Wirestock/iStock Editorial via Getty Images

Introduction

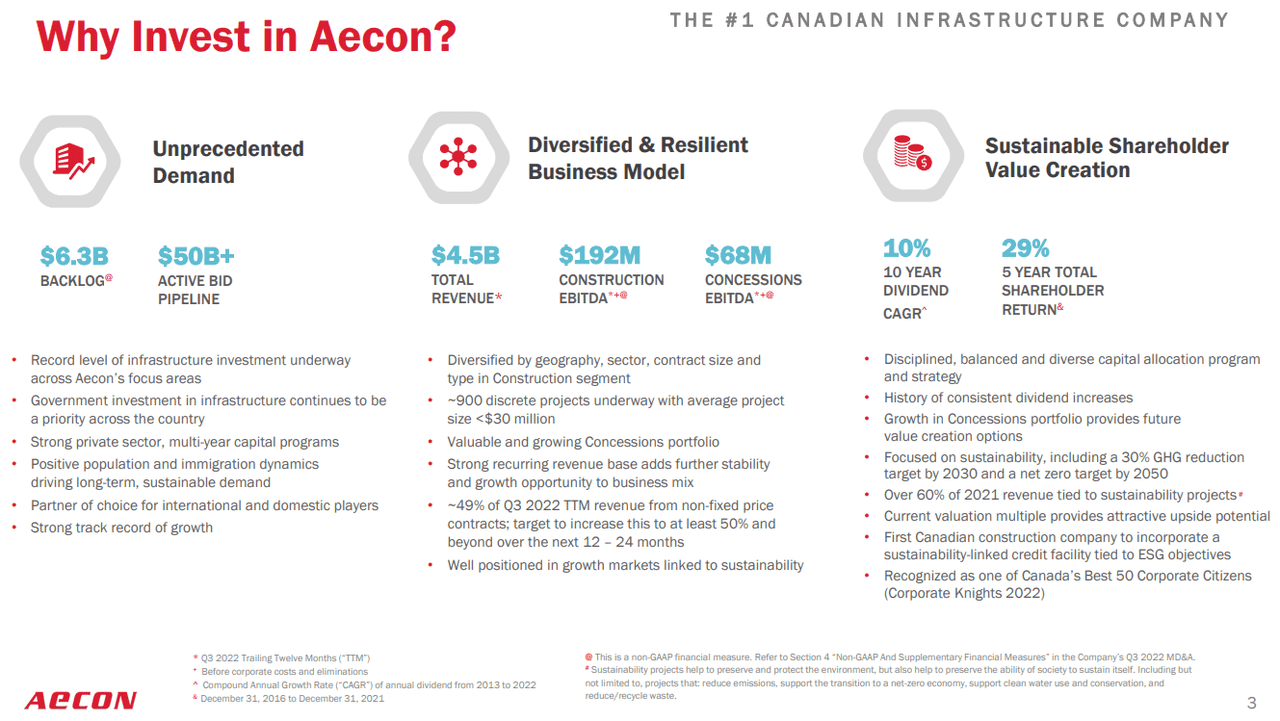

As the world’s population rises above 8 billion, the importance and necessity of critical infrastructure is always at the forefront of a nation’s mind. This creates financial incentive from those with the cash, or federal governments, despite the slow process of bureaucracy. Aecon Group Inc. (OTCPK:AEGXF, TSX:ARE:CA) is one diversified construction and engineering firm that has a major market share of the industry in their native Canada. I find that the company is currently offering a strong buy thanks to the inherent cyclicality of the industry, and buying now will let investors capitalize on a 7%+ dividend yield for long-term holding.

