welcomeinside

This article is part of a series that provides an ongoing analysis of the changes made to ValueAct’s 13F stock portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 8/15/2022. Please visit our Tracking ValueAct Portfolio article for an idea on their investment philosophy and our previous update for the fund’s moves during Q1 2022.

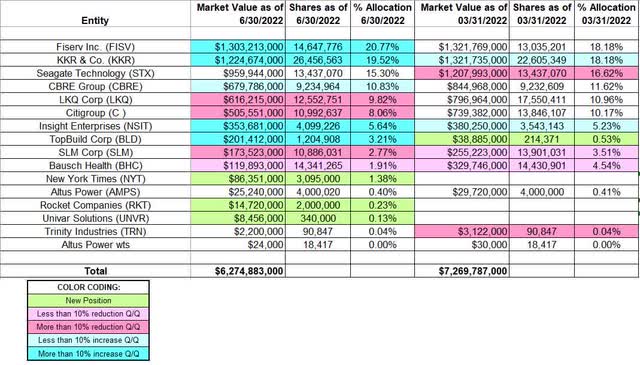

This quarter, ValueAct’s 13F portfolio value decreased ~14% from $7.27B to $6.27B. The number of holdings increased from 13 to 16. The top three positions are at ~56% while the top five are at ~76% of the 13F assets. The largest position is Fiserv which is at ~21% of the portfolio. To know more about ValueAct’s activist style of value investing, check out Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations.

Note 1: Jeffrey Ubben retired from ValueAct last June to launch Inclusive Capital Partners (climate change and social inequity focus). Many of the stakes previously in the ValueAct portfolio are now managed by Inclusive Capital Partners.

Note 2: It was reported in April 2020 that ValueAct has built a 2.6M share (~2% of the business, ~$1.1B) stake in Nintendo (OTCPK:NTDOY). The stock was around ~$50 at that time and is currently at around the same price.

New Stakes:

New York Times (NYT), Rocket Companies (RKT), and Univar Solutions (UNVR): These are the new positions this quarter. The 1.38% NYT stake was established at prices between ~$28 and ~$47 and it is now near the low end of that range at $29.73. RKT and UNVR are minutely small (less than ~0.25% of the portfolio each) positions purchased this quarter.

Stake Disposals:

None.

Stake Decreases:

LKQ Corporation (LKQ): LKQ is a large (top five) ~10% of the portfolio stake purchased at around $27 per share in September 2019. Q1 2020 saw a ~30% stake increase at prices between ~$14 and ~$36. Q4 2021 saw a ~20% reduction at $57.28 in a repurchase agreement with the issuer. That was followed with a ~30% reduction this quarter at $50.35 per share. The stock currently trades at $51.27.

Note: In August 2020, ValueAct’s Jacob H. Welch was elected to LKQ Corporation’s board.

Citigroup (C): The large ~8% Citigroup position established in Q4 2017 saw a ~500% stake increase in Q1 2018 at prices between $67 and $80. H2 2018 had also seen another ~25% increase at prices between $49 and $75. There was a ~20% selling in Q1 2021 at prices between ~$58 and ~$75. That was followed with a one-third reduction in Q3 2021 at prices between ~$65 and ~$74. This quarter saw a ~22% selling this quarter at prices between ~$45.50 and ~$54. The stock currently trades at $48.22.

SLM Corp. (SLM): SLM was a very small 0.83% of the portfolio stake established in Q1 2018. Next quarter saw the stake increased by ~410% at prices between $11 and $12. There was a ~18% selling in Q1 2020 at prices between $6.45 and $12.30. That was followed with a ~60% selling over the last five quarters at prices between ~$15 and ~$21. The stock is currently at $14.57, and the stake is at 2.77% of the portfolio.

