lindsay_imagery/E+ via Getty Images

Ambiguity is the devil’s volleyball. – Emo Philips

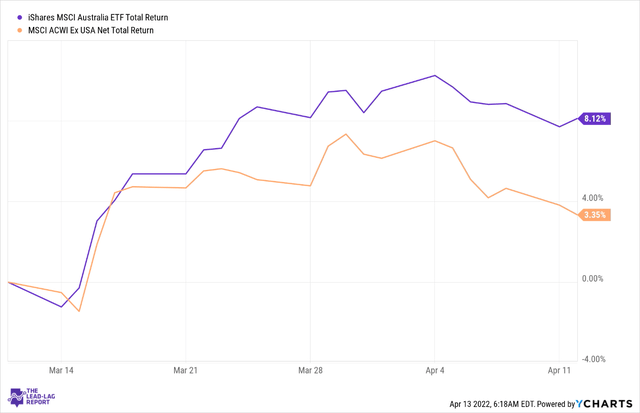

The iShares MSCI Australia ETF (NYSEARCA:EWA), a product with $1.85bn in assets, offers investors a route to large and mid-sized companies from the Australian stock market. EWA has been one of the better-performing developed markets over the past month, delivering returns that were more than 2x higher than the MSCI ACWI (Ex-US) Index.

It’s been a decent 2022 so far for Australian equities but I believe the road ahead could be a lot more ambiguous given some of the conflicting prospects ahead. I will cover some of the good and bad facets of Australian economic outlook in this article and investors can then decide if they want to pursue this product.

Macros

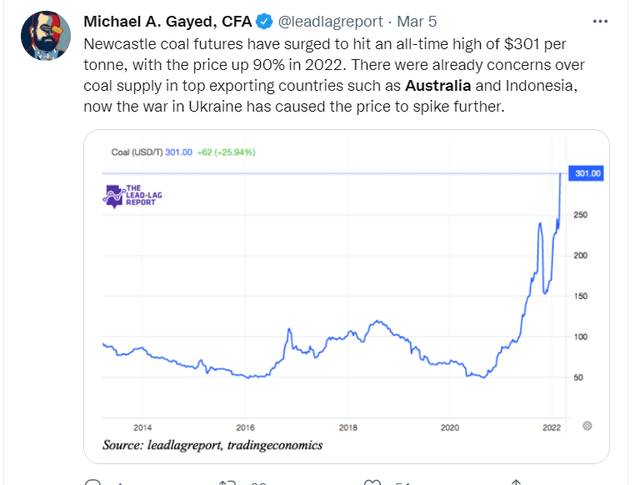

As highlighted in The Lead-Lag Report, the country’s profile as a notable global commodity participant has attracted the attention of the bulls, particularly considering how the supply side has been disrupted on account of the Russian-Ukraine tussle. Australia gets plenty of attention for its prowess with industrial metal exports, but don’t also discount the impact of some of its agricultural imports. If you’re a subscriber of The Lead-Lag Report, you’d note that I’ve been writing about a potential commodity supercycle in the years ahead and I’ve also covered in detail the impact of Russian-Ukraine developments in the agricultural markets. Australia looks like one of those economies that could really exploit and benefit from developments here; consider something like the wheat market. Russia and Ukraine are believed to contribute over 100m tons of the global wheat trade. Australia clearly can’t make up for that gap but yet still the US Department of Agriculture estimates that Australia will likely see a record wheat crop this year and could potentially export 27.5m tons in the 2021-2022 year.