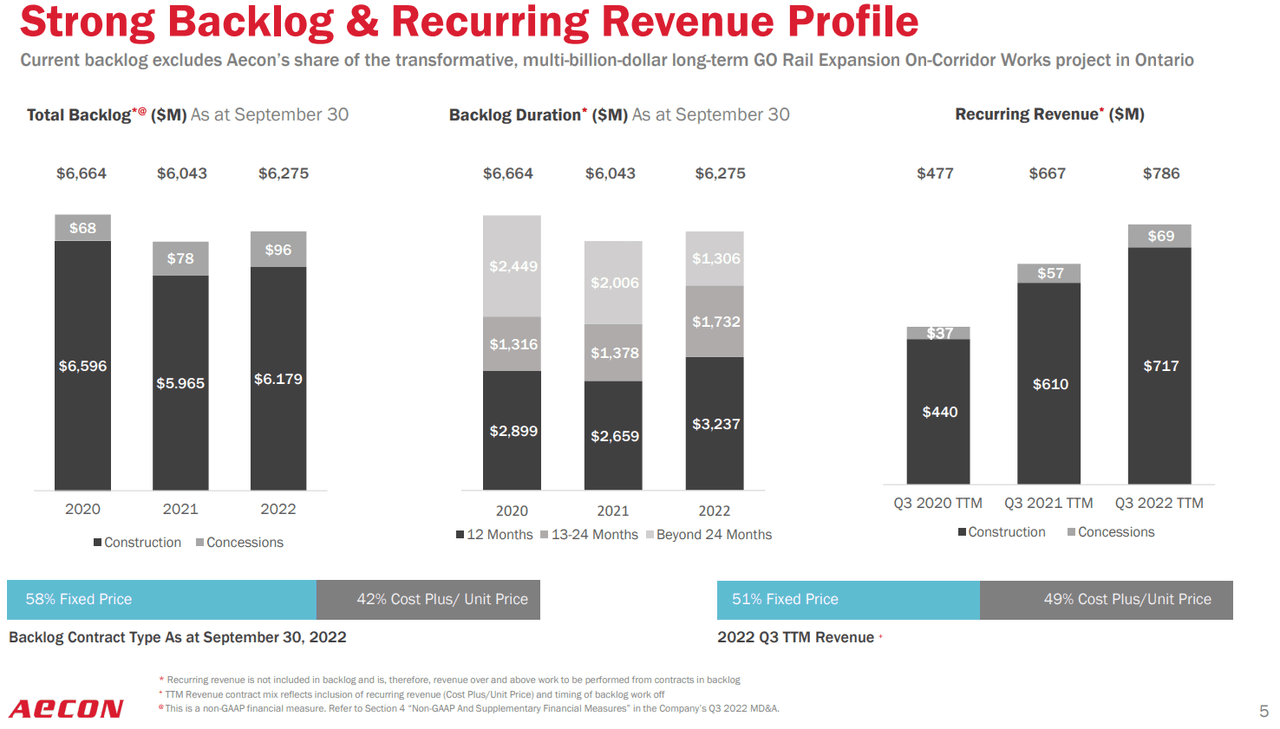

With a backlog of $6.6 billion CAD and a market cap of only $600 million CAD, 2022 is also allowing for investors to take advantage of an excellent value proposition to take advantage of the coming years of global infrastructure spending (all following financial data will be in CAD unless noted otherwise). Without the low valuation, the company would not be enticing to me as an investment, but the opportunity is reaching out to me to present to my readers. Let’s dive into the details.

