JINGXUAN JI

This article is part of a series that provides an ongoing analysis of the changes made to Baillie Gifford’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 10/27/2022. Please visit our Tracking Baillie Gifford 13F Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q2 2022. The 13F securities represent roughly 40% of their overall Assets Under Management. The portfolio is diversified with over 1,000 13F securities. 59 of those positions are significantly large (more than ~0.5% of the portfolio), and they are the focus of this article.

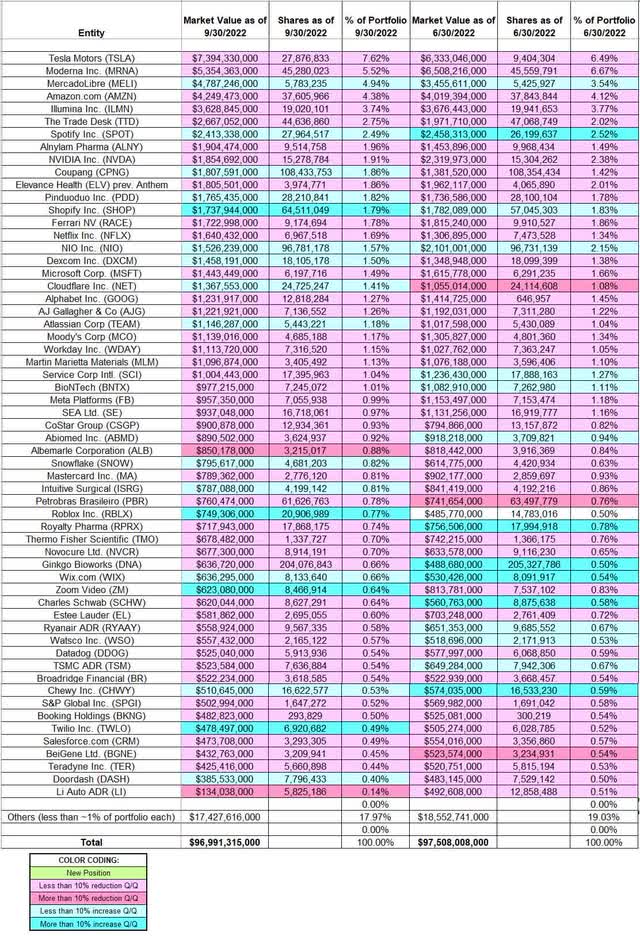

This quarter, Baillie Gifford’s 13F portfolio value decreased marginally from ~$97.51B to ~$96.99B. The number of holdings decreased from 1,147 to 1,135. The top three holdings are at ~18% while the top five holdings are close to ~26% of the 13F assets: Tesla Motors (TSLA), Moderna (MRNA), MercadoLibre, Amazon.com (AMZN), and Illumina (ILMN).

Note: Although the following positions are really small compared to the overall size of the portfolio, it is significant that they have sizable ownership stakes: 10x Genomics (TXG), Abiomed (ABMD), Adaptimmune Therapeutics (ADAP), Affirm Holdings (AFRM), Allbirds (BIRD), Appian Corporation (APPN), Axon Enterprise (AXON), Carvana (CVNA), Certara (CERT), Chegg (CHGG), Codexis (CDXS), Copa Holdings (CPA), Coursera (COUR), Denali Therapeutics (DNLI), Digimarc (DMRC), Duolingo (DUOL), EverQuote (EVER), Farfetch Ltd. (FTCH), HashiCorp (HCP), Jumia Technologies (JMIA), Lemonade (LMND), LendingTree (TREE), Lilium (LILM), NuCana Inc. (NCNA), Oscar Health (OSCR), Pacira BioSciences (PCRX), Peloton Interactive (PTON), Recursion Pharma (RXRX), Redfin Inc. (RDFN), STAAR Surgical (STAA), The Howard Hughes Corporation (HHC), Teladoc (TDOC), Tencent Music Entertainment (TME), Warby Parker (WRBY), Wayfair Inc. (W), and Zillow Group (Z).

Stake Increases:

MercadoLibre Inc. (MELI): MELI position goes back to 2010 when a 2.25M share stake was built at prices between ~$35 and ~$73. The position size peaked at 6.56M shares in 2014. The stake increase happened at prices between ~$60 and ~$140. Since then, the position had seen trimming in most years. Last five quarters had seen a ~25% increase at prices between ~$635 and ~$1946. The stock currently trades at ~$882 and the top-three stake is at 4.94% of the portfolio.

