SusanneB

This article is part of a series that provides an ongoing analysis of the changes made to Kahn Brothers’ 13F stock portfolio on a quarterly basis. It is based on Kahn Brothers’ regulatory 13F Form filed on 11/15/2022. Please visit our Tracking Kahn Brothers Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q2 2022.

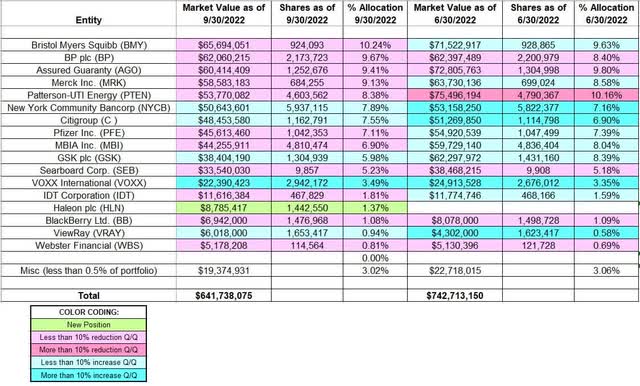

This quarter, Kahn Brothers’ 13F portfolio value decreased ~14% from ~$743M to ~$642M. The number of holdings remained steady at 45. The largest individual stock position is Bristol Myers Squibb which accounts for 10.24% of the portfolio. Largest five positions are Bristol Myers Squibb, BP plc, Assured Guaranty, Merck, and Patterson-UTI Energy. Together, they account for ~47% of the 13F portfolio.

Irving Kahn was a disciple of Benjamin Graham and is the author of “Benjamin Graham The Father of Financial Analysis“. He was by far the oldest protégé (died 2/26/2015 at age 109) and one of the closest followers of the original teachings of Benjamin Graham.

New Stakes:

Haleon plc (HLN): The 1.37% of the portfolio stake in HLN came about as a result of the spin off from GSK plc. They had 1.43M shares of GSK for which they received the same number of HLN shares. They also increased the stake marginally since. Shares started trading in July at $7.50 and currently goes for $6.89.

Stake Increases:

New York Community Bancorp (NYCB): NYCB is a 7.89% of the portfolio stake. It is a very long-term position that was first purchased in 2000. The stake was built to a large ~10% position (over 1.4M shares) by 2003 and in 2004 the position was doubled. Since then, the position had been kept largely steady although adjustments occurred every year. 2015 thru 2017 saw a ~30% overall reduction at prices between $13.50 and $19. 2018 saw an about turn: ~130% stake increase at prices between $9 and $14.50. Q2 2019 saw a ~28% further increase at prices between $9.50 and $12. H2 2020 had seen a ~20% selling at prices between $7.80 and $11.10 while last year saw a ~15% stake increase. There was a similar increase last quarter at prices between $8.65 and $11. The stock is now at $9.35. There was a minor ~2% further increase this quarter.

Citigroup Inc. (C): Citigroup is a very long-term holding. It was a small position in Kahn Brothers’ first 13F filing in 1999. By 2006, the position still accounted for less than 0.1% of the portfolio. The 2009-10 timeframe saw a huge stake built at a cost-basis in the 30s. Recent activity follows. There was a ~20% stake increase in Q2 2019 at prices between $62 and $71. The six quarters through Q4 2020 had seen ~28% selling at prices between $37 and $81. Last three quarters had seen a ~34% stake increase at prices between ~$46 and ~$72. The stock currently trades at $48.41, and the stake stands at 7.55% of the portfolio. There was a minor ~4% further increase this quarter.

GSK plc (GSK): GSK is a ~6% of the portfolio position. It was a very small 0.41% of the portfolio stake as of Q3 2015. That original position was increased by roughly eighteen-times over the next six quarters at prices between $37.50 and $45. The stock is currently at $34.59. Recent activity follows: The three quarters through Q1 2021 had seen a ~17% trimming while over the next three quarters there was a similar increase.