Aecon 22Q3 Presentation

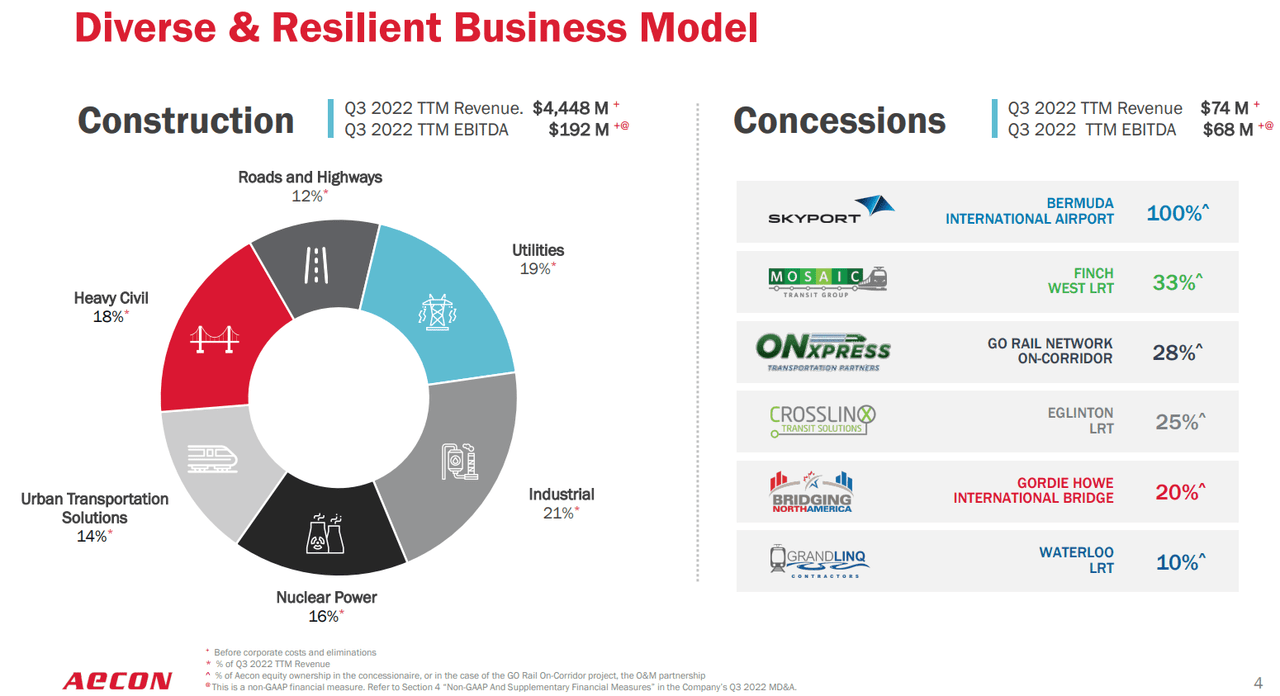

Aecon is an interesting company due to the fact that they are extremely diversified across the entire construction and engineering market despite the sub-$1 billion market cap. Part of this is due to a bearish cycle suppressing the valuation, but for the most part Aecon does well to not rely on a single sector. As shown in the slide below, the company is well position to take advantage of multiple bull cycles over the next few years, whether it is North America’s aging roads and utilities, heavy civil infrastructure projects to allow Canada to compete on the global stage, or the rise of low-carbon energy infrastructure such as nuclear power and natural gas.

I also like that the company has significant exposure to high profit concessions, or recurring maintenance and operational revenues, that are well suited for reducing volatility. As the company grows in scale with current and future projects. I would look for profitability to grow faster than revenues, as these high margin concessions sales increase in proportion. However, based on current financial performance, margins remain cyclical and the proportion of concessions (partially impacted by pandemic lockdowns) is not enough to reduce major volatility.

Aecon 22Q3 Presentation

Canadian Infrastructure Spending Supports Rising Backlog

Other qualitative indicators to look at include the state of funding for infrastructure projects in Canada. As of 2022, there were four major areas of federal investment and spending for Aecon to rely on:

-

Invest In Canada Plan: $180 billion between 2016 and 2028.

-

Canada Infrastructure Bank: Public and Private grants and loans up to $35 billion.

-

Canada Growth Fund: $15 billion to help build net-zero infrastructure to meet 2050 goals.

-

Provincial Budgets (mostly for Transportation): $91 billion Ontario, $44 billion Quebec, $8 billion BC, $7.3 billion Albert, and sub-$1 billion for other provinces.

As you can see, there is enough stimulus available, and the market has availability for many new projects. The major issues that are facing the industry are only related to temporary labor shortages and supply chain issues, and so the temporary bearish cycle may end swiftly. I will rely on my bull case on the fact that prices are already going down, unemployment in Canada remains at close to all-time lows, and historical financial data suggests bearish cycles are short-lived.

