Sarah Silbiger/Getty Images News

Congressional insider trading is a rare topic in U.S. politics which has led to a bipartisan movement in finding new and effective ways of either limiting or completely denying the ability of U.S. lawmakers to participate in individual securities trading. It is the nature of their public service which allows them access to confidential information often weeks or months before it becomes available to the general public. This allows for a clear and unfair advantage which many in the U.S. Congress seemingly utilize as a tool in order to generate returns that by far outpace the average investor.

The Democrat from Long Beach California has had his fair share of trouble keeping his name out of news headlines concerning insider trading over the years. Throughout his 30-year-long tenure as a public serviceman, he has proven to be one of the most successful investors on the Congressional floor. Incidents surrounding the Lowenthal family and their questionable trading practices ranged from late filings to eyebrow-raising timely trades. As far as additional questionable trading practices go, you can view our Nancy Pelosi article here.

Some of the more problematic cases involve Mr. Lowenthal, a member of the House Committee on Natural Resources and the chairman of an energy-related subcommittee, pushing for the inclusion of renewable energy companies in pandemic relief measures, while his wife happened to have bought the pandemic-era dip on Sunrun (RUN) that provides home solar energy systems. Similar cases followed him throughout the years, such as one where his wife sold shares of Boeing (BA) a day before a House committee meeting, in which Mr. Lowenthal was sitting, released its damaging report on the company’s 737 Max plane crashes.

Following the introduction of the 2012 STOCK Act, members of congress are required to make their trading record available to the public, which in turn made it possible for us to collect and utilize years of Congressional trading data. In today’s article, we will discuss how we have successfully leveraged the collected trading data of the current Long Beach representative, in order to design a trading strategy that attempts to emulate his trading style. Thus, allowing the average investor the ability to replicate a part of the trading success that the Lowenthal family has been able to enjoy for decades.

Lowenthal’s trading activity

The average American was not always privy to information on what exact stocks their public representatives were involved in trading and the returns those representatives were generating. With growing demand for more transparency, Congress passed the 2012 STOCK Act. In its current form, the bill requires members of Congress to publicly file and disclose their stock trading transactions within 45 days of the transaction date. However, while it represents a significant step forward in terms of enabling more transparency, this hasn’t kept policymakers from generating above-average returns. Congressman Lowenthal has disclosed 66 trades year-to-date. It is important to note that Mr. Lowenthal rarely trades companies in his own name, and his trades are mostly filed under the name of his spouse, while some are also made from a joint account. Here are the latest Lowenthal stock picks that are worth considering:

Amazon (AMZN)

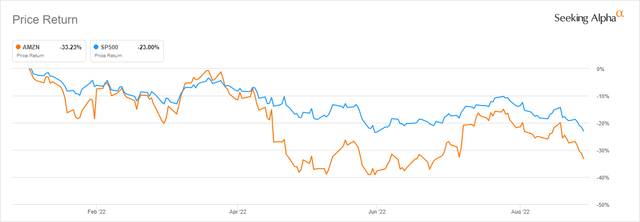

Rep. Lowenthal first opened his Amazon position in the first quarter of 2021 and has purchased shares of the Jeff Bezos empire on three different occasions since. AMZN remains his favorite FAANG stock and is currently the largest holding within our Lowenthal strategy, taking up 8.62% of the portfolio’s NAV. Amazon, like many of the high-flying tech stocks, has underperformed the market more recently and delivered a negative 33.23% year-to-date return. After the latest pullback, AMZN is currently selling for an FWD EV/EBITDA of 15.59x, FWD P/E of 68.97x, and an FWD P/FCF of 28.29x. Seeking Alpha Authors remain largely bullish about the prospects of AMZN, even after the decline, with an average rating of 3.62/5.00. On the other end, Wall Street Analysts still rate the stock as a “Strong Buy” with an average rating of 4.62/5.00. The company remains popular with members of the U.S. Congress and is also a part of our Nancy Pelosi strategy. Rep. Lowenthal most recently acquired shares in AMZN for a price of $123 per share on June 7th of this year, a day after the stocks 20-1 split. Shares of Amazon are currently trading at $120.52.

Amazon vs S&P500 YTD Returns (Seeking Alpha)

Verisk Analytics (VRSK)

Rep. Lowenthal initially opened his Verisk Analytics position in February of 2021, purchasing shares in the company on five different occasions since. The company provides data analytics solutions for U.S. and international markets. VRSK provides predictive analytics and decision support solutions to customers in rating, underwriting, claims, catastrophe, weather and global risk analytics, natural resource intelligence, economic forecasting, commercial banking, finance, and various other fields. It operates its business through three segments: Insurance, Energy and Specialized Markets, and Financial Services. Verisk delivered a negative 20.96% year-to-date return, trading mostly correlated with the broader market. The company remains priced at somewhat of a premium even after the recent decline. It is selling for an FWD EV/EBITDA of 19.84x, FWD P/E of 29.34x, and an FWD P/FCF of 41.38x. The company remains popular with members of the House Committee on Natural Resources and House Committee on Transportation and Infrastructure. Rep. Lowenthal acquired shares in VRSK twice during the second quarter of this year on the 16th and 17th of June for the average price of $180.14 per share.