Note: The purchase price range quoted above is skewed because of the spinoff of Haleon plc in July. Shareholders received 1 share of Haleon for each GSK. In addition, GSK shares held were adjusted in the ratio 4:5.

VOXX International (VOXX): VOXX has been in the portfolio since 2001 when the company was named Audiovox. The current position stands at 3.49% of the portfolio. Recent activity follows. The two quarters through Q1 2021 had seen the stake reduced by ~60% at prices between $7.75 and $27. Q3 2021 saw a ~40% stake increase at prices between $9.70 and $14.50. That was followed with a ~45% stake increase over the last three quarters at prices between ~$6 and ~$13. The stock is now at $10.99.

Note: Kahn Brothers owns ~14% of the Class A shares thru the ownership of ~2.94M shares – John J. Shalam has majority control thru ownership of the Class B shares.

ViewRay, Inc. (VRAY): The very small 0.94% of the portfolio VRAY stake saw a ~300% stake increase over the last four quarters at prices between ~$2.40 and ~$7.60. The stock currently trades at $4.82. There was a minor ~2% further increase this quarter

Stake Decreases:

Bristol Myers Squibb (BMY): The 10.24% of the portfolio BMY stake was built in Q1 2019 at prices between $45 and $54 and doubled next quarter at prices between $44.50 and $49.50. The three quarters through Q1 2021 had seen a combined ~18% trimming at prices between ~$57 and ~$67. The stock currently trades at $80.28. Last six quarters have seen only minor adjustments.

BP p.l.c. (BP): BP stake was first purchased in 2010. The position remained minutely small for the next two years. The bulk of the current large 9.67% of the portfolio stake was built in 2013 at prices between $40 and $53. Thru Q1 2019, the stake was increased by ~60% at prices between $28.50 and $53. There was another ~22% stake increase next quarter at prices between $40.50 and $45.25. Q2 2020 also saw a ~17% stake increase at prices between $21.50 and $28.50. That was followed with a ~13% increase in Q2 2021 at prices between ~$24 and ~$28. The stock currently trades at $35.90. Last five quarters have seen only minor adjustments.

Assured Guaranty (AGO): AGO is currently the third-largest position in the portfolio at 9.41%. It was established in Q1 2017 at prices between $36 and $42.50 and doubled the following quarter at around the same price range. The three quarters thru Q1 2018 had seen a combined ~60% increase at prices between $33 and $45. Q2 2019 also saw a ~25% stake increase at prices between $41 and $48. Since then, there have only been minor adjustments. The stock is now at $66.57.

Note: Assured Guaranty is considered a uber-cannibal as it has bought back more than half of the shares outstanding over the last decade.

Merck & Co., Inc. (MRK): MRK is currently at 9.13% of the 13F portfolio. It was a very small stake first purchased in 2000. The position had fluctuated over the years, but the bulk of the current stake was purchased in 2009 at prices between $24 and $38. The position had since been sold down by roughly 40% over the next ten years through minor trimming almost every quarter. Q2 2019 saw a ~28% stake increase at prices between $73 and $86. The four quarters through Q1 2021 had seen a similar reduction at prices between ~$73 and ~$87. The stock currently trades at $110. Last six quarters have seen only minor adjustments.

Note: Last May, Merck spun-off Organon & Co. (OGN), a business focused on women’s health. Shareholders received one-tenth of a share of OGN for each MRK held. Organon was a ~$15B acquisition by Schering-Plough in 2007. It became part of Merck when they acquired Schering-Plough in 2009.

Patterson-UTI Energy (PTEN): PTEN is currently at 8.38% of the portfolio. It was first purchased in 2009. Most of the original stake was purchased in 2010 and 2012 at prices between $13 and $22. The position has wavered. Recent activity follows. The three quarters thru Q3 2019 had seen a ~45% stake increase at prices between $9.50 and $18 and that was followed with a ~37% increase next quarter at prices between $7.90 and $11.80. H1 2020 had seen another ~125% stake increase at prices between ~$1.70 and ~$11. Q3 2020 also saw a ~15% further increase while next quarter saw similar selling. Last quarter saw a similar reduction at prices between ~$14.30 and ~$19.80. The stock currently trades at $17.95. There was a minor ~4% trimming this quarter.

