Justin Sullivan/Getty Images News

The bar has been set low for nearly all social media companies coming into earnings season because advertising is hit first in challenging economies. Look no further than the steep cuts to earnings (both company guidance and analysts’ models) for Snap (NYSE:SNAP) over the last six months, and it’s clear the social media industry is struggling for growth. Earnings have only added to the noise, but the investor who can shut out the noise and listen for the real wavelengths will come out on top in the long term.

Lowering Expectations; The Market Is Still Adjusting

Investors have to remember the lowered bar has not been set in hard numbers by management but rather by analysts on Wall Street. Recall Snap did not provide Q3 guidance on its Q2 earnings call due to poor visibility. Remembering this piece of information puts Thursday’s $10M miss on $1.13B in revenue in perspective.

The market, however, trashed the stock after hours on Thursday, pressuring investors to hurriedly look for the black spot on the earnings report. Considering the economic environment for advertisers, I can’t find the black spot; instead, I see healthy business fundamentals in users and subscriptions. And while the step function beating the market has given Snap made sense for the last two earnings reports, where the news of dramatic slowing was, well, news, it doesn’t make sense for Q3’s report.

There’s a point where the “bad” news is priced in. As indicated by the 25% drop after hours, the market is still searching for it. But the relative performance against the lowered bar allows investors to find opportunities to get in at several-year lows. At the same time, the long-term business fundamentals of user growth and Snapchat+ continue to explode.

The angle is this: Snap, Meta Platforms (META), and the rest of the social media group are dealing with recessionary pressures, where advertisers are cutting budgets. This is not a permanent, secular trend but a recessionary one. Therefore, as long as you’re investing for the long term and believe there’s light at the other end of the recessionary tunnel, Snap isn’t going bankrupt, and growth will return. And, as I’ve said over the last few months, Snap is the first to branch outside of advertising and find success in a subscription product based on its actual product, its app.

This is a diversification away from a cyclical industry.

It comes down to see the report for what it is: inline as advertising fear is at a peak while other revenue streams are well on their way.

Beyond The Near-Term Ad Struggles

The long-term remains intact as plenty of other facets of the business continue to be strong.

Here’s what’s working for Snap.

- User growth – continues to remain at elevated growth levels

- Snapchat+ – continues to gain traction

- Stock – reaching peak pessimism

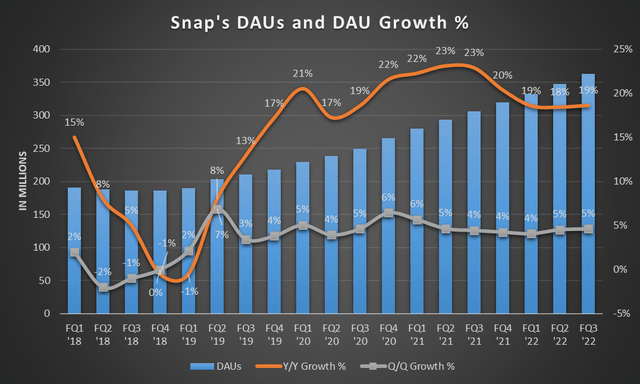

In the Q3 report, the company said DAUs (daily active users) grew 19% year-over-year to 363M. This is a consistent and even accelerating trend from last quarter. So advertisers may be cutting budgets, but users are not cutting out the app.

Snap’s User Growth (Chart mine, data Snap’s press releases)

And while it didn’t provide proper guidance (just guesstimates) in its Investor Letter, it still expects DAUs to grow 18% year-over-year in Q4 to 375M.

Why does this matter?

It matters for two reasons. First, when advertising comes back (and it will), Snap will likely have 100M more users than when advertisers last allocated dollars to it. Second, the growing user base provides a bigger TAM (total addressable market) for its Snapchat+ subscription service, which has gone from launching at the end of June to 1M users on August 8th to over 1.5M at the end of September (Q3 end). At this rate, the company will have over 3M subscribers by year-end, for $144M in annual recurring revenue.

That’s not a small revenue center (in absolute or growth terms) and should not be overlooked.

If you’re missing the concept of growing a direct user product during these challenging economic times with tremendous success, you’re missing an opportunity.

If Snap’s user growth was flailing like it was in late 2018 and early 2019, then I would not be anywhere near bullish on the company. It would mean fewer reasons for advertisers to return and less growth available for its Snapchat+ product. But since user growth has remained strong, the company’s future remains strong.

Additionally, engagement has been strong while user growth continues to grow above its historical average.

In Q3, overall time spent watching content globally grew on a year-over-year basis, driven primarily by growth in total time spent watching content on Discover and Spotlight.

– Snap’s Q3 Investor Letter

Remain Grounded

These strengths and long-term investments aren’t without concern for near-term revenue. As the company outlined in its Investor Letter, it’s working with internal expectations for flat year-over-year revenue growth in Q4. This isn’t surprising, given Q4 is the toughest quarter to lap, and it’s likely conservative since it’s an internal guide.

As long as the company can make it to the other end of the economic headwinds – which Snap has $4.4B in cash on hand to do so – it will come out the other side stronger than it entered. But you can’t be too far behind a stock that rallies 25% as much as it drops 25%.

For those conservative in their investing approach, you’ll want to wait until earnings adjustments for Q1 aren’t at risk of being cut but instead are in line or better than expected. This means waiting for channel checks to improve or for management to give color on Q1 during Q4’s report proving in line or better expectations. The market may sniff this out ahead of time, though, and the stock will be materially above $8 if so.

For those sniffing out the bottom of the financials before they happen, we’re nearing that point now. At worst, Q4 revenue adjustments need to only come down $80M from the current $1.38B estimate. After the company’s brief color on Q4, a flat year-over-year report is $1.3B. This means analyst models are nearly aligned with management and industry expectations. Therefore, Q1 likely will be the start of inline or better earnings versus consensus, which means we’re mere weeks away from finding the pivot in the stock.

The company is still performing well at its core. While it can only do so much during a challenging advertising climate, it’s doing all the right things elsewhere. The story is nowhere near dead, and the long-term is still on track.

Be the first to comment