Verisk Analytics and S&P500 YTD Results (Seeking Alpha)

Waste Connections (WCN)

This position was initially opened in March of 2020 after the offset of the pandemic, when Rep. Lowenthal purchased shares in Waste Connections on three different occasions. The company is in the business of providing non-hazardous waste collection, transfer, disposal, and resource recovery services in the U.S. and Canadian markets. It offers collection services to a broad range of residential, commercial, municipal, industrial, and E&P customers. It also offers landfill disposal services, and recycling services for various recyclable materials, including compost, cardboard, mixed paper, plastic containers, glass bottles, and ferrous and aluminum metals. WCN delivered a positive 4.22% year-to-date return, proving itself as a first-class defense-oriented stock. The company is currently even more steeply-priced than Waste Management (WM). It is selling for an FWD EV/EBITDA of 17.88x, FWD P/E of 34.40x, and an FWD P/FCF of 31.58x while offering a token yield of 0.65%. Seeking Alpha Authors remain largely neutral about the prospects of WCN, most often quoting the relatively high valuation and assigning it an average rating of 3.00/5.00. On the other end, Wall Street Analysts rate the stock as a buy with an average rating of 4.15/5.00. The average closing price on the dates of Mr. Lowenthal’s purchases is $102.33 and he has not yet disclosed any sales of the stock. The company is currently selling at $139.72 per share.

Waste Connections and S&P500 YTD Returns (Seeking Alpha)

Brookfield Infrastructure (BIPC)

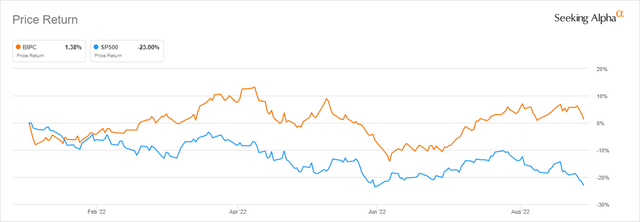

Rep. Lowenthal initially opened his Brookfield Infrastructure position in April of 2020. BIPC represents one of Brookfield Asset Management’s (BAM) publicly traded subsidiary companies. The company is in the business of investing in and operating infrastructure assets through its main four segments Utilities, Transport, Data, and Midstream. BIPC proved itself up to this point as both an inflationary and recessionary hedge, managing to generate a 1.38% year-to-date return, while the market generated a negative 23.00% during the same period. It is selling for an FWD P/FFO of 17.12x and is offering a dividend yield of 3.00% while distributing roughly 52.36% of FFO. Seeking Alpha Authors failed to reach a consensus on the subject, which resulted in an average rating of 3.00/5.00. On the other end, Wall Street Analysts are extremely bullish on BIPC, rating the stock as a “Strong Buy” with an average rating of 5.0/5.00. The company is currently trading at $41.92 per share.

Brookfield Infrastructure and S&P500 YTD Returns (Seeking Alpha)

NextEra Energy (NEE)

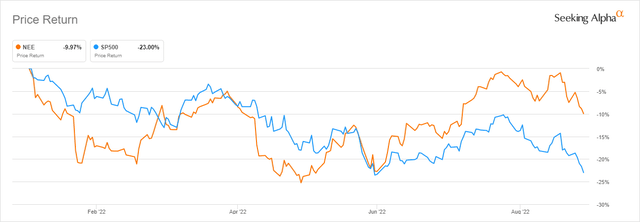

Rep. Lowenthal’s position in NextEra Energy was first opened in March of 2020 when he purchased the stock twice in the same week. NextEra Energy is a US-based energy company. The company was founded in 1925 and was formerly known as FPL Group, but changed its name in 2010 to its current one in order to better position its own brand in the market. NEE is in the business of generating, transmitting, distributing, and selling electric power to retail and wholesale customers in North America. NEE places a strong emphasis on renewable energy solutions such as wind and solar. It serves approximately 11 million people through approximately 5.7 million customer accounts in the United States. NextEra Energy delivered a negative 9.97% year-to-date return, but still managed to outperform the market by 13.03% during the same period. It is selling for a FWD EV/EBITDA of 20.46x and an FWD P/E of 30.78x, while also offering a dividend yield of 2.03%. Seeking Alpha Authors remain largely neutral about the current prospects of the company, assigning it an average rating of 3.12/5.00. On the other end, Wall Street Analysts rate the stock as a “Buy” with an average rating of 4.09/5.00. NEE is also featured in our Shelley Moore Capito Strategy. The company is currently selling at $81.98 per share.

