Ekaterina Markelova/iStock via Getty Images

Although many market pundits like to make the case that the market operates fairly efficiently, evidence, particularly on a company-by-company basis, suggests otherwise. Consider a firm like UFP Industries (NASDAQ:UFPI), which produces wood decking and related accessories, as well as structural packaging solutions made of wood, steel, and other products, and more. Because its health is heavily tied to the construction market, general pessimism earlier this year kept shares down compared to where they deserved to be. Finally, though, the market is recognizing what kind of upside the company provides. It is true though that the easy money has already been made. But so long as the firm’s bottom line results don’t deteriorate materially, it likely does still warrant some upside from here. So as a result, I’ve decided to keep the ‘buy’ rating I had on the stock previously.

Great results during tough times

The most recent article that I wrote about UFP Industries was published in the middle of September of this year. In that article, I was following up on the firm, discussing the strong financial performance it had achieved up to that point. On top of this, I found myself impressed with how cheap shares were. I even concluded that if financial performance were to worsen from that point, that it would be unlikely shareholders would experience any significant downside. This led me at that moment to retain the ‘buy’ rating I had on its stock, reflecting my view that shares should continue to outperform the market for the foreseeable future. So far, that call has played out really well. While the S&P 500 is up only 1.6% since the publication of that article, shares of UFP Industries have generated a return for investors of 9.7%. If we go back to my article in June of this year, the disparity is even greater, with the market up only 0.4% compared to the 19% increase experienced by this business.

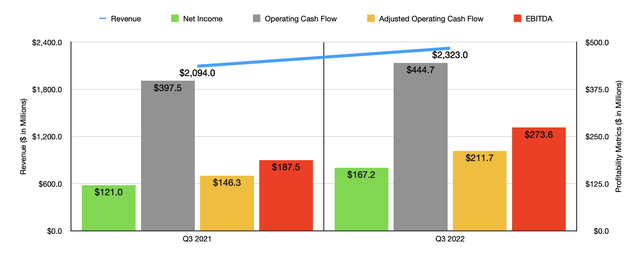

This kind of return disparity was only made possible because of robust financial performance achieved by the company. To see what I mean, I would like to point to financial results covering the third quarter of the company’s 2022 fiscal year. During that time, sales came in at $2.32 billion. That’s 10.9% higher than the $2.09 billion the company reported only one year earlier. Due to inflationary pressures, the firm did manage to increase the selling prices of its offerings, with that adding 6% to the company’s top line. Despite this, demand for its offerings remained strong, as evidenced by the 3% increase in unit sales associated with its organic operations. Acquisitions, meanwhile, added another 2% to the company’s top line. On the organic side of things, unit growth would have been even greater had it not been for a 2% decline in its industrial segment. This was more than offset though by the 5% rise that the company saw in its retail operations and the 6% it experienced in its construction operations.

Naturally, this rise in sales brought with it improved profits. Net income of $167.2 million beat out the $121 million the company reported in the third quarter of 2020 one. Other profitability metrics followed a similar trajectory. Operating cash flow, as an example, jumped from $397.5 million to $444.7 million. If we adjust for changes in working capital, meanwhile, the metric would have risen from $146.3 million to $211.7 million. And finally, EBITDA also improved, rising from $187.5 million to $273.6 million.

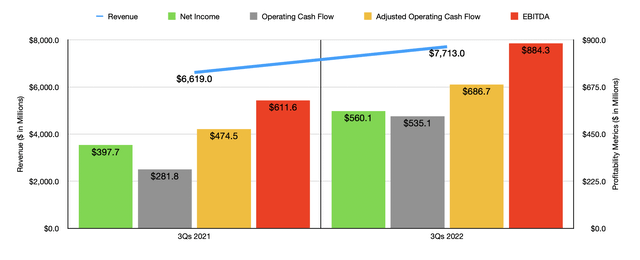

The company’s third quarter was not the only period of strength for the firm. For the first nine months of 2022 as a whole, sales came in strong at $7.71 billion. That’s 16.5% higher than the $6.62 billion generated the same time one year earlier. Net income during this time frame grew from $397.7 million to $560.1 million. Operating cash flow saw an even larger increase, expanding from $281.8 million To $535.1 million. And if we adjust for changes in working capital, it would have shot up from $474.5 million to $686.7 million. Once again, EBITDA also improved, climbing from $611.6 million to $884.3 million.

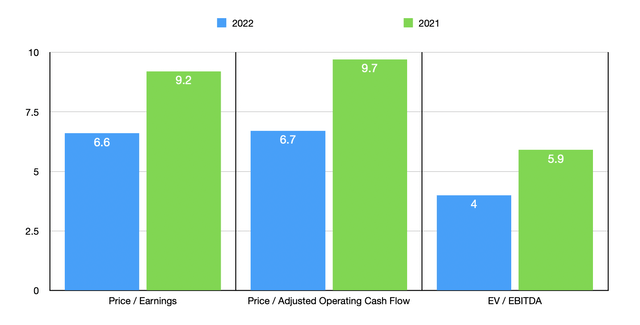

Given how close we are to the end of 2022, it’s fairly easy to just annualize results experienced so far for the year to see what 2022 in its entirety should look like. Based on this approach, we should anticipate net income of $754.4 million, adjusted operating cash flow of $741.7 million, and EBITDA of roughly $1.19 billion. Taking these figures, I calculated that the company is trading at a forward price-to-earnings multiple of 6.6. The price to adjusted operating cash flow multiple is only marginally higher at 6.7, while the EV to EBITDA multiple should come in at 4. Even if financial performance were to weaken some, shares would still look quite affordable. As an example, using data from the 2021 fiscal year, these multiples would be 9.2, 9.7, and 5.9, respectively. As I did in my prior article, I also decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 7.6 to a high of 48.9. Using the price to adjusted operating cash flow approach, the range was from 13.6 to 46.7. And when it comes to the EV to EBITDA approach, the range was from 5.9 to 39.5. In all three cases, UFP Industries was cheaper than all of its peers.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| UFP Industries | 6.6 | 6.7 | 4.0 |

| Simpson Manufacturing (SSD) | 11.5 | 13.6 | 8.2 |

| Armstrong World Industries (AWI) | 17.3 | 20.1 | 11.0 |

| Zurn Water Solutions (ZWS) | 48.9 | 46.7 | 39.5 |

| Hayward Holdings (HAYW) | 9.5 | 15.8 | 7.5 |

| Resideo Technologies (REZI) | 7.6 | 18.9 | 5.9 |

Takeaway

Given the rise in interest rates we have seen and the inflationary pressures that prompted said increases, I understand why investors might be cautious regarding the company like UFP Industries. At the end of the day though, the company continues to perform remarkably well and shares of the enterprise are trading at levels that indicate further upside potential is still on the table. Due to these factors, I feel completely comfortable keeping the business as a ‘buy’, indicating that additional upside Is possible, including relative to what the broader market should experience.

Be the first to comment