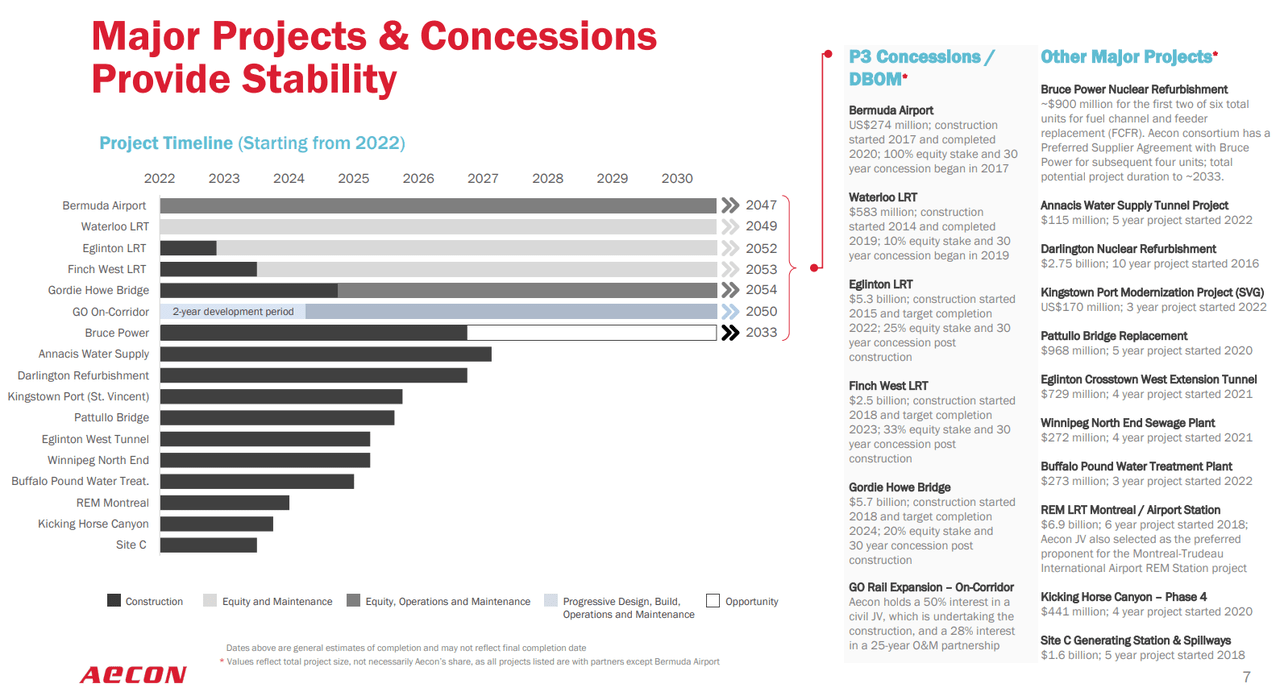

The current backlog is also a great way to predict that good things are yet to come. Currently, Aecon has work already underway at over 15 major projects, and seven of these have concessions set to last at least a decade, but often longer. One of the highest profile cases includes the Gordie Howe Bridge, a new international crossing between Detroit and Ontario due to open in 2024/25 that will allow for 30 years of concession revenues. The project data also supports the thesis that recurring and concessions revenue will increase with time allow for margins to improve.

