Dimensions/E+ via Getty Images

This is my fifth coverage of pioneering protein degrader technology developer Arvinas (NASDAQ:ARVN). After an initial 25% spurt following my first coverage last year, the stock has been on a joyride towards the bottom. It is trading near 52-week lows as of today, having fallen 35% since my February 2022 article.

Arvinas’ PROTAC technology hijacks the body’s natural E3 ligase-ubiquitin-proteasome mediated protein degradation, and uses it to selectively tag and degrade pathologic proteins. In theory, this sounds like excellent strategy, and when I covered it last year, they already had phase 1 data to back up theory.

Arvinas’ technology was developed in the lab of Dr. Craig Crews at Yale. The Yale connection is strong, as we can see from the news last month that the two entities are occupying research space in the same building in Connecticut:

Clinical-stage biotech Arvinas also committed to a 10-year lease occupying 160,000 square feet across three floors, while Yale University reserved 125,000 square feet across three floors.

Two programs were in the clinic, ARV-110 for mCRPC or metastatic chemotherapy resistant prostate cancer, and ARV-471 in ER+/HER2- breast cancer. Both are currently running phase 2 trials. About the data from ARV-471, I wrote last year:

Up to the 120 mg dose level – a level that was well-tolerated by patients – ARV-471 degraded up to 90% of ER. Average was 62%, which is superior to Fulvestrant reported data of 40-50%. In one patient dosed at 120 mg who had extensive prior therapy and ESR1 mutation, 50% reduction in lesion per RECIST was observed.

In July last year, Pfizer (PFE) inked a major deal with Arvinas for this promising molecule, with $650mn in upfront payment, and an additional $1.4bn in milestone payments. Pfizer will also buy 7% of ARVN stock, worth $350mn.

This is Pfizer’s second cash infusion into the molecule. Earlier, in 2018, they invested $28mn into Arvinas.

Recently, Wedbush made some interesting comments about ARV-471 as it downgraded ARVN from outperform to neutral and lowered the price target from $48 from $98. Analyst Robert Driscoll said:

While we acknowledge that ARV-471 has a different mechanism of action to SERDs, and Ph 1 dose-escalation data for ARV-471 appears to show clinical benefit in both ESR1 wildtype and ESR1 patients, we believe ARVN may decide to at least enrich for ESR1 in any registration-directed late line study, thus potentially limiting the initial opportunity.

This opinion follows from recent study failures for oral SERDs amcenestrant (Sanofi) and giredestrant (Roche) in late line ER+/HER2-breast cancer patient. However, there has been no commentary from the company on whether they want to limit the upcoming studies to ESR1 mutant patients only.

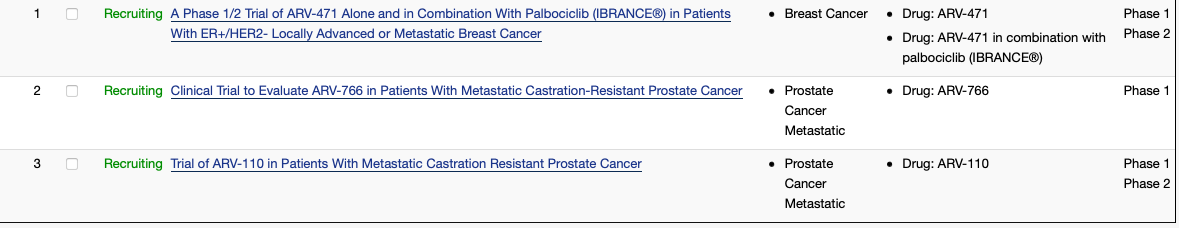

In November last year, the company has three listed trials in the registry:

Trials (Clinical Trials website)

The estimated primary completion date for the ARV-471 trial is March 2022, and for the other two the dates are Dec 2024 and Feb 2023, respectively. To this list, they have now added a fourth study, a phase 1 trial of ARV-110 in combination with Abiraterone in mCRPC.

The company presented additional data from ARV-110 at ASCO-GU in February. Data saw responses in 12 of 26 AR T878X/H875Y-positive patients, which is a genetically defined but small subpopulation of mCRPC patients with analysts calling this a $300mn small market. Two of the seven Response Evaluation Criteria in Solid Tumors (RECIST)-evaluable patients in this group also had confirmed tumor responses.

Other highlights from this data announcement include:

One confirmed and three unconfirmed RECIST responses were seen in patients with tumors lacking AR T878X/H875Y mutations. The “less pretreated” subgroup (n=27) had a similar molecular profile – as assessed by circulating tumor DNA analysis – to the more pretreated, biomarker-defined subgroups in the ARDENT trial. These similarities included both AR variations (point mutations and AR-V7 splice variants) and non-AR mutations frequently associated with poor outcomes (e.g., TP53, BRCA1). Six of the 27 patients (22%) had PSA50 reductions, and this PSA50 rate was similar to that observed collectively in the “more pretreated” subgroups (16%; n=77). Four of the six “less pretreated” patients with PSA50 declines had tumors with AR T878X/H875Y mutations.

Combined data from the phase 1/2 ARDENT trial was as follows:

|

ARV-110 (bavdegalutamide) activity in metastatic castration-resistant prostate cancer (Ardent) |

||

|

Cohort |

Evaluable patients |

PSA50 rate |

|

1-2 prior novel hormonal agents +/- chemo, AR T878X and/or H875Y mut |

26* |

46% |

|

1-2 prior novel hormonal agents +/- chemo, AR L702H** or AR-V7** mut |

114 |

10% |

|

1-2 prior novel hormonal agents +/- chemo, wild-type AR or other AR alterations |

||

|

Less pretreated: 1 prior novel hormonal agent, no prior chemo |

19 |

26% |

|

Total |

159 |

16% |

Source – Evaluate

Clearly, ARV-110 has little activity in the broad population; and it is only in the subpopulation of AR T878X/H875Y-positive patients that it has any activity of note. AstraZeneca’s (AZN) Lynparza and Clovis’s (CLVS) Rubraca were approved based on activity in such genetically defined subpopulations of mCRPC patients.

“These results reinforce our belief that bavdegalutamide has the potential to provide meaningful clinical benefits to a patient population for which few options exist after progression of their mCRPC,” said John Houston, Ph.D., president and chief executive officer of Arvinas. “In addition to a PSA50 response rate of 46% in tumors harboring T875X and/or H878Y mutations, we also saw durable confirmed responses in 2 of the 7 evaluable patients in this group. Overall, these data give us confidence that there is a clear path forward to accelerating the potential development of this novel treatment as a precision medicine option for patients.”

Arvinas “intends to initiate a pivotal trial by year end 2022” working through an accelerated approval pathway.

Financials

ARVN has a market cap of $2.3bn and a cash reserve of $1.4bn. Research and development expenses were $64.0 million for the quarter ended March 31, 2022, while G&A stood at $20mn. At that rate, the company has cash for well over 10 quarters, even accounting for increased expenses following initiation of phase 3 trials in ARV-471.

Bottomline

The discussion here gives us some idea why ARVN stock has traded downwards and sideways since last year. The market seemed to have higher expectations from ARV-110, in the broad population and not just in a small subpopulation. The other reason is a catalyst desert at least in terms of pivotal data for the next few quarters. I believe ARVN stock may bounce back upon strong pivotal data announcements; however, I will just hold on to my shares for now, and not make fresh purchases.

Be the first to comment