champja

Recently, I wrote an article on the Proshares UltraPro Short QQQ ETF (SQQQ), arguing it should only be used for short-term trading purposes as the volatility ‘decay’ causes levered ETFs to lag significantly. What about the Proshares UltraPro QQQ ETF (NASDAQ:TQQQ), SQQQ’s twin? Should the TQQQ also be avoided?

Investors should be aware that levered long ETFs like the TQQQ only deliver on their stated levered returns over a 1-day horizon. Convexity and volatility will introduce tracking error for holding periods longer than 1 day. Some nimble traders may look to swing trade-levered long ETFs, as their potential returns are magnified by their positive convexity, although this isn’t recommended for beginners.

Fund Overview

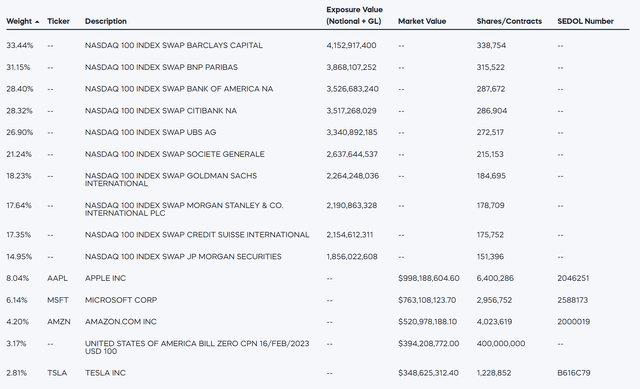

The Proshares UltraPro QQQ ETF seeks daily returns that are 3x the return of the Nasdaq-100 Index. The fund achieves this levered return by holding the stocks underlying the Nasdaq-100 Index and entering into total return swaps with the large investment banks that are reset nightly (Figure 1).

Figure 1 – Abridged TQQQ Holdings (proshares.com)

Levered ETFs Only Work On Short Time Horizons

Similar to my warning on the SQQQ, the TQQQ only works as intended on short-period time frames. When we start to look beyond the 1-day horizon, volatility and convexity will start to introduce tracking error.

For example, if you started off with $100 invested in TQQQ, if the Nasdaq-100 index returns 5% on day 1, the position will grow to $115 (3 times 5% return). If the index returns 5% again on day 2, the position will grow to $132.25, more than three times the theoretical 2-day compounded return of 10.25% or $130.75.

Conversely, if the returns were consecutive -5% on the Nasdaq-100 index, your initial investment will end up at $72.25, versus a three times the 2-day compounded loss of 9.75% or $70.75.

If the return experience is +5% followed by -5%, you end up with $97.75, significantly less than the three times the 2-day compounded loss of 0.25% or $99.25. This ‘decay’ is from volatility.

It is important to remember levered ETFs have ‘positive convexity’ in the direction of the bet and losses from ‘volatility decay’.

Levered Long ETFs As Medium-Term Plays

In contrast to inverse ETFs like the SQQQ that trend towards zero in the long run, some swing traders like to use levered long ETFs exactly because of their positive convexity.

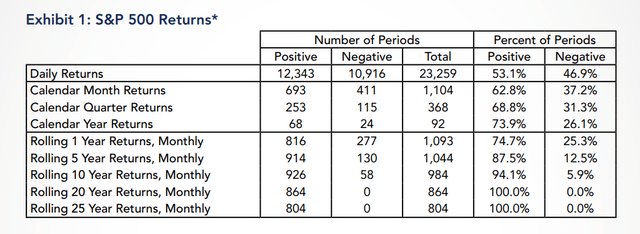

Over the long run, we know that stock markets tend to go up. In fact, studies have shown that 53% of S&P 500 daily returns are positive, 63% of monthly returns are positive, 69% of quarterly returns are positive and 74% of annual returns are positive (Figure 2).

Figure 2 – S&P 500 period returns (Fisher Investments)

We also know that stock returns show significant auto-correlation, i.e., stocks that have gone up will go up again, and vice versa.

What this means for swing traders is that over the medium-term (weeks to months), there can be scenarios where trading in the levered long ETFs can produce significantly higher profits than an equivalent unlevered ETF.

For example, measured from March 23, 2020 (the COVID-19 lows) to September 2, 2020 (the first recovery peak), the QQQ ETF returned 76%, whereas the TQQQ returned 376%, due to the positive convexity we mentioned above (Figure 3). A $30,000 investment in QQQ would have returned $22,800 in profits, whereas an equivalent $10,000 investment (assuming the position is scaled for leverage) in TQQQ would have returned $37,600 in profits.

Figure 3 – QQQ vs. TQQQ Positive convexity in uptrends (Seeking Alpha)

Positive convexity can also be beneficial on drawdowns, as the position gets smaller as the price goes lower. YTD to June 16, 2022 (the recent near-term bottom), QQQ was down 29% while TQQQ was down 70% (Figure 4). A $30,000 investment in QQQ would have lost $8,700, whereas a $10,000 investment in TQQQ would have lost $7,000.

Figure 4 – QQQ vs. TQQQ Positive convexity in downtrends (Seeking Alpha)

The challenge, of course, is to figure out when to take profits on swing trades, as the position size can grow very quickly on levered ETFs and if profits are not taken along the way, they can disappear quickly on pullbacks because the drawdowns are magnified.

Conclusion

In conclusion, investors should be aware that levered long ETFs like the TQQQ only deliver on their stated levered returns over a 1-day horizon. Holding periods longer than 1-day will see significant tracking error due to positive convexity and volatility decay. Nimble traders may look to swing trade levered long ETFs, as their potential returns are magnified by their positive convexity, although this isn’t recommended for novices.

Be the first to comment