Aecon 22Q3 Presentation Aecon 22Q3 Presentation

Historical Data

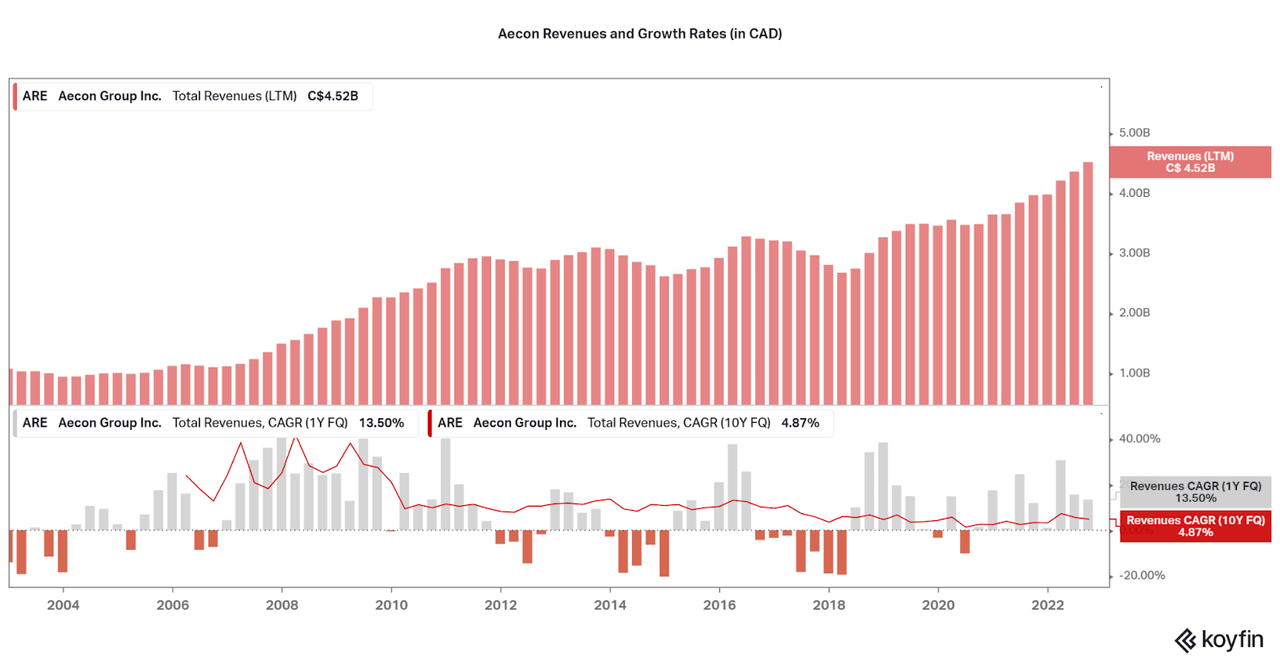

Aecon is well positioned with a range of high quality projects already underway and a $6 billion+ backlog, but current financial data is where some of the risk points arise. The most important factor to consider is the fact that the industry is cyclical, both in terms of revenues and profitability. Through the 2010s, revenues were held in a cyclical pattern of limited growth, but a breakout began in 2020 and 2021. However, the long-term growth rate remains below 5% per year. Despite that, I believe that the revenues are less at risk than the market may be anticipating, and this is another factor going into the bull thesis.

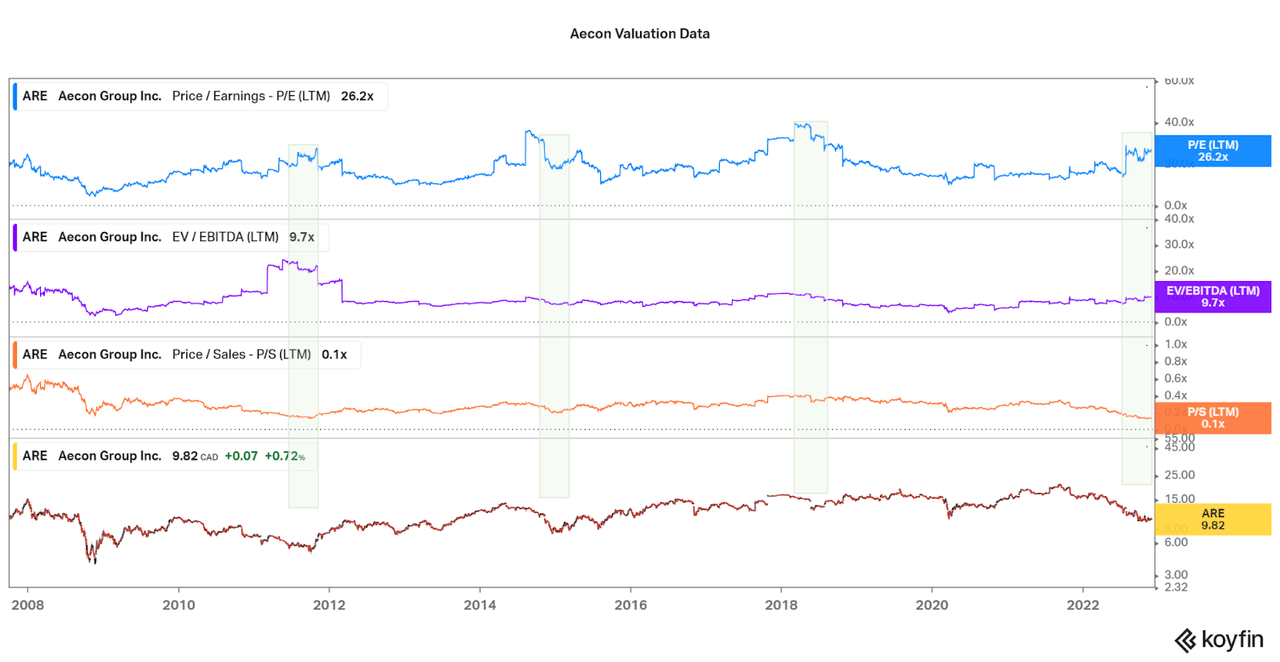

Koyfin

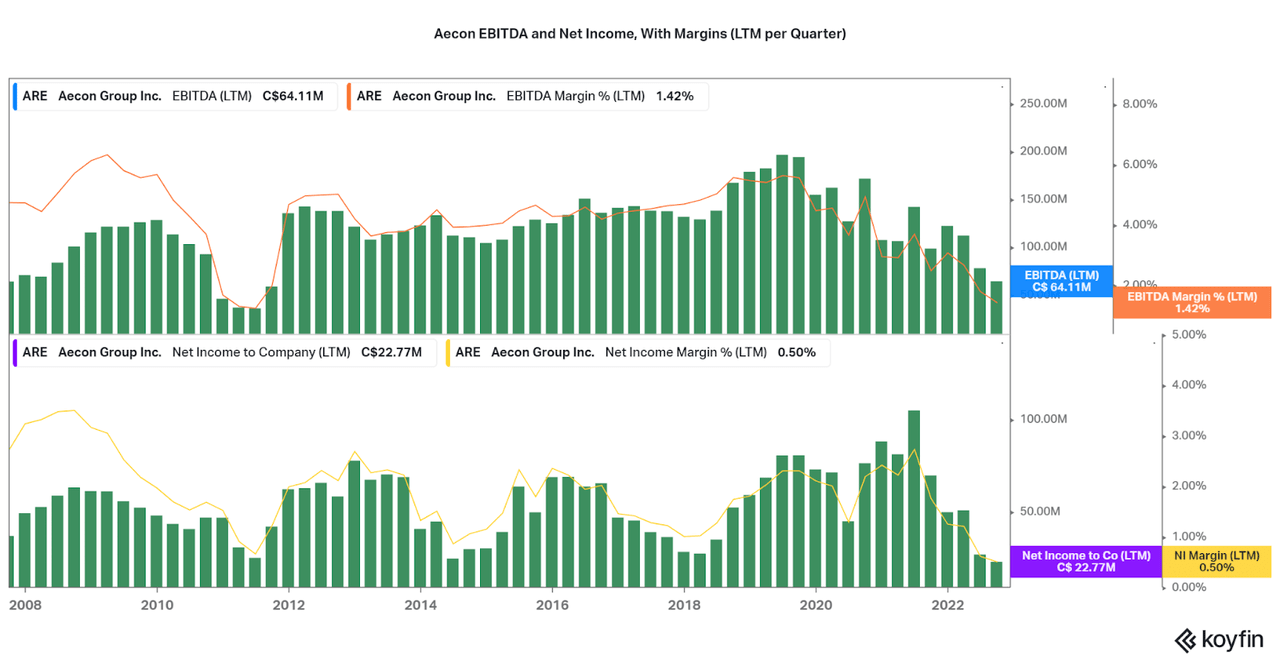

With the cyclical revenues comes even more cyclical earnings. While EBITDA margins have remained fairly stable over the past 15 years, net income has been more volatile as much of the cyclicality is the result of cost and labor factors, rather than a lack of revenues. Now, 2022 is approaching a record low point in terms of profitability as Aecon has faced labor issues and immense supply chain hurdles. But, like in the past all bear cycles are relatively short-lived and lead to buying opportunities, as long as the company remains fundamentally healthy.

Koyfin

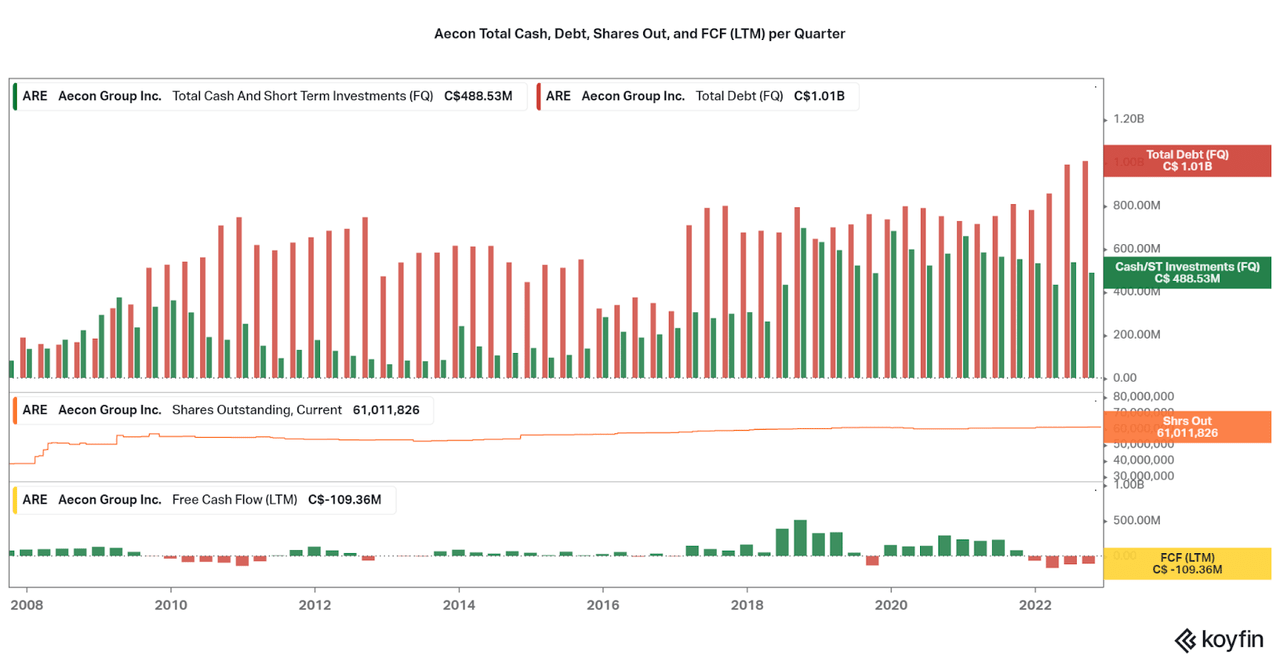

One way to assess whether Aecon is fundamentally healthy is through the balance sheet. While at first glance, the company has a lot of debt compared to cash, this is an issue across the entire industry and leverage data will be looked at next. First, I would like to highlight that dilution is not an issue and for investors to continue to take note of the cyclicality in cash flows. We will be comparing 2022 to periods such as 2010-11 and these are the key data points that will support the thesis.

