Hello my names is james,I’m photographer./iStock via Getty Images

Copper is a great conductor you can find essentially anywhere you look. Did you know that your iPhone probably has about 16 grams of copper? Your computer, TV, car, household appliances, and many more everyday devices have copper wiring pumping electricity through their veins. With the world population continuously growing and the demand for copper-powered products perpetually rising, it is no surprise that copper is in such high demand.

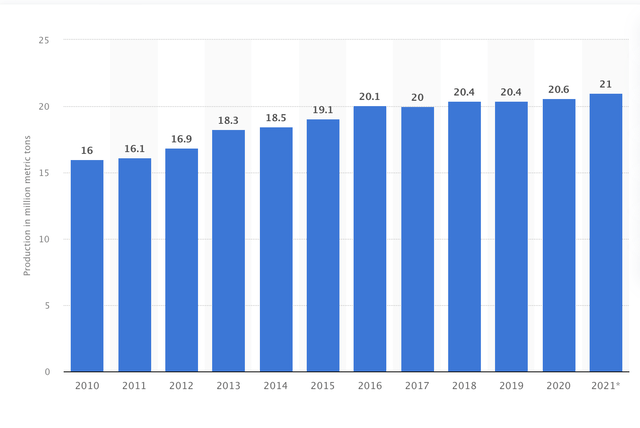

Copper Production (million metric tons)

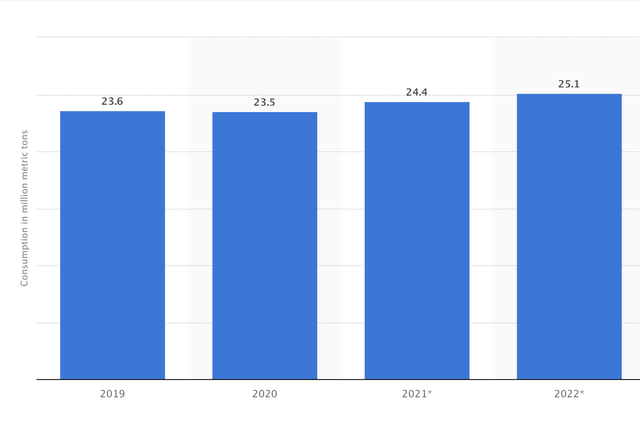

Copper Consumption (million metric tons)

We see that copper consumption is significantly outstripping the production of this finite resource. Moreover, global demand for copper will likely increase as the world moves forward with EV batteries and other copper-powered technologies. Furthermore, we have multi-decade high inflation putting upward pressure on copper prices.

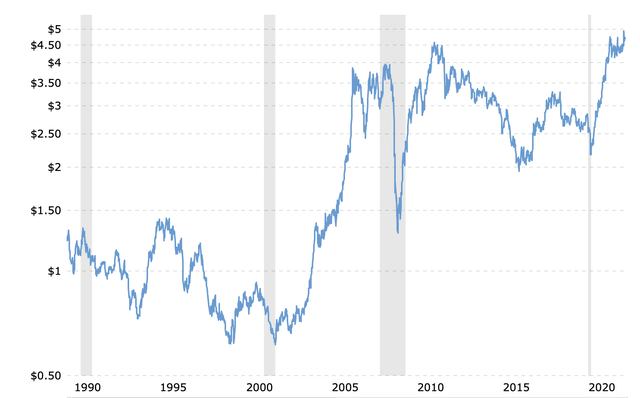

Copper Price Chart

Copper hit an all-time high (“ATH”) around $5 recently and could soon break out to new ATHs. I’ve been bullish on copper since the latest leg of the commodities bull market began in 2015, and we could see a significant move higher soon. Several copper-related companies in my All-Weather Portfolio have appreciated considerably recently. The price of copper should break out to new ATHs this year, powering copper-related equities significantly higher in 2022 and beyond.

1. Rio Tinto Group (RIO) is a diversified mining company, but it is also my number one copper-related stock. Rio is an established, dependable miner with significant upside potential. The company’s operations should continue benefiting from increased demand and higher inflation. Last year, Rio grew revenues by a whopping 42% YoY. Analysts (consensus) anticipate that the company could earn about $12 in EPS this year, placing its forward P/E multiple at a rock bottom of 6.7.

Moreover, the company provides a dividend of approximately 10% here. The stock may be cheap because forecasts are factoring in a sharp drop in inflation, but we may have more persistent inflation for longer as we advance. Therefore Rio’s earnings will likely increase more than anticipated, and the stock should run higher.

