Freedomstocker/iStock via Getty Images

All prices in CAD unless noted.

Introduction

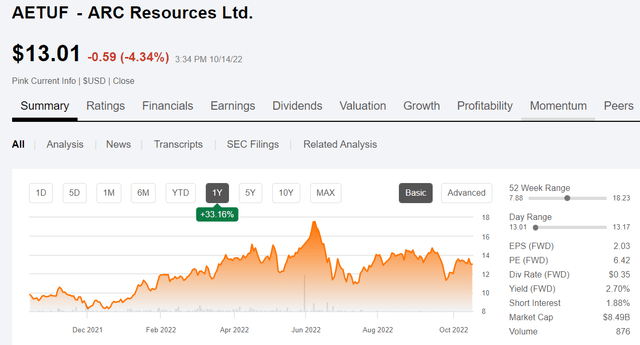

The question before us is do we buy ARC Resources (OTCPK:AETUF) before earnings, or wait a bit for a slightly better price. In our last article on the company, just over a year ago we correctly identified the company as a likely winner thanks to crazy high gas prices extant then. ARC doubled as gas prices soared last winter. Gas prices have since cooled about 30% following a peak in the high $9s last summer, and have taken the price of ARC shares down with them. Is this an opportunity? We will address this later in the article.

AETUF price chart (Seeking Alpha)

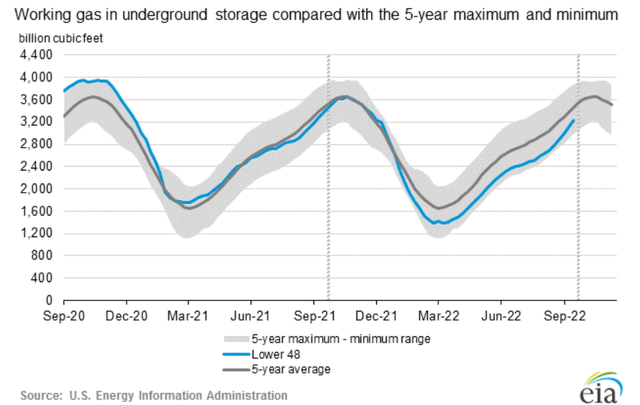

Now it’s here. What am I referring to? The winter of 2022-23 naturally. For many places it hasn’t yet arrived, but most of the United States is getting ready for a wallop by old man winter. Even down here in the deep south, we are expecting temperatures as low as 32 F in a couple of days. Domestic gas demand is going to go from nearly nil, to “gotta have it” as the thermostats move higher to keep the cold out. At a time when U.S. storage has made some gains with injections the last few months bringing us to -6.4% below the 5-year average, and -3.8% below 2021 levels at this point.

We think this sets the stage for enhanced sales for ARC over the next half year as cold dictates the conversation. U.S supplies are constrained, somewhat by export requirements to Asia and the EU, and evidenced by the low ebb of the 5-year average storage in the EIA chart above.

I’ll go ahead and answer the question posed in the paragraph above. We wait a bit for better pricing above. Here’s why. But first, let’s try and pierce the veil of things to come, gas-wise.

More on the macro picture for gas

Our domestic knife-edge balance is just one of the levers that could move ARC shares higher. Across the pond, the WSJ reports that EU gas caverns are largely filled, thanks to U.S. LNG exports.

Storage facilities of gas for heating and power generation are almost full, consumption is down and liquefied natural gas tankers are steaming in. Europe is in a stronger position than feared in recent months, after Moscow slashed gas deliveries in retaliation for Western sanctions over the invasion of Ukraine.

However, much could go wrong. One long cold spell or a busted pipeline could upset the region’s preparations, threatening emergency rationing, blackouts and a deeper economic recession. Officials and analysts say the willingness of consumers to cut back on gas use will be key for getting through the winter.

Asia takes up a lot of digital ink and in particular on the subject of Chinese demand, the forecast of which seems to change almost daily. It’s ink well spent as huge and growing economies are the product of this region’s ascendancy as manufacturing and distribution hubs for nearly everything. But that keeps another import hub off the front page, I am of course referring to the EU. While seemingly out of the woods for the early part of this season, with full storage caverns, two challenges lie ahead for this energy beleaguered continent.

The first is making it through this winter without the draconian cutbacks discussed in the WSJ article. They are largely at the mercy of the weather.