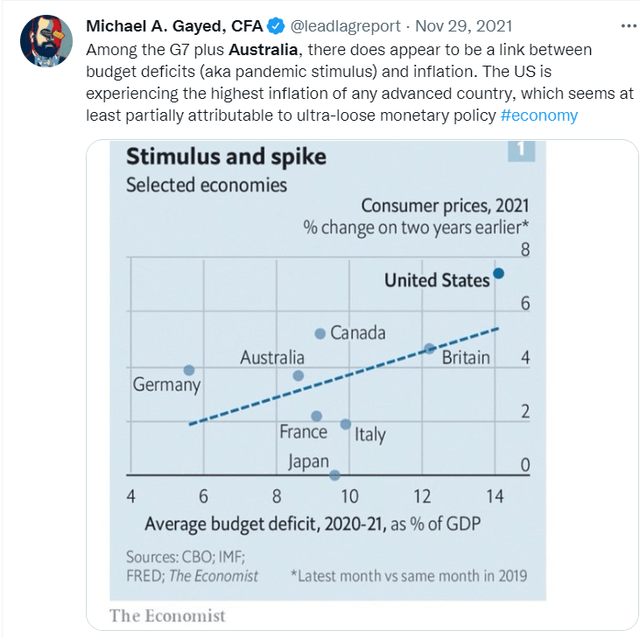

Then last year, I had put out a tweet on The Lead-Lag Report timeline highlighting how various developed markets, including Australia, had run up ample budget deficits (Australia reportedly spent 18% of GDP on pandemic-related activities). Whilst a lot of these countries are scrambling to get their house in order, something like an Australia has undoubtedly benefitted from its commodity exports and this had helped ease the fiscal strain on the economy. Going forward, economists believe Australia’s budget deficit will dip from 3.3% of GDP to 2% over the next three years.

The improving fiscal situation coupled with the commodity boom has certainly helped boost the allure of the AUD, which has been one of the hottest commodities this year, up by ~5% YTD. AUD bulls can also feel emboldened by the fact that the cash rate could be hiked as soon as June. This was not something that was in the cards as recently as last week, but after the Reserve Bank of Australia’s recent meeting, we could well see a pivot away from the dovish stance with the word “patient” being cast aside. Note that some of Australia’s top banks have already been making upward adjustments to their fixed rate products.

At the other end of the spectrum, one ought to wonder what this could do for the mortgage market which benefitted from the pandemic-related stimulus over the past couple of years. Recent reports suggest that the property market in Australia is fast becoming unaffordable and this could put a spanner in the works for bank loan growth as mortgages account for a significant chunk of the loan book (reportedly 60% of total loans, one of the highest in the world). Just for some perspective, do note that from March 2020 to Dec 2021, whilst dwelling values have grown by 23%, wages have only grown by 3%! At a time when wage growth has been anemic, you can imagine the pressure higher rates would put on debt servicing costs.

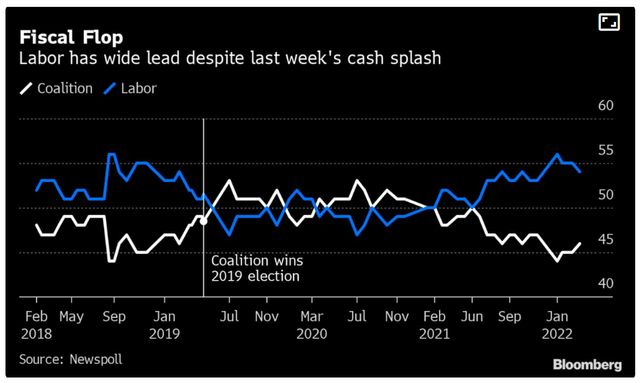

Another concern that I have with Australia is the rather unsteady political situation and this could make foreign investors rather queasy. For the uninitiated, Scott Morrison has served as the PM for a good three-and-a-half years, but in recent months, his popularity has dimmed enormously. The country is poised to vote before May 21st and the recent poll numbers suggest that we could see a lot of volatility ahead. Firstly, a Newspoll survey showed that the ruling coalition government has an enormous gap with the opposition Labor party and another survey by Ipsos showed that the gap was even worse.

Interestingly, note that Morrison was in a similar position during the previous election but managed to overturn things and negate the poll results. I don’t know if this will happen again, but investors also ought to consider the prospect of a hung parliament, last seen in 2010. If no party ends up with a majority, you’re looking at a rather difficult landscape where it will be challenging to implement reforms.

Conclusion

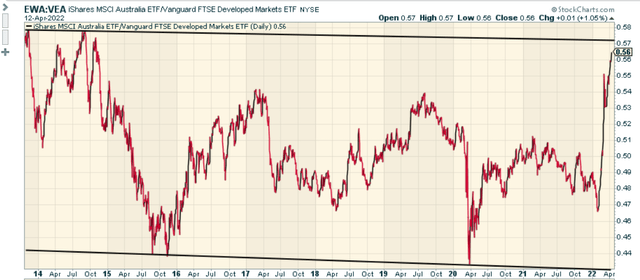

As mentioned in the introductory section, EWA has enjoyed a good run of late but this also means that value-conscious investors are unlikely to find this too appealing. Note that a ratio measuring Aussie equities relative to the Developed markets is currently at its highest point in 7 years and poised to hit a resistance zone. Even from a valuation angle, EWA appears to be rather pricey, trading at 16.5x forward P/E, this represents a 28% premium over the broad developed market landscape as represented by VEA.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment