Edwin Tan/E+ via Getty Images

Torrid Holdings Inc. (NYSE:CURV), a North American direct-to-consumer brand offering women’s plus-size apparel and intimates, is a classic case of a busted IPO. Having debuted on the NYSE last year, the stock is down ~77% amid COVID headwinds and consistent downward revisions to guidance.

That said, Street expectations have been reset to account for the impact of labor, transportation, and inflation headwinds. Thus, the company could see upward revisions from here.

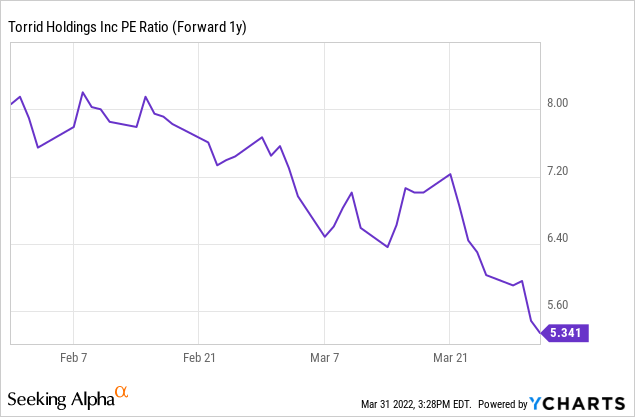

As the macro backdrop improves and its growth initiatives kick in toward the back half of the year, CURV has a clear opportunity to accelerate its sales and earnings growth trajectory back in line with its long-term targets. At ~5x fwd P/E for a company with pricing power and clear growth opportunities in an underserved category, the stock may have overshot too far to the downside. The $100m buyback authorization could prove to be a catalyst given the elevated short interest in the name.

Looking Through the COVID-Driven Turbulence

Amid the recent Omicron surge, CURV’s store traffic has come under pressure, while logistical difficulties have impacted its distribution center. Per management, >10% of stores temporarily closed or reduced hours through late-December/January 2022, with worsening labor shortages resulting in shipping delays.

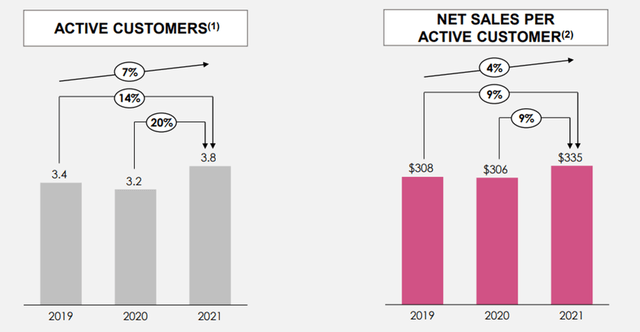

Still, CURV showed resilience relative to its updated January 2022 guidance – as the Omicron impact faded, the distribution center disruption improved and drove a -$7m sales impact (vs. the -$14m guided at the ICR conference in January). Overall, total sales rose 5.5% YOY on a +4.5% growth in comparable sales amid increased transactions and an expanding customer base. As of 2021, CURV had 3.8 million active customers (+20% YOY) and average sales per active customer of $335 (+9% YOY).

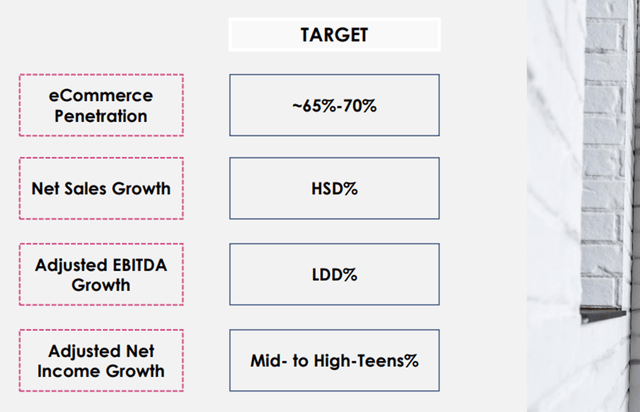

The initial full-year guidance strikes me as conservative. Sales are guided to land in the $1.3bn-$1,365bn range (+4% at the midpoint), with adjusted EBITDA in the $195m-$220m range (~15.5% margin). Yet, the company is on track to roll out its Curve assortment (Torrid’s intimates apparel brand) to a third of its store base in 2022, which could drive a mid-teens sales growth uplift (consistent with Q4 2021 trends) and higher comparable sales growth.

With ten stand-alone Curve stores also set to open in the second half of the year, CURV is positioned to realize a step up in the growth algorithm. Inflationary pressures will be an issue, but CURV has ample pricing power to offset the headwinds – management has successfully raised prices with little customer pushback over the past ten years, benefiting from the shift toward a higher-quality specialty retailer model. Maintaining its pricing power is key and should go a long way toward helping it achieve its high-single-digit revenue growth target as well as low-double-digit EBITDA expansion over the long run.