‘Europe is probably as well prepared as it could be. The infrastructure is pretty much maxed out,’ says Michael Bradshaw, professor of global energy at Warwick Business School. ‘We are up against the hard reality that there are physical limitations to the ability to replace Russian gas in the short term. That means that doubling down on the demand-reduction side of the equation is vital.’

A lot could go wrong. If freezing weather jacks up demand, stockpiles could drain and prices could shoot to levels that hammer companies and government finances. Low temperatures could also spark a contest between North America and Europe for LNG supplies.

And that leads us into our second point in this macro thesis. It is only pure serendipity that things aren’t much worse in the U.S. than they are. Sky high prices for coal have kept U.S. utilities burning gas this summer for electricity generation. That should have kept prices higher than they were. What happened?

You perhaps remember that fire in the Freeport LNG plant near Galveston in June? It had the effect of putting 2-BCFD back on the market, and available for injection vs export. Hence we are only ~4% under 5-year averages in our storage. This week.

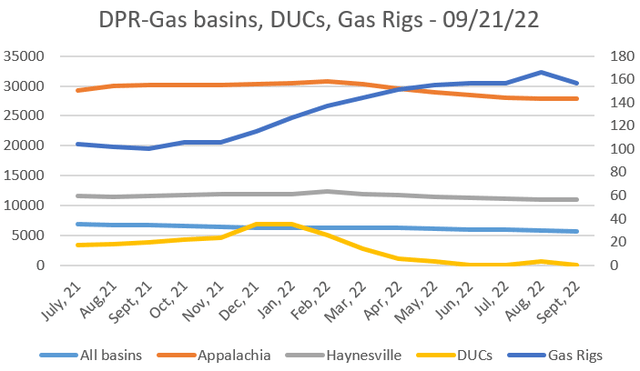

It will be interesting to see what sort of draws are seen in next week’s report as a big chunk of the nation feels winter’s first blast. Nor am I optimistic, absent a big surge in gas drilling, that we will be able to do anything to materially impact this tight supply scenario.

The trend isn’t encouraging for mid to long term new supplies as noted in the chart above. This is compiled from data put out by the EIA and only measures a running average between production noted in various reports and the number of rigs turning to the right. A simplistic measure as I have noted in past reports, but trends are instructive of their own accord. And the trend suggests, for whatever reason, well productivity is declining.

That’s the macro picture. Now why AETUF versus domestic producers like EQT (EQT), or CNX Resources (CNX) or several other large, mostly Marcellus/Utica shale producers?

The problem with the Marcellus

In a word “takeaway” from the field to end users is the problem in this area due to lack of pipelines going east. The politicians-I won’t say people, of the Northeast don’t want them, and have fought building them tooth and claw for decades. There is plenty of takeaway headed south down to the Gulf Coast LNG plants, but those are running near capacity now, with excess that’s been going into storage. And, as noted above there’s just too much gas right now, driving prices down and reducing incentives to drill.

It wasn’t supposed to be this way. There was a pipeline planned – The Atlantic Coast project – that would have taken gas from West Virginia to North Carolina, that was scrapped in 2020 by its builders, Dominion Energy (D) and Duke Energy (DUK). Now it appears its back on as the link above notes, with a proposed completion date mid-2023. We will see about that.

Then there is the oft-discussed Mountain Valley pipeline, for which Sen. Joe Manchin exchanged his vote on Biden’s latest spending folly – The Inflation Reduction Act – for a promise of easier permitting for this pipeline. The odds are increasing that Joe sold that vote in vain, as Progressives claim they weren’t a part of the deal. However that turns out in the long term, for the near term Marcellus gas is boxed in except for what heads south.

I think this puts a cap on the big U.S. producers, like EQT and CNX. They are sending all they can south, but they are closed off from their big markets on the East Coast, like New York City, and Boston.

An OilPrice article quoted an unnamed expert attending a conference put on by Hart Energy:

If you have to get an act of Congress to get your permits to build a pipeline, if you’ve got to go to the Supreme Court and you still can’t build a pipeline, this is not a great environment to build midstream infrastructure.

In an irony of ironies, the article also notes the East Coast is importing LNG from abroad, since the Jones Act keeps Gulf Coast LNG shipments to ports in the U.S. by any other than U.S. Flag Carriers. There are few of those, so foreign ships just target our ports directly. That pretty well sums it up and sets the stage for ARC Resources.