NextEra Energy and S&P500 YTD Returns (Seeking Alpha)

Since the beginning of the year, Rep. Alan Lowenthal has purchased shares in Verisk Analytics, Boeing, JPMorgan Chase (JPM), T-Mobile US (TMUS), Constellation Brands (STZ), Netflix (NFLX), Hyatt Hotels (H), S&P Global (SPGI), ProShares Short QQQ ETF (PSQ), Sunrun (RUN), and Janus International Group (JBI).

During the same time frame, he also sold shares in Uber Technologies (UBER), iShares Russell 2000 Value ETF (IWN), Expedia Group (EXPE), HCA Healthcare (HCA), Intercontinental Exchange (ICE), Elanco Animal Health (ELAN), International Flavors & Fragrances (IFF), Autodesk (ADSK), Citigroup (C), Wells Fargo (WFC), Home Depot (HD), Medtronic (MDT), American Tower (AMT), Alphabet (GOOG).

Our approach and strategies

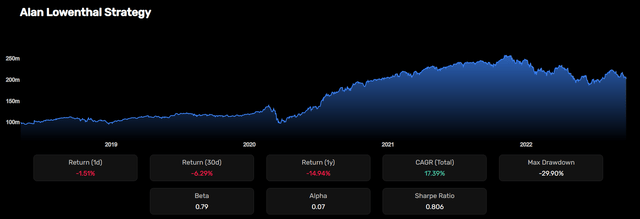

For a long time, the average John Doe was not always privy to information on what exact stocks his public representatives were involved in trading and if they were generating successful returns doing so. With the data collected, now we can attempt to change that. With the idea of benefiting from the collected datasets, we created the “Alan Lowenthal” Strategy, which approaches the data in a unique and interesting way. The strategy tracks the performance of companies that have been purchased by Congressman Alan Lowenthal. It takes a long position in stocks that have been purchased, and a short position in stocks that have been sold by her or by members of their family. The current top holding, representing slightly more than 8% of the portfolio’s NAV, is Amazon. The strategy is weighted based on the reported size of the disclosed purchases, with an implemented system of daily rebalancing. This strategy has shown a historical CAGR rate of 17.39% across its backtest period.

Alan Lowenthal Strategy (Quiver Quantitative Strategies)

If one was about to have $100 million invested in Representative Lowenthal’s stock-picking abilities at the beginning of 2018, the same investment would have compounded to $201 million as of today, which is slightly off the November high, when the portfolio hit its peak of almost $255 million. The strategy is currently outperforming the S&P500 (SPY) by 8.06%.

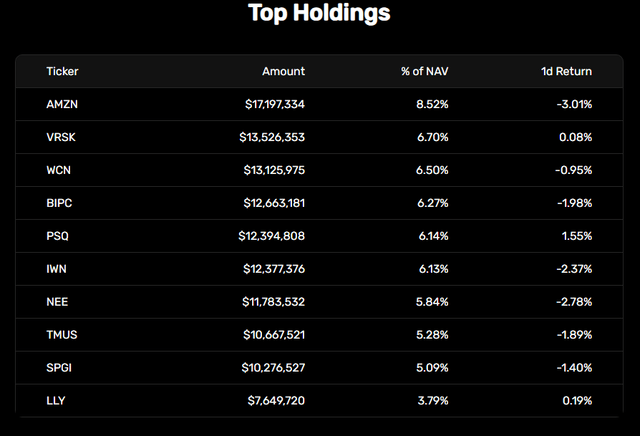

Lowenthal Strategy Top Holdings (Quiver Quantitative Strategies)

Final thoughts and conclusions

A bipartisan bloc is slowly being formed in an attempt to curb policymakers’ ability to abuse the inadequacies of the current. As pressure grows it’s easy to wonder how long Congress will be able to delay implementing any substantial improvement to the STOCK act. The Lowenthal trading record played a significant role in generating this outcry, but they remained adamant up to this day that the overwhelming majority of their trades, including the Sunrun and Boeing trades, were made by their stockbrokers and without their involvement.

Congressman Lowenthal announced late last year that he is not planning to seek reelection and to pursue a sixth term in office, leaving us without a valuable source of insider information. However, until that time arrives, one thing is for sure: there is value to be had in monitoring the trading activity of our country’s political leadership. It’s our belief that Congressional members supply the market with high-quality investment information whenever they decide to trade shares of public companies. This is what has led us on the path of creating a trading strategy that allowed us to replicate part of the trading success of Mr. Lowenthal. We stand firm by the belief that the average investor should remain open to the idea of utilizing alternative data during their due diligence process.

Be the first to comment