Bryan Bedder

This article is part of a series that provides an ongoing analysis of the changes made to Pershing Square’s 13F portfolio on a quarterly basis. It is based on Ackman’s regulatory 13F Form filed on 11/14/2022. Please visit our Tracking Bill Ackman’s Pershing Square Holdings article for an idea on how his holdings have progressed over the years and our previous update for the fund’s moves during Q2 2022.

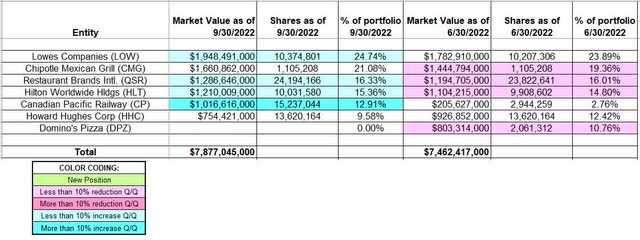

Ackman’s 13F portfolio value increased ~6% from ~$7.46B to ~$7.88B this quarter. The number of positions decreased from 7 to 6. The portfolio remains heavily concentrated with a few huge bets. The top three positions account for ~62% of the total portfolio value: Lowe’s Companies, Chipotle Mexican Grill, and Restaurant Brands.

In addition to partner stakes, the fund also invests the capital from Pershing Square Holdings (OTCPK:PSHZF), a public entity that debut in Euronext Amsterdam in October 2014. This was set up primarily to increase the amount of capital invested that is permanent. Pershing Square Holdings had underperformed the S&P 500 since its EOY 2012 inception. This changed in 2019 as they compounded at ~50% in the three years through 2021. For 2022 through November 15th, they are down 9.1%. Their original flagship fund’s (2004 inception) track record is excellent with annualized returns of ~16% compared to ~9.7% for the S&P 500 index.

Note 1: Pershing Square Holdings has always traded at a discount to NAV. It currently trades at ~$35 per share compared to NAV of $52.77.

Note 2: This year, they disclosed the following regarding their hedging strategy, principles, and performance: “Principles: asymmetric payoff structures along with monetization that provides liquidity during periods of market dislocation. Strategy: Interest rate hedges from late 2020 to early 2022 as they believed Fed would raise rates earlier than anticipated. Performance: $5.2B of their P&L came from hedging in the last three years. This is compared to their current capital base of ~$11.5B.”

Note 4: Pershing Square has a ~10% stake in UMG Music Group (OTCPK:UMGNF) at a cost-basis of ~€18 per share. It currently trades at €21.57.

To learn more about Bill Ackman, check-out the book “Confidence Game: How Hedge Fund Manager Bill Ackman Called Wall Street’s Bluff”.

Stake Disposals:

Domino’s Pizza (DPZ): DPZ was a ~11% of the portfolio stake established in Q1 2021 at prices between ~$330 and ~$375 and the stock currently trades at ~$392. The position was sold this quarter at prices between ~$310 and ~$417. They had a ~5.3% ownership stake in the business.

Stake Increases:

Lowe’s Companies (LOW): LOW is currently the largest position at ~25% of the portfolio. It was established in Q2 2018 at prices between $81 and $101 and increased by ~9% next quarter at prices between $95 and $117. There was also a ~40% stake increase in Q1 2020 at ~$84 per share. The four quarters through Q2 2021 had seen a ~20% selling at prices between ~$136 and ~$211. The stock currently trades at ~$211. Last few quarters have seen only minor adjustments.

Note: Pershing Square’s cost-basis on LOW is ~$85 per share.

Restaurant Brands International (QSR): The QSR stake is a large ~16% of the portfolio stake. Pershing Square’s original cost-basis was ~$16. Q3 2017 saw a ~32% selling at prices between $59 and $66. That was followed with a ~22% reduction in H1 2018 at prices between $53 and $64. The four quarters thru Q3 2019 had also seen a ~28% selling at prices between $52 and $79. In June 2020, they increased the position by roughly two-thirds thru forward contracts at $44.20 cost-basis. The stock currently trades at ~$67. Last few quarters have seen only minor adjustments.

Hilton Worldwide Holdings (HLT): The large ~15% portfolio stake was established in October 2018. It was purchased at prices between $64 and $78. Q1 2020 saw a ~30% stake increase at a cost-basis of ~$70. Q1 2022 saw a ~20% selling at prices between ~$129 and ~$158. The stock currently trades at ~$139. Last two quarters have seen only minor adjustments.

Note 1: Their overall cost-basis is ~$72 per share.

Note 2: In Q4 2018, Hilton Worldwide Holdings came back into the portfolio after a gap of eighteen months. The previous position was purchased in Q3 2016 and disposed a year later. Pershing Square has said that the new position was acquired at a better valuation compared to their previous purchase. Also, the business structure has transformed into a capital-light model following the spinoff in early 2017 of Park Hotels & Resorts (PK) and Hilton Grand Vacations (HGV).

Canadian Pacific Railway (CP): CP is a ~13% of the portfolio position purchased in Q4 2021 at prices between ~$64.50 and ~$78. The position was built this quarter at prices between ~$67 and ~$83. The stock currently trades at ~$81.

Note: the position was not in their Q4 2021 13F report but was disclosed in an amended filing this March.

Kept Steady:

Chipotle Mexican Grill (CMG): CMG is a large ~21% of the portfolio position. The stake was established in Q3 2016 at a cost-basis of ~$405 per share. The position was sold down by ~30% in Q3 2018 in the high-400s price-range and that was followed with a ~17% trimming over the next four quarters. Q1 2020 also saw a one-third selling at ~$860 per share. There was a ~7% trimming in Q1 2021 at ~$1340 per share. Q3 2021 saw a ~3% increase at ~$1910 per share. The stock currently trades at ~$1509.

Howard Hughes Corp. (HHC): HHC is now a 9.58% of the 13F portfolio position. The stake was first established in 2010 as a result of its spin-off from GGP Inc. The vast majority of the current stake is from the addition of ~10M shares in Q1 2020 at ~$50 per share through a private placement. Q1 2021 saw a ~25% stake increase at prices between ~$78 and ~$102. The stock is currently at ~$70.

Note: They have a ~27% ownership stake in the business. In October, they announced a tender offer to purchase 6.34M additional shares of Howard Hughes at a price between $52.50 and $60 per share. On November 11th, the tender was extended, and the price range increased to between $61 and $70 per share.

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are other long positions in the partnership – the holdings were disclosed in 13D filings on November 15, 2013 – as they are not 13F securities, they are not listed in the 13F report. Ackman held just under 10% of the outstanding shares of both these businesses – 115.57M shares of FNMA at a cost-basis of $2.29 and 63.5M shares of FMCC at a cost-basis of $2.14. The combined investment outlay was ~$400M. FNMA & FMCC currently trade at ~$0.43 per share. In March 2018, Pershing Square said their Fannie/Freddie pfds now amounts to 21% of the total investment in the two GSEs. Their Q4 2021 Annual Investor Presentation had the following regarding Fannie/Freddie: “Remains confident of long-term value – believes re-privatization is an eventuality regardless of court outcomes”.

The spreadsheet below highlights changes to Pershing Square’s 13F stock holdings in Q3 2022:

Bill Ackman – Pershing Square’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Pershing Square’s 13F filings for Q2 2022 and Q3 2022.

Be the first to comment