The thesis for ARC Resources

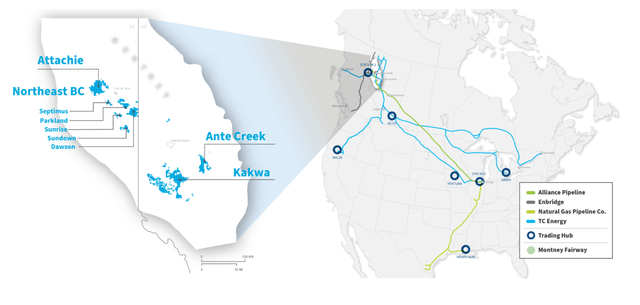

Ok, we finally get to it. Why ARC? Canada’s third largest gas producer has plenty of takeaway to key markets in the booming LNG export trade on America’s Gulf Coast, and east to Toronto and Montreal, Canada’s big population centers.

ARC Resources Takeaway (ARC Resources)

That’s it really. With its takeaway agreements in place with the big trunk line carriers, ARC can grow production into this gap in supply where U.S. competitors are constrained. I am thinking of companies like CNX, EQT, and RRC. These companies are closed off from their biggest markets, just over the Appalachians.

Q2 and guidance

Second quarter 2022 production averaged 336,112 boe per day. Cash flow from operating activities was $1,093 million and funds from operations was $1,030 million, a ~40% improvement over Q-1, 2022. This performance was driven by the sharply higher realizations companies saw for much of Q2, as well as market diversification.

Having access to remote markets generated higher realized pricing than local benchmarks, enhancing strong commodity prices. ARC’s average realized natural gas price of $9.08 per Mcf was $2.81 per Mcf higher than the average AECO 7A Monthly Index price. ARC’s average realized condensate price was $137.91 per barrel, compared to US$WTI of $108.52 per barrel.

Record free funds flow of $677 million or $1.00 per share represented a 67 per cent increase in the second quarter of 2022 compared to the first quarter, and a 186 per cent increase compared to the same period in the prior year. ARC distributed approximately 60 per cent or $406 million of its free funds flow to shareholders, with the balance allocated to debt reduction.

ARC declared dividends of $80 million or $0.12 per share and repurchased 18.4 million common shares for $326 million under its normal course issuer bid (“NCIB”). ARC has repurchased 67.1 million common shares or approximately nine per cent of the total common shares outstanding since instituting the NCIB in September 2021, at an average price of $14.00 per share. ARC intends to complete the existing 10 per cent NCIB by the end of August 2022. Upon completion and subject to review and approval by the TSX, ARX intends to renew the NCIB for an additional 10 per cent of the public float outstanding at that time.

As of June 30, 2022, ARC’s long-term debt balance was $1.2 billion and its net debt balance was $1.5 billion or 0.4 times funds from operations

Cash flow used in investing activities was $364 million, of which $352 million was invested into capital expenditures. During the second quarter of 2022, ARC drilled 29 wells and completed 38 wells primarily in its Alberta operations. Capital spending and production guidance have been revised upwards to primarily reflect realized and anticipated inflation, along with additional water infrastructure in Kakwa and funds to manage longer supply chain related lead times that will support 2023 activity. Capital expenditure guidance for 2022 has increased from $1.15 to $1.25 billion to $1.35 to $1.45 billion.

Production guidance for 2022 has increased from 335,000 to 350,000 boe per day to 340,000 to 350,000 boe per day. (Source)

Your takeaway

I am holding ARC at present and not adding to my fairly small position. The company is actually a little pricey at current levels with an EV/OCF of 10ish, but pretty cheap (and the reason to hold) on a flowing barrel price of $28K per barrel.

I expect gas companies will continue to see some market weakness due to recent price action, and the Q-3 results will certainly be off the range seen in Q-2. If we were to see pricing sub $12 over the next few weeks, we might be tempted.

Longer term into the winter I think ARC is a company to own in this space, somewhat depending on the severity of winter in the EU and UK. If they are begging for gas come January and February, the cash register should ring at ARC and deliver stock prices that fulfill or exceed analyst expectations in the upper teens to low $20s CAD.

The thesis continues into next year pretty smoothly as I don’t see much changing here, and the good folks in the EU are going to be looking at filling up those caverns again. Cha-Ching!

Be the first to comment