Koyfin

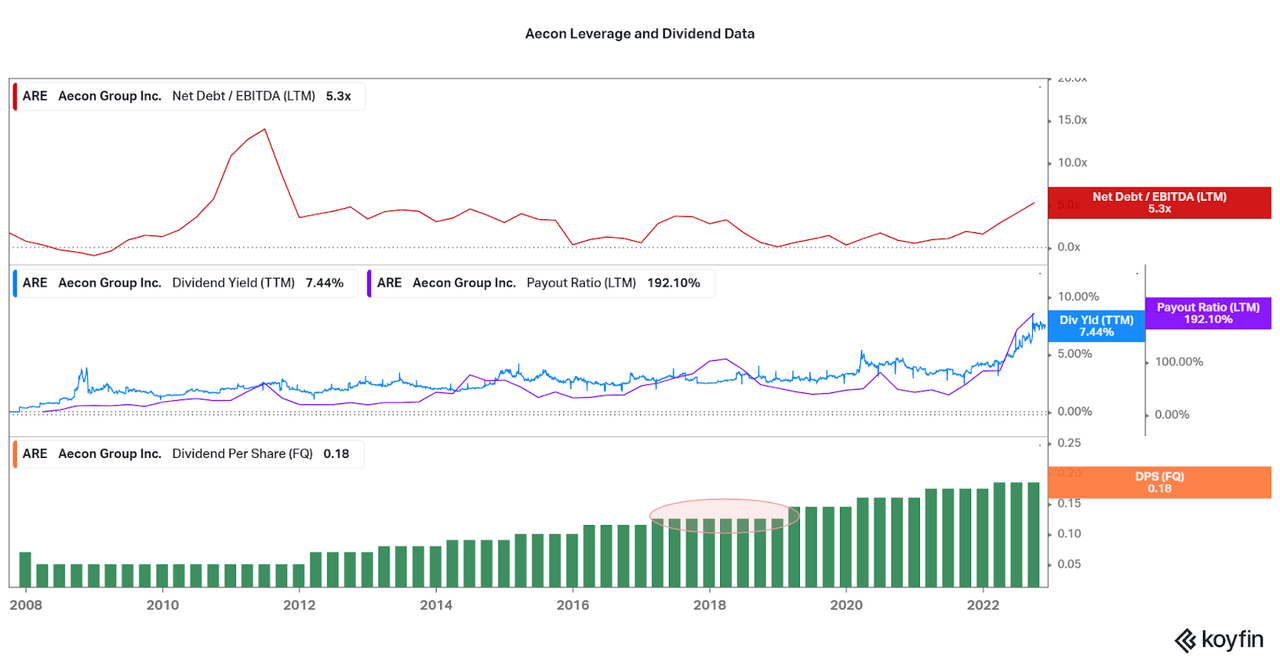

Other data points include leverage compared to the dividend payout and yield. Shareholders may be excited by the fast-growing dividend and current high yield of 7.5%, but this has come at the expense of the payout ratio. Some debt has also been issued to address the nearly 200% payout ratio, and I expect that the dividend will not be raised this year. This is similar to the other high payout ratio period in 2018 when the dividend was not raised. However, as is usually the case with cyclicals, temporary weakness is always the basis of a turnaround play and strong results.

Koyfin

The major periods I would use to support the thesis of a turnaround are 2011, 2015, and late 2018. Issues were preceded by a period of negative FCF, a rise in leverage, and a higher payout ratio. After a quarter or so, the P/E began to seem high due to low profitability, but the company began to look undervalued based on P/S metrics. When accumulating in those periods, the share price was usually trading around multi-year lows, and returns were significant:

|

Period |

6 Month Share Price Return from Bottom (%) |

1 Year (%) |

Trough to Peak (%, Within 2 Years) |

|

2011 |

85 |

65 |

90 |

|

2015 |

15 |

40 |

80 |

|

2018 |

20 |

30 |

45 |

Koyfin

Conclusion

Due to the volatility over those periods, I would not attempt to time the Aecon Group Inc. share price trough, but it is clear that periodic buys during weakness always result in solid returns. Other market turndowns such as the financial crisis and pandemic also led to buying opportunities for reasons outside of the financial performance, so this suggests to be wary of the price rising from any point. Due to the inherent risk of investing in cyclical companies, I would not recommend Aecon Group Inc. as an investment for low-risk investors, even with the yield exceeding 7%. Instead, look to peers such as Stantec (STN), a much lower-volatility and safer bet on the industry.

Thanks for reading.

Be the first to comment