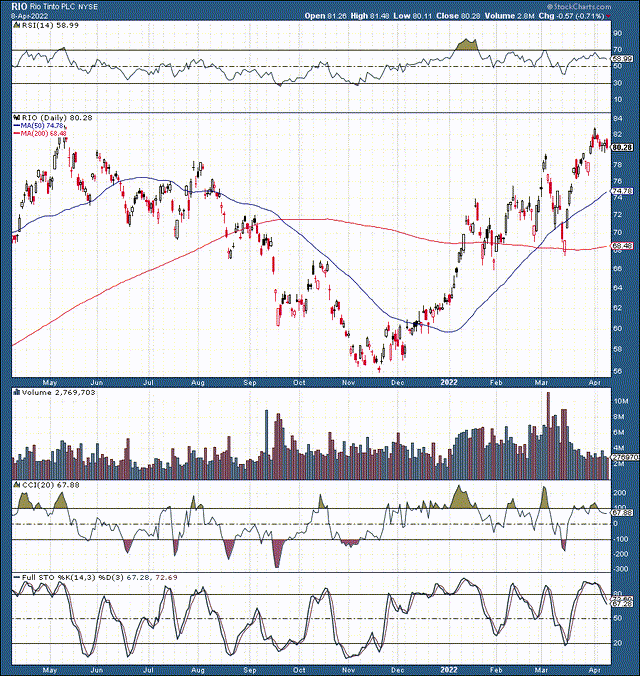

Rio 1-Year Chart

Rio’s been on a rampage since the November bottom, appreciating by approximately 43%. We see a bowl-shaped bottoming pattern, followed by higher highs and higher lows. The technical image remains strong, and Rio is likely setting up for a new move higher to new multi-year highs above $100.

2. BHP Group Limited (BHP) – Another mining juggernaut is my second metals and copper-related stock pick here. In addition to metals mining, BHP provides exposure to coal, petroleum, and other commodities that should do well in the current high inflation economic environment. Much like Rio’s revenues, BHP’s YoY sales were up by more than 40% in 2021. This year, the company should bring in about $7 in EPS, putting its forward P/E ratio at only 11. The stock also delivers a healthy growing dividend of approximately 8%.

Again, we have a very cheap stock here as analysts likely expect inflation to cool off and earnings to come down significantly. However, many analysts may be early in their lower inflation forecasts, as relatively high inflation could persist longer than anticipated. Therefore, we should see sales growth continue at BHP, leading to multiple expansion, and a higher stock price.

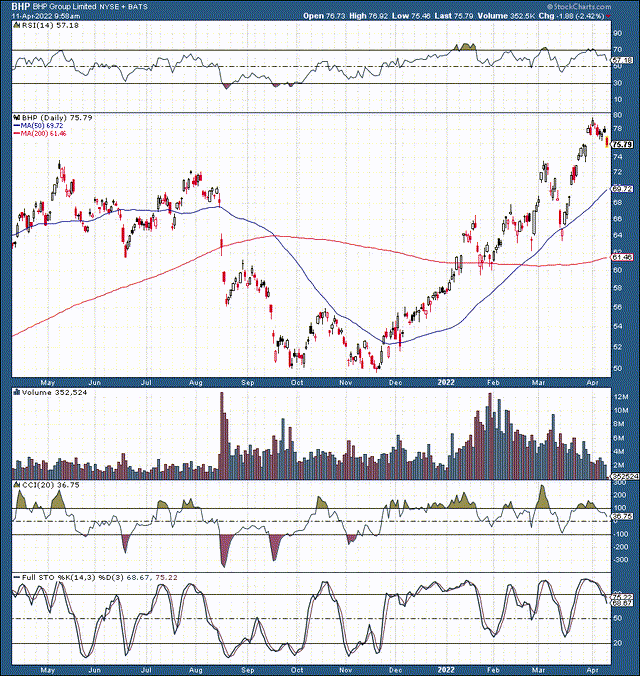

BHP 1-Year Chart

We see a similar technical setup here in BHP. A double W-shaped or a bowl-shaped bottom occurred last fall, and the stock looks poised to trade higher as we advance. BHP is around multi-year highs now, but the stock could break out to new ATHs above $100 relatively soon, as copper and other metal prices should continue to appreciate due to more demand and high inflation in future years.

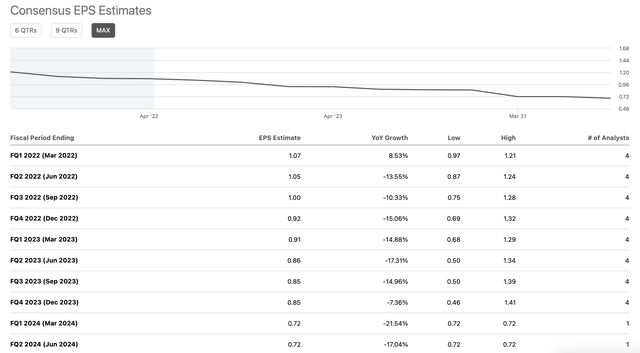

3. Southern Copper Corporation (SCCO) – Southern Copper is a good old American miner specializing in copper. Last year, the company delivered $4.40 in EPS, illustrating a TTM P/E ratio of about 16. Analysts anticipate $4.14 in EPS for this year (consensus). This estimate puts the company’s forward P/E ratio slightly higher than the TTM. Furthermore, analysts’ estimates imply that Southern Copper’s earnings will continue declining in future years.

