chonticha wat

Introduction

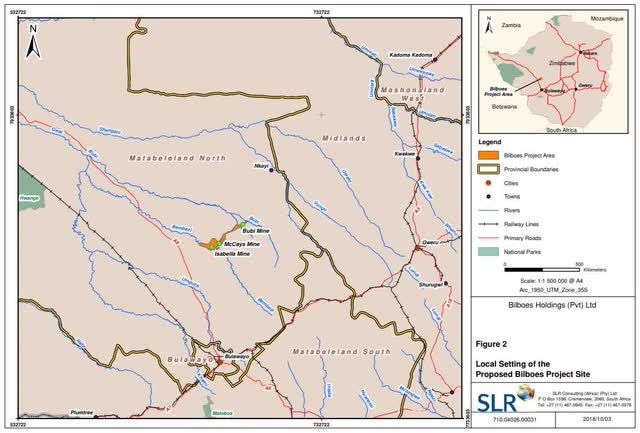

Back in January 2021, I wrote an SA article about Zimbabwe-focused gold miner Caledonia Mining Corporation Plc (NYSE:CMCL) in which I said that the company was rumored to be interested in the mothballed Isabella-McCays-Bubi gold project in northwest Zimbabwe.

Well, a deal was inked in July 2022 and Caledonia is paying $53.3 million in shares for the company that owns the project plus a 1% net smelter royalty on revenues.

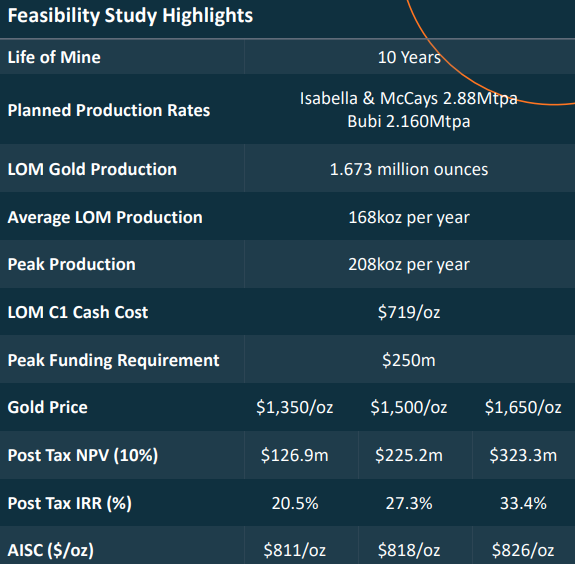

At first look, it looks like a good deal considering Isabella-McCays-Bubi has a net present value (NPV) of over $300 million. However, the peak funding requirement is $250 million, which Caledonia doesn’t have, and the ore is mainly sulfide. In my view, this is a high-risk project that can easily run into cost overruns and delays. I’m still bearish on Caledonia.

Overview of Isabella-McCays-Bubi

The project is owned by a company named Bilboes Gold and it consists of three heap leach open pit mines that have produced over 280koz of gold from oxide ore. However, 235koz of that amount was produced over a 13-year period ended in 2002 and the average output between 2003 and 2013 was only 4,200 ounces.

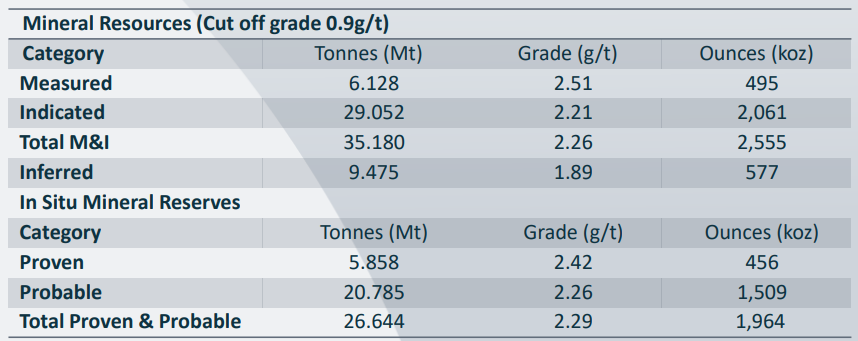

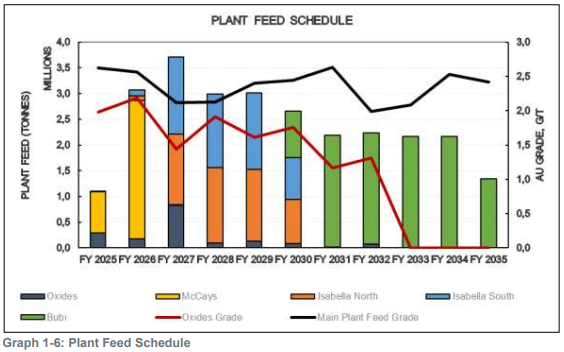

Oxide ore is easy to process from a technical point of view, so a heap leach is usually a good solution, and the issue here is that Isabella-McCays-Bubi has almost ran out of it. At the moment, the project has proven and probable reserves of 1.96 Moz at an average grade of 2.29 g/t but looking at the plant feed schedule from a 2020 feasibility study we can see that oxides account for a small part of expected production.

Caledonia Mining Caledonia Mining Caledonia Mining

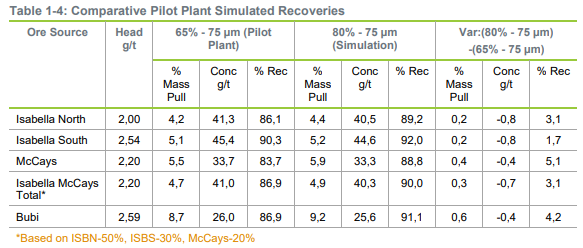

Sulfide ore is tricky to process, and miners regularly run into issues with low recovery rates. In addition, this type of gold ore typically requires an expensive carbon-in-leach (CIL) plant as well as bio-oxidation (BIOX) for a mine to work well. Looking at the pilot plant recoveries from the feasibility study, the results don’t look great. Engineering group DRA has concluded that around 84% of the gold contained can be recovered using BIOX technology together with gravity and CIL processing.

Caledonia Mining

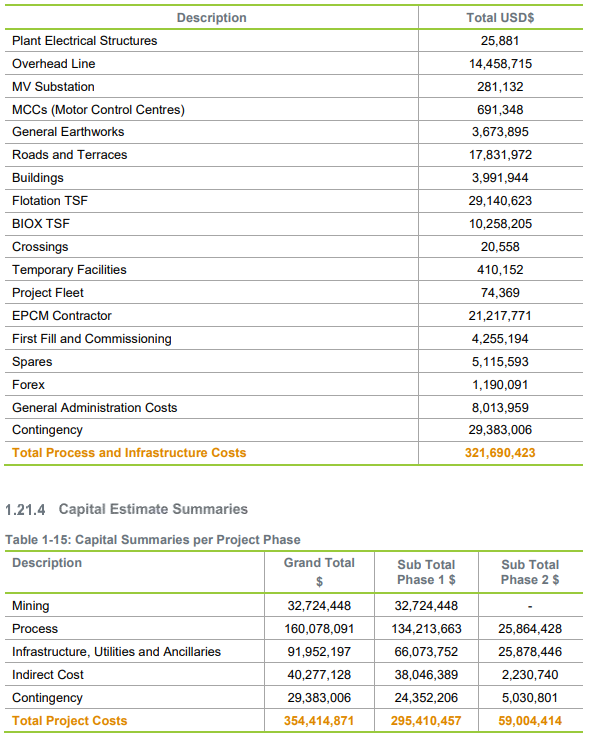

Another issue is the initial costs. According to the feasibility study, the total process and infrastructure costs are estimated at $321.7 million while the total project costs are expected to be $354.4 million. The peak funding is $250 million.

Caledonia Mining

This is a lot of money for a miner of Caledonia’s caliber, so the company wants to go for a phased development approach. The company estimates that starting out with an output of around 60 koz would slash peak up-front capital investment to below $100 million. However, I see two problems here. First, I can’t think of a single mining project developed using a phased approach that has worked out well from a financial point of view. Second, Caledonia has a dividend yield of 5.5% which has kept it from building a cash reserve of anywhere near close to even $100 million. As of June 2022, the company had cash and cash equivalents of just $10.9 million. Sure, net cash from operating activities was $26.9 million for H1 2022 and the attributable net income for the period was $17.2 million but reserves at the Blanket mine are set to run out in 2026. It seems that significant stock dilution to finance the development of Isabella-McCays-Bubi is likely.

So, how does the timeline for the project look like? Well, Caledonia wants to conduct its own feasibility study which would take around a year. After that, the company will need to secure funding and there are about 11 months of waste stripping to expose enough ore for a constant ore feed rate. If all goes well, Isabella-McCays-Bubi could be back in commercial operation in 2025.

Overall, I think that key financial figures in the feasibility study look good, but I don’t like the switch to a phased approach and the lack of oxide ore. In addition, this is a project located in Zimbabwe, which is widely considered one of the worst mining jurisdictions in the world due to political and economic instability, blackouts and a history of nationalization plans . I think that Isabella-McCays-Bubi is a risky project that shouldn’t be worth much at the moment.

Looking at Blanket, Caledonia’s 64% share of the net cash flow from the mine between 2022 and 2026 stands at $117.2 million using an average gold price of $1,660 per ounce. This means that unless the company cuts its dividend or gold prices increase in the coming years, a large stock dilution could be coming.

With all of that being said, I think that short-selling Caledonia stock could be dangerous as the prices of commodities are notoriously volatile and gold isn’t an exception. A spike in gold prices could send the company’s stock soaring.

Investor takeaway

Caledonia has a relatively small gold mine whose reserves are running out in 2026 and it seems that the company is planning to make Isabella-McCays-Bubi its new flagship project in a few years. This seems like a good buy at just 0.16x NPV but there are important reasons why this property is so cheap. Isabella-McCays-Bubi has high initial capex and there is a lot of sulfide ore, which is technically challenging to process. On top of that, the project is located in Zimbabwe and I find it unsurprising that Bilboes Gold hasn’t been able to find funding for it for years (the definitive feasibility study was released in February 2020).

Even if all goes smoothly, I think that there is likely to be significant stock dilution here. In my view, it could be best for risk-averse investors to avoid Caledonia’s stock.

Be the first to comment