Sustained Curve Momentum Brings the $1bn Opportunity into Focus

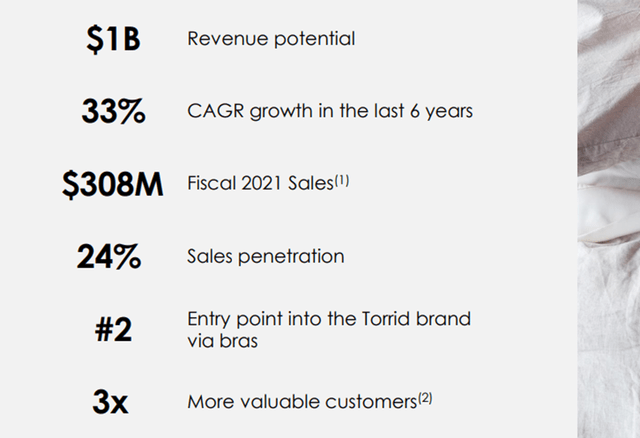

The stock price might be all doom and gloom, but in the long term, I remain positive on the growth opportunity ahead of the Curve brand as it looks to hit its $1bn sales target. Curve’s operating metrics make for compelling reading – not only do one-third of customers come to Torrid through Curve, but these customers also tend to spend three times as much as regular customers.

No surprise, then, that the Curve product line delivered another blockbuster growth year, rising +42% YOY in 2021. This could accelerate in Q2 2022 and beyond, as Torrid will launch a dedicated online Curve experience on the website and expand its product assortment to as much as a third of the store fleet (or ~200 stores) throughout the year.

With a rich product launch pipeline for the year, including the Happy Camper collection for camping and hiking clothing as well as the relaunch of its Studio modern workwear line, the newness in the current inventory should support the sales outlook. Beyond 2022, the Curve brand’s ability to offer a broad assortment across every element of a shopper’s closet could prove invaluable as the company looks to tap into more opportunities to gain wallet share within the plus-size market. Assuming Curve continues to build on recent momentum and retains its superior quality and fit, the brand should benefit from recurring purchases within its customer base and drive stronger pricing power for the overall group.

Balance Sheet Capacity Enables a Potential Share Repurchase Catalyst

As of quarter-end, CURV reported ~$29m in cash and equivalents and ~$341m in debt – a net debt to adjusted EBITDA ratio of ~1.3x (slightly above the prior quarter’s 1.1x). Total inventory was also up ~61% to $171m, but excluding in-transit levels, inventory growth was closer to +12%. Higher inventory levels should help mitigate delays in sales/deliveries but more importantly, management stressed the level and newness of the inventory, which should be sufficient to support CURV through Q1 2022. This leaves the company with ample balance sheet capacity, and during the quarter, CURV opted to buyback ~$23m of shares outstanding under its existing authorization (the Board authorized up to $100m of buybacks in December).

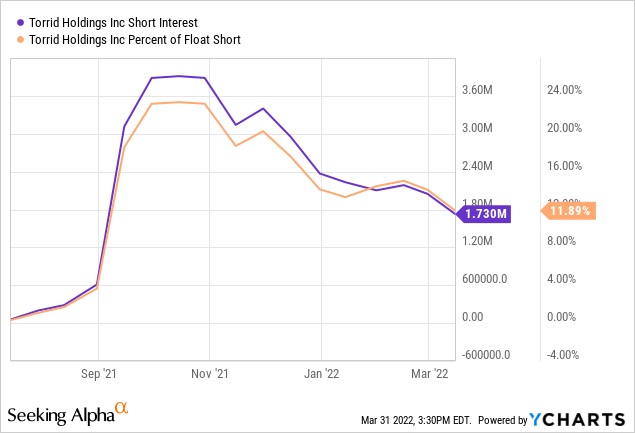

Given that ~12% of the float is currently sold short (~1.7m shares), the full deployment of the remaining $77m authorization could trigger a significant short squeeze, in my view. The retirement of CFO George Wehlitz at the end of Q1 2022 shouldn’t affect the buyback run rate this year, although CURV’s long-term capital allocation priorities under the new CFO will be worth keeping an eye on.

An Inexpensive Play on the Plus-Size Apparel Space

Net, CURV remains one of the best-positioned specialty apparel retailers to capitalize on the growing and underserved women’s plus-size apparel market. With superior quality, fit, and constant product newness, CURV has been able to sustain its pricing power through the pandemic while also driving recurring purchases across its customer base.

COVID headwinds have weighed on recent earnings, but I think management deserves credit for executing well through the pandemic. It has maintained profitability and a clear line of sight to reach ~$1bn in sales over the long term.

With CURV stock suffering such a huge drawdown since its IPO last year, investor sentiment is clearly bearish, with the stock trading at a wide discount to its historical PE multiple. That said, the company remains on track for EPS growth post-2022, with the $100m buyback authorization also likely to squeeze out the short interest and catalyze a re-rate.

Be the first to comment