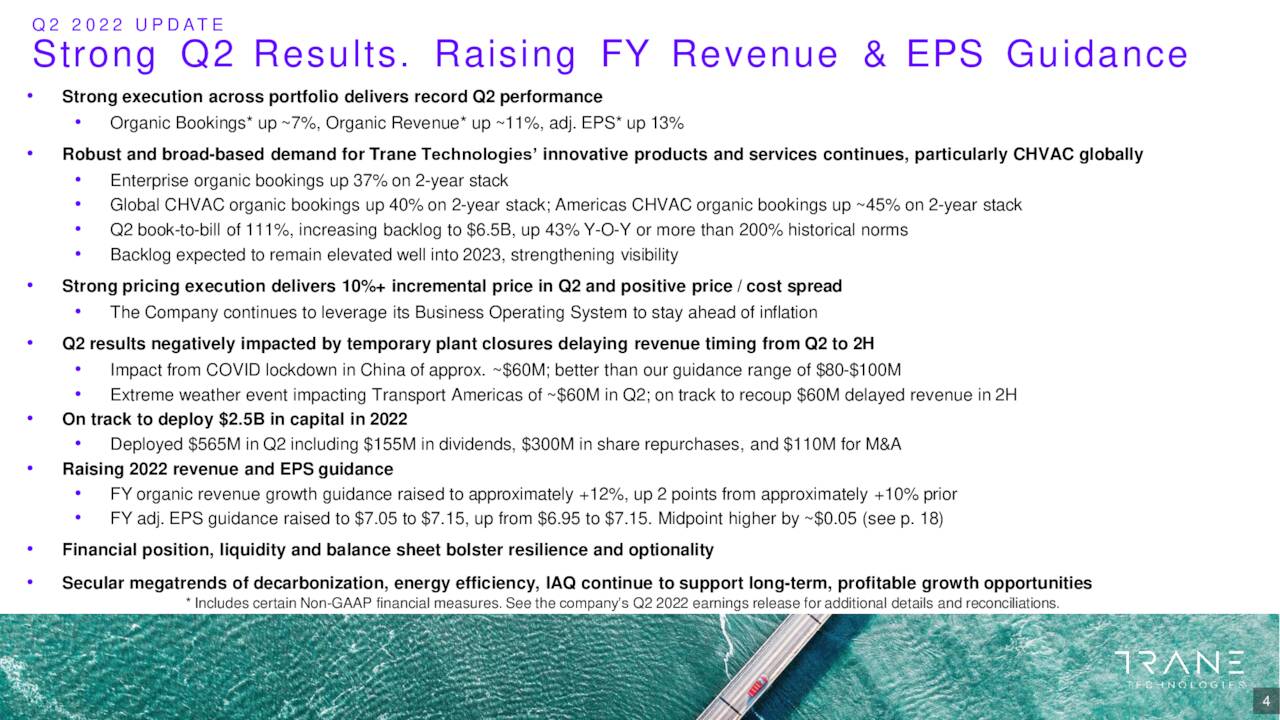

Strong Q2 earnings (Q2 Earnings call slides)

I have capitalization and growth guidelines where the capitalization must be greater than $10 billion and the growth greater than 7%. Trane Technologies passes these guidelines. Trane Technologies is a large-cap company with a capitalization of $34.9 billion, well above the guideline target. Trane Technologies 2022 projected cash flow from operations at $2.1 billion is excellent, allowing the company to have the means for company growth and increased dividends.

One of my guidelines is whether I would buy the whole company if I could. The answer is yes. The total return is good, and the dividend growth makes a good combination of growth and income. The Good Business Portfolio likes to embrace all kinds of investment styles. Still, it concentrates on buying businesses that can be understood, makes a fair profit, invests profits back into the business, and generates a fair income stream. Most of all, what makes TT interesting is the long-term growth of the world economy and industrial budgets as the COVID virus gets controlled by the vaccines, giving you increasing growth.

A qualitative guideline I don’t mention often is how you think about your investments. Don’t just think of buying shares as pieces of paper but think of yourself as an owner of the company you are, and understand its business and how it made its profit. If you can’t understand the business, don’t invest in the company.

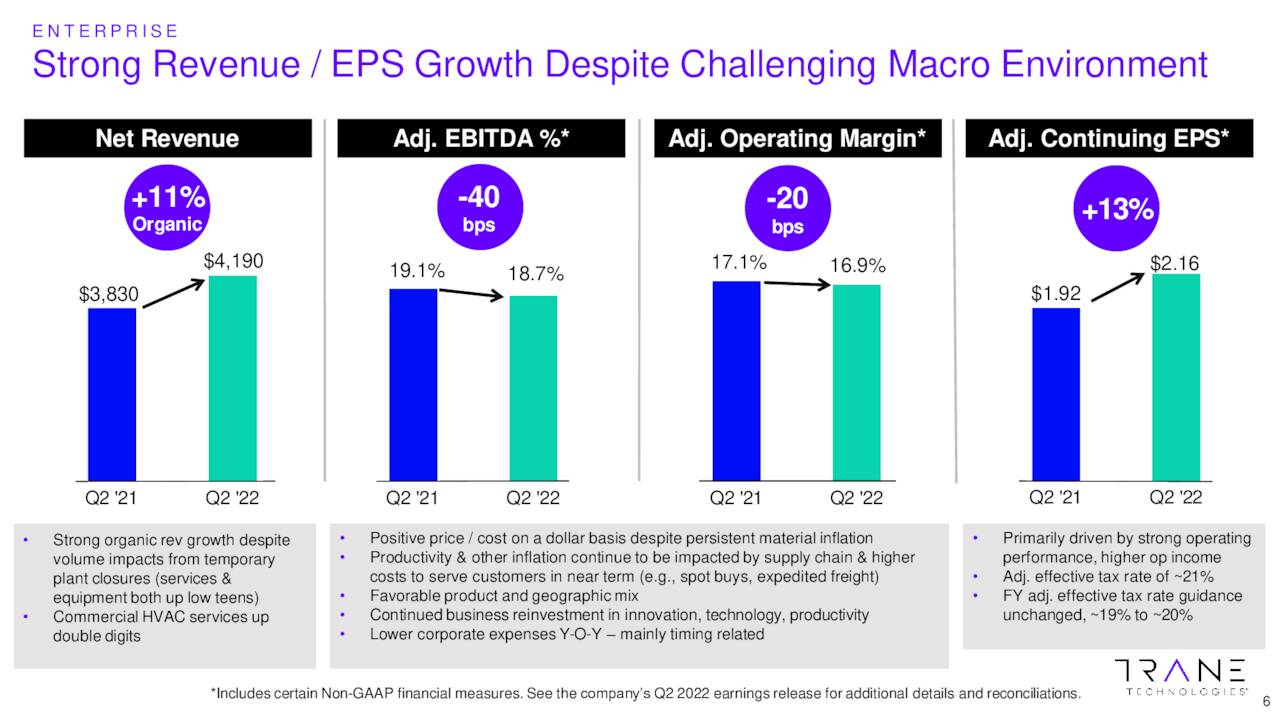

I look for the earnings of my positions to consistently beat their quarterly estimates. For the last quarter, on August 3, 2022, Trane Technologies reported earnings that beat expected at $2.16 by $0.05, compared to last year at $1.92. Total revenue was higher at $4.2 billion more than a year ago by 9.7% year over year and beat expected total revenue by $90 million. This was a great report with a bottom-line beating expected, the top line increasing, and a bottom-line increase compared to last year. The next earnings report will be in November 2022 and is expected to be $2.22 compared to last year at $1.73, a nice increase. The graphic below shows a comparison of earnings between 2021 and 2022 for Q2.

EPS Growth (Q2 Earnings Call Slides)

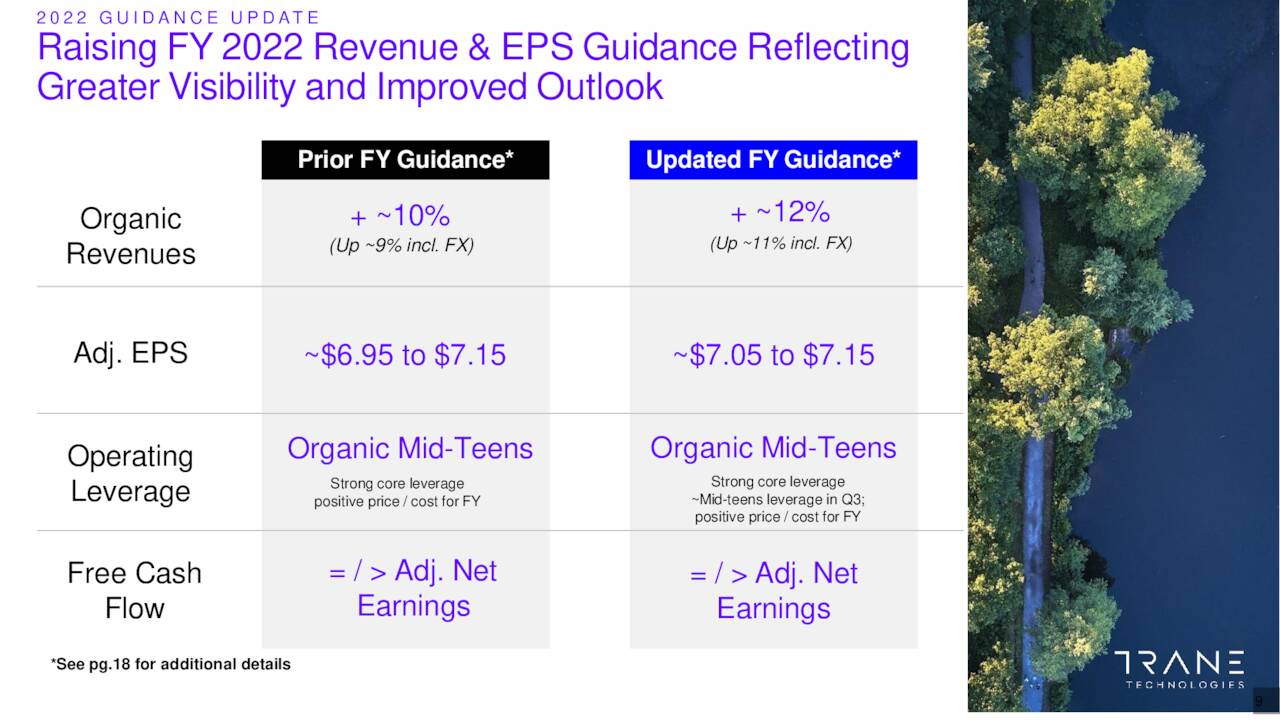

Trane Technologies manufactures on a global scale heating, ventilation, air conditioning, and refrigeration systems. Overall, Trane Technologies is a good business with a 10% CAGR projected growth as the worldwide economy grows going forward with the increasing demand for TT’s industrial products. The good earnings and revenue growth looking forward provide Trane Technologies to continue its growth as the HVAC business increases and foreign sales are expanded. The graphic below shows the guidance for 2022 with Solid revenue and cash flow improvement.

Guidance (Q2 Earnings Call Slides)

This shows top management’s feelings for the continued growth of the Trane Technologies business and shareholder return with an increase in future cash flow growth. Trane Technologies has good growth and will continue as the world’s industrial budgets grow.

Risks and Negatives of the business

Trane Technologies has great products, and they keep adding new varieties to existing products and developing new products that increase their sales. Still, there is always the risk of a new product failing. As more businesses and people get back to work, Trane Technologies’ earnings should continue their steady growth unless they are impacted by new varieties of the COVID virus. There is also always the risk of government regulation that could hurt Trane Technologies’ product development and cause a decrease in earnings. The last factor is the exchange rate to the dollar since Trane Technologies has a worldwide business.

Conclusions

Trane Technologies is a good investment choice for the total return investor with its good projected growth as worldwide industrial budgets increase. The company is using its cash to buy bolt-on companies and increase the dividend. Trane Technologies is 6.4% of the Good Business Portfolio and will be held until it becomes 8% of the portfolio. Then it will be trimmed down by 1%. If you want a steadily growing total return in the industrial business, Trane Technologies may be the right investment for you.

The Good Business Portfolio’s total return is behind the Dow average from 1/1/2022 to August 15 by 1.5%, which is a loss below the market loss of 7.09% for a total portfolio loss of 8.59%. Each quarter after the earnings season is over, and I write an article giving a complete portfolio list and performance. The latest article is titled “ The Good Business Portfolio: 2022 First Quarter Portfolio Review“. We still have 4.5 months in the year and the mid-term elections to make the portfolio profitable.

Be the first to comment