Note: they have a ~11.5% ownership stake in the business.

Spotify Inc. (SPOT): The original SPOT position goes back to a Series G funding round in 2015 when the company was valued at ~$8B. They had an IPO in 2018. Shares started trading at ~$150 and currently goes for ~$83. The valuation is now at ~$14B. H2 2019 saw a ~25% stake increase at prices between ~$112 and ~$157. That was followed with a ~27% increase over the last three quarters at prices between ~$86 and ~$244.

Note: they have a ~14% ownership stake in the business.

Coupang Inc. (CPNG): CPNG had an IPO in Q1 2021. Shares started trading at ~$48 and currently goes for ~$17. The 1.86% of the portfolio stake was built over the five quarters through Q1 2022 at prices between ~$17.50 and ~$48.50. Last two quarters have seen only minor adjustments.

Pinduoduo Inc. (PDD): PDD is a 1.82% of the portfolio stake built over the three years through 2021 at prices between ~$19 and ~$197. The stock currently trades at ~$53. Last three quarters have seen only minor adjustments.

Shopify Inc. (SHOP): The 1.79% of the portfolio SHOP stake was built in the 2017-2019 timeframe in the low-single-digits price range. Since then, the position had seen minor trimming. Last two quarters have seen a ~20% stake increase at prices between ~$27 and ~$73. The stock currently trades at ~$34.

NIO Inc. (NIO): NIO had an IPO in September 2018. Shares started trading at ~$8.50. The original position was acquired immediately after the IPO. Q1 2021 saw a ~15% selling at prices between ~$36 and ~$62 while last quarter there was a ~9% increase at prices between ~$12.70 and ~$24. The stock currently goes for $9.69. The stake is a 1.57% of the portfolio. There was a marginal increase this quarter.

DexCom Inc. (DXCM): A minutely small stake in DXCM was first purchased in 2012. The stake remained small till 2016 when a substantial ~6.1M share position was built in the low-20s price range. The period through 2019 saw the stake reduced to ~4.8M shares through periodic selling. Recent activity follows. There was a ~30% stake increase in Q4 2020 at prices between ~$79 and ~$103. Q4 2021 saw a ~16% reduction at prices between ~$130 and ~$163. The stock currently trades at ~$121. The last three quarters have seen only minor adjustments.

Note: they have a ~4.5% ownership stake in the business.

Cloudflare Inc. (NET): The 1.41% NET stake was purchased during Q2 and Q3 2020 at prices between ~$21 and ~$42. Last three quarters had seen a ~19% selling at prices between ~$40 and ~$217. The stock currently trades at $55.35. There was a ~3% stake increase this quarter.

Note: they have a ~9.3% ownership stake in the business.

Atlassian Corp (TEAM): A large ~10.2M share stake in TEAM was built in 2016 at prices between ~$20 and ~$32. The period through 2020 saw a roughly one-third reduction through periodic selling at higher prices. Last year had also seen a ~14% trimming at prices between ~$213 and ~$458. The stock is now at ~$201 and the stake is at ~1% of the portfolio. The last three quarters have seen only minor adjustments.

Chewy Inc. (CHWY), DoorDash Inc. (DASH), Intuitive Surgical (ISRG), Roblox Inc. (RBLX), Snowflake (SNOW), Twilio Inc. (TWLO), Wix.com (WIX), and Zoom Video (ZM): These small (less than ~1.5% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Tesla Motors (TSLA): The TSLA stake was first purchased in 2013 at very low prices. The period through 2019 saw the original position almost tripled at prices up to ~$28. There was minor trimming in the next two quarters and that was followed with a ~55% selling in H2 2020 at prices between ~$81 and ~$235. The last seven quarters have seen another two-thirds reduction at prices between ~$193 and ~$407. The stock currently trades at ~$229 and the stake is still the largest position in the portfolio at 7.62%. They are harvesting gains.

Moderna Inc. (MRNA): A small position in MRNA was established in Q1 2020. H2 2020 saw the position built to over 24M shares at prices between ~$58 and ~$157. Next quarter saw another ~85% stake increase at prices between ~$105 and ~$184. Since then, the activity has been minor. The stock currently trades at ~$151, and it is now the second-largest position at 5.52% of the portfolio.