Pfizer Inc. (PFE): PFE is a 7.11% of the portfolio position. This was a very small stake first purchased in 2000. The position was built in 2007 at prices between $23 and $28. The seven quarters thru Q1 2016 had seen a one-third reduction at prices between $28 and $36. The next two years had also seen another two-thirds selling at prices between $30 and $39. The pattern reversed in Q2 2019: ~50% stake increase at prices between $39 and $44. The two quarters through Q3 2021 had seen another ~50% stake increase at prices between ~$36 and ~$50. The stock currently trades at $50.13. Last three quarters had seen minor increases while this quarter saw marginal trimming.

MBIA Inc. (MBI): MBI has been in the portfolio since 2007 and it is currently at ~8% of the portfolio. Most of the original position was purchased during the financial crisis in 2008 and 2009 at low prices. Q2 2015 saw a ~75% stake increase at prices between $5 and $9.81 and that was followed with another ~30% increase in the following quarter at prices between $5.50 and $7.70. Q2 2019 also saw a similar increase at prices between $8.75 and $10.25. The stock currently trades at $12.71. Last several quarters have seen only minor adjustments.

Note: Kahn Brothers controls ~9% of the business.

Seaboard Corporation (SEB): SEB is a very long-term position that was reduced significantly over the last two decades. The position size was ~29K shares in 1999 and accounted for around ~2% of the 13F portfolio. The tremendous share price appreciation in the interim has resulted in the current stake accounting for 5.23% of the portfolio even though the position-size was reduced by over two-thirds to 9.86K shares: the stock is a twenty-bagger during this period. The five years thru Q1 2019 had seen a ~36% selling at prices between $2550 and $4700. Q2 2019 saw an about turn: ~80% stake increase at prices between $3955 and $4700. The four quarters through Q2 2021 had seen a ~18% selling at prices between ~$2660 and ~$4144. The stock currently trades at ~$3953. Last several quarters have also seen minor trimming.

IDT Corporation (IDT): IDT is a 1.81% portfolio position that saw a roughly one-third stake increase in Q2 2017 at prices between $10 and $15. Q4 2017 saw another ~20% increase at prices between $7.75 and $13.25. There was a ~25% selling in Q4 2020 at prices between ~$6 and ~$14. The stock is now at $27.95. It is a very long-term position that has returned many-fold over the years. Last seven quarters have seen only minor adjustments.

BlackBerry Limited (BB): BB was a very small position established in Q3 2013 at prices between $8 and $10.84. Q2 2014 saw a 270% stake increase at prices between $7.15 and $10.12. The five quarters thru Q1 2016 saw the position more than doubled at prices between $6 and $11. There was another ~40% increase in Q2 2016 at prices between $6.29 and $8.09. Q2 2019 also saw a ~22% stake increase at prices between $7.40 and $9.60. Next two years had seen a ~75% selling at prices between ~$4.50 and ~$25. The stock is now at $4.87. It is currently a 1.08% of the portfolio position. There was a minor ~2% trimming this quarter.

Webster Financial (WBS): Last April, Webster Financial and Sterling Bancorp jointly announced a merger. Terms called for Sterling shareholders to receive 0.463 shares of Webster stock for each Sterling stock held. Kahn Brothers had ~271K shares of Sterling Bancorp for which they received ~125K shares of Webster Financial. The original stake was a very long-term position that was established in 2004 (Provident Bancorp at the time). WBS stock is now at $54.34. There was minor trimming in the last three quarters.

The spreadsheet below highlights changes to Kahn’s 13F stock holdings in Q3 2022:

Kahn Brothers’ Q3 2022 13F Portfolio Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Kahn Brothers’ 13F filings for Q2 2022 and Q3 2022.

Be the first to comment