Bausch Health (BHC) previously Valeant Pharmaceuticals: The BHC position is now at 1.91% of the 13F portfolio. It is a very long-term stake. They first purchased Valeant in 2006 when it was an early-stage pharmaceutical business. Recent activity follows. Q1 2017 saw a ~20% stake increase at ~$10.85 per share. Last two quarters had seen a similar selling at prices between ~$22 and ~$29. The stock is now at $6.49. There was marginal trimming this quarter.

Stake Increases:

Fiserv Inc. (FISV): FISV is currently the largest position at ~21% of the portfolio. It was established over the five quarters through Q4 2021 at prices between ~$95 and ~$126. The stock currently trades near the low end of that range at ~$104. This quarter saw a ~12% stake increase.

KKR & Co. (KKR): KKR is currently the second largest 13F position at ~20% of the portfolio. It was established in Q2 2017 and increased by a whopping ~800% the following quarter at prices between $18 and $20.50. Q4 2020 saw a ~15% selling at ~$37.50 per share. The three quarters through Q3 2021 had seen another ~37% selling at prices between ~$38 and ~$68. There was a ~17% stake increase this quarter at prices between ~$45 and ~$60. The stock currently trades at $48.52.

CBRE Group (CBRE): CBRE is a large 10.83% of the 13F portfolio stake. The majority of the original position was established in 2011 & 2012 in the mid-to-high-teens price-range. Q4 2017 and Q1 2018 saw a ~31% selling at ~$44 per share and that was followed with a one-third selling in Q1 2019 at $49.51. Q3 2019 also saw a ~23% selling at $53.86. The stock is currently at ~$77. There was a ~10% trimming in Q3 2021 at ~$96 per share. This quarter saw a marginal increase.

Insight Enterprises (NSIT): NSIT is a 5.64% of the portfolio stake established in Q1 2021 at ~$95 per share cost-basis. Next quarter saw a ~160% stake increase at prices between ~$94 and ~$107. That was followed with a ~17% stake increase in Q3 2021. This quarter also saw a similar increase at an average cost of ~$97 per share. The stock currently trades at $84.33.

Note: Regulatory filings since the quarter ended show them owning 4.35M shares (~12.5% of the business) of Insight Enterprises. This is compared to 4.1M shares in the 13F report. The increase happened at ~$94 per share.

TopBuild Corp (BLD): BLD is a 3.21% of the portfolio position established over the last two quarters at prices between ~$153 and ~$276 and the stock currently trades at ~$176.

Kept Steady:

Seagate Technology (STX): STX is currently the third-largest position at 15.30% of the portfolio. It saw a huge ~220% increase in Q3 2016 at prices between $23 and $38.50. There was another ~45% increase in Q2 2017 at prices between $38.75 and $50.50. That was followed with a ~55% increase the following quarter at ~$33 per share. The five quarters thru Q2 2019 had seen a ~47% further increase at prices between $36 and $60. H1 2021 had seen a ~42% reduction at prices between ~$59 and ~$104. That was followed with a ~23% selling over the last two quarters at prices between ~$79 and ~$116. The stock is now at $65.35.

Altus Power (AMPS): AMPS is a very small 0.40% of the portfolio position established last quarter at prices between ~$6.40 and ~$11 and the stock currently trades at $10.24.

Note: ValueAct also has a small stake in the warrants which has a strike price of $11.

Trinity Industries (TRN): The TRN stake was roughly doubled at ~$13.75 per share in Q3 2016 and that was followed with another ~25% increase the following quarter at ~$12.25 per share. Recent activity follows. The two quarters through Q3 2021 had seen a ~45% reduction at prices between ~$25.50 and ~$30. That was followed with a ~75% selling in Q4 2021 at around the same price range. The position was reduced to a minutely small stake last quarter at ~$28.45 per share. The stock is now at $23.57.

Note: The prices quoted above are adjusted for the Arcosa Inc. (ACA) spinoff that closed in November 2018.

The spreadsheet below highlights changes to ValueAct’s 13F stock holdings in Q2 2022:

ValueAct’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from ValueAct’s 13F filings for Q1 2022 and Q2 2022.

Be the first to comment