HJBC

In my mind, TotalEnergies (NYSE:TTE) has basically become synonymous with European energy. The second thought that comes to mind when thinking of TTE is what remains of France’s role in going out into the world to settle the global diplomatic, geopolitical, and resource matters on behalf of a good chunk of the European continent. After the relatively strong year energy stocks have enjoyed in 2022, I find it a good time to review my positions in the top global energy giants and see which are worth holding on to.

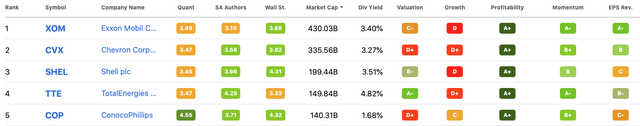

TTE: Highest dividend yield among top 5 oil stocks

When we look at the Seeking Alpha stock screener, filter on the “Energy” sector and sort by market cap, we see that TTE is the 4th largest energy stock globally by size, but shows by far the highest dividend yield of these five at 4.8%, over a whole percentage point higher than Exxon and Shell. I also find it attractive as it shares the A+ profitability rating of these five names but has the best valuation grade of the five.

If we look directly at the TotalEnergies dividend page, we can double-check this dividend yield calculation, and see that the EUR 2.64 indicated annual dividend (a yield of 4.7% on an EUR56.00 share price) presents a yield that is somewhat below the average dividend yield of 5.9% over the past 10 years. While >4% is still a good dividend yield for a company that still has good dividend growth ahead of it, the next big question is how much future growth of this dividend lies ahead to make TTE shares a better inflation-indexed income investment than T-notes. I estimate TTE’s dividend will continue to sustain healthy dividend growth for two reasons: buybacks and diversification.

Why I am optimistic about TTE’s dividend growth

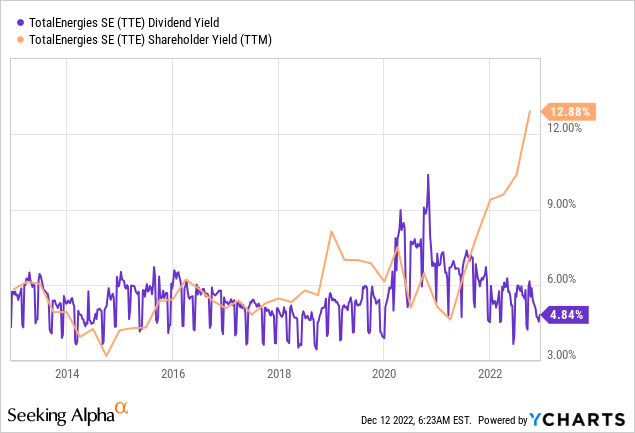

First of all, on buybacks, this is a factor I mostly look at for large companies that I no longer consider growth companies, and TTE is a stock I clearly have in my “income” column, not any “growth” column. This means, although we may see continued total earnings growth from the diverse sources described in the next paragraph, I expect just as much of my return to come from an improvement of per-share numbers, driven by buybacks that spread equal profits among fewer shareholders. This is an idea I’ve called “sharpen and shrink“, and is one way companies can boost shareholder returns with low to negative growth, making positive growth a bonus rather than a necessity. As the below chart shows, TTE’s shareholder yield is at a 10+ year high with their recent buybacks, which I might criticize for being higher when the yield is low and vice versa, but it is what it is.

Second, and perhaps more optimistically, is how TTE seems to be diversifying its revenue portfolio away from oil and towards, as its name suggests, a total energy portfolio. According to its 2021 annual report, on pages 8 and 9 of the PDF, we see the following strong growth numbers:

- Gross installed renewable power generating capacity grew from 3 GW in 2019 to 10.3 GW in 2021, roughly double each year’s gas-fired capacity.

- New power production grew from 11.4 TWh in 2019 to 21.2 TWh in 2021.

- LNG sales volume increased from 34.4 Mt in 2019 to 42 Mt in 2021.

- Biofuels production up from 200 kt in 2019 to 391 kt in 2021, and

- The main growth in petrochemicals being in product production, rather than more upstream, and in my view easier to commoditized, extraction and refining.

By contrast, the numbers show declines in proven reserves and refining capacity of “traditional” oil and hydrocarbon assets. It’s worth spending more time checking these numbers for how relevant they are to that dividend per share projection, but for now, it seems clear which direction the trends are going in each of TTE’s business lines.

My current trades on TTE

I am already long TTE, so am already scheduled to receive the EUR 1.00/share bonus dividend that went ex on December 6th, and I think the ideal action on TTE shares right now depends on whether an account already holds TTE shares as well as on tax situation. Note that for ex-dividend dates, I will be referencing the ex-dates on the earlier-referenced TTE dividend website, not the Seeking Alpha dividend history dates, which are slightly different, but not too different for medium-long term investors.

For accounts that already hold TTE shares, I am looking to sell covered calls. This call premium boosts my return, with the trade-off that I will be happy to take profits if the stock rises another ~6% over the next 5-6 months to around 62.50, meaning the dividend yield would have fallen to 4.5%. Looking at the May 2023 62.50 strike calls, I would look to sell these at a premium of around 3.20. Selling these calls allows me to collect two more expected dividends between now and May, providing a total maximum target rate of return as follows:

- 3.20 premium received up-front

- 1.40 from two dividends of around 0.70 each, one in January and one in March/April, and

- About 3.67 in price appreciation from the last closing price of 58.83 to the 62.50 strike.

These would add up to a roughly 14% return ((3.2+1.4+3.67)/58.83) between now and May in a best-case scenario where the shares keep rising and get called away at the strike. Of course, one of the reasons I sell this call is to offset the case where TTE shares don’t rise or even fall from current levels, in which case I would still be 3.20/share ahead of not selling this call.

For accounts that do not yet hold TTE shares, and especially those concerned about the French withholding tax on the dividend paid to residents of countries without favorable tax treaties (see page 15 of this TTE shareholder’s guide), I’d look at using a put write to get in. In this case, I would look at writing the May 2023 55 strike put, which would bring in a premium of around 3.10/share up-front in exchange for having to buy 100 shares at 55 in May if they fall to that level, at which point its dividend yield would be back above 5%. The put writer would not receive the January or March/April dividend on these shares, but the premium provides a simple 3.10/55 = 5.6% “yield” on the $5,500 per contract put at risk on this trade over a 5-month time horizon, an annualized yield of over 12% per year.

Conclusion

TTE “ticks the boxes” of a solid income stock with some room for growth, even though I agree with the consensus that upside is relatively limited from current levels. My way of boosting returns in the face of limited upside expectations is to write a covered call expiring after the next two dividends. In other accounts where I don’t hold shares, I’d look at writing puts to receive a premium to wait for the dividend yield to rise back above 5%.

Be the first to comment