Amazon.com Inc. (AMZN): AMZN stake was a very small position purchased in 2004. The period through 2009 saw a large position built at very low prices. Since 2014, the position has seen selling. Recent activity follows. 2020 saw a one-third reduction at prices between ~$89 and ~$170. The last six quarters had seen another ~40% selling at prices between ~$102 and ~$187. The stock is now at ~$103. It is still a top-five stake at 4.38% of the portfolio. There was marginal reduction this quarter.

Illumina Inc. (ILMN): The ILMN stake goes back over a decade to 2011 when a large 13.5M shares stake was built at prices between ~$25 and ~$75 per share. The period through 2020 saw a ~50% stake increase through incremental buying at higher prices. The stock currently trades at ~$233. The last six quarters had seen only minor adjustments. There was a ~5% trimming this quarter.

Note: they have a ~12% ownership stake in the business.

The Trade Desk (TTD): The 2.75% TTD position was first purchased in the 2018-2019 timeframe at prices up to ~$28. H1 2021 saw a ~80% stake increase at prices between ~$52 and ~$90. The last three quarters have seen a ~16% trimming. The stock currently trades at $53.71.

Alnylam Pharma (ALNY): The bulk of the ~2% of the portfolio stake in ALNY was built in 2019 at prices between ~$69 and ~$124. The stock currently trades at ~$205. Last three quarters have seen minor trimming.

NVIDIA Inc. (NVDA): A large stake in NVDA was first purchased in 2016 at prices up to ~$28. The position has seen periodic selling since. Recent activity follows. Last six quarters saw a ~20% reduction at prices between ~$125 and ~$330. The stock currently trades at ~$138. The stake is at 1.91% of the portfolio. There was marginal reduction this quarter.

Elevance Health (ELV) previously Anthem: ELV is a 1.86% of the portfolio long-term stake. The position has wavered. Recent activity follows. Q4 2021 saw a ~15% stake increase at prices between ~$370 and ~$468 while in the next two quarters there was a similar reduction at prices between ~$428 and ~$530. The stock currently trades at ~$544. There was a ~2% trimming this quarter.

Ferrari NV (RACE): RACE was a ~18M shares stake that was established in 2016 at prices between $34 and $58. The period through 2020 saw the stake reduced to ~13.5M shares at higher prices. There was a ~15% selling in Q2 2021 at prices between ~$199 and ~$217. The stock currently trades at ~$199. There was a ~7% trimming this quarter.

Netflix Inc. (NFLX): NFLX is a 1.69% of the portfolio stake established in the 2015-2016 timeframe at prices up to ~$130. There was a ~15% trimming over the last six quarters. The stock currently trades at ~$296.

Sea Limited (SE): SE became a substantial stake in the portfolio in Q1 2020, when around 6M shares were purchased at prices between ~$38 and ~$52. The quarters since had seen only minor activity. Q1 2022 saw a ~75% stake increase at prices between ~$88 and ~$223. The stock currently trades at $49.54. The last two quarters have seen minor trimming.

Abiomed Inc. (ABMD), Arthur J. Gallagher & Co (AJG), Albemarle Corporation (ALB), Alphabet Inc. (GOOG), BeiGene Ltd. (BGNE), BioNTech (BNTX), Booking Holdings (BKNG), Broadridge Financial (BR), CoStar Group (CSGP), Charles Schwab (SCHW), Datadog Inc. (DDOG), Estée Lauder (EL), Gingko Bioworks (DNA), Li Auto (LI), Martin Marietta Materials (MLM), Meta Platforms (META), Microsoft Corp (MSFT), Moody’s Corp (MCO), Mastercard Inc. (MA), NovoCure Ltd. (NVCR), Petrobras Brasileiro (PBR), Royalty Pharma (RPRX), Ryanair ADR (RYAAY), S&P Global (SPGI), Salesforce.com (CRM), Service Corp International (SCI), Teradyne Inc. (TER), Thermo Fisher Scientific (TMO), TSMC ADR (TSM), Watsco Inc. (WSO), and Workday Inc. (WDAY): These small (less than ~1.5% of the portfolio each) stakes were reduced during the quarter.

The spreadsheet below highlights changes to Baillie Gifford’s 13F holdings in Q3 2022:

Baillie Gifford’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Baillie Gifford’s 13F filings for Q2 2022 and Q3 2022.

Be the first to comment