SCCO EPS Estimates

I want to emphasize this point as this is not a Southern Copper isolated phenomenon due to the perception that the Fed can control inflation with interest rates. Many metals companies’ estimates are skewed lower in future years. Southern Copper’s consensus estimates are only for about $3.50 in 2023, about a 15% YoY decline. However, these EPS estimates should be based on substantially lower inflation readings and a much lower price of copper. Reality may be much different several years from now. We may be looking at persistent high inflation, a copper price well above $5, and a much higher stock price for Southern Copper and other top companies with copper and additional metal exposure. The company’s dividend is around 5.5%, and its technical image appears constructive here.

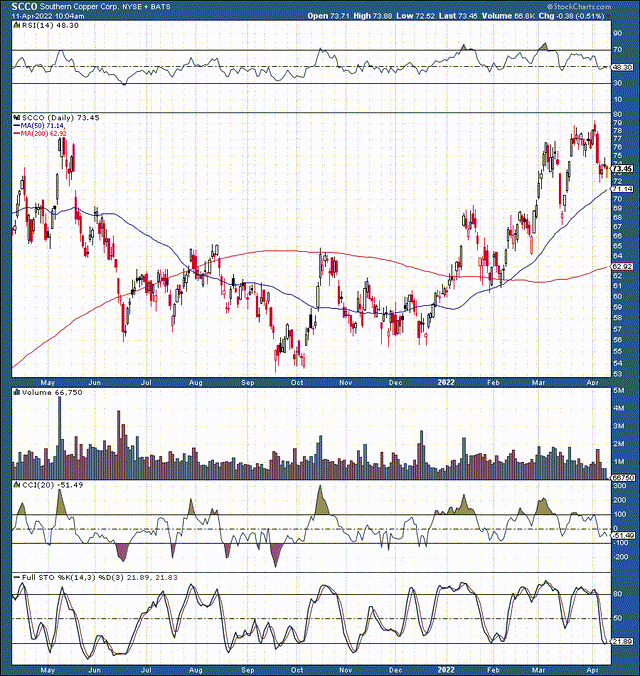

SCCO – 1-Year Chart

We see a broad bullish reverse head and shoulders pattern in SCCO here. This stock also bottomed last fall and has been trending higher ever since. We see a series of higher highs and higher lows developing, implying that the bullish trend could continue long term.

Inflation, Inflation, Inflation

Generally, I feel that many analysts are off on inflation being highly controllable, and we will probably see higher prices persist for longer than many market participants expect. The Fed already told us that inflation was transitory and not a significant problem. However, the facts tell a much different story, and inflation could be anything but transitory, even with the Fed raising rates.

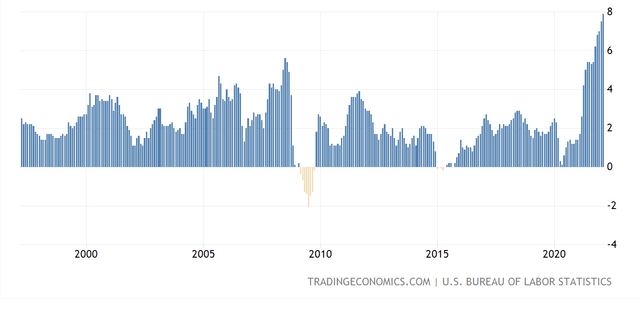

CPI Inflation

We have not seen anything like the current inflation in many years. We would need to look back to the 1970s and 1980s to see inflation around the levels it is at now. However, it was a much different world back then. In the 1980s, the Fed could spike the funds rate to 10% or higher to battle inflation. Do you think the Fed could do anything like this now? The national debt was at 35% of GDP in 1980, and the debt-to-GDP ratio is at 126% now. The debt is a big difference. Back then, the economy could function in a high-interest rate environment. However, due to the enormous loads of debt and the reliance on ultra-easy monetary policy, the Fed cannot effectively raise interest rates without crashing the economy.

Therefore, there is a finite limit to how high interest rates can go, and it is likely only around 2-3% on the benchmark rate. Any higher and the economy will probably fall into a recession, which is not an acceptable alternative to inflation. Therefore, the Fed will likely keep rates relatively low despite high inflation, so copper and other significant metals should continue appreciating in future years. I suspect copper can breakout above $5 resistance soon and can probably move significantly higher in the coming years. Companies like Rio Tinto, BHP, Southern Copper, and others should benefit from higher copper prices, and their stocks should appreciate as we advance through 2022 and beyond.

My Top Rated Metals and Copper Stocks

While I own Rio Tinto, BHP, and Southern Copper, these are not the only copper/metals stocks I’ve owned in recent quarters. Here is a list of some of the best metals plays as we move through 2022 and beyond.

- 1. Rio Tinto: TT Score – 8.6, Rating – Strong Buy

- 2. BHP: TT Score – 8.5, Rating – Strong Buy

- 3. Southern Copper: TT Score – 8.2, Rating – Buy

- 4. Vale (VALE): TT Score – 8, Rating – Buy

- 5. Cleveland-Cliffs (CLF): TT Score – 7.9, Rating – Buy

- 6. U.S. Steel (X): TT Score – 7.9, Rating – Buy

- 7. Nucor (NUE): TT Score – 8, Rating – Buy

- 8. Newmont (NEM): TT Score – 8.3, Rating – Buy

Be the first to comment