Torsten Asmus

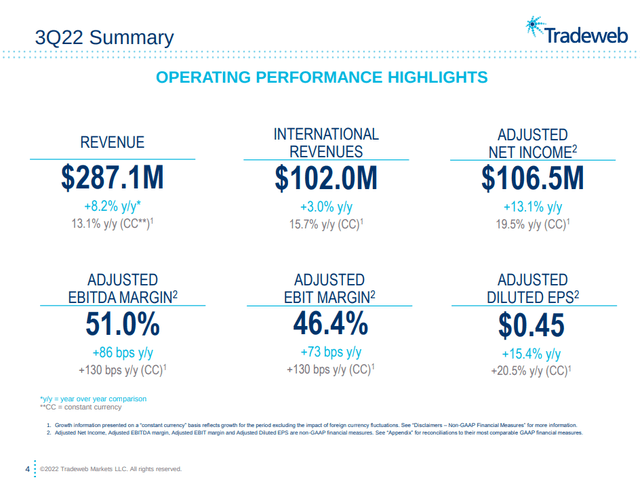

Tradeweb’s (NASDAQ:TW) valuation is starting to get interesting, and this is rare given that as a reliable growth company the valuation has historically been pretty expensive. For the most recent quarter, Tradeweb reported solid results, with strong trading volume that was partially offset by foreign exchange headwinds. Revenue increased 8.2% from last year, or 13.1% when adjusted for foreign exchange impacts. Adjusted diluted earnings per share of $0.45 were 15.4% higher than last year, or 20.5% higher on a constant-currency basis.

Importantly, the company continues to deliver well balanced growth, with double-digit average daily volume growth across US high grade credit, munis, CDS, global ETFs, equity derivatives, repos, and retail certificates of deposit. The interest rate swap market and credit remain two of its biggest growth areas.

This quarter’s adjusted EBITDA margin of 51.0% increased by 86 basis points on a reported basis and 130 basis points on a constant currency basis relative to the third quarter of 2021. The company believes it can continue delivering margin expansion going forward. The slide below summarizes the operating performance of the company in the third quarter of 2022.

Tradeweb Investor Presentation

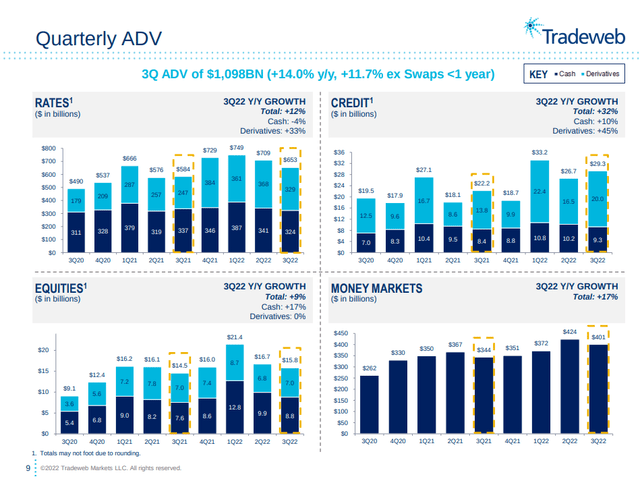

Impressively, Tradeweb reported record third quarter average daily volume of nearly $1.1 trillion, up 14% y/y, and up 12% when excluding short tenor swaps. Among the 22 product categories that the company includes in their monthly activity report, 10 of the 22 product areas produced y/y volume growth of more than 20%.

Tradeweb Investor Presentation

Growth

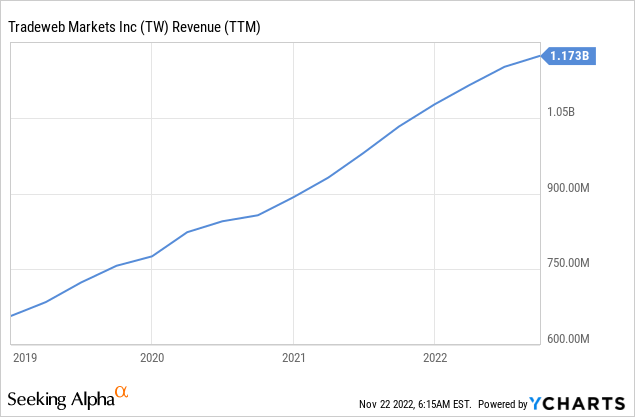

For investors one reason to like Tradeweb is its very reliable revenue growth. From 2004 to 2021, the company averaged 12.9% annual revenue growth. So far it looks like growth is set to continue. For example, in the first three quarters of 2022 Tradeweb generated revenues of $896 million, up 55% from the first three quarters of 2019, or an average growth of 16% per year. It accomplished this despite the material foreign exchange headwinds the company is facing in 2022. The company believes that it still has a long-term growth runway ahead as most of its markets are still trading over the phone.

Balance Sheet

Another reason to like Tradeweb is that it has an excellent balance sheet. The company ended the third quarter holding $1.1 billion in cash and cash equivalents, and free cash flow reached $555 million for the trailing twelve months. The company has access to a $500 million revolver that remains undrawn as of the end of the quarter, and has basically no long-term debt.

Competitors

Tradeweb’s main competitor is MarketAxess (MKTX). We previously compared both companies in another article. It also competes to a certain degree with Bloomberg in some products. During the most recent earnings call, there was an interesting question on competition. President & Director William Hult, who by the way is also going to be the next CEO of the company next year, gave an answer worth sharing here. In his response to the question on competition, he argues that Tradeweb mostly competes by using innovation, more than lower prices, and that the market supports and wants competition.

I kind of have made this point before pretty strongly that as we have entered into the credit space and shown our ability to really compete in the credit space at a very high level, we’ve never kind of led with price.

I think that’s an important thing. We’ve led with innovations and creating efficiencies for our clients and we feel at a very – in a very strong way that the market is really supportive and wants kind of this competition in a way that you just described because they benefited from it.

And I’ve always been, I think you know in a very straightforward way, like a complementary of MarketAxess from the perspective of having gotten a lot of things right. I think they were a little bit late around portfolio trading and have done a very good job recently of understanding how important that protocol is and doing better in it.

One of the things for sure that we found is, as we delivered innovations into our customers, specifically speaking, around portfolio trading or around net spotting and net hedging, we are able to get more of their kind of traditional RFQ business as a consequence. So in the exact way that you described, I do think there is some convergence of where we are all competing.

That being said, again, high level and in a really important way, the market really does want to support and have this kind of competition in the space. As you know exceptionally well, we grew up competing in a lot of the markets that we are in, Alex, with Bloomberg from essentially day one.

So that competitive dynamic has kind of existed for us always and I think it makes both firms better and I think the clients wind up winning as we continue to innovate.

Valuation

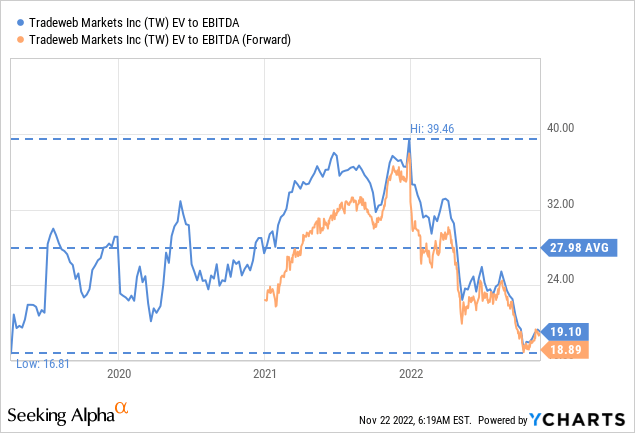

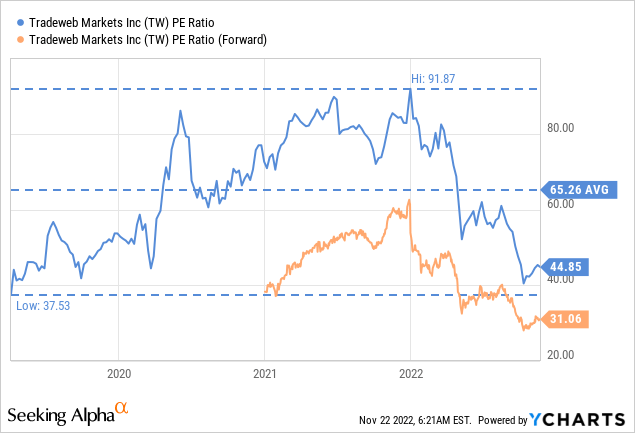

As previously mentioned, Tradeweb is a company that has historically traded at a very rich valuation. Since its IPO its EV/EBITDA multiple has averaged ~27.9x, and at one point went up almost to 40x. Despite the company continuing to have excellent growth prospects, the valuation has come down considerably. It now trades with a multiple of ~19x. For comparison, competitor MarketAxess’ multiple is around 23x.

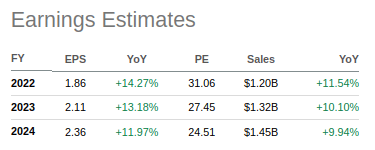

The price/earnings ratio still looks elevated, but is almost a third cheaper than what it has averaged since the IPO. The forward p/e is much lower at roughly 31x.

Shares are trading at approximately 24.5x fiscal year 2024 analyst earnings estimates. For a growth company with a long runway ahead, we don’t think that this valuation is too demanding.

Seeking Alpha

To value the shares, we like to discount future earnings. Using analyst estimates for the next three years, 15% EPS growth for the next seven years, a 10% discount rate, and a terminal growth rate of 3%, we estimate a net present value per share of roughly $55. This is very close to where shares are currently trading, which leads us to believe that investors buying today can probably expect returns of ~10% per year.

| EPS | Discounted @ 10% | |

| FY 22E | 1.86 | 1.69 |

| FY 23E | 2.11 | 1.74 |

| FY 24E | 2.36 | 1.77 |

| FY 25E | 2.71 | 1.85 |

| FY 26E | 3.12 | 1.94 |

| FY 27E | 3.59 | 2.03 |

| FY 28E | 4.13 | 2.12 |

| FY 29E | 4.75 | 2.21 |

| FY 30E | 5.46 | 2.32 |

| FY 31E | 6.28 | 2.42 |

| FY 32 E | 7.22 | 2.53 |

| Terminal Value @ 3% terminal growth | 103.13 | 32.86 |

| NPV | $55.49 |

Risks

The current valuation is discounting a good amount of growth ahead, so should growth decelerate, the share price could fall significantly. We believe a potential growth disappointment is the biggest risk, but there are also other risks worth considering including regulatory risk.

Conclusion

We believe Tradeweb’s valuation is now attractive, with revenue growth remaining strong despite currency headwinds. The company has an excellent track record of growth and new product innovation. Our estimated fair value for the shares is very close to the current share price, leading us to believe investors buying today can probably expect ~10% returns going forward. While there are risks to consider, including a potential growth deceleration and regulatory risks, we consider shares to be attractive at current